Presentasjon AGM 2014

advertisement

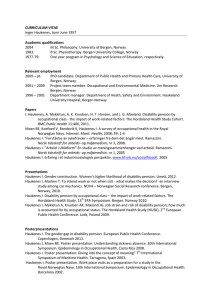

Nordic Petroleum AS Generalforsamling mars 2014 Lysaker Disclaimer This document contains certain forward-looking statements relating to the business, financial performance and results of the Company and/or the industry in which it operates.Forward-looking statements concern future circumstances and results and other statements that are not historical facts, sometimes identified by the words “believes”, “expects”, “predicts”, “intends”, “projects”, “plans”, “estimates”, “aims”, “foresees”, “anticipates”, “targets”, and similar expressions. The forward-looking statements contained in this Presentation, including assumptions, opinions and views of the Company or cited from third party sources are solely opinions and forecasts which are subject to risks, uncertainties and other factors that may cause actual events to differ materially from any anticipated development. None of the Company or any of the respective group companies or any such person’s officers or employees provides any assurance that the assumptions underlying such forward-looking statements are free from errors nor does any of them accept any responsibility for the future accuracy of the opinions expressed in this Presentation or the actual occurrence of the forecasted developments. The Company assumes no obligation, except as required by law, to update any forward-looking statements or to conform these forward-looking statements to our actual results. An investment in the Company involves risk, and several factors could cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements that may be expressed or implied by statements and information in this presentation, including, among others, risks or uncertainties associated with the Company’s business, segments, development, growth management, financing, market acceptance and relations with customers, and, more generally, general economic and business conditions, changes in domestic and foreign laws and regulations, taxes, changes in competition and pricing environments, fluctuations in currency exchange rates and interest rates and other factors. Should one or more of these risks or uncertainties materialise, or should underlying assumptions prove incorrect, actual results may vary materially from those described in this presentation. The Company does not intend, and does not assume any obligation, to update or correct the information included in this presentation. No representation or warranty (express or implied) is made as to, and no reliance should be placed on, any information, including projections, estimates, targets and opinions, contained herein, and no liability whatsoever is accepted as to any errors, omissions or misstatements contained herein, and, accordingly, none of the Company or any of the group companies or any such person’s officers or employees accepts any liability whatsoever arising directly or indirectly from the use of this document. By attending the investor presentation you acknowledge that you will be solely responsible for your own assessment of the market and the market position of the Company and that you will conduct your own analysis and be solely responsible for forming your own view of the potential future performance of the Company’s business. This Presentation is confidential and is being communicated in the United Kingdom to persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (such persons being referred to as “investment professionals"). This presentation is only directed at qualified investors and investment professionals and other persons should not rely on or act upon this presentation or any of its contents. Any investment or investment activity to which this communication relates is only available to and will only be engaged in with investment professionals. This Presentation (or any part of it) is not to be reproduced, distributed, passed on, or the contents otherwise divulged, directly or indirectly, to any other person (excluding an investment professional’s advisers) without the prior written consent of the Company. This Presentation and the information contained herein do not constitute an offer of securities for sale in the United States and are not for publication or distribution to U.S. persons (within the meaning of Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). The securities proposed to be offered in the Company have not been and will not be registered under the Securities Act and may not be offered or sold in the United States or to U.S. persons except pursuant to an exemption from the registration requirements of the Securities Act. page 2 HENDELSER 2013 Inngått forlik med Mercom Q4 2013 – Erstatning ca CAD 350.000 • Alle kostnader + kompensasjon ca CAD 200.000 Inngått forlik med Piikani Nation – Erstatning ca CAD 125.000 før kostnader Inngått avtale med Athabasca Resource Limited (ARL) om utvikling av Chard – Avtalen innebærer: • finansiering av arbeidsprogram USD 2,5 mill • Cashelement til Nope USD 750.000 Carmangay ervervet 100% – Nordic Petroleum sitt Kanadiske datterselskap ervervet 100% av Carmangay – Tidligere eierandel 40% gjennom farm in page 3 HENDELSER 2013 cont’d Forenkling av selskapsstruktur i Kanada – Nordic Mega og Norwegian Oilsands fusjonert med Nordic Americas Inc • Alle assets ligger nå i Nordic Americas Inc – Norwegian Petroleum fortsetter som operatørselskap • Datter av Nordic Americas Inc – Formål er å forenkle og redusere administrasjon og kostnader Svalbard & Grønnland eiendel gjennom Norwegian Petroleum AS – Grønnland eiendel levert tilbake til myndighetene – Svalbard søker partner for feltarbeid – Nordic har 10% royalty Administrative forhold – Redusert admin kost med nesten 50% i 2013 i forhold til 2012 – Mye ressurser brukt til opprydning og gjennomgang av selskap i Norge og Canada – Minimum driftsnivå opprettholdt page 4 Eiendeler Nope mars 2014 • Hovedaktiva Chard Canada • • Avtale inngått med Athabasca Resources Limited om arbeidsprogram Chard Planlagt gjennomført Q3 2014 • Kjøp av 100% av Carmangay • Seismikk program igangsatt • Prosessering og tolkning p.t. • Planlegger “science based” program hvor seismikk er første ledd. page 5 CHARD Nordic Petroleum har 100% eierandel I Chard 50% etter implementering av avtalen med Athabasca Resource Limited Reserve sertifiseringsbyrå DeGolyer & MacNaughton har estimert utvinnbare “contingent resources” som følger 2C = 27mln boe’s 3C = 60mln boe’s In place volum på 240 mill fat Arbeidsprogram Q3 2014 skal fundes av Athabasca USD 2,5 mill budget Skal inneholder 4-5 kjerneboring, analyser, engineering studie samt oppdatert CPR Målsetning : verifisere / oppgradere volumer Verifisere kommersialitet page 6 CHARD cont’d Arbeide mot nabo områder for å gjøre caset større – Gjøre terksel for kommersialitet lavere – Mer interessant I konkuranse med andre felt – Synergier Organsisasjon etablert I Calgary – Nope har etablert kompetent organisasjon I Calgary – Gjennomføre arbeidsprogram – kvalitetssikring page 7 Veien videre på Chard 4-5 brønner i området rundt section 5 vil avklare om D&M’s geotolkning er riktig Dersom 10M pay i gjennomsnitt i section 5 gir det drøye 20-30 mill fat utvinnbart volum – mulig mer oppside i området rundt Investeringer/priser/opex vil avklare om kommersielt Ved å samarbeide med nabo lager man et større prosjekt med lavere terskel for å bli kommersielt page 8 Carmangay Ervervet 100% i 2013 Regional geostudie utført ved bruk av gamle brønn data for å lage cross sections – Området sør/øst for brønn 16-25 mest interessant – Ligger høyere på struktur på basis av dagens tolkning 20km 2D seismikk innkjøpt våren 2014 – Prosesseres og tolkes i Calgary – Tolkning estimerte klar etter påske – Utarbeidelse av ytterligere arbeid på basis av resultat av seismikk Arbeidsprogram i 2 faser – Første fase igangsatt med geostudie/seismikk/logging – Andre fase avgjøres av utfall av fase 1: • Testing av eksisterende brønn (16-25) om fase 1 tilsier det • Boring av ny brønn – Åpne for farm out page 9 SEISMIKK Carmangay Well 16-25 page 10 Budsjett /Økonomi Avtalen med Athabasca gir Nordic USD 750.000 i Cash Nope har ihht budsjett penger ut 2014 og planlegger ikke finansiering før etter Chard program er gjennomført page 11 ATHABASCA RESOURCE LIMITED Presentation by Julian Hamilton Barns Q&A page 12