File

advertisement

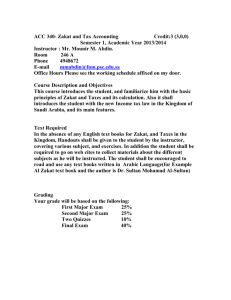

Chapter# 4 Islam and Distribution of Wealth Prepared by Kokab Manzoor Chapter`s outlines Rent Definition, & Islamic Doctrine Profit Justification of profit, limits, Definition and Islamic principle of fixation of profit Wages Definition, theories & Islamic view point of wage determination. Measure to stop concentration of wealth 1) Legal Measures 2) Optional Measures Meaning and importance N.I is produced by cooperative efforts of F.O.P, and then is distributed among the same factors. Eco system of Islam makes utmost efforts to maintain the distribution wealth on just and benevolent basis and to provide means of sustenance to every member of the society in a dignified manner RENT Islam recognizes the right of private ownership of property. One of the lawful form of profitable use of property is to let it out on rent. Those goods which are Lawful and durables i.e land, house machinery etc Definition of Rent) Rent is the surplus produce of the land which is given to the owner of the land due to permanent and durables qualities of the land. (David Ricardo) Islamic Doctrine of Rent The Islamic doctrine of rent is so framed that the wealth flows in the direction of the poor rather than the rich. Fixing the rate of Rent Justice Benevolence No injustice Fixing the rate of Rent & the State 1 Nature of Land Higher rates of Rent from more fertile and productive lands and vice versa. “Allah does not place more burden upon a person than he can bear” [Al-buqra ;286] Cont`d…. 2 Nature of Crops Higher rate of Rent on good crop and low on bad or inferior quality crop. Cont`d…. 3 Nature of irrigation The nature of irrigation shall be taken into consideration while fixing the rate of Lagan. 10% on rain fed land and 5% on that land which is irrigated through artificial means. Cont`d…. 4 Allowance for cultivator`s Labor A low rate of rent shall be levied in the land which require heavier labor and which are difficult to irrigate, and vice versa. PROFIT Justification of Profit Limits of profitable business Definition of profit Principles of fixing the Profit Rate Justification of Profit Justification of profit is established by the Quran and the Sunnah. The Holy Prophet (sws) himself was engaged in trade and his companions also carried out various business activities and earned profit. 2 Limits of Profitable Business Islam forbids adoption of unethical behavior in business. Fraud, deception, misinterpretation Unjust weights and measures Adulteration in foods, Hoarding and creation of artificial shortage To buy or sell at higher or lower price by taking undue advantage of the dire need of other party Limits of profitable business…. Undue influence to carry through transaction To sell defective goods without informing the buyer Monopolies, Cartel etc are forbidden To buy goods from the farmer midway to market on lower than the prevailing market rates. 3 Definition of Profit “The share of the National Income which is given to risk capital for its services in the process of production is called profit.” 4 Principles of fixing the Profit Rate Islam has not established any fixed rule for fixing the rate of profit, however Profit should be fixed on the basis of; Justice Equality Prevailing circumstances Custom and conditions of work WAGES Definition of Wages Theories of Wages Determination of Wage-Rate The Islamic Viewpoint 1 Definition of Wages In economic terms, wages means the compensation, which a person receives for his mental and physical work. Wages are of two kinds Nominal Wages Real Wages 2 Theories of Wages 1 Marginal Productivity theory 2 Subsistence theory of wages 3 Modern theory or demand and supply theory Islamic viewpoint of Determination of wages 1 Just Wage And Allah created the heavens and the earth with (a strategy based on) Truth in order that every soul is rewarded for the deeds that it earns and they will not be wronged. [Al-Jashiya: 22] Cont`d…. 2 Standard of wages And he will talk to the people (alike) both in the cradle and in ripe years, and he will be one of the pious servants (of Allah).’[Al-Imran: 161] Cont`d… 3 Minimum wage Rate There is no living being in earth but its sustenance is the responsibility of Allah [Al-Hood: 6] Rights and Duties of Labor Rights of worker Fraternal rights Settling the wage rate Prompt payment of wages Adherence to settled Terms Workload according to his capacity Kind treatment The right to withdraw from work Assignment of Lawful work Duties of worker Loyalty Capability Trust Honesty Abiding by the contract Avoiding negligence Avoiding carelessness Measures to stop concentration of wealth Legal Measures 1 Zakat 2 The law of Inheritance Optional Measures 1 Sadaqat and Alms 2 Charity of surplus 3 Auqaf LEGAL MEASURES 1 ZAKAT 1 2 3 4 5 6 Meaning of Zakat Purpose of zakat Nisab and the Rate of zakat Eight Heads of Expenditure of Zakat Difference between Zakat and tax Importance of Zakat The meaning of Zakat The word “Zakat” is derived from the word Zaka which means “ increase or growth”. In addition it also implies purification, enlargements etc In Fiqh terminology Zakat means “financial devotion” every Muslim who own a certain amount of wealth, should give away a specific amount of wealth to those who are entitled to receive that amount, in the eyes of Shariah. Purpose of Zakat The purpose of Zakat is not only to support the poor and to effect a division of wealth, but as an obligatory act of worship. It also purifies heart and soul. Its an expression of gratitude for the bounties of Allah. Kinds of wealth on which Zakat is levied…. a) Animals b) Gold and silver c) Trade Goods d) Cash e) Mines and Treasures Eight Heads of Expenditure of Zakat 1 2 3 4 5 6 7 8 The poor The indigent ()تنگدست Functionaries of the Zakat Department Reconciliation of Hearts Ransom for Slaves Debtor In the way of Allah Ibn Al-Sabeel or Traveler Economic Importance of the Zakat System Circulation of wealth Just distribution of wealth A remedy for unemployment National Assistance Eradication of poverty Economic expansion Difference between Zakat & Tax ZAKAT Religious obligation Levied only on Muslims Payment is must Rate is fixed Heads of expenditure is fixed Collected from rich and spent on poor TAX An economic need of state Imposed on All It can be remitted Rates are changed subject to conditions Tax revenue are spent for the benefit of all, rich and poor 2 Islamic Law of Inheritance The Islamic law which contains the details of distribution of a deceased`s property among his/her heirs is known as Law of Inheritance. The purpose of this law is to break the estate of deceased into prescribed shares and distribute them among near or distant relatives. Economic Importance of the Law of Inheritance Elimination of concentration of wealth Growth in circulation of wealth Elimination of Feudal system Growth in agriculture production Equitable distribution of wealth Means of better economic conditions of the survivors. OPTIONAL MEASURES Sadaqat & Alms Charity of surplus Auqaf thanks