An Introduction to Will Substitutes

advertisement

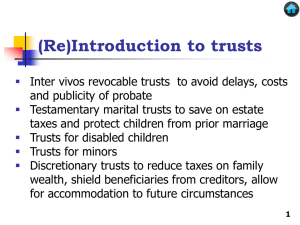

An introduction to will substitutes Will substitutes are like wills because They dispose of the owner’s wealth upon death, The owner has complete control over them while alive (including the power to amend and revoke), and The interests of the beneficiaries are “ambulatory” (i.e., they don’t come into being until the owner’s death) 1 An introduction to will substitutes Will substitutes are not subject to all of the formalities of wills You’ll have a writing and a signature. But you won’t have the attestation and signatures of two witnesses. Is that a problem? The short answer is no for the most part, and it makes sense that will substitutes are not held to the same level of formality as a will. When you consider the purposes of the formalities, you see that they’re generally well-satisfied by will substitutes. 2 Will substitutes, pp. 394-397 “Pure” Will “Impure” Will Substitutes Substitutes Life Insurance Joint Tenancies Pension Accounts Joint Accounts Revocable Trusts Will Substitutes: 1) tend to be asset-specific; 2) avoid probate; and 3) are not subject to the Wills Act. 3 Farkas v. Williams, Farkas v. Williams 125 N.E.2d 600 (Ill. 1955), p. 398 Farkas (Settlor) Right Right Right Right Transfer In Trust to to to to Farkas (Trustee) Contingent Remainder Interest Williams Fiduciary Enforcement Revoke Income Principal Change Beneficiary Must this trust be executed with Wills Act formalities? 4 Farkas This case illustrates the early efforts to justify revocable trusts on the grounds that they were not really will substitutes but were financial vehicles that transferred a present interest to the beneficiaries According to the court, Farkas assumed fiduciary responsibilities toward Williams But Williams really was in the same position as a named beneficiary in a will—Farkas could sell the assets in the trust and use the proceeds in any way he chose, just as if he had written a will with Williams as the beneficiary In fact, as the UTC and later cases indicate (e.g., Moon, note 3, page 403; Linthicum), Williams really did not have any enforceable interests 5 Farkas The lasting significance of Farkas comes from its observations at the end of the opinion that the formalities of the trust satisfied the purposes served by the formalities for wills Thus inter vivos revocable trusts are valid will substitutes even though they do not have to meet the witnessing requirements of wills 6 Indiana on revocable trusts An instrument creating an inter vivos trust in order to be valid need not be executed as a testamentary instrument . . . even though such trust instrument reserves to the maker or settlor the power to revoke, or the power to alter or amend, or the power to control investments, or the power to consume the principal, or because it reserves to the maker or settlor any one or more of said powers. Ind. Code § 29-1-5-9 7 Linthicum v. Rudi, Linthicum v. Rudi 148 P.3d 746 (Nev. 2006), p. 403 Claire L-Cobb Rudi Claire executes a will and a revocable trust. Ernette and Myra named as successor trustees and beneficiaries. Ernette Myrna ?? Claire executes a new will and amendment to trust. Rudi replaces Ernette and Myrna as beneficiary and successor trustee. Rudi and State petition for guardianship over Cobb. State awarded guardianship. Ernette and Myrna challenge amended trust seeking constructive trust or cancellation. 8 Linthicum Why can’t Ernette and Myrna challenge the trust? First the court observed that Nevada’s provisions for challenges to trusts apply to nontestamentary trusts, but we have here a revocable inter vivos trust This argument does not make sense. A revocable inter vivos trust is a nontestamentary trust. More importantly, the statute only gives standing to interested persons, and Ernette and Myrna don’t have a present interest. Because Claire can revoke the trust, Ernette and Myrna have “at most a contingent interest that has not yet vested.” As long as the trust is revocable, Ernette and Myrna had no legal rights until Claire died. 9 Question, p. 406 1. The cases cannot be reconciled on the matter of the beneficiaries’ interests. Linthicum overtakes Farkas. As a result, just as a beneficiary of a will cannot challenge the will until it takes effect upon the testator’s death, a beneficiary of a revocable trust cannot challenge a trust until it becomes irrevocable upon the settlor’s death. At Claire’s death, Ernette and Myrna can challenge the trust or the amendments to it on grounds of incapacity and undue influence (see UTC §604); during Claire’s life they can petition for guardianship of the person and/or the property. 10 Questions, p. 407 2. While modern law does not impose any duty upon Farkas toward Williams while Farkas is alive, Williams would have recourse against a third-party trustee who looted the trust without Farkas’ knowledge, but still only after the trust becomes irrevocable. If Farkas is incompetent, a guardian or conservator could sue the third-party trustee on Farkas’ behalf while he’s alive, and Williams could sue the trustee after Farkas’ death. See Restatement (Third) of Trusts § 74 and comments a(2) and (e). 3. Kentucky said yes, but it rejects the majority view and imposes fiduciary duties to beneficiaries of revocable trusts. Under the Restatement, there is no duty to disclose for revocable inter vivos trusts, but there is a duty to disclose if the settlor loses capacity. 11 Payable on death transfers Atkinson and Hillowitz illustrate the evolution of trusts and estates law for POD transfers POD transfers include a wide range of investments While POD transfers once were viewed as invalid testamentary transfers, for lack of proper witnessing, now they are treated as valid nontestamentary transfers (i.e., valid will substitutes), mostly via statutory provisions 12 In re Estate of Atkinson, In re Estate of Atkinson 175 N.E.2d 548 (Ohio Prob. 1961), p. 407 First Wife Walter P.O.D. $5500 P.O.D. $1000 Patricia Maxine Emma P.O.D. $2000 Are the certificates of deposit invalid testamentary dispositions? Yes, according to traditional (but superseded) law 13 Estate Estate of ofHillowitz Hillowitz 238 N.E.2d 723 (N.Y. 1968), p. 409 Partnership Abraham Wife “In the event of the death of any partner, his share will be transferred to his wife, with no termination of the partnership.” This court viewed the transfer to the wife as a valid contract rather than an invalid testamentary disposition 14 Question, p.410 410. (1) Arguably, the POD designation in Atkinson was more reliable since it was executed with a bank, and the maker’s attention was focused on that provision. In Hillowitz, there was no financial institution involved, and the POD provision was probably a small part of an elaborate partnership agreement and therefore might have not been given much attention. With statutory reform, the law expressly validates non-probate transfers even without the formalities required of wills. That is the case under UPC 6-101 and under Indiana law. 15 Questions, pp.410 and412 410. (2) Analogy not sound. If the interest passes to a surviving partner, that’s a bargained for exchange. If the interest passes to the surviving spouse, that’s a gift. Better to observe that this will substitute involves dealings with partners disinterested in the beneficiary designation and that the purposes of will formalities are served by the partnership agreement 412. (1) The POD designations would have been valid in Atkinson. The Farkas court would not have had to consider whether Williams had an enforceable interest. 16 UPC §6-101: Nonprobate Transfers on Death, p.411 A provision for a nonprobate transfer on death in an insurance policy, contract of employment, bond, mortgage, promissory note, certificated or uncertificated security, account agreement, custodial agreement, deposit agreement, compensation plan, pension plan, individual retirement plan, employee benefit plan, trust, conveyance, deed of gift, marital property agreement, or other written instrument of a similar nature is nontestamentary. 17 Indiana on POD transfers Ind. Code § 32-17-14-4 (b) A beneficiary designation made under this chapter must do the following: (1) Designate the beneficiary of a transfer on death transfer. (2) Make the transfer effective upon the death of the owner of the property being transferred. (d) Except as otherwise provided in this chapter, a transfer on death direction is accomplished in a form substantially similar to the following: (1) Insert Name of the Owner or Owners (2) Insert "Transfer on death to" or "TOD" or "Pay on death to" or "POD". (3) Insert the Name of the Beneficiary or Beneficiaries. (e) An owner may revoke or change a beneficiary designation at any time before the owner's death. 18 Indiana on POD transfers Ind. Code § 32-17-14-5 A transfer on death transfer: (1) is effective with or without consideration; (2) is not considered testamentary; (3) is not subject to the requirements for a will or for probating a will under IC 29-1 . . . 19 Functions of formalities “Does this remark indicate finality of intention to transfer ?” [i.e., finality in the absence of writing a new will] Ritual Function Evidentiary Function Supply satisfactory evidence to the court. Protective Function The performance of some ceremonial for the purpose of impressing the transferor with the significance of his statements. Prophylactic purpose of safeguarding the testator. Channeling Function Standardization of form simplifies administration. 20 (p. 224) UTC §603: Settlor’s powers; Powers of withdrawal, p.403 (a) While a trust is revocable [and the settlor has capacity to revoke the trust], rights of the beneficiaries are subject to the control of, and the duties of the trustee are owed exclusively to, the settlor. (b) During the period the power may be exercised, the holder of a power of withdrawal has the rights of a settlor of a revocable trust under this section to the extent of the property subject to the power. 21