Argentina in the Aftermath of International Financial Crisis

Argentina in the Aftermath of International

Financial Crisis: Commodity Booms and the

New State Capitalism

Sylvia Maxfield

Simmons College

Prepared for a Workshop to Precede the Montreal International

Studies Association Meeting, March 15, 2011

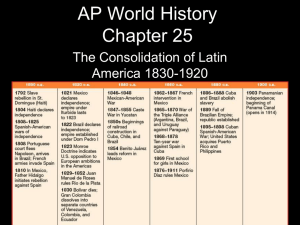

Generalizing Across the Region:

• commodity boom improves external and fiscal balance sheets

• provides room for counter-cyclical policy

• transmission mechanism of the crisis is trade not finance

You Can’t Have a Credit Crunch if there is No Credit

Argentina’s unique situation post-2001 crisis

Argentina’s New State Capitalism

Regional growth over the century

GDP per capita, LAC and Asia relative to US

Gold

Stand.

Interwar US

Postwar

Boom

US &

LAC on par

LAC &

Asian

Tigers outpace

US

LAC &

Asian

Tigers lag

US, with incipient recovery

Alliance for

Progress

ISI Lost

Decade

LAC lags;

Asian

Tigers outpace

US

Slight

LAC increase,

Asian

Tigers take off

LAC slides,

Asian

Tigers accelerat e

Wash.

Cons.

Wash.

Diss.

Cont.

2002

LAC starts to outpace

US

Commodity Prices Against 1970s Base

• OcaOc

Ocampo, Jose Antonio, 2009, Latin American and the global financial crisis,

Cambridge Journal of Economics, 33.

Argentine Growth 3 rd Highest in

Region, 2000-2008

Commodity boom helped improve external balance sheet positions throughout the region and created space for counter-cyclical macro-economic policy

Argentina’s macro-economic policy response

• External and government balance sheets aided by pension fund nationalization in Fall

2008

• Central bank relaxes monetary targeting rules in 2010 (Fernandez fires Martin Redrado when he refuses to do this – confirmation of his successor required a public advertising campaign to win sufficient congressional support)

Transmission mechanism of the crisis is through trade not finance

• Data on correlation of export decline and GDP decline

No banking crises in 2008-2009

• Banking crises in 1980-85 (Argentina, Brazil,

Chile, Colombia, Ecuador, Mexico, Peru,

Uruguay)

• Banking crises 1995-2000 (Argentina, Brazil,

Colombia, Ecuador, Honduras, Jamaica,

Nicaragua, Paraguay, Peru)

• Supervision & regulatory reform; flexible exchange rates (depreciation the norm); central bank independence and price stability

Argentina: No credit to crunch

• Data on credit

Impact of crisis on unemployment much lower than in prior recessions

Changes in unemployment rate (ILO)

Prior recessions: Argentina=1998-2002; Brazil=2001-2002; Chile=1998-1999;

Colombia=1998-1999; Mexico=1994-1995

Argentina: the “bad” left or an example of the new state capitalism?

• Kirschnerismo involves increased state ownership & social spending

Central Government Expenditures (% of GDP)

Room for countercyclical policy and state intervention is shrinking

Fiscal and current account balances (% of GDP)

Argentine fiscal situation in comparative perspective

Growth prospects for remain strong

Real GDP Growth 2009-2011 (OECD)