In re Martin B.

advertisement

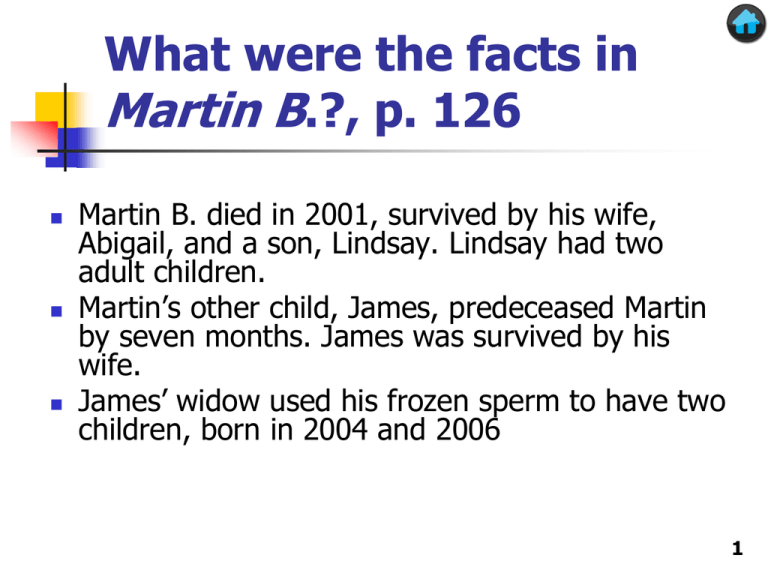

What were the facts in Martin B.?, p. 126 Martin B. died in 2001, survived by his wife, Abigail, and a son, Lindsay. Lindsay had two adult children. Martin’s other child, James, predeceased Martin by seven months. James was survived by his wife. James’ widow used his frozen sperm to have two children, born in 2004 and 2006 1 In re Martin B., In re Martin B. 841 N.Y.S.2d 207 (N.Y. Surr. Ct. 2008) Abigail B. Nancy James Mitchell James Warren Martin B. Lindsay Adult Child 1 Adult Child 2 2 What were the relevant terms of Martin’s trusts? Martin B. left seven trusts that gave the trustees authority to sprinkle principal among his issue while his wife, Abigail, was alive Martin also gave Abigail a special power of appointment to determine the distribution of the principal upon her death If Abigail did not exercise her power of appointment, the trustees had authority to sprinkle the principal among Martin’s issue Should the posthumously-conceived children of James count as the issue of Martin? 3 Could the two children inherit from James? No. Under NY law, posthumously-conceived children do not share in the intestate estate (p. 127). Similarly, if James had left a will, the children would not take as “after-born” children unless he stated otherwise in his will (p. 127). What result under the UPC? You have a 45-month window to give birth to the child. James died on January 13, 2001, and the first child was born on October 15, 2004, which is 45 months and 2 days after James’ death. If Nancy could show that she conceived by January 13, 2004, then the first child would count as an heir under the UPC. 4 But we’re dealing with a third-party’s trust The rules that govern James as decedent do not necessarily apply to Martin Moreover, the trust interests are future interests. We don’t have the need to wind up a decedent’s estate in a timely fashion (p. 128) The relevant statutes for future interests include posthumously-born children in the definition of issue, but they did not anticipate posthumously-conceived children 5 Are James’ children eligible for trust sprinklings? General trusts and estates principles hold that a child of assisted reproduction should be treated as any other child of the decedent if the decedent considered the child as his or her own (pp. 128-129) In this view, the two boys are part of Martin’s bloodline, and Martin intended the trusts to benefit all the members of his bloodline The court observed that under the trust instruments, Martin’s intent was to have the trust “benefit his sons and their families equally” (page 129) 6 Advancements: hotchpot Hotchpot Example example Testator ($50,000) Daughter A ($10,000) 1. Testator’s estate at death: plus advancements Daughter B ($0) Daughter C ($0) $50,000.00 3. Daughter A's share $20,000.00 $10,000.00 minus advancements $10,000.00 Total hotchpot $60,000.00 2. Hotchpot divided by 3 heirs: $20,000.00 $10,000.00 4. Daughter B's share $20,000.00 minus advancements $0.00 $20,000.00 5. Daughter C's share $20,000.00 minus advancements $0.00 $20,000.00 7 Presumption against treating lifetime gifts as advancements—gifts may reflect a desire to favor the recipient UPC § 2-109(a) treats gift as an advancement only if (i) the decedent declared in a contemporaneous writing or the heir acknowledged in writing that the gift is an advancement or (ii) the decedent's contemporaneous writing or the heir's written acknowledgment otherwise indicates that the gift is to be taken into account in computing the division and distribution of the decedent's intestate estate Ind. Code § 29-1-2-10 (1) the decedent declared in a writing or the heir acknowledged in a writing that the gift is an advancement; or (2) the decedent's writing or the heir's written acknowledgment otherwise indicates that the gift is to be taken into account in computing the division and distribution of the decedent's intestate 8 estate. Guardianship of Minors Guardianship of the property Conservatorship A guardian of property with investment powers similar to those of trustees, more flexible than guardianship. Custodianship Subject to burdensome and costly judicial supervision and should be avoided. A person is given property to hold for the benefit of a minor under the UTMA or UGMA. Useful for modest funds. Trusts Flexible and highly customizable property management arrangement. Don’t expire when child reaches age 18 or 21 9 C. Bars to Succession 10 Two key bars to succession Slayer rule—if you kill the decedent, you lose your entitlement as an heir or beneficiary (forfeiture) Disclaimer—you may voluntarily relinquish your entitlement as an heir or beneficiary (waiver) Usually done to reduce taxes or avoid having one’s share of an estate go to one’s creditors 11 What were the facts in Mahoney, p.146? Charlotte Mahoney murdered her husband, who died intestate. If her husband had died of natural causes, Charlotte would have been the sole heir of her husband’s estate. If there had been a larger estate, the husband’s parents also would have been heirs What result under Indiana’s intestacy rules? Charlotte ¾, Howard’s parents split ¼ May Charlotte inherit? 12 In re Estate of Mahoney, In re220 Estate of (Vt. Mahoney A.2d 475 1966) Mother Charlotte Mahoney Mark Mahoney Howard Mahoney 13 Slayer rules (p.146) Slayer inherits—inappropriate to impose an additional penalty for the crime, plus constitutional prohibition against corruption of blood Legal title does not pass to slayer—no one should be able to profit from own wrongdoing Slayer receives share in “constructive trust” for heirs next in line—avoids the rewriting of the statutory laws of descent but ensures that slayer does not profit from wrongdoing (UPC and Ind. Code § 29-1-2-12.1) 14 Indiana slayer rule A person is a constructive trustee of any property that is acquired by the person or that the person is otherwise entitled to receive as a result of an individual's death, including property from a trust Ind. Code § 29-1-2-12.1(a) (emphasis added) 15 Non-probate transfers Slayer rules include non-probate transfers. In Indiana, A person is a constructive trustee of any property that is acquired by the person or that the person is otherwise entitled to receive . . . including property from a trust Ind. Code § 29-1-2-12.1(a) (emphasis added) See also Heinzman v. Mason, 694 N.E.2d 1164 (Ind. Ct. App. 1998) (imposing constructive trust on proceeds from life insurance policy and retirement account) 16 Who counts as a slayer? Usually have to have acted intentionally In Indiana, one is a slayer if the person has been found guilty, or guilty but mentally ill, of murder, causing suicide, or voluntary manslaughter Ind. Code § 29-1-2-12.1(a) 17 What happens to the slayer’s share? Some states will let the slayer’s share pass to the slayer’s heirs Other states (including Indiana) do not let the slayer’s heirs take 18 Constructive trust without a conviction A criminal conviction is a sufficient and conclusive basis for imposing a constructive trust but not a necessary basis—can demonstrate guilt by a preponderance of the evidence in a civil proceeding to impose a constructive trust (e.g., when killer commits suicide after the murder or when killer is acquitted) UPC § 2-803(g) Heinzman v. Mason, 694 N.E.2d 1164 (Ind. Ct. App. 1998) 19 O’s estate goes to sister A; if A disclaims, property goes to niece B, avoiding gift and estate taxes and possibly income taxes— note 9-month time limit for disclaimer under federal tax code (Note 1, page 153) O A Disclaims B 20 Disclaimer and Representation, p. 154 O C takes ½ and A’s children each take ¼, even if we’re in a modern per stirpes state—don’t want A to be able to reduce C’s share A Disclaims A1 A2 B A3 A4 C 21 Drye v. United States, 528 U.S. 49 (1999) Irma Disclaims Rohn Cannot use disclaimer to evade a federal tax lien—but note that the IRS could not have seized Irma’s estate had she left it to Theresa in a will Sue Theresa 22 Indiana intestacy law Except as otherwise provided in subsection (c), the surviving spouse shall receive the following share: (1) One-half (1/2) of the net estate if the intestate is survived by at least one (1) child or by the issue of at least one (1) deceased child. (2) Three-fourths (3/4) of the net estate, if there is no surviving issue, but the intestate is survived by one (1) or both of the intestate's parents. (3) All of the net estate, if there is no surviving issue or parent. Ind. Code 29-1-2-1(b) 23