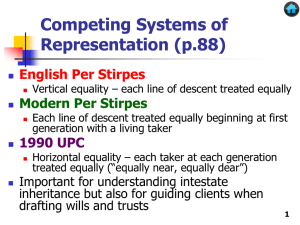

Transfers to Children - Robert H. McKinney School of Law

advertisement

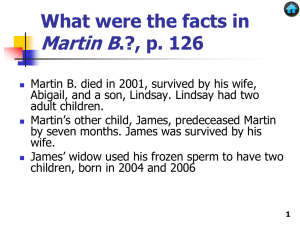

Intestacy and children In our consideration of the rules of intestacy, we’ve seen that spouses are most favored, with children being next favored. Today, we consider what it means to be a “child.” The simple case exists when you have a married couple that has a child together without the involvement of a third party. But what if the child is adopted? What if the child is born or conceived after the death of a genetic parent? In today’s class, we’ll look at how these differences affect the child’s rights to inherit. 1 What were the facts in Hall v. Vallandingham (p. 97)? (Is it really true that the “primary purpose for adoption . . . is inheritance rights?”) Earl and Elizabeth had four children. Earl died, Elizabeth remarried, and her new husband, Jim, adopted the four children. This case arose because Earl’s brother died intestate. The brother had no children, no spouse and no parents. To whom should the brother’s estate pass? The brother’s siblings and their descendants 2 Hall v. Vallandingham (p. 97) Hall v. Vallandingham 540 A.2d 1162, (Md. Ct. Special App. 1988) Sibs Sibs Sibs Wm. Jr. Earl Eliz. Jim Biological Children of Earl, Adopted by Jim 3 What should happen to the sibling share that would have gone to Earl? Should it go to Elizabeth, Earl’s widow since his estate would pass to her through intestacy? No—she’s an in-law Can Earl’s children inherit? No—under Maryland trusts and estates law, they lost their right to inherit by virtue of their adoption by Elizabeth’s second husband If the children cannot inherit from Earl after the adoption, they also cannot inherit through Earl after the adoption 4 Did the court correctly interpret Maryland law? What textual argument can we make, and Earl’s children did make, that they were heirs? “On adoption, a child no longer shall be considered a child of either natural parent, except that upon adoption by the spouse of a natural parent, the child shall be considered the child of that natural parent” (current law) “Upon entry of a decree of adoption, the adopted child shall lose all rights of inheritance from its parents and from their natural collateral or lineal relatives” (prior law) How did the court reconcile the two statutes? The current statute just uses different words to say the same thing—wouldn’t want to give adopted children greater rights than other children 5 What result under the UPC? b) [Stepchild Adopted by Stepparent.] A parent-child relationship exists between an individual who is adopted by the spouse of either genetic parent and: (1) the genetic parent whose spouse adopted the individual; and (2) the other genetic parent, but only for the purpose of the right of the adoptee or a descendant of the adoptee to inherit from or through the other genetic parent. Which approach—Maryland or UPC—does a better job of reflecting the likely intent of someone like Earl’s brother? UPC 2-119 Probably the UPC Besides the Maryland and UPC approaches, some states allow adopted children to inherit from both adoptive and genetic parents even when the adoptive parent is not a stepparent 6 UPC and adopted children If an adopted child can inherit through the genetic parent after being adopted by a step-parent, why can’t the genetic parent inherit through the adopted child? Why is it a one-way street? Inheritance would become too complex if genetic relatives as well as adoptive relatives could inherit from or through the child; Is not clear that this is what the intestate decedent would want; and If adoption records are sealed, it may not be possible for the adopted child to prove who the genetic relatives are and vice versa. 7 Indiana law (same as Hall) For all purposes of intestate succession, including succession by, through, or from a person, both lineal and collateral, an adopted child shall be treated as a natural child of the child's adopting parents, and the child shall cease to be treated as a child of the natural parents and of any previous adopting parents. However, if a natural parent of a child born in or out of wedlock marries the adopting parent, the adopted child shall inherit from the child's natural parent as though the child had not been adopted, and from the child's adoptive parent as though the child were the natural child. In addition, if a person who is related to a child within the sixth degree adopts such child, such child shall upon the occasion of each death in the child's family have the right of inheritance through the child's natural parents or adopting parents, whichever is greater in value in each case. Ind. Code 29-1-2-8 (emphasis added) 8 Adoption of adults We’ve seen that you can make a child your child for purposes of inheritance by adopting the child. Can you make an adult your child for purposes of inheritance by adopting the adult? Maybe you want your spouse or partner to be able to receive your share if you predecease your spouse or partner Most states say yes, but some states will prevent the adoption (p.102) Note the value of adoption also for fending off challenges to the validity of a will T wants to leave estate to partner in T’s will, and T’s siblings are the apparent heirs and can challenge the will If T adopts partner, then partner replaces T’s siblings as the 9 apparent heir; T’s siblings no longer can challenge the will Adoption and wills We’ve seen that you can make a child your child for purposes of inheritance by adopting the child. Does an adopted child also step into your shoes as a genetic child for purposes of your share under someone else’s will (e.g., child adopts grandchild)? Traditional trusts and estates law said no—testators who were “strangers-to-the-adoption” were not viewed as intending that the adopted children take Current law includes a presumption that adopted children will be treated as genetic children. If testators do not want adopted children to be treated as genetic children, they need to say so (something to remember when advising clients whose wills you draft) (page 103) 10 What if the adopted child is an adult? What were the facts in Minary, p. 103 Amelia Minary and her husband had three sons, James, Thomas and Alfred In her will, Amelia set up a trust to support her husband and sons, with the trust terminating after all four died. When the trust terminated, the corpus would go to her surviving heirs (making rules of intestacy necessary to interpret her will and trust) Amelia died, triggering the trust The husband died first, then James died without descendants, Thomas died after having two children and Alfred died after adopting his wife (whom he married two years after his mother’s death) 11 Minary v. Citizens Fidelity Bank, p.103 Minary419 v. S.W.2d Citizens Fidelity Bank (1) 340 (Ky. 1967) Amelia Mr. Minary James Thomas Alfred 1934 Myra M. Adopted 1959 Thomas Jr. Amelia M.G. 12 Dividing the trust in Minary How should Amelia’s trust be divided? Who were the heirs, and what were their shares? Should Thomas’ two children each take 1/2 of the estate, should Thomas’ two children and Alfred’s wife each take 1/3 of the estate, or should Alfred’s wife take 1/2 and Thomas’ children each take 1/4 ? Would Alfred’s wife take from the trust if she had been a child when Alfred adopted her? Yes—absent an indication of contrary intent by the testator, adopted children are treated as genetic children 13 What do we learn from Kentucky statutes on adoption? “An adult person . . . may be adopted in the same manner as provided by law for the adoption of a child and with the same legal effect. . . .” KRS 405.390 “From and after the date of the judgment the child shall be deemed the child of petitioners and shall be considered for purposes of inheritance and succession and for all other legal considerations, the natural, legitimate child of the parents adopting it the same as if born of their bodies.” KRS 199.520 14 What result and why? Alfred’s wife did not inherit from Amelia’s will (pp.105-106) Alfred adopted his wife solely as a way to qualify her for the trust’s corpus. Amelia had not included her children-in-law in her will, and Alfred was trying to evade that exclusion. According to the court, including Alfred’s wife would violate Amelia’s intent Might there be a reason why Amelia did not include Alfred’s wife in her will that would suggest the wife should take? By not including the wife, she wouldn’t take if there was a divorce On the other hand, if they remained married, she would be protected by Alfred or their children As we will see, there are ways to provide flexibility in a trust so future developments can be taken into account (e.g., power of 15 appointment in Martin B.) What result and why? Minary is consistent with the UPC, p. 106. It’s one thing to adopt a child and raise it—one is not likely to do so to manipulate the interpretation of a will or trust If adopted adults were included in class gifts in trusts or wills (i.e., gifts to my heirs or my descendants), one could easily manipulate the interpretation of a trust or will For example, childless beneficiaries of a trust or will could adopt their 20 closest friends. 16 Posthumously-born children If H dies, and W is pregnant, their posthumouslyborn child will be treated as a child for purposes of trusts and estates law (p. 115) What if W does not become pregnant with H’s child until after H’s death (man freezes sperm in anticipation of infertility and/or death)? 17 What were the facts in Woodward ?, p.118 Warren Woodward was diagnosed with leukemia. Advised that treatment for the leukemia might leave him infertile, Warren froze some of his semen for later use. Treatment for the leukemia was unsuccessful, and Warren died. Two years later, Warren’s wife, Lauren, gave birth to twin girls after artificial insemination with Warren’s semen. 18 Woodward of Social Woodwardv.v.Commissioner Comm’r of Soc. Sec., Security 760 N.E.2d 257 (Mass. 2002) Lauren Woodward Michayla Woodward Warren Woodward Mackenzie Woodward 19 Were the twin girls Warren’s “children” under the MA rules for intestacy? The status of the children under the rules for intestacy did not come up because Warren failed to write a will Rather, Lauren applied for Social Security survivor benefits for the children, and Social Security rules look to state intestacy law to determine whether the twins were Warren’s children Not clear why Social Security does not have a federal rule since policies for intestacy don’t necessarily align with policies for Social Security benefits In Astrue v. Capato, 132 S. Ct. 2021 (2012), Supreme Court upheld Social Security’s reliance on state intestacy law 20 Were the twin girls Warren’s “children” under the MA rules for intestacy? Lauren argued that posthumously-conceived children should always be treated as the decedent’s children. What’s the problem with this argument? It could take many years to figure out who the children are The decedent may not have wanted his semen used posthumously Did the MA definition for “issue” include posthumouslyconceived children? MA defined issue as all direct genetic descendants, marital or nonmarital Was there any reason to create an exclusion for posthumouslyconceived children? 21 In deciding the status of the girls, what were the relevant interests? Best interests of children (pp.120-121) The state has consistently acted to protect children and assure their financial support, regardless of their birth status The state has not excluded posthumously-conceived children as heirs under its intestacy rules The state has done much to promote artificial insemination On the other hand, what may be best for the children born posthumously may not be best for children overall—if posthumouslyborn children are given rights of inheritance, the children born during the testator’s life are given a smaller share, and this can provoke conflict within families This takes us to the next state interest—providing certainty to heirs and creditors by the orderly, prompt and accurate administration of estates 22 In deciding the status of the girls, what were the relevant interests? Orderly administration of estates (p.122) The usual limitations period is one year. But will that work for posthumously-conceived children? The state requires certainty of the decedent’s paternity—not difficult to establish with posthumously-born children The state employs a limitations period for the filing of claims against an estate (for potential heirs and creditors) Not fair to the surviving spouse to require a decision so soon after the decedent’s death Also, it might take several inseminations to generate a pregnancy What’s the appropriate limitations period? Court leaves this question for another day (other states require conception within two-three years, p.125) 23 In deciding the status of the girls, what were the relevant interests? Reproductive interests of the decedent (pp. 122123) The decedent may not have intended to have posthumously-born children (perhaps only to use the sperm while he was still alive) Treat them as heirs if the decedent consented before death to Posthumous reproduction and Support any children born through posthumous reproduction (not always required by states that recognize posthumous reproduction) 24 What does Indiana law say? Descendants of the intestate, begotten before his death but born thereafter, shall inherit as if they had been born in the lifetime of the intestate and had survived him. With this exception, the descent and distribution of intestate estates shall be determined by the relationships existing at the time of the death of the intestate. Ind. Code § 29-1-2-6 But this statute was adopted in 1953. 25 Do posthumously-conceived children take from a nonparent’s will? For an answer to this question, we turn to the Martin B. case 26 What were the facts in Martin B.?, p. 126 Martin B. died in 2001, survived by his wife, Abigail, and a son, Lindsay. Lindsay had two adult children Martin’s other child, James, predeceased Martin by seven months. James was survived by his wife James’ widow used his frozen sperm to have two children, born in 2004 and 2006 Martin had left trusts for the benefit of his “issue” 27 In re Martin B., In re Martin B. 841 N.Y.S.2d 207 (N.Y. Surr. Ct. 2008) Abigail B. Nancy James Mitchell James Warren Martin B. Lindsay Adult Child 1 Adult Child 2 28 What were the relevant terms of Martin’s trusts? Martin B. left seven trusts that gave the trustees authority to sprinkle principal among his issue while his wife, Abigail, was alive Martin also gave Abigail a power of appointment to determine the distribution of the principal upon her death If Abigail did not exercise her power of appointment, the trustees had authority to sprinkle the principal among Martin’s “issue” and “descendants” Should the posthumously-conceived children of James count as the issue of Martin? 29 Could the two children inherit from James? No. Under NY law, posthumously-conceived children do not share in the intestate estate (p. 127). Similarly, if James had left a will, the children would not take as “after-born” children unless he stated otherwise in his will (p. 127). What result under the UPC? (p. 125) You have a 45-month window to give birth to the child. James died on January 13, 2001, and the first child was born on October 15, 2004, which is 45 months and 2 days after James’ death. If Nancy could show that she conceived by January 13, 2004, then the first child would count as an heir under the UPC. 30 But we’re dealing with a third-party’s trust The rules that govern James as decedent do not necessarily apply to Martin as donor Moreover, the trust interests are future interests. We don’t have the need to wind up a decedent’s estate in a timely fashion (p. 128) The relevant statutes for future interests include posthumously-born children in the definition of issue, but they did not anticipate posthumously-conceived children 31 Are James’ children eligible for trust sprinklings? General trusts and estates principles hold that a child of assisted reproduction should be treated as any other child of the decedent if the decedent considered the child as his or her own (pp. 128-129) In this view, the two boys are part of Martin’s bloodline, and Martin intended the trusts to benefit all the members of his bloodline The court observed that under the trust instruments, Martin’s intent was to have the trust “benefit his sons and their families equally” (page 129) 32 Advancements: hotchpot Hotchpot Example Advancements: example Testator ($50,000) Daughter A ($10,000) 1. Testator’s estate at death: plus advancements Daughter B ($0) Daughter C ($0) $50,000.00 3. Daughter A's share $20,000.00 $10,000.00 minus advancements $10,000.00 Total hotchpot $60,000.00 2. Hotchpot divided by 3 heirs: $20,000.00 $10,000.00 4. Daughter B's share $20,000.00 minus advancements $0.00 $20,000.00 5. Daughter C's share $20,000.00 minus advancements $0.00 $20,000.00 33 Presumption against treating lifetime gifts as advancements—gifts may reflect a desire to favor the recipient UPC § 2-109(a) treats gift as an advancement only if (i) the decedent declared in a contemporaneous writing or the heir acknowledged in writing that the gift is an advancement or (ii) the decedent's contemporaneous writing or the heir's written acknowledgment otherwise indicates that the gift is to be taken into account in computing the division and distribution of the decedent's intestate estate Ind. Code § 29-1-2-10 (1) the decedent declared in a writing or the heir acknowledged in a writing that the gift is an advancement; or (2) the decedent's writing or the heir's written acknowledgment otherwise indicates that the gift is to be taken into account in computing the division and distribution of the decedent's intestate 34 estate. Guardianship of minors Guardianship of the property Conservatorship A guardian of property with investment powers similar to those of trustees, more flexible than guardianship. Custodianship Subject to burdensome and costly judicial supervision and should be avoided. A person is given property to hold for the benefit of a minor under the UTMA or UGMA. Useful for modest funds. Trusts Flexible and highly customizable property management arrangement. Don’t expire when child reaches age 18 or 21 35 UPC intestacy rules (p.73) Facts 1990 UPC § § 2-101 to 2-106 (rev. 2008) S; no D; no P §2-102(1)(A) all S S; D §2-102(1)(B) all S only if all D are also S’s and S’s only kids §2-102(3) $225K + 1/2 S if D are also S’s but S has others; rest D §2-102(4) $150K + 1/2 S if one or more D is not S’s; rest D S; no D; P §2-102(2) $300K + 3/4 S; rest P no S; D §2-103(a)(1) all D (per capita at each generation) no S; no D; P §2-103(a)(2) all P no S; no D; no P; B or S §2-103(a)(3) B or S (per capita at each generation) no S; no D; no P; no B or S; G or GD §§2-103(a)(4) and (5) 1/2 paternal G; 1/2 maternal G or all to maternal or paternal if no survivors on other side – per capita at each generation no S; no D; no P; no B or S; no G or GD §2-103(b) stepchildren §2-105 escheat to state; therefore no “laughing heirs”; note: no great grandparents 36 Maryland law An adopted child shall be treated as a natural child of his adopted parent or parents. On adoption, a child no longer shall be considered a child of either natural parent, except that upon adoption by the spouse of a natural parent, the child shall be considered the child of that natural parent. Md. Estates and Trusts Code Ann. §1-207(a) 37