Mangesh Kinare service tax_Goa_Chamber

advertisement

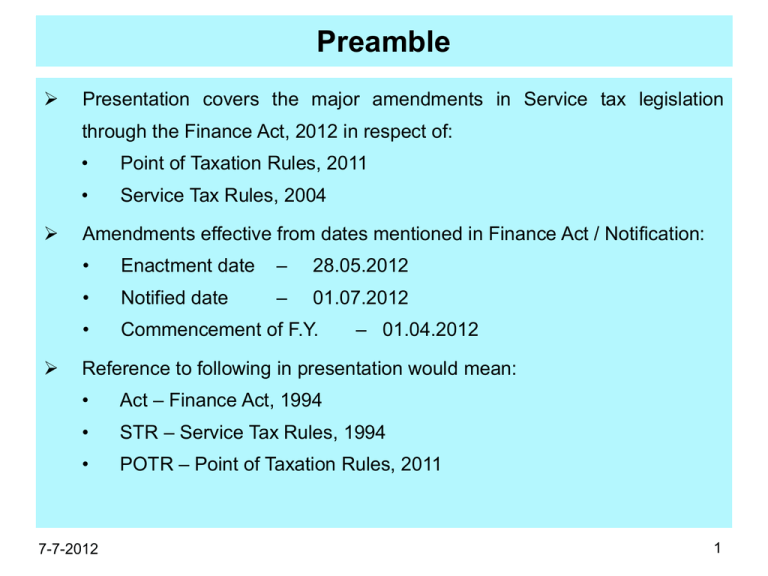

Preamble Presentation covers the major amendments in Service tax legislation through the Finance Act, 2012 in respect of: • Point of Taxation Rules, 2011 • Service Tax Rules, 2004 Amendments effective from dates mentioned in Finance Act / Notification: • Enactment date – 28.05.2012 • Notified date – 01.07.2012 • Commencement of F.Y. – 01.04.2012 Reference to following in presentation would mean: • Act – Finance Act, 1994 • STR – Service Tax Rules, 1994 • POTR – Point of Taxation Rules, 2011 7-7-2012 1 POINT OF TAXATION RULES, 2011 (‘POTR’) AS AMENDED BY NOTIFICATION NO.4/2012SERVICE TAX DATED 17 MARCH,2012 7-7-2012 2 POTR – Basics “Point of Taxation Rules” (‘POTR’) prescribes the point of taxation “Point of Taxation” (‘POT’) means the point of time when service shall be deemed to have been provided (occurrence of taxable event) [Rule 2(e)] Due date for tax payment linked with POT (Rule 6(1) of Service Tax Rules) Pre POTR, tax obligation was on realization of consideration (Cash basis) Post POTR, tax obligation generally arises on accrual or realization of consideration, whichever is earlier (subject to few exceptions) Does POTR is in consonance with legislative intent to bring it at par with VAT or Excise Duty in view of impending GST enactment? 7-7-2012 3 POT – Reverse Charge Mechanism (Rule 7) POT for following services in respect of which service recipient is obliged to pay tax under reverse charge mechanism U/s 68(2) / Rule 2(1)(d) shall be the date of payment: Nature of Service Service provider Service recipient Insurance auxiliary business Insurance agent Any person carrying on insurance business GTA services Goods transport agent Specified persons paying freight Sponsorship Services Any person Any body corporate or partnership firm located in taxable territory Arbitration services Arbitral tribunal Business entity located in taxable territory Legal services Individual advocate / firm of advocates Business entity located in taxable territory 7-7-2012 4 POT – Reverse Charge Mechanism (Rule 7) Nature of Service Service provider Service recipient Support services excluding (1) renting of immovable property (2) Postal services (3) Services in relation to an aircraft or vessel (4) Transport of goods or passengers Government or local authority Business entity located in taxable territory Rent-a-cab Any individual, HUF, firm or partnership firm including AOP located in taxable territory Business entity registered as a body corporate Person in non-taxable territory Person in taxable territory Supply of manpower for any purpose Works contract Any service (popularly known - Import of service) Where payment for service is not made within period of 6 months of date of invoice, POT shall be determined as per General Rule (Rule 3) 7-7-2012 5 POT–Transaction with Associated Enterprises (Rule 7) In case where service provider is located outside India and is an associated enterprise of service recipient, POT will be earlier of (Proviso to Rule 7): • Date of payment • Date of debit in books of account of person liable to pay tax This Proviso does not apply to an Indian service provider providing service to associated enterprise located in or outside India ‘Associated Enterprise’ has the meaning assigned to it in Section 92A of Income Tax Act, 1961 (Section 65(7b) of Act) Relationship to be seen on which date? Rule 7 overrides all other Rules of POTR • Rule 3–General Rule (discussed in slide 8) • Rule 8–Royalty, Patents, Copyright, Trademarks (discussed in slide 7) • Rule 4-Change in tax rate (discussed in slide 14) 7-7-2012 6 POT – Copyright etc. (Rule 8) This exception is carved out for Copyrights Trademarks What about Franchise services? This Rule applies where: Designs Patents Royalty • Whole consideration not ascertainable when services performed; and • Usage by / benefit to service recipient gives rise to payment obligation In above referred cases, POT would be earlier of [Rule 8]: • Date of issue of invoice • Date of receipt of consideration by service provider Whether this Rule will be redundant in case where service provider is associated enterprise? 7-7-2012 7 POT – General Rule (Rule 3) General rule applies to cases not falling under: • Rule 4 - Change in tax rate • Rule 5 - Where the service is taxed for the first time • Rule 7 - Liability under reverse charge mechanism - Transactions with associated enterprises • Rule 8 - Transactions for copyright, patents, trademarks or design In general, POT would be earlier of [Rule 3]: • Date of issue of invoice – where invoice is issued within 30 days from completion of service • Date of completion of service – where invoice is not issued within 30 days from completion of service • Date of receipt of consideration (including receipt of advance) Continuous supply of service falls under General Rule w.e.f. 01.04.2012 7-7-2012 8 POT – General Rule (Rule 3) Where service provider receives a payment upto Rs. 1,000/- in excess of the amount indicated in the invoice, POT for such excess amount, at the option of the service provider, shall be earlier of • date of issue of invoice, or • date of completion of service, where invoice not issued within 30 days Amendment vide Notification No 37/2012-ST dated 20.06.2012 • Where service provider opting receipt as POTR in respect of an amount of Rs. 1,000/- in excess of the amount indicated in the invoice, no invoice is required to be issued to such an extent 7-7-2012 9 Meaning of Continuous Supply of Service Continuous supply of service would mean [Rule 2(c) of POTR]: • Services provided/agreed to be provided continuously, or recurrent basis, Under a contract for a period exceeding 3 months With the obligation for payment periodically or from time to time • Any service notified as continuous supply of service Notification No. 28/2011-ST dated 01.04.2011 notifies following services as “continuous service”: • Telecommunication Service • Commercial or Industrial Construction • Residential Construction • Internet Telecommunication Service • Works Contract Service 7-7-2012 10 Meaning of ‘Completion of Service’ Date of completion of continuous service would be completion of an event which requires service receiver to make payment as per contract. ‘Completion’ is not defined/explained in POTR except continuous service In terms of Circular No 144/13/2011-ST dt. 18.07.2011 completion means: • completion of all other auxiliary / related activities that place the service provider in a situation to be able to issue an invoice • Such auxiliary activities could include activities like measurement, quality testing etc which may be essential pre-requisites for identification of completion of service • This interpretation of completion of services also applies to “continuous supply of service” Circular puts the caveat that auxiliary activities should not be flimsy or irrelevant Circular may not achieve desired purpose due to such caveat 7-7-2012 11 Circular Explaining General Rule TRU Circular No.F.No.341/34/2010-TRU dated 31.03.2011 explaining applicability of POTR in regular cases: Completion of service Invoice date Payment received Point of Taxation 16.07.11 26.07.11 06.08.11 26.07.11 Remarks Invoice issued in 30 days and before receipt of payment 16.07.11 18.08.11 21.07.11 16.07.11 Invoice not issued within 30 days and payment received after invoice date 16.07.11 26.07.11 21.07.11 21.07.11 Invoice issued in 30 days but payment received before invoice 16.07.11 7-7-2012 18.08.11 11.07.11 (part) and 21.07.11 (remaining) 11.07.11 and 16.7.11 for respective. Amounts Invoice not issued in 30 days. Part payment before completion, remaining later. 12 POT – New Services (Rule 5) New services (other than continuous service), not liable to tax if (Rule 5): • Invoice raised and payment received before effective date; or • Payment received before effective date and invoice raised within 30 days from effective date ‘Effective date’ would mean notified date on which Services become taxable Consider following example: • Hotel Accommodation Service is taxable w.e.f. 01.05.2011. • Hotel opts for POT from inception (i.e. 01.05.2011) • A person stays in hotel from 16.04.2011 to 10.05.2011 • Hotel makes bill / guest makes payment on check out (i.e. 10.05.2011) In terms of above Rule, service tax is payable on entire billing though the service was not taxable for the period 16.04.2011 to 30.04.2011 Is this proposition legally tenable? 7-7-2012 13 POT – In case of change in Tax Rate (Rule 4) Provision of service Date of Invoice Date of payment POT / Effective tax rate on POT date Before rate change 30.04.2011 After rate change 02.05.2011 After rate change 30.05.2012 Invoice date or payment date, whichever is earlier 02.05.2011 Before rate change 30.04.2011 Before rate change 30.04.2011 After rate change 30.05.2012 Date of invoice 30.04.2011 Before rate change 30.04.2011 After rate change 30.09.2011 Before rate change 30.04.2011 Date of payment 30.04.2011 After rate change 30.09.2011 Before rate Change 30.04.2011 After rate change 30.05.2012 Date of payment 30.05.2012 After rate change 30.09.2011 Before rate change 30.04.2011 Before rate change 30.04.2011 Invoice date or payment date, whichever is earlier 30.04.2011 After rate change 30.09.2011 After rate change 30.09.2011 Before rate change 30.04.2011 Date of invoice 30.09.2011 Is it fair and legally correct to modify POT in case of change in tax rates? Circular No 158/9/2012-ST dated 08.05.2012 is in consonance with Rules? 7-7-2012 14 Determination Of Tax Rate, Value Of Taxable Services And Exchange Rate [Section 67A] – w.e.f. 28.05.2012 Following prevailing on the date of provision of service / receipt of advance will be relevant for discharging service tax liability: • Tax rate • Value of taxable services • Exchange rate. Subsequent change in any of above would not alter service tax liability at later date. Whether Rule 4 of POTR is inconsistent with above referred provision? The exchange rate would mean the rate of exchange referred to in the Explanation to Section 14 of the Customs Act, 1962. 7-7-2012 15 Insertion of New Rules – POTR Vide Notification No 4/2012-ST dated 17.03.2012 w.e.f. 01.04.2012 Pre-amendment Position Rule Rule 2A – Date of Payment Post-amendment Position --- Earlier of: • Date on which payment is entered in the books of accounts, or • Date on which payment is credited to the bank account of the person liable to pay tax Rule 8A – POT --in other cases Where POT cannot be determined as the date of invoice or the date of payment or both are not available, the Officer shall by an order in writing, after giving an opportunity of being heard, determine POT to the best of his judgment 7-7-2012 16 MAJOR AMENDMENTS IN SERVICE TAX RULES, 1994 THROUGH NOTIFICATION NO. 3/2012-ST DATED 17.03.2012 AND 36/2012-ST DATED 20.06.2012 7-7-2012 17 Change in Tax Rates w.e.f. 01.04.2012 – Notification 3/2012-ST Alternate / Optional Rates (excluding education cess) Service Rule Life Insurance - First year Premium - Renewal Premium 6(7A) Promotion, Marketing and organizing Lottery - Guaranteed Prize Payout less than 80% 6(7C) - Guaranteed Prize Payout more than 80% Air Travel Agents - Domestic bookings - International bookings 7-7-2012 Rule 6(7) Up to 31.03.2012 From 01.04.2012 1.50 % 1.50 % 3.00 % 1.50 % Rs.6,000 for every Rs. 10,00,000 Rs.7,000 for every Rs. 10,00,000 Rs.9,000 for every Rs. 10,00,000 Rs.11,000 for every Rs. 10,00,000 0.60% 1.20% 0.60% 1.20% 18 Change in Tax Rates w.e.f. 01.04.2012 – Notification 3/2012-ST Service Foreign Exchange Dealing - Up to Rs.1,00,000 Rule Up to 31.03.2012 From 01.04.2012 0.1% (Minimum of Rs.25) 0.12% (Min. of Rs.30) 6(7B) - Rs.1,00,001 to Rs.10,00,000 Rs.100 + 0.05% of excess Rs. 120 + 0.06% of over Rs.1,00,000 excess over Rs.1,00,000 - Above Rs.10,00,000 Rs.550 + 0.01% of excess over 10,00,000 (Max of Rs.5,000) 7-7-2012 Rs.660 + 0.12% of excess over 10,00,000 (Max of Rs.6,000) 19 Service Tax Rule 6A and Notification 39/2012-ST Exporter of Services will be entitled to refund (rebate) of Input service tax used in providing export of services – Notification No 39/2012-ST dated 20.06.2012 Any service provided/agreed to be provided shall be treated as export of service when: • Service provider is located in the taxable territory • Service recipient is located outside India • Service is not a service specified in Negative list (i.e. Section 66D) • Place of provision of the service is outside India • Consideration for such service is received in convertible foreign exchange; and • The service provider and service recipient are not merely establishments of a distinct person 7-7-2012 20 Procedural Amendments Extension of Time limit for issuance of invoice (w.e.f 01.04.2012): • For banking and financial institutions – 14 days to 45 days • For other service providers – 14 days to 30 days Discharge of service tax liability on accrual to realization basis / vice versa (w.e.f 01.04.2012) Individuals / firms and LLP having turnover Realization basis irrespective of taxable services of Rs.50 Lakhs or less of nature of services. in immediately preceding financial year. Individuals / firms and LLP having turnover of taxable services of more than Rs.50 Lakhs in immediately preceding financial year. Accrual basis irrespective of nature of services. Provider of professional services will also be covered. Service providers other than Individuals / Accrual basis irrespective of firms and LLP nature of services. 7-7-2012 21 Procedural Amendments Adjustment of excess payment of service tax (w.e.f 01.04.2012): • Monetary limit of Rs.2 Lakhs removed and adjustment allowed without any monetary limit • Requirement of intimating such adjustment to jurisdictional superintendent is omitted Partnership firm to include Limited Liability Partnership (LLP). This provides clarity on due date for tax payment and whether to pay service tax on accrual / realization basis by LLP (w.e.f 01.04.2012) 7-7-2012 22 Words of Caution Views expressed are the personal views of faculty based on his interpretation of law Application/implications of various provisions will vary on facts of the case and law prevailing on relevant time Contents of this presentation should not be construed as legal or professional advice This is an educational meeting arranged with clear understanding that Faculty will not be responsible for any error, omission, commission and result of any action taken by participant or anyone on the basis of this presentation 7-7-2012 23 THANK YOU 7-7-2012 24