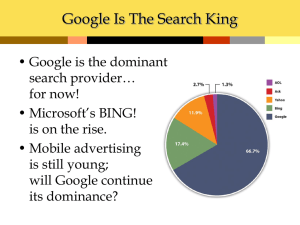

Lecture 9 Slides

advertisement

As we wait for class to start, please sign in for today’s attendance tracking: Text to 37607: DILBERT netID or • Go online to AEM 4550 class website • Click on “attendance tracking” – in green font • Submit your netID LECTURE 9: ADVERTISING COSTS AND MEDIA, ECONOMICS OF ONLINE ADVERTISING AEM 4550: Economics of Advertising Prof. Jura Liaukonyte Selling Network Television NETWORKS SELL THEIR TIME IN 3 STAGES: 1.The Upfront Market 2.The Scatter Market 3.The Opportunistic Market Television Sells Spots Like Airlines Sell Seats If a flight leaves with empty seats, revenue for the seat is zero. To assure full planes, sell the seats at a price that will sell them out early. Charge last -minute buyers highest price 1. THE UPFRONT MARKET Annual purchase of commercial time well in advance of the telecast time. Upfront advertisers buy 70% of prime time and 50% of other dayparts. Most buy for one year. Get best price. Biggest national advertisers buy children’s programs, prime time, daytime, news, and late night. 2. SCATTER MARKET Sale of most of the year’s remaining inventory not sold at upfront. Inventory generally tight. Prices usually 50% higher than upfront. 3. OPPORTUNISTIC MARKET Last-minute buying of inventory due to: Changes in programming Advertisers don’t want to be on controversial programs Advertiser inability to pay Cancellations and Guarantees Most network orders are non-cancelable. If an advertiser cannot or does not want the time, it is the advertiser’s responsibility to sell the time - not the network’s. Networks cancel programs with no notice to the advertiser with the provision that commercials will run in another program that delivers the same audience profile. Ratings Guarantees The cost of network time is based on network guarantees of spot price vs. audiences, computed in cost per thousand. If the ratings projected by the network to the advertiser are not achieved, the network runs the spot in other programs to accumulate sufficient ratings to bring the CPM down to the promised level. The extra spots the advertiser gets are called MAKEGOODS Ratings Guarantees Networks are incentivized to give a slightly inflated estimate than to low-ball it and outperform (additional GRPs are free for advertisers). Networks aim to estimate ratings of new shows within 5% of what they will deliver (and usually on average they achieve that). Otherwise a lot of inventory will need to be given back as makegoods. Predictions are based on last year’s performances among other things. Examples: 2013 Baseball World Series resulted in makegoods. Some makegoods can be transferred to HULU Volatility of Ratings Advertising Avoidance DVR Penetration DVR Penetration A Major Concern: Forrester predicts US HH to watch 15% fewer commercials due to DVRs 47% of [DVR] respondents skip ads most of the time (Jupiter Media) 60% of advertisers plan to decrease TV ad budgets due to DVRs (Association of National Advertisers and Forrester Research) American Advertising Federation poll finds ¾ of ad execs feel DVRs significantly affect TV advertisement methods DVRs and ad avoidance DVRs may increase commercial avoidance, BUT: Facilitate the measurement of commercial avoidance Advertisers can use ad avoidance data to improve creative strategies, targeting, message rotation and scheduling, media buying, and ROI (return on investment) measurements The very act of fast-forwarding requires that the viewer pays attention Alternatives: viewers getting up to go to the fridge or the bathroom or turning away to the computer or to talk to someone else in the room or flipping the remote around the channels There can be a real effect on purchasing behavior due to the attention required Advertisers Adapting Advertisers figure out ways to take advantage of the attention fast-forwarding requires Improve ad creative itself Reduce viewers’ motivations to fast-forward Advertisers Adapting Advertisers can use information gathered from DVRs to figure out how to combat fast-forwarding Target niche audiences to tailor more effective advertising TiVo’s Stop||Watch is tracking second-by-second viewing among all users and 20,000 DVR users with demographic data known Networks adopt to fast-forwarded commercials by: Further integrating products into programming – product placement Tricking viewers by changing the length of commercials Integrating Tune-ins for the show that is being watched Downside: may annoy viewers One Early Study Finds No DVR Effect Why no DVR effect? Advertising has small effects to start with People do not skip many ads People in control group zap anyhow People attend to what they skip Mandese (2004) finds 67% of DVR viewers notice the advertisements they forward through Multiple ad viewing from repeat plays More recent findings (Wilbur 2015): Viewers were much less likely to avoid ads during: animated programs (31%-59%), followed by professional basketball (25%-36%), game shows (23%-36%) and situation comedies (26%-33%). Five product categories were found to reduce ad-avoidance: quick service restaurants, domestic hybrid automobiles, family clothing stores, pizza products and movies. More recent findings (Wilbur 2015): Networks with highest ad skipping: MSNBC, CBS, Lifetime, NBC, Discovery Precipitation increases advertising avoidance, with one inch of rain associated with a 2%-24% higher ad skipping probability. Online Advertising ONLINE ADVERTISING Online Advertising Partially Based on HBS case “Google Advertising”, which is a required reading Online Advertising Models Measurability Google Advertising Revenues Online Ad Formats Floating ad: An ad which moves across the user's screen or floats above the content. Expanding ad: An ad which changes size and which may alter the contents of the webpage. Polite ad: A method by which a large ad will be downloaded in smaller pieces to minimize the disruption of the content being viewed. Wallpaper ad: An ad which changes the background of the page being viewed. Trick banner: A banner ad that looks like a dialog box with buttons. It simulates an error message or an alert. Pop-up: A new window which opens in front of the current one, displaying an advertisement, or entire webpage. Pop-under: Similar to a Pop-Up except that the window is loaded or sent behind the current window so that the user does not see it until they close one or more active windows. Video ad: similar to a banner ad, except that instead of a static or animated image, actual moving video clips are displayed. Map ad: text or graphics linked from, and appearing in or over, a location on an electronic map such as on Google Maps. Mobile ad: an SMS text or multi-media message sent to a cell phone. Search Advertising Highly effective since it reaches people when they are interested in a topic Relevant, yet not obtrusive Has expanded rapidly in last few years Online Advertising Measurability Huge advantage in measuring effectiveness Pay per click Conversion tracking Value of ranking system Ranks ads by bid x ad quality Show ads likely to get the most valuable clicks in the most prominent position E.g., “best ads get best exposure” Creates a virtuous circle: individuals want to click because results are relevant Search Advertising Search advertising estimated to be 6 times more effective than a banner ad Delivers qualified leads 80% of Internet user sessions begin at the search engines (Source: Internetstats.com) 55% of online purchases are made on sites found through search engine listings (Source: Internetstats.com) Search Engines Market Share (2014) Internet Advertising Models For what exactly should advertisers pay and when? When the ad is being shown to the user When the ad is being clicked by the user When the ad has “influenced” the user in the sense that its presentation lead to a “conversion event” Conversion event - the actual purchase of the product advertised in the ad Why wouldn’t an advertiser favor number 1? Google Revenues Advertising Payment Methods CPM – Cost per Mille – an advertiser pays per one thousand impressions of the ad (“Mille” stands for “thousand” in Latin); an alternative term used in the industry for this payment model is CPI (Cost per Impression). CPC – Cost per Click (a.k.a. Pay per Click or PPC; we will use these terms interchangeably) – an advertiser pays only when a visitor clicks on the ad. CPA – Cost per Action – an advertiser only pays when a certain conversion action takes place, such as a product being purchased, an advertised item was placed into a shopping cart, or a certain form being filled. This is the best option for an advertiser to pay for the ads from the advertisers’ point of view since it gives the PAY-PER-CLICK Advertising Model Targeted advertisement based on two effectiveness measures: 1. Click-Through Rate (CTR): specifies on how many ads X, out of the total number of ads Y shown to the visitors, the visitors actually clicked; in other words, CTR = X/Y. CTR measures how often visitors click on the ad 2. Conversion Rate: it specifies the percentage of visitors who took the conversion action. Conversion rate gives a sense of how often visitors actually act on a given ad, which is a better measure of ad’s effectiveness than the CTR measure Recent History of CPC Method Cost Per Click is the predominant advertising payment method, made popular by search engines such a Google and Overture (now part of Yahoo!). Google introduced CPC AdWords program in 2002. Combining a particular ad payment method with a particular targeting method. For Google and Yahoo! the two main models are the keyword-based PPC and the content-based PPC models. Cost Per Click Two problems with the Cost per click model: Although correlated, good click-through rates are still not indicative of good conversion rates It does not offer any “built in” fundamental protection mechanisms against the click fraud