Panel 2, Songzuo Xiang | Challenges of the International Monetary

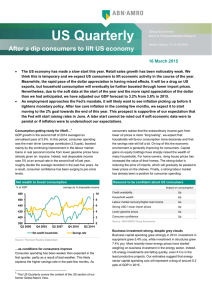

advertisement

the BRICS & Asia, Internationalization, and International Monetary System Conference December 10-11 Hong Kong Songzuo Xiang Chief Economist, Agricultural Bank of China Deputy Director, International Monetary Institute Renmin University of China I. Fundamental causes of international capital and exchange rate volatility, assets bubble-bust cycles and financial crises: seven sins of the pure dollar standard and floating exchange rates II. Stabling exchange rate as the nominal anchor for stabilizing global economy: a case study of RMB exchange rate III. A Proposal for Action I. Fundamental causes of international capital and exchange rate volatility, assets bubble-bust cycles and financial crises: Seven sins of the pure dollar standard and floating exchange rates 1. Great Inflation in the past four decades 2. High frequency of financial crises 3. Dramatic decline of real economic growth rates globally 4. Deterioration of global imbalance 5. Violent capital flows always leads to currency collapse and financial instability 6. Huge augmentation of the “exorbitant privilege” of the dollar 7. Unjustness of the dollar standard and the Great bubble—bust cycle of global economy The First Sin: The Great Inflation in the past four decades Since 1971, The growth rate of international reserve money has been much higher than the growth rate of global real economy. the consequence of which is that the accumulated inflation in global economic system in the past four decades exceeds the accumulated inflation in the whole history of the human being. The year of 1971 The Year of 2011 Increased by Source of Data International Reserve Money($) 45.1b. 7,516b. 170 times IMF Real Economy Growth Rate 4.91% (1953-1973) 3.01%(after 1973); 3.7%(20032006) Less than 4 times Madison and Greenspan 4.5% (1939-1989) (1980-2009) 12.64% (1980-1990) 16.1% (1990-2009)11.42% Greenspan and IMF Inflation Rate 0.2% (1870-1913) According to Alan Greenspan: 1.The Great Inflation after collapse of the Gold Standard reflects the fact that there is no inherent anchor in a fiat money regime (the pure Dollar Standard) 2.The Moderate Inflation even a little bit deflation after 1990 in developed countries reflects the fact that the global wages and prices are being suppressed by a massive shift of low-cost labor (particularly in China), which, by its nature, must come to an end. The Second Sin: High frequency of financial crises Total Crisis World Bank Survey(2003) 117 in 93 countries (1970-2000) Eichengreen and Bordo (1973-1997) 139(1973-1997) 44 Developed countries; 95 Developing countries (1945-1971) Fixed Period 38 Banking Crisis Currency Crisis Twin Crisis 17 E 9 D 26 total 57 E 29 D 86 total 21 E 6 D 27 total 0E 16 E 7E Key facts of financial crises in the past four decades: 1. According to World Bank Research (2003), 27 0f these crises imposed fiscal costs equal to or exceeding 10 % of GDP. 2.The most expensive crises were those in Indonesia after 1997 and in Argentina in the early 1980s, both of which cost taxpayers 55% of GDP. 3. How much did the 2007-2008 crisis impose on these countries or global economy? No exact figure so far, but absolutely very much higher than any previous crisis in terms of fiscal cost and slowing down of GDP growth. The third Sin: Dramatic Decline of Real Economic Growth Rate in almost all developed economies The rate of real GDP growth in different regions or countries before and after the Bretton Woods System USA Japan Germany UK Russian Latin America Africa China Global Total 19501973 3.93 9.29 5.68 2.93 4.84 5.33 4.45 5.02 4.91 After 1973 2.99 2.97 1.76 2.0 -1.15 3.02 2.74 7.84 3.01 2003-2007 2.76 1.86 1.7 2.94 7.51 4.02 4.78 11.66 4.75 2008-2011 0.2 -0.7 0.68 -0.68 1.57 3.78 2.02 9.63 Source: World Bank Website 2.94 The rate of real GDP growth in different regions or countries after Global crisis in 2008 2008 2009 2010 2011 World 2.9 -0.52 5.01 4.4 Asia 7.9 6.5 8.4 8.4 European 1.0 -4.0 2 1.5 China 9.6 9.2 10.4 9.3 USA -0.4 -3.5 3 1.7 Germany 1.1 -5.1 3.7 3.0 Japan -1.0 Source: World Bank Website -5.5 4.4 -0.7 Ronald McKinnon and Kenichi Ohno Hypothesis: Generalized exchange rates floating leads to Global Growth Slowdown. “ The major puzzle of postwar economic history is the slowdown of the growth trend of major industrial countries in the early 1970s. The timing of the slowdown largely coincided with the introduction of generalized float among those countries. Might there be a causal link between the two events? Did weaker growth somehow necessitate an era of exchange fluctuations? Or can we say that the acquiescence to exchange instability led to the deterioration of real performance?” “Our alternative hypothesis is that the deterioration of global economic performance is of monetary and financial origin. We further suspect that exchange fluctuations have much to do with it. It is plausible that reduced productivity growth and output since the 1970s has been, at least in part, the consequence of noisy price signals associated with inflation and deflation, exchange misalignments, and volatility in long-term interest rates. Dysfunction of the price mechanism naturally reduce allocative efficiency, especially that of physical investment.” The Fourth Sin: Deterioration of Global Imbalance 1. the definition of global imbalance by US Treasury (US Trade Deficit) is totally wrong, we need redefine the Global Imbalance. 2.My definition of Global Imbalance: Two Divergence The First is Globally Divergence of Virtual Economy (or Financial Economy) from Real Economy, Which means the growth rate of virtual economy has been much higher than the growth rate of real economy. The Second is Geographically Divergence of Real Wealth Creating Center from Virtual Wealth Creating Center: The real wealth creating center (or manufacturing center) has gradually transferred to emerging countries (particularly China). However, global money and financial center still remain in developed countries (particularly USA), which has the most fundamental implications on global division of labor, global distribution of income, financial crisis, and all macroeconomic policies. Increasing divergence of virtual or financial economy with real economy: ratio of financial assets with GDP Financial Assets/GDP 1980 1995 2005 2010 Global 109% 215% 316% 338% USA 158% 303% 405% 420% Eurozone 118% 278% 359% 380% UK 128% 180% 303% 344% Martin Wolf: “This huge and rapidly growing mountain of financial assets represents promises of future, often contingent, receipts in return for current payment. Sophisticated and dynamic modern economies depend on pyramids of promises.” However, The financial promises is subject not just to calculable risks but to fundamental uncertainty—to “unknown unknowns”. “That is at least part of the reason why financial crises have been so frequent and so dangerous” The Myth: Why the growth rate of financial assets or virtual economy has been so much higher than the growth rate of real economy? We have no satisfactory explanation yet. (A) Ben Bernanke’s “ Global Savings Glut Hypothesis” (B) Richard Duncan’s “ Global Money Glut Hypothesis” (C) Songzuo Xiang’s “ Credit System—Virtual Economy— Real Economy General Equilibrium Model” The Fifth Sin: Financial Globalization and capital flows very often Lead to Economic Collapse 1. Why and When Did Financial Globalization Begin? Martin Wolf: “the abandonment of the Bretton Woods system of fixed, but adjustable, exchange rates in the 1970s marked the beginning of a new global economy. It was the start of an era of unstable exchange rates among the world’s most important currencies. Other events followed. These developments led to the emergence of the second globalization.” 2.Many distinguished people are highly skeptical of financial globalization. Joseph Stiglitz: “ the opening of financial markets in the emerging market economies to foreign capital leads to economic collapse”. Jagdish Bhagwati: “ the claims of enormous benefits from free capital mobility are not persuasive.” George Soros: “ The Deficiencies of Global Capitalism.” Fred Bergsten: “ USA and other developed countries got the large part of benefits of financial globalization” 3. Capital flow from poor to rich countries: The amount of private capital flowing to emerging market countries is only one fifth of total international capital flows from private sources. When governments are added into the picture, emerging market countries have actually been sending capital back to rich countries! In 1913, over 25% of the world stock of foreign capital went to countries with income per person less than one-fifth of the United States, by 2007, this figure had fallen to around 5%. 4.How to explain the current pattern of capital flows? (A) Currency Mismatch for emerging countries (B) “fear of floating” of emerging countries (C) “Liquidity Services” provided by the Dollar as the major international reserve money. The Sixth Sin: Huge Augmentation of The “Exorbitant Privilege” of the Dollar 1.The end of the Bretton Woods system of fixed exchange rates has made exorbitant privilege of the dollar much more exorbitant, as the extraordinary accumulations of foreign exchange reserves by emerging market economies and the cheapness of US liabilities bear witness. 2. A remarkable indication of these effects is what happened to US net liabilities between 2001 and 2006. The ratio of US net liabilities to GDP fell by 3.4 percent of GDP over this period, despite current account deficits that ought , on their own, to have raised net liabilities by 28.2 percent of GDP. ( Quoted from Martin Wolf: “ Fixing Global Finance”) 3. The returns on US assets were 3.32 percentage points higher than the cost of its liabilities between 1973 and 2004. However, during Bretton Woods system period (1952— 1973), the returns on US assets were only 0.26 percentage points higher than the cost of its liabili:ties, according to Gourinchas and Rey:“ From World Banker to World Capitalist: US External Adjustment and the Exorbitant privilege”. 4. the Pure Dollar Standard and Floating Exchange rates serve US benefits much better. The Seventh Sin: unjustness of the dollar standard and the great bubble-bust cycles of global economy 1. The unjustness of the dollar standard “ The functioning of the international monetary system was thus reduced to a childish game in which, after each round, the winners return their marbles to the losers.” “More specifically, the process works this way. When the US has an unfavorable balance with another country ( let us take as an example France), it settles up in dollars. The Frenchmen who receive these dollars sell them to the central bank, the Bank de France, taking their own national money, francs, in exchange. The Bank de France, in effect, creates these francs against the dollars. But then it turns around and invests the dollars back in the US. Thus the very same dollars expand the credit system of France, while still underpinning the credit system in the US.” ( Jacques Rueff, 1961) We can change France to China and the Bank de France to PBOC, and everything is absolutely true, only in much larger scale! 2. US BoP deficit is the mechanism of creating international reserve money and origin of the Great Bubble in Global Economy. Six Important Conclusions 1. The Seven Sins explain the fact that why the US has no incentive to reform. 2. The Seven Sins explain the fact that why the US always urge other countries to float ( Now the major target is China): All nominal arguments for RMB appreciation and flexibility have been refuted by empirical evidences. 3. The Seven Sins explain the fact that why the US push forward financial liberalization and globalization for almost all countries. 4. Seven Sins Explain the Fact That Global Economy as well as almost all countries have experienced Bubble—Bust Cycles in the Past Four Decades. 5. Seven Sins Explain the 2007—2008 Subprime Crisis and Global Financial Crisis. 6. Seven Sins Demonstrate That “ International monetary reform, after all, could have a profound effect on the world economy and on national economies; its impact on these countries, including the US, could be more important than that of all the domestic measures currently being studied or discussed.” ( Valery Giscard d’Estaing, Former French President, 1968) II. Stabling exchange rate as the nominal anchor for stabilizing global economy: A Case Study of RMB Exchange Rate 1. From 1994—2005, stable RMB/Dollar exchange rate has contributed to China’s stable price level, high and smooth economic growth, reasonable trade balance and stable accumulation of foreign reserve. After unification and fixing of RMB exchange rate, China’s GDP growth has maintained smoothly very high and inflation very low and stable CPI data for China from 1990 to 2001: Unification and fixing of exchange rate have contributed significantly to reduce inflation 2. Single-sided appreciation of RMB against dollar since July 21, 2005 has not achieved the claimed objectives: (1) correct Sino-US trade imbalance? NO (2) stabilizing China’s price level and inflation expectation? NO (3) increasing and strengthening monetary policy independence of PBC? NO Since July 21, 2005, nominal RMB against Dollar has appreciated more than 25% (from 8.28 to 6.22), even more in terms of real exchange rate CPI data for China from 2002 to 2012: after single sided appreciation of RMB exchange rate, China’s inflation has become much more volatile The average price of housing in China Unit(yuan/m2): single sided appreciation expectation has triggered assets bubble particularly in real estate market 2012/9 2012/5 2012/1 2011/9 2011/5 2011/1 2010/9 2010/5 2010/1 2009/9 2009/5 2009/1 2008/9 2008/5 2008/1 2007/9 2007/5 2007/1 2006/9 2006/5 2006/1 2005/9 2005/5 2005/1 2004/9 2004/5 2004/1 2003/9 2003/5 2003/1 2002/9 2002/5 2002/1 The Sino-US trade surplus : Unit(billion dollar). appreciation has not reduced Sino-US trade surplus 25.00 20.00 15.00 10.00 5.00 0.00 After RMB appreciation, Sino-US trade surplus has been expanded significantly which refutes empirically the argument for flexible exchange rate adjustment 3. single-sided appreciation of RMB against Dollar has almost exact opposite effects (1) Sino-US trade balance has worsened (2) hot money and speculative capital inflows has increased dramatically (3) monetary independence of PBC has been reduced significantly (4) assets bubble particularly in real estate market has become very serious and led to the most tightening policies in 2010 Appreciation forces PBC to intervene massively. Since July 21, 2005, foreign reserve accumulation by PBC has increased by 450% Conclusions: 1. we need an credible anchor for monetary policy 2. flexible exchange rate couldn’t be an anchor or rule for monetary policy 3. countries other than international reserve issuing country cannot afford and manage fully flexible exchange rate 4. fixed and stable exchange rates are not incompatible with capital account liberalization, interest rate liberalization and internationalization of a currency 5. stable capital inflows and exchange rates are prerequisite for stabilizing global economy III. A Proposal for Action 1.To Create Multiple System of International Reserve Money and Reduce Monetary Dependence on the Dollar (A) To Stabilize the Euro (B) To encourage Regional Monetary and Financial Cooperation. (C) To promote RMB international use 2.To Create A Multiple Agreement for Exchange Rates Stability (MAERS ) Among Major Countries ( Eurozone, USA, Japan, UK, China, etc.) (1)New Version of Bretton Woods Fixed Exchange Rates System. (2)The Key is to stabilize the Dollar—Euro exchange rate. (3) European Union Can Offer Proposal to USA (4) European Union and China can jointly take initiative at the next G20 Summit. (5) Consider Bob Mundell’s DEY (Dollar –Euro-Yuan) exchange rate system Different perspectives for IMS reform Three perspectives for IMS Reserve money Exchange rate or adjustment mechanism International last resort of lender USA Dollar is the best Floating IMF Eurozone Continue to Expand Euro Stable Exchange rates IMF+ ESM Emerging Countries Multiple reserve money Stable or fixed exchange rates Reserve Pool or mutual assistant mechanism Q&A