- Global Equity Organization

advertisement

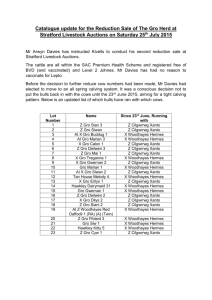

Geo Chapter meeting Amsterdam May 2013 Introducing Ahold; The Corporate Structure… Supervisory Board Remuneration Committee Selection & Appointment Committee Audit Committee Corporate Executive Board D. Boer(CEO) J. Carr (CFO), & L. Hijmans van den Bergh (CCGC) J. McCann (COO) Corporate Center Ahold USA Operations Ahold Europe Operations 200 Employees Tax Fin. Comm Audit HR C&B Legal MD 2 Sander vd Laan (COO) In Perspective Corporate Center & Management Layers 5,000 employees Ahold USA approx. 115,000 employees Giant Carlisle Stop & Shop NE Giant Landover Stop & Shop Metro NY Ahold Europe approx. 95,000 employees Albert Heijn Etos Gall & Gall Albert Bol.com 3 Ahold Central Europe (Retention) Risk Paradox (financial driven approach vs development driven approach) Reducing the overall risk as a results of talent leaving thru probability axis: Reducing the overall risk as a result of talents leaving thru impact axis: Inspiring leadership Successful succession planning Training Clear career opportunities Mentor programs Probability = C&B Increase effectiveness of pay/benefits Reduces Risk High Impact = MD & Succession Planning High Low Reduces Risk 4 The Deal Total Rewards Strategy Pay: Benefits Base Salary Short-Term Incentive Mid-Term Incentive Long-Term Incentive Pension Car allowance Health Insurance etc. Work Environment Learning and Development Attracts Education Training (on the job) Career perspective Mentor programs etc. 5 Building Supporting Systems Culture Supervisor etc. Retains The pay component Compensation for: Variable Long Short Multiyear Incentive Fixed Three components: Base Salary Value creation Equity 0 Annual Incentive (Out)Performance Cash Doing your job 6 Long-term Incentive Equity Component Design Objectives Motivate / retain participants Reinforce alignment with shareholder interests and identification with Ahold Simple / easy to understand / administer Defendable publicly / Tabaksblat No particularly negative tax consequences (company or participant) More in line with market practice Overall, the Long-Term Incentive Program should: Be regarded as a meaningful component of Total Direct Compensation Restore credibility of Long-term Incentive component as a pay component Make it possible for Ahold to attract and retain the best available talent Create corporate glue Historical Share Price Development 8 Global Reward Opportunity 2006 - 2012 Package Base salary € 600,000 GRO grant : 150% 1. Target grant value: € 900,000 2. Prior year bonus multiplier: example multiple = 1.20 3. Actual grant value: 1.20 x € 900,000 = € 1,080,000 4. Assumed share price: € 10.00 3-year component: # of shares granted: 54,000 Conditional: Waiting period of 3 years Vesting condition: employment only 5. # of shares to be granted: € 1,080,000 / € 10.00 = 108,000 6. 50% of the shares granted thru: the 3-years conditional component and 50% through the TSR component Grant Date T=3 5-year, TSR component: # of Shares: 54,000 The number of performance shares that will vest is determined by a TSR performance-ranking and the pay out curve. Holding period for all shares is five years after date of grant 9 T=5 Historical overview 2005 Redesign Pay Component: 1. benchmarking top structure 2. New STI (AIP) 3. New LTI (GRO) Credibility 2006 1. Approval In AGM for new Pay Policy CEB 2. Roll out AIP 3. Roll out Gro 2009 1. First vesting of GRO shares 2. GRO wins ‘best plan effectiveness’ award (GEO Paris) 2011 1. Completion first full GRO cycle 2. Ahold ranks first in the RTSR Peer group resulting in a 150% vesting 3. Transfer to MSSB as administrator GRO Effectiveness 2012 1. Assessment of appropriateness design of variable pay components 2. Increase effectiveness by better communication 3. Education 4. Simplicity & transparency. 2013 1. Approval in AGM for ‘simplified’ GRO design 2. Roll out of the new design. 3. New website, new logo, explanatory video 1. Assessment of appropriateness design of variable pay components (in light of development in market and new strategy) Evaluation remuneration policy of CEB and rest of population Delinking AIP from Gro and grant at target (multiplier at 1x) Reduce performance period TSR component from five to three years Rescind matching share feature 2. Communication Development of AIP Performance tracker report in close cooperation with finance (please be referred to documents attached) Gro revitalization project 3. Education ELM modules on GRO and The Deal Periodic education sessions with European/CC Reward teams 4. Simplicity Evaluate pay policies (effectiveness current policies, gap analyses, close the gap strategy) Align pay policies where possible Tailor expat policy to new strategy (local plus, short-term exchange etc.) Global Reward Opportunity 2013 Package Base salary € 600,000 Conditional share grant: 50% Performance share grant: 100% 2. Prior year bonus multiplier: example multiple = 1.20 3. Actual grant value: 1.20 x € 300,000 = € 360,000 4. Assumed share price: € 10.00 No change 1. Target grant value: € 300,000 3-year component: # of shares granted: 36,000 Conditional: Waiting period of 3 years Vesting condition: employment only 5. # of shares to be granted: € 360,000 / € 10.00 = 36,000 Grant Date 1. Target grant value: € 600,000 T=3 T=5 3-year, RoC: # of Shares: 30,000 2. Assumed share price: € 10.00 3. # of shares to be granted: € 600,000 / € 10.00 = 60,000 3-year, TSR component: # of Shares: 30,000 Biggest change No performance hurdle at grant, 50% TSR and 50% RoC hurdle at vesting. 11 Historical Share Price Development 12 Value delivered through the GRO Program Recent trends on equity programs Design Employee share purchase programs Performance share plans Financial education Responsibility Employer vs employee Financial Planning Communication Less technical, more emphasis on intention, objectives Simplicity http://www.gro-ahold.com https://www.youtube.com/watch?feature=player_embedded&v=zUuXBiDrAzY