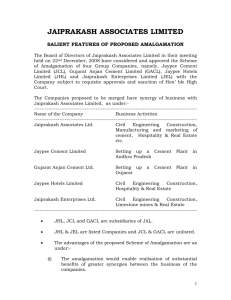

AMALGAMATION AND MERGERS

advertisement

MERGERS & AMALGAMATIONS

Institute of Company Secretaries of India

Hyderabad Chapter

The Meaning

MergerWhere Assets and Liabilities of one company

are transferred to another and the first company

loses its existence

AmalgamationWhere two or more companies merge into a

third new company and the existing cos lose

their existence

The reasons

Expansion and Diversification

Optimum Economic Benefit

De-risking Strategy

Scaling up of operation for competitive advantages

Increase the Market capitalization

Cost reduction by reducing overheads

Increasing the efficiencies of operations

Tax benefits

Access foreign markets

Legal Issues

The Companies Act. 1956

The Income Tax Act

Other Laws

The procedure

Precedents

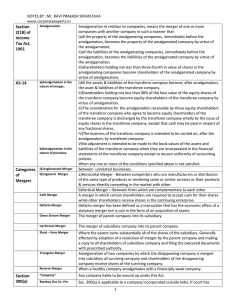

The Companies Act

Section 391 to 394

-Arrangement

-The Scheme

-The Petition to the Court

-Chairman appointed by Court

-Meeting under Court’s supervision

-Voting by Poll (Postal Ballot!?)

-Notice to Central Govt.

-No objection from Official liquidator

The Income tax Act

Carry forward and set off of accumulated loss

and unabsorbed Depreciation:

- Sec 72A of the Income Tax Act

- Available to Industrial Undertakings

(Manufacture,Computer, Power, Mining construction Ship,Aircraft,

rail)

- 3/4th Value of Assets to be held for 5 years

- Continue the business of transferor Co. for 5

Years

The Income Tax Act…

Transferor company need not pay any capital

gains {Sec 47 (vi)}

Amortization cost can continue in the transferee

Co.

Carry forward of losses/ depreciation in the

transferor company

Issue of Shares to the shareholders of shares to

the transferor Co. does not attract capital gains

{Not a transfer – SEC 47(vii)}

Other Laws

Pass on of Modvat to the transferee company

New undertaking benefits available to the

transferee company

Stamp dutyIn A.P., Maharashtra, Gujarat and Karnataka

stamp duty is to be paid on the Court orders

Other Laws…..

Maharashtra - 0.7% of value of shares allotted

or 7% of value of immovable properties in

Maharashtra subject to a ceiling of 10% of the

value of shares

Gujarat = Maximum 2% of value of shares

allotted

Karnataka: 0.1% of value of properties in

Karnataka

A.P- 2% on the market value of shares

The Procedure

The Terms used

Appointed Date

Effective Date

Record Date

Transferor Company- Can be any body Corporate

Transferee Company – Can only be company under

this

Act.

The Procedure

The Terms used

Compromise -- “a dispute, a sacrifice”

Arrangement – “parties agree without any

dispute between them”

“Compromise and arrangement covered u/s 391 are of

the widest character, ranging from a simple composition

or moratorium to an amalgamation of various

companies, with a complete reorganisation their share

and loan capital….. Sec 391 is a complete code by itself”

–Navjivan Mills Co. Ltd In re.(1972) Comp. Cas.265

(Guj.)

The Procedure…

To Review of Memorandum of Association

-to verify that power to amalgamation is

available

-transferee has power to carry on the business

of the transferor company.

Value the Company and determine value of

shares as of appointed date

The Scheme of Merger/Amalgamation

- Transfer of Licences, permits, Sanctions

The Procedure…

Hold the Board Meeting of both companies and approve

in principle the amalgamation

File the applications to the Court

File details of Shares of held by Non Residents with RBI

(FEMA/20 Para 7)

Court appoints chairman for both the companies

Prepare Notice convening the Meeting

Court appointed chairman convenes shareholders

meeting (Certificate of Posting)

Paper advertisement of the notice

The Procedure…

Pass the resolution by poll

On the same day the transferee company can hold EGM

to increase the authorised capital/81(1A) resolution

Get the minutes of the meeting approved by the court

appointed chairman

Petition to high courts seeking approval of the scheme

High court sends copy of petition to the central Govt

(R.D.) And official liquidator seeking their report that the

affairs of the company have not been conducted in a

manner prejudicial to the members or public interest

The Procedure…

Public Notice in local dailies intimating the hearing date

of the petition by the advocate

Official Liquidator on scrutiny of the books and papers of

the company files his report to the Court in respect of

transferor companies being wound up.

Where the Court Passes an order providing for transfer

any property or liabilities then, the properties shall be

transferred to and vest in, and liabilities shall become

liabilities of transferee company.

--The Dept does not permit transfer of Authorised

Capital….. (property includes powers of every

description)

The Procedure…

File the Certified copies of the Court orders with ROC

within 30 days

Attach Copy of the order made by Court u/s 391(2) to

every Memorandum of the company

Intimation to Stock Exchanges, and apply for in principle

approval for allotment of shares

Apply to RBI for getting in principle approval to allot

shares to Non Residents ( Approval from FIPB in case %

increases)

Fix the Record Date

Convene Board Meeting and allot shares as per the

Scheme

File the return of allotment (Which Form to be used)

Post Merger

Board Meeting

Intimation to Stock Exchanges

General Intimation in news papers

Transfer of Licences, Registrations, Bank Accounts,

Mutation of Title Deeds, RC Books of vehicles,

Insurance policies, PF, ESI, Sales Tax

Action plan for integration in Finance and Accounts

Intimate the Auditors of the transferor company

Any pending legal cases to be in the name of transferee

Co. (Obtain sufficient copies of Certified order of the

Court)

What happens to Remuneration of Directors where Appointed date

is substantially larger?

Precedents

Tenancy rights cannot be transferred to

transferee company– General Radio & Appliances Co. Ltd.

V. M.A. Khader (1986) 60 Company Cas.1013

Employees cannot be compulsorily transferred

to another under a scheme—John Wyeth (India) Ltd., In.

re. (1988) In. re. (1988) 63 Comp. Cas.233 (Bom)

Who can file petition under Section 391?

Creditor, member or liquidator in addition to the company only can

move a petition u/s391 -- S.K. Gupta Vs. KP Jain (1979) Comp.

Cas. 342 (SC)

Precedents…

Rights of creditors or members of a

company to make an application u/s 391

are not taken away after winding up order

has been passed -- Rajdhani Grains & Jaggery

Exchange Ltd., In re (1983) 54 Comp. Cas.166 (Delhi)

It is not compulsory for Court to give direction to

convene a meeting contemplated under Section 391(1)–

Sakamari Steel & Alloys Ltd. In re (1981) 51 Comp.

Cas.266 (Bom)

Precedents…

Scheme once sanctioned becomes

binding and cannot be varied except with

the Sanction of Court—JK (Bombay)(P) Ltd.

Vs.New Kaiser-I-Hind Spg. & Wvg. Co. Ltd (1970) 40

Comp. Cas.689 (SC)