Business Plan - Makerere University

advertisement

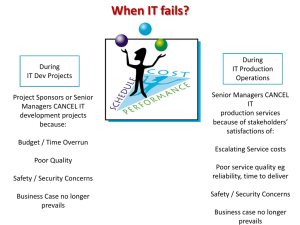

Finance Department Business Plan For the 5 years from 2010 to 2014 Position of University Bursar Applicant: Joshua S Karamagi Executive Summary – Strategy Map Personal Information Challenges of the Job The Department’s Vision and Mission Performance Improvement Strategies MUK Finance Department – Strategic Initiatives (2010 – 2014) Position of University Bursar Applicant : Joshua S Karamagi VISION PERSPECTIVE MISSION / STAKEHOLDER PERSPECTIVE “Our Vision is to be one of the leading University Finance Departments in the region, effectively supporting the achievement of Makerere University’s own Vision and Mission, while responsibly being one of the most critical and relevant Departments in the overall University organisation and function structures.” Control & Safeguard Quality information Accountability External Stakeholders: MUK, GOU, Donors, and Auditors Financial Mgt Processes Innovation Processes • Fee collection • Student debtors information • Student payments system • Banking framework • Student Unit Cost / Fee justification • 10 ICT innovations • Intra-University Flash reporting • Benchmarking • Investments • Staff performance measurement • Mgt. Accounts System • MIS / Costing • Cost control & Cash management • Treasury Mgt. • SFM. Development LEARNING AND GROWTH PERSPECTIVE Rationalisation • • IFRS reporting • “Big Four” audit firm • Auditor General • PPDA Compliance • NSSF issues • NIC / Pension issues • Taxation 10 innovations Information Capital Culture Leadership Organisation Capital [1] Reward / Equity Human Capital New ERP MUK Finance Department – Strategic Initiatives (2010 – 2014) Position of University Bursar Applicant : Joshua S Karamagi Opportunity & Team identity Regulatory Processes Reward & Equity Internal Stakeholders: Students , General and Finance Staff Student service Processes INTERNAL PROCESS • Budgetary Control PERSPECTIVE • Internal Control Efficiency & Quality Compliance BCP + DRP Alignment Teamwork Critical Success Factors SFM Strategic Financial Management BIO DATA: WORKING EXPERIENCE: # Item Detail # Employer Position Responsibilities 1 Name: Joshua S Karamagi. 1 Ministry of Finance 2 Profession: Certified Public Accountant (U), (K). Asst. Commissioner (Treasury) 3 DOB: 27 February 1972. • Financial mgt. reforms in Debt, Asset Mgt. And Investment policy. • Identification and appraisal of investments. • Budgeting process linkages. • Managing US$ 6bn debt portfolio. • Business partner relationship mgt. • Product structure and negotiation. 4 Current Position Assistant Commissioner (Treasury), Ministry of Finance. EDUCATIONAL BACKGROUND: # Degree/PQs Institution Period 1 MBA Edinburgh Business School, Scotland, GB. 2004 2005 Strathmore College, NBI, Kenya 1996 1999 Makerere University, Kampala, Uganda 1992 1995 2 CPA (U), (K) 3 B.Com (MUK) Jul 2007 to date. 2 NSSF Chief Finance Officer (CFO) Dec 2003-Jul 2007 3 Uganda Breweries Ltd Chief Accountant Oct 2001-Nov 2003 4 Africa Online Ltd Chief Accountant Jan 2000-Sep 2001 5 Celtel Ltd Financial Accountant Aug 1998-Jan 2000 MUK Finance Department – Strategic Initiatives (2010 – 2014) Position of University Bursar Applicant : Joshua S Karamagi 6 Price Waterhouse [2] Audit Senior Jul 1995-Jul 1998 • Leading the Finance Department. • IFRS reporting / Ext. Auditors. • Budgeting process. • Departmental Strategy. • Member of Executive Committee. • Cash flow management. • Capital Expenditure planning. • Procurement oversight. • Product pricing. • Capital Expenditure appraisal. • Budgetary control. • Tax planning. • Monitoring & Evaluation. • Financial reporting & analysis. • Operational mgt. of Finance Department. • Tax planning. • Staff mgt. Including training. • Collection and dissemination of financial data. •Trend analysis. • Preparation of management reports. • Supervision of corporate audits. • Financial consulting in areas of Donor Aid, Project Management etc. • Financial services auditing and advisory experience. • Create and sustain a robust system of financial and internal controls. • Financial Risk Management. • IFRS reporting. • Precipitating efficient use of funds. • Detection and prevention of fraud. • BCP / DRP. • Positive and mutually benefit working relationship with Internal Audit • NSSF outstandings. • NIC pension issue. • Streamlining procurement (PPDA). • Grant Accountability. • Political issues (PAC, HE etc). • Student Unit Cost / Fee justification • Taxation. OTHERS • Capex justification • System development • User training • “Resistance to Change”. • “Fear of the Unknown”. FINANCIAL MGT. & CONTROL BUDGETING PROCESS ICT APPLICATION REVMOB, COLLECTION & COST CONTROL STAFF MANAGEMENT • Quality and Quantity • Motivation • Retention • Training • Performance measurement systems • Reward & Equity OPTIMAL USE & SAFEGUARDING ASSETS MUK Finance Department – Strategic Initiatives (2010 – 2014) Position of University Bursar Applicant : Joshua S Karamagi • Reliable record of ownership, state, value of assets • Asset productivity measurement and monitoring. • Physical security and asset movement controls. • Planning and time mgt. • Inter-department coordination. • Methodology selection. • Alignment with Strategy • Identifying non-traditional sources of income. • Product development. • Product marketing • Effective collection system • Entrenchment of a Cost control culture. • Budgetary control systems. [3] “Our Vision is to be one of the leading University Finance Departments in the region, effectively supporting the achievement of Makerere University’s own Vision and Mission, while responsibly being one of the most critical and relevant Departments in the overall University organisation and function structures.” Our Mission MUK, GOU, Donors, Auditors Students, General Staff • To proper control finances and safeguard assets and resources. • To be comprehensively accountable. • To provide quality financial and management information. • Compliance Assurance. External stakeholders • To provide efficient, effective and timely fee and allowance payment systems, and relevant customer service. • To provide quality fee and allowance payments information. • To provide effective and timely financial services to MUK general staff eg salary payments, advances, NSSF etc. Internal stakeholders Finance Staff • • • • To provide appropriate development opportunities. To provide meaningful team identity to staff. To precipitate commensurate reward for performance. To be fair and ensure equity is the order of the day. MUK Finance Department – Strategic Initiatives (2010 – 2014) Position of University Bursar Applicant : Joshua S Karamagi [4] FINANCIAL MANAGEMENT & CONTROL # Performance Improvement Strategies Milestones, Deliverables and Due Dates 1 Implementation of the COSO Framework of Internal Control. 36 months, 33% each 12 months. Due date December 2012. 2 Implementation of a Best Practice Financial Risk Mgt. Framework. 18 months, 33% each 6 months, Due date June 2011. 3 IFRS training and Compliance Auditing. IFRS tools. 9 months. Due date September 2010. 4 Implementation of a Fraud Detection and Prevention Policy. 12 months. Due date December 2010. 5 Design and implement a BCP that includes a DRP. 36 months. Due date December 20112 6 Positive co-ordination of control efforts with Internal Audit. Immediate. BUDGETING PROCESS # Performance Improvement Strategies Milestones, Deliverables and Due Dates 1 Generation of an Annual Budgeting Process Plan. 3 months, Due date March 2010. 2 Empirical testing of the most appropriate Budgeting Method for MUK 1 months, Due date January 2010. 3 Creation of an IT-based inter-departmental budget preparation and reporting system. 3 months, Due date March 2010. 4 Annual Budget / Strategy alignment process, including documented explanations for significant deviations from Strategy. 3 months, Due date March 2010. MUK Finance Department – Strategic Initiatives (2010 – 2014) Position of University Bursar Applicant : Joshua S Karamagi [5] REVMOB, COLLECTION & COST CONTROL # Performance Improvement Strategies Milestones, Deliverables and Due Dates 1 Identify and exploit non-traditional sources of income, including the implementation of relevant new product development cycles. 2 months, identify; 10 months exploit. Due date December 2010. (Repeat annually). 2 Implementation of a zero arrears fee collection system, supported by foolproof student fee payment checks. 6 months, Due date June 2010. 3 Setting and seeking to achieve ambitious cost control targets, including training general MUK staff on adopting a cost control culture (supported by cost MIS). 6 months. Due date June 2010. 4 SEE POINT 3, BUDGETING PROCESS. OPTIMAL USE OF & SAFEGUARDING ASSETS # Performance Improvement Strategies Milestones, Deliverables and Due Dates 1 A 100% physical verification of all MUK fixed assets. 12 months, Due date December 2010. 2 Implement a Fixed Asset IT-based management system and generate a computer-based Fixed Asset Register. 15 months, Due date March 2011. 3 Fully utilise all of the embedded MIS potential in the Fixed Asset IT-based management system to control and safeguard MUK’s Fixed Assets, including effecting physical security. 18 months, Due date June 2011. 4 Design and effect an Asset productivity measurement and monitoring system. 10 months, Due date October 2010. MUK Finance Department – Strategic Initiatives (2010 – 2014) Position of University Bursar Applicant : Joshua S Karamagi [6] STAFF MANAGEMENT # Performance Improvement Strategies Milestones, Deliverables and Due Dates 1 Effect a staff rationalisation process (Needs assessment, quality review, hires and fires). 6 months. Due date June 2010. 2 Implement an IT-based staff Performance Measurement System (PMS). 6 months. Due date June 2010. 3 Perform a market-based staff remuneration survey and review, recommending adjustments where justified. 6 months. Due date June 2010. 4 Carry out technical, soft skills and team-building training for staff. 12 months . Due date December 2010. (Repeat annually). ICT APPLICATIONS # Performance Improvement Strategies Milestones, Deliverables and Due Dates 1 Implement an International Enterprise-Wide Resource Planning (ERP) system, with robust MIS, payroll and budgetary control capabilities. 36 months, 3 Phase implementation. Due date December 2012. (24 months requirement infeasible). 2 Implement an IT-based Fixed Assets management system. 15 months, Due date March 2011. 3 Implement an IT-based PMS for staff. 6 months. Due date June 2010. 4 E-learning IFRS training and tools. 9 months. Due date September 2010. 5 Financial Department customer service hotline, electronic complaints log and electronic notice board. 12 months . Due date December 2010. MUK Finance Department – Strategic Initiatives (2010 – 2014) Position of University Bursar Applicant : Joshua S Karamagi [7] OTHERS # Performance Improvement Strategies Milestones, Deliverables and Due Dates 1 Precipitate immediate prospective compliance with the NSSF Act. 9 months, Due date September 2010. 2 Negotiate an amicable medium-term arrears repayment plan with NSSF. 6 months. Due date June 2010. 3 Negotiate an amicable closure to the staff pension fund issues with NIC, avoiding any adverse legal action. 6 months. Due date June 2010. 4 Streamline MUK procurement procedures by (a) training all PDU staff (b) sensitising general staff (c) enforcing the PPDA rules eg Annual Procurement Plan (d) Inviting PPDA for a full scope special procurement audit (e) regular PPDA consultations. 18 months. Due date June 2011. 5 Training and sensitising general staff on the best practice requirements for Grant Accountability, as well as specific Donor Accountability requirements. 12 months . Due date December 2010. (Repeat annually). 6 Getting to the bottom of the “Student Unit Cost quagmire” and creating a cost model for the timely justification of any fee changes at MUK. 12 months . Due date December 2010. 7 Performance of a pervasive Tax Health Check, and effecting allowable tax planning and maintaining a good professional relationship with URA. 6 months, Due date June 2010. (Then continuous). MUK Finance Department – Strategic Initiatives (2010 – 2014) Position of University Bursar Applicant : Joshua S Karamagi [8]