Tax Issues for Students

advertisement

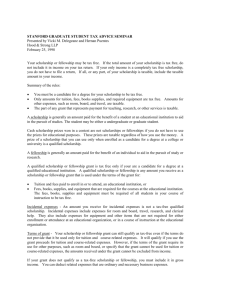

TAXES & EDUCATIONAL CREDITS FOR STUDENTS & PARENTS Presented By Joseph R. Maggitti Sr., MBA James Hudson, CPA, MBA Harold Singletary 1098T FORM FILER’S name, street address, city, state, ZIP code, and telephone number 1 Payments received for qualified tuition and related expenses OMB No. 1545-1574 $ 2011 2 Amounts billed for qualified tuition and related expenses $ FILER’S federal identification no. STUDENT'S social security number Form 1098-T 3 If this box is checked, your educational institution has changed its reporting method for 2011 4 Adjustments made for a prior 5 Scholarships or year grants STUDENT'S name $ 6 Adjustments to scholarships or grants for a prior year Street address (including apt. no.) City, state, and ZIP code Service Provider/Acct. No. (see instr.) $ 8 Check if at least half-time student 9 Check if a graduate student . . . . Copy B For Student This is important tax information and is being furnished to the $ Internal Revenue 7 Check if the amount Service. in box 1 or 2 includes amounts for an academic period beginning January March 2012 ▶ 10 Ins. contract reimb./refund $ 1098T FORM • Block 2 - Amount billed for qualified tuition and related expenses for calendar year 2011 • IRS allows deduction for amount paid for tuition and related expenses for calendar year 2011 • Student loans are the same as you paying the tuition and related expenses the day that the loans are posted to your account 1099T Form • For expenses to be deductible block 8 must be checked • If block 9 is checked you may not be eligible for The American Opportunity Educational Credit since this can only be used for the first four years of post secondary education • You may still be able to take the Lifetime Education Credit 1099T Form • Box 5 contains any scholarships, stipends and grants that you may have received • Box 7 is checked if box 2 included the tuition for the following spring semester • EG If you spring 2012 tuition bill was billed to you in December 2011 it would be included in Box 2 Scholarships and Fellowships • A scholarship is generally an amount paid for the benefit of a student at an educational institution to aid in the pursuit of studies. The student may be either an undergraduate or a graduate. A fellowship is generally an amount paid for the benefit of an individual to aid in the pursuit of study or research. Generally, whether the amount is tax free or taxable depends on the expense paid with the amount and whether you are a degree candidate. Scholarships and Fellowships • A scholarship generally is an amount paid for the benefit of a student at an educational institution to aid in the pursuit of studies. The student may be in either a graduate or an undergraduate program. • A fellowship grant generally is an amount paid for the benefit of an individual to aid in the pursuit of study or research. Scholarships and Fellowships A scholarship or fellowship is tax free only if you meet the following conditions: • You are a candidate for a degree at an eligible educational institution. • You use the scholarship or fellowship to pay qualified education expenses. Qualified Education Expenses • For purposes of tax-free scholarships and fellowships, these are expenses for Tuition and fees required to enroll at or attend an eligible educational institution and courserelated expenses, such as fees, books, supplies, and equipment that are required for the courses at the eligible educational institution. These items must be required of all students in your course of instruction. Expenses that Don’t Qualify Qualified education expenses do not include the cost of: • Room and board. • Travel. • Research. • Clerical help. • Equipment and other expenses that are not required for enrollment in or attendance at an eligible educational institution. This is true even if the fee must be paid to the institution as a condition of enrollment or attendance. Scholarship or fellowship amounts used to pay these costs are taxable. Student Exception to FICA Tax • FICA (Social Security and Medicare) taxes do not apply to service performed by students employed by a school, college, or university where the student is pursuing a course of study. Whether the organization is a school, college, or university depends on the organization’s primary function. In addition, whether employees are students for this purpose requires examining the individual’s employment relationship with the employer to determine if employment or education is predominant in the relationship. Who Can You as a Dependent Exemption • If you are under 24 years old, attended school for at least five months of the year, you are not married and you did not contribute over half your support your parents can claim you as a dependent exemption Who Can Claim a Dependent’s Expenses • If there are qualified education expenses for your dependent during a tax year, either you or your dependent, but not both of you, can claim an American opportunity credit for your dependent’s expenses for that year. Who Can Claim the Credit You can claim the American opportunity credit if all three of the following requirements are met. • You pay qualified education expenses of higher education. • You pay the education expenses for an eligible student • The eligible student is either yourself, your spouse, or a dependent for whom you claim an exemption Note. Qualified education expenses paid by a dependent for whom you claim an exemption, or by a third party are considered paid by you. American Opportunity Tax Credit • This credit can help parents and students pay part of the cost of the first four years of college. The American Recovery and Reinvestment Act modifies the existing Hope Credit for tax years 2009 and 2010, making it available to a broader range of taxpayers. Eligible taxpayers may qualify for the maximum annual credit of $2,500 per student. Generally, 40 percent of the credit is refundable, which means that you may be able to receive up to $1,000, even if you owe no taxes . The Lifetime Learning Credit • This credit can help pay for undergraduate, graduate and professional degree courses – including courses to improve job skills – regardless of the number of years in the program. Eligible taxpayers may qualify for up to $2,000 per tax return. Education Credit Notice • To qualify for an education credit, you must pay post- secondary tuition and certain related expenses for yourself, your spouse or your dependent. The credit may be claimed by the parent or the student, but not by both. Students who are claimed as a dependent cannot claim the credit. The End • Any Questions • Web Page: www.hudsoncpallc.com • Email: joesenior@hotmail.com • Office Phone: 843-654-5025 • Cell Phone: 843-708-9110 • Address: 885 Island Park Drive Suite A • Dabiels Island SC 29492