Associated Taxpayers of Idaho

advertisement

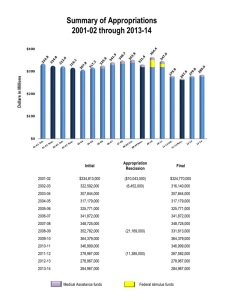

Senator Dean Cameron Chair Senate Finance Committee Co-Chair JFAC Guiding Principles - Constitution EXECUTIVE DEPARTMENT Article IV Section 8 – Governor May Require Reports Messages to the Legislature 1) 2) 3) State of the State Report of all Expenditures Estimates of amount of money required by taxation Section 17 – Accounts & Reports of Officers Agencies report all revenues and expenditures to Governor before the session, who then transmits to the Legislature FINANCE AND REVENUE Article VII Section 11- Finance & Revenue Legislature must balance budget Section 13 – Money How Drawn from the Treasury All money drawn from the state treasury subject to appropriation 2 Guiding Principles - Statutory Chapter 35, Title 67 - State Budget Chapter 36, Title 67 - Standard Appropriations Act of 1945 Chapter 68, Title 67 - Economic Estimates Sections IC 57-814 – 57-814A - Budget Stabilization Fund Sections IC 67-432 thru 67-440 – Joint FinanceAppropriations Committee (JFAC) Section IC 67-703 – Budget & Policy Analysis – Function of Legislative Services Office 3 Idaho State Budget Process Budget Development Manual May State Agencies Develop Budgets June – Aug. Agencies Submit Budgets Legislature September 1 Analysis & Development of Legislative Budget Book Budget Hearing Process for JFAC Sept.-Dec. Jan.-Feb. Budget Setting Process by JFAC Feb.-Mar. Appropriation Bills to the Floor House Senate Governor’s Office Analysis & Development of Executive Budget Recommendation Presentation of Executive Budget to Legislature If Vetoed Signature or Veto To Governor For Approval Becomes Law Idaho Joint FinanceAppropriations Committee 10 Senators & 10 Representatives Meets 8 am - Monday thru Friday 5 Weeks of Budget Hearings 3 Weeks of Budget Setting Idaho Legislature looks at both the agency request and the Governor’s recommendation, and key measures and fiscal information. JFAC has “early morning meetings” during budget setting at 7am to discuss the upcoming morning’s work. JFAC members often share prepared motions with other committee members and often work out differences. FY 2015 Gen Fund Revenue $2,990.4 million Corporate Income Tax $206.5 6.9% All Other Taxes $146.5 4.9% Individual Income Tax $1,406.0 47.0% Sales Tax $1,231.4 41.2% 6 FY 2015 Gen Fund Appropriation $2,936.1 million College & Universities $251.2 8.6% Other Education, $153.7 , 5.2% Public Schools $1,374.6 46.8% All Education $1,779.5, 60.6% Public Safety $308.0 10.5% Health & Human Services $680.9 23.2% General Government, $105.2 , 3.6% Natural Resources $36.2 1.2% Economic Development $26.2 0.9% 7 Idaho’s line-item, incremental, program, zerobased performance budget At What Level Do We Budget? Base Budgeting - Incremental By Program By Fund By Object Class 1) Personnel Costs: Salaries and Benefits 2) Operating Expenditures: Leases & Travel 3) Capital Outlay: Computers and Vehicles 4) Trustee and Benefit Payments: Services on Behalf of Another 5) Lump Sum: No Defined Category Three Fund Types 1) General Fund: Sales Tax, Individual & Corporate Income & Product Taxes, Miscellaneous Revenue 2) Dedicated: Taxes, Fees, and Penalties 3) Tax Commission Fish & Game Federal: Grants, with or without match Health & Welfare - Medicaid Commission on Aging 9 General Fund History Department/Agency Public School Support H&W Medicaid College and Universities Dept of Correction Health & Welfare Prof-Technical Education Juvenile Corrections Catastrophic Health Care Judicial Branch Revenue & Taxation Community Colleges Ag Research & Ext Idaho State Police Total Top 13 Agencies FY 2009 Orig Appropriation 1,418,542,700 402,492,800 285,151,500 175,915,200 184,785,100 54,899,400 40,029,300 20,767,700 31,862,500 29,011,500 29,666,400 28,249,200 24,529,500 2,725,902,800 FY 2012 Orig Appropriation 1,223,580,400 436,159,000 209,828,300 157,367,900 128,683,800 46,511,600 35,763,500 19,267,700 29,246,700 29,034,700 23,033,000 22,559,000 14,889,700 2,375,925,300 FY 2015 Orig Appropriation 1,374,598,400 492,347,100 251,223,200 204,240,600 144,941,300 53,079,000 39,027,400 34,966,300 40,930,400 31,490,200 32,978,500 26,453,700 23,799,500 2,750,075,600 Total Lowest 42 Agencies Statewide Total 233,380,600 2,959,283,400 153,035,300 2,528,960,600 186,021,000 2,936,096,600 FY 2016 % of Tot Request Req 1,461,944,500 46.7% 507,301,000 16.2% 299,936,300 9.6% 209,324,600 6.7% 150,644,500 4.8% 56,635,900 1.8% 39,800,900 1.3% 32,303,900 1.0% 39,898,200 1.3% 34,294,500 1.1% 37,305,000 1.2% 28,476,800 0.9% 28,755,700 0.9% 2,926,621,800 93.4% 207,196,700 3,133,818,500 6.6% 100.0% This table illustrates one challenge for the Legislature in setting the state budget when trying to manage growth. The largest five budget requests for agencies make up 81% of the General Fund, and the largest 13 make up 93.4% of the General Fund. Caseload Matters Gen Fund FUNDING HISTORY: Public Schools Coll & Universities Community Colleges Medicaid IDOC: State Prisons & Medical Comm Supv & Treatment Total Funds 2008 2015 % Chg $1,376 $1,375 -0.6% $264 $251 -4.9% $24 $33 39.8% $376 $492 30.8% $141 $23 $152 $24 7.4% 6.6% 2008 2015 $1,657 $1,677 $399 $499 $59 $83 $1,294 $2,033 $152 $31 $163 $30 % Chg 1.2% 25.0% 40.8% 57.2% 7.3% -3.7% Caseload Matters CASELOAD Public Schools Coll & Universities Community Colleges Medicaid IDOC: State Prisons & Medical Comm Supv & Treatment 2008 272,058 38,066 7,149 185,038 FUNDING PER INDIVIDUAL Gen Fund Total Funds 2015 % Chg 2008 2015 289,064 6.3% $5,056 $4,755 40,171 5.5% $6,941 $6,254 15,531 117.2% $3,299 $2,123 236,352 27.7% $2,034 $2,083 7,361 8,050 9.4% $19,121 $18,777 13,361 15,110 13.1% $1,688 $1,591 % Chg -5.9% -9.9% -35.6% 2.4% 2008 $6,089 $10,482 $8,219 $6,992 2015 $5,800 $12,413 $5,327 $8,603 % Chg -4.7% 18.4% -35.2% 23.0% -1.8% $20,642 $20,257 -1.9% -5.8% $2,332 $1,986 -15.0% State Stabilization Fund Balances (in millions at the end of each fiscal year) 450 400 $389M 350 300 $282.3M 250 200 150 Mill Fund PESF ERRF 100 50 0 BSF