Facilitator slides for screen (PPT 3.6 MB)

advertisement

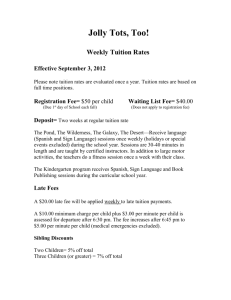

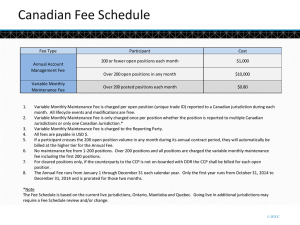

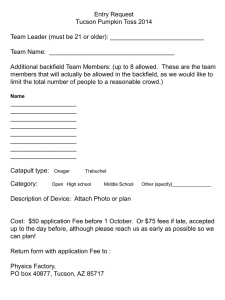

Futures for Higher Education Scenario workshop FACILITATOR PACK Before we start, fill in these cards and hand them in Introductions Who do we have in the room? FUTURES FOR HIGHER EDUCATION Trends presentation 2011 The workshop addresses two main aims Analysing trends into the future and what is taking us there Exploring what we want for the future and how we could get there This presentation focuses on three main trends The demand for higher education The funding of higher education in the UK Innovation and evolution in higher education A PICTURE FOR THE FUTURE? THIS SLIDE ILLUSTRATES COMPONENTS OF THE DAY NOW Current situation 2/3-5 years ‘Lock ins’ Outcome 1 What is hoped for in the 30-year vision? Outcome 2 Long-term drivers Outcome 3 Institutional level Sector level Key indicators 1. ‘Segment stories’ Short-term choices Long-term choices A. 2010 2015 2040 B. 2. 3. C. And these are points for the group to consider Headline questions Things to think about • What are the key decisions that face your institution? • What sectors have changed beyond recognition? • How might these shape higher education in the UK and around the world? • What sectors are starting rapid change now? • What about ‘Black Swans’? • How do you see the future of HE in the long term? DEVELOPING A PICTURE OF THE FUTURE These are some caricatures of the last decade • Demand continuing to outstrip heavily regulated supply • Persistence of a dominant 3 year residential degree model – prestige of traditional models • Private providers and FE marginal or subordinate to universities And this has been the story of funding for the past twenty years 9,000 8,500 Government publicly planned unit of funding (real terms 2009-10=100) grant grant + public fee 8,000 grant + public fee + private regulated fee £ per FTE student 7,500 7,000 6,500 6,000 5,500 5,000 4,500 4,000 grant + public fee + private regulated fee + capital We are now set for a liberalisation of the market • Supply side liberalisation • Tuition fee replacing grant – with more scope for differentiation in cost (Or not...) • Stronger demand led focus on ‘quality’ • Introduction of amendable mechanisms to restrain taxpayer liability Others sectors have been through liberalisation New entrants? Innovation? Continued market domination for a time? Failures, mergers and takeovers? New regulation? New sources of funding? • Lots of small niche suppliers & some big value entrants • In what is offered in terms of services, pricing, support, etc • Biggest and most financially sound of the ‘incumbents’ • Amongst both original players and new entrants • Ex ante to protect consumer interests and ex post competition law • An influx of foreign investment at some point A big assumption that needs to be assessed Post industrial economic development Developing middle classes in emerging economies Data rich and knowledge driven world – learning throughout career Ongoing and growing demand for higher education and research Could this be a picture of a deregulated high demand future? Higher education institutional income from non-EU domiciled students 1994/95 - 2008/09 (and non-EU domicile student numbers; excluding students from EEA countries) 2,500 * 300,000 247,995 2,000 214,690 219,175 229,645 250,000 * 200,000 173,985 1,500 152,620 136,295 0 £2,200 £1,880 £1,713 £1,499 £ 1,275 m £ 1,085 m £ 875 m £ 746 m £ 672 m £ 507 m £ 455 m 500 £ 636 m 97,997 £ 1,396 m 111,480 109,940 150,000 116,840 117,290 122,150 £ 622 m 1,000 £ 563 m £ million, cash terms 199,225 1994/95 1995/96 1996/97 1997/98 1998/99 1999/00 2000/01 2001/02 2002/03 2003/04 2004/25 2005/06 2006/07 2007/08 2008/09 Academic years Source: Higher Education Statistics Agency (HESA): Resources of higher education institutions, Students in higher education institutions, various years * From 2007/08 writing up and sabbatical students are no longer included in standard counts of students 100,000 50,000 0 Student numbers (head counts) 239,210 However - the worst financial and economic crisis since 1929 started in 2007 Our GDP growth forecast is slow relative to previous recoveries. This reflects the effects of the fiscal consolidation, the relatively slow easing of tight credit conditions and ongoing private sector deleveraging. (Office for budget responsibility: March 2011) Given rising pressure on governments’ balance sheets and limitations on public funding growth, Moody’s anticipates that the university sector will, over the long term, seek more independent sources of funding to finance growth and expansion. We anticipate that endowment fund building through philanthropy, enrolments of international students and borrowing will rise in some countries. (Moody’s International Public Finance: Higher Education, June 2009) And the route out is long and complex Sovereign debt crisis Recession and unemploy - ment Economic outlook Credit and lending crisis Banking debt crisis Will this lock in the shift to tuition based funding? 100% Indicative breakdown of funding between loans for the graduate contribution and HEFCE teaching grant, 2010/11 to 2014/15 90% 80% 70% Loans outlay to HEIs 60% HEFCE teaching grant 50% 40% 30% 20% 10% 0% 2010/11 2011/12 2012/13 2013/14 2014/15 What other questions will need to be resolved? Immediate questions • Impact of government student number de regulation and incentives (AAB and £75000) • The new regulatory framework – extent of any de regulation or liberalisation • Ending ‘moral hazard’ produced by government-backed loan – some risk transfer onto institutions • Reducing government exposure to cost of loan book through RAB charge adjustments Short/ Medium • Setting student numbers free – ending student number controls term questions • Use of competition regulation Ongoing variable themes • Public value agendas of mobility, equality and access • Research concentration v. diversification How will these changes affect pressures around... • ‘Customer’ satisfaction – quality of teaching and facilities? • Staff and professional satisfaction – the volume and quality of research? • Prestige and the push for ‘world class’ status – continued cost inflation? We are already seeing the globalisation of higher education Overseas students on UK HE provision and location of study, 2009/10 450000 400000 350000 300000 250000 Non-EU 200000 150000 100000 50000 Other EU 0 2009/10 HEI in the UK 2009/10 HEI overseas Location of study This is being driven by global economic development 0 China seeks to be the Asian country with the greatest number of international students and a major destination in the world for international students, according to goals outlined in its National Plan for Medium and Long-Term Education Reform and Development (2010–2020). With an annual international student growth rate of 7%, international student numbers will reach at least 500,000 by 2020, making it the biggest hosting country in Asia. 20,000 40,000 60,000 China India Nigeria United States Malaysia Hong Kong Pakistan (China on the Cusp: Becoming the biggest international student destination in Asia: The Observatory on Borderless Higher Education) Saudi Arabia Canada Thailand Taiwan 1998/99 2009/10 Korea (South) Bangladesh Sri Lanka Singapore Japan Norway Russia Iran Turkey Number of students in UK higher education institutions from the top 20 countries of domicile for non-EU students, 2009/10 Producing new concentrations of demand UK providers with courses in Hong Kong 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. Birmingham City 19. University Coventry University 20. De Montfort University 21. Edinburgh Napier University 22. Glyndwr University 23. Herriot-Watt University Kingston University 24. Lancaster University 25. Leeds Metropolitan 26. University Manchester 27. Metropolitan University Middlesex University28. Nottingham Trent 29. University 30. Oxford Brookes University 31. Queen Mary, University of London 32. Sheffield Hallam University 33. Staffordshire University 34. Swansea Metropolitan University 35. The Royal Veterinary College, 36. University of London The University of 37. Bolton 38. The University of Hull 39. The University of Nottingham 40. The University of Salford 41. University College Birmingham 42. University of Bath University of 43. Bedford University of 44. Birmingham University of 45. Bradford University of Central 46. Lancashire 47. University of Derby 48. University of 49. Durham University of 50. Glamorgan University of 51. Gloucestershire University of 52. Greenwich University of Hertfordshire 53. University of Huddersfield University of Leicester University of London University of Manchester University of Northampton University of Northumbria University of Plymouth University of Portsmouth University of Reading University of Strathclyde University of Sunderland University of Surrey University of Ulster University of Wales University of Wales, Newport University of Warwick University of Wolverhampton University of the West of England, Bristol York St John University And increasingly global research networks The continued strength of the traditional centres of scientific excellence and the emergence of new players and leaders point towards an increasingly multipolar scientific world, in which the distribution of scientific activity is concentrated in a number of widely dispersed hubs. Royal society 2011 But addressing these trends is not simple Complex ethical and political landscape Diverse student and staffing needs New organisational challenges – HR, finance New competitors – US and Chinese universities Overseas academic and industry partners for research Brand Positioning Investment Wider range of degree models (1+2 etc) Research concentration may affect your institution’s positioning domestically and globally Or will a drift toward contract based funding present challenges or opportunities? 5,000,000 4,000,000 3,000,000 2,000,000 Science budget allocation 1,000,000 - 1000 900 800 700 Collaborative research 600 500 400 HEBCI survey 300 Contract research 200 100 0 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 How will financial models evolve? • Efficiencies: streamlining and new accounting practices? • Costs: hollowing out of functions as part of efficiency and modernisation strategies – narrower focus? • Funding: new models of private revenue? • New ways of monetising the asset base – investment driven organisations? You may be interested in US revenue models You may be interested in US expenditure models How might the presence of new entrants affect you? Online provision, with local learning bases: locations within 10 miles of 87 million Americans No tenured professors – recruited by the class The University of Phoenix 455,600 enrolled students in 2010 (25,000 in 1995) Large marketing budget –20% of Apollo Group’s $1.3 billion net revenue on selling and promotional expenses Aggressive recruitment of those with access to federal aid and veterans – nearly 90% of revenue And what about online – are we leaving a decade of disappointment? • Development in CPD & TNE: • Facilitated • Blended • Online • Increasingly bottom up adoption and adaptation of technologies – e.g. Cloud computing • Do technologies require review of methods? • Navigating knowledge • Intercultural and online learning • Research methods & networks And what about ‘unbundled’ models of delivery? • The role of technology in enabling the disaggregation of delivery and compartmentalised ‘products’ – The delivery process: • Content – syllabus, research & scholarship • Classroom – teaching, lectures, supervision • Infrastructure – IT networks, libraries, estates etc – The ‘product’: • • • • • • Pay as you go tuition, credit accumulation Examination, accreditation and validation Assessment Library services Accommodation Student finance? And through all of this generations will change – what will this mean? Today • Cohort of fee paying students entering into academic workforce • Web 2.0 generation entering into higher education 2020 • Fee paying cohort entering and maturing into academic posts • Web 2.0 generation entering into the academic workforce 2030 • Fee paying cohort moving into leadership positions • Web 2.0 generation entering into mature academic posts 2040 • HEIs staffed and led by those who have paid for most or all of the cost of their tuition and been brought up on internet social networking And social priorities will evolve – what will be the next one? • The shift to a digital society: innovated and incubated by universities in the first place • Will it all be about technological and social solutions for climate change, or something else? Future of UK university research base, UUK 2010 Some initial questions for the group • What is right, wrong or missing from this picture: or have you heard it too often to care? • What is most significant for you and what are you less bothered about? • What are the most significant uncertainties and how might these shape outcomes? • What other ways are there or should there be of looking at all this? In groups, work through the template to create scenarios for the future of our institution Headline feedback on scenarios • add What’s your vision for the HE sector in 30 years? add Comments from discussion • add 42 www. .com What will the most successful institutions be doing in 30 years that the others aren’t? add Comments from discussion: • 43 add www. .com It’s 15 years from now, what will have changed most in terms of the university’s… …mission add Comments from discussion • 44 add www. .com It’s 15 years from now, what will have changed most in terms of the university’s… …income add Comments from discussion • 45 add www. .com It’s 15 years from now, what will have changed most in terms of the university’s… …organisation / ways of working add Comments from discussion • 46 add www. .com Which aspect of your strategy is most critical to ensuring the future success of the university? Comments from discussion • add add 47 www. .com Please complete the review card and hand it in