Bislery-case

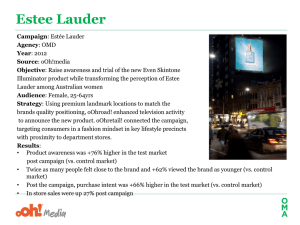

advertisement

Bislery case study Background • Market leader in 1971 • Increased selling in 250 towns in 1997 from 60 towns in 1993 • In the early 1990s, Parle Bisleri became synonymous with branded water and had a market share of 70% • Faced competition from new entrants in late 1990’s • In 1990’s focus was on pure and safe water Background • In 2000-01, it faced another challenge from Cola majors, Pepsi and Coca-Cola and the confectionery giant, Nestle • Distibution network was a problem • In September 2000, Parle Bisleri launched its Play Safe ad campaign • Added fun element to Bisleri to rejuvenate the brand • The ultimate aim was to increase Bisleri's turnover from Rs 4 billion in 2000 to Rs 10 billion by 2003 Need identification Need identification • Everyone positioned their products on the purity platform, so the need to differentiate arose • Large shops and commercial complexes were fast emerging as attractive targets and Bisleri attracted them with bulk packs • People were hygiene conscious so Bisleri started pure and safe campaign Need identification • Bisleri planned to target the soft drinks market by adding a fun element to the product • Small packs to attract the market where there were no competitors • Bisleri sensed that a strong distribution network would help in the long run. • Bisleri identified that the 1 litre pack was not considered trendy Segmentation,Positioning,Targeting Segmentation,Positioning,Targeting • The market was segmented into premium, popular and bulk • They changed their segments as per market situation keeping the old intact • They changed strategy and grew market share in Bulk segment • Every new entrant in the mineral water market adopted the purity so shift necessited • The ad campaign of play safe saw a shift in positioning from "pure and safe" to "play safe“ Packaging and pricing Packaging and pricing • Use of packaging to differentiate their products • Introduction of tamper proof seals • In 2000 Bisleri's 5 and 20 litres packs accounted for 20% of its sales • In 2000, Bisleri launched the 1.2 litre pack. This added to the five pack sizes that Bisleri had (500 ml, one, two, five and 20 litres) • The new pack was priced at Rs 12 Packaging and pricing • In 2000, Bisleri also launched smaller packs like the 300 ml cup • The new design of 500ml and 5 lt bottle was patented • The new pack allowed better brand display • Vertical labelling was easier on flat sleeved packages • It made label information visible from all sides of the bottle • In place of the round ringed bottles, Bisleri would be available in hexagonal flat-sleeved bottles Distribution Distribution • Kinley and Aquafina made huge investments in bottling plants and distribution • Kinley and Aquafina got the advantage of their distribution network in the country through Coca Cola and Pepsi • Coca-Cola India’s Kinley unit planned to double the number of water bottling plants to 16 • Pepsi’s Aquafina announced that it would add seven more plants to the existing five Distribution • Branded mineral water which sold in only 60 towns in 1993, was available in 250 towns in 1997 • In 1998, Bisleri's market share came down to 60%, while Parle Agro's Bailley had 20% • The remaining 20% was shared by regional players • In 1998, the branded mineral water market had grown to a 424 million litre business, valued at Rs 4 billion Distribution • In contrast, Bisleri had only 15 bottling plants and three franchisees • Kinley had 500,000 outlets compared to Bisleri's 350,000 Advertisement Advertisement • Late 1990s • ad campaign brand image—'There is just one Bisleri’ • Print-and-TV campaign - "pure and safe." • Safety feature - tamper proof seals • Weakness of conventionally sealed bottles "breakaway" seal Advertisement • September 2000 • Play Safe ad campaign to make its brand stand apart • Targeted the youth and hoped to convey a social message • Shift in positioning from "pure and safe" to "play safe“ • "Our observation is that people consume mineral water not for the minerals, but for safety. Hence the word "safe" is critical." -Mr. Chauhan CEO of Parle Bisleri Ltd Current Situation Current Situation • Tough competition from competitors to the aggressive marketing strategies of bisleri • Kinley trying to build market on trust factor • Coca-Cola announced that it would enter the bulk segment where Bisleri was a dominant player • The 20 litre bulk water packs would be targeted at institutional and home segment • Cola giants are shifting their focus to branded water in India Learning Learning • Segmentation, targeting and positioning is very important • Distribution network plays a very important role • Packaging and pricing play an important role in brand building and brand recalling • Innovation is the key for success of a firm so it is important to change with time • Advertisements help in promotion of the brand • Customer is the king Thank you