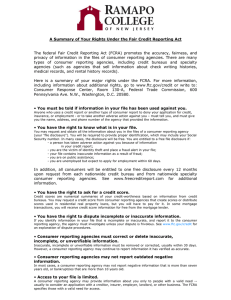

Business Law Today June 2016 The Fair Credit Reporting Act: Not Just About Credit David Neal Anthony and Julie Diane Hoffmeister Jun 20, 2016 17 min read Business Regulation & Regulated Industries Federal Trade Commission Consumer Finance Consumer Financial Protection Bureau Summary Part I describes the various individuals and entities that fall within the FCRA’s reach. Part II illustrates the potentially staggering damages that may result from an FCRA violation. Part III explores some of the common claims that typically are asserted against employers and CRAs. Part IV explains the emerging scrutiny on furnishers of consumer information. iStock.com/Ridofranz Jump to: Introduction → I. The FCRA’s Expansive Reach → II. Potential Damages under the FCRA → III. Common Claims Against FCRA Players → IV. Emerging Trends: Increased Scrutiny on Furnishers → Conclusion → Introduction Many companies believe that they are beyond the reach of the Fair Credit Reporting Act (FCRA) because they do not engage in typical “credit” reporting; however, such beliefs are enormously mistaken. Rather, the FCRA regulates a sprawling spectrum of products and industries ranging from insurance to retail to energy. The FCRA further governs all those involved in the consumer report chain of custody – furnishers, consumer reporting agencies (CRAs), and users of consumer information. Indeed, it is difficult to imagine an employer or a consumer-facing business that is not subject to the FCRA’s strict, technical requirements. Given the innumerable number of products offered by the plethora of specialty CRAs in the marketplace today, users may even unknowingly purchase a regulated consumer report. The bottom line is that the FCRA is likely regulating your client’s business, even if you do not think it is, and with regulation comes risk – both monetary and reputational. Besides the ever-expanding FCRA class-action arena, federal regulatory enforcement has become just as prominent, with the Consumer Financial Protection Bureau (CFPB) and Federal Trade Commission (FTC) taking the lead in prosecuting FCRA violators. Counsel must take notice of this ever-increasingly prominent statute and advise their clients accordingly. This article explores the broad scope and expansive reach of the FCRA. Part I describes the various individuals and entities that fall within the FCRA’s reach. Part II illustrates the potentially staggering damages that may result from an FCRA violation. Part III then explores some of the common claims that typically are asserted against employers and CRAs. Part IV explains the emerging scrutiny on furnishers of consumer information. I. The FCRA’s Expansive Reach Although its name insinuates a limited scope, the FCRA governs more than just traditional credit reports. Rather, the FCRA focuses on any information that can be broadly defined as a “consumer report.” A “consumer report” means “any written, oral, or other communication of any information by a consumer reporting agency bearing on a consumer’s credit worthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living which is used or expected to be used or collected in whole or in part for the purpose of serving as a factor in establishing the consumer’s eligibility” for credit, insurance, or employment purposes. A “consumer reporting agency,” in turn, is defined as “any person which, for monetary fees, dues, or on a