In Million

advertisement

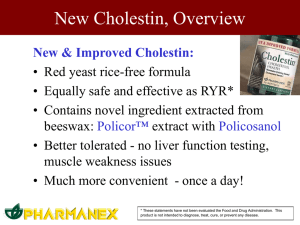

Nu Skin Enterprises Inc. Covering Analyst: Cecilia Xia ceciliaxia89@gmail.com Company Overview Company Overview › Multi-level direct seller of Antiaging personal care and nutritional supplements › Found by Blake Roney, Sandra Tilltson and Steven Lund in 1984 › Headquartered in Provo, UT The Evolution of Nu Skin The Evolution of Nu Skin – Phase One: Start-up (1984-1991) › U.S. business › Skin care focus › Product positioning: “All of the good, none of the bad” › Effectively resolved regulatory inquiries The Evolution of Nu Skin – Phase Two: International Expansion (19911996) › Rapid international expansion › Seamless compensation plan › Additional product category › Robust growth rates The Evolution of Nu Skin – Phase Three: Coming of Age (1996-2003) › IPO – Morgan Stanley › Pharmanex acquisition › Consolidation of global operations › Additional international expansion The Evolution of Nu Skin – Phase Four: Transformation (2003-2008) › Business transformation o Transfer of control from founders to public o Significant G&A restructuring › China entry The Evolution of Nu Skin – Phase Five: Nu Skin 2.0 (2008-present) › Accelerating revenue growth › ageLOC › Refined product launch process › Performance-based management incentives Business Segments Business Segments Revenue Segment 2011 Revenue (in Million) 2012 First Three Types of Quarters Products Revenue (In Million) Nu Skin $964 (55.3%) $816 (51.6%) Core Systems, Targeted Treatments, Total Care, Cosmetic, and Epoch. Pharmanex $770 (44.2%) $759 (48.0%) Nutritional, Antiaging, Solutions, Weight Management, and VitaMeal Others $10 (0.5%) $6 (0.3%) Household product and Digital content storage Industry Analysis Industry Overviews - Cosmetic & Beauty Products Manufacturing › Growth phase › Industry players number remain constant › Revenue is expected to grow 2.2% to $54.9 B Industry Overviews - Direct Selling Industry › Gloomy in the five years › Strong competition with department stores and big-box stores › Short seller David Einhorn’s bearish suggestions › Short seller Citron Research › China’s direct selling rules Comparable Analysis Comparable Companies › Comparables chosen for Beta, Product Offering, Geographic sales, FCF 3 year growth, Market Cap, EBITDA 3 year growth. Herbalife Ltd. (NYSE: HLF) › 55% › Similar product line › Similar distribution method › Similar FCF 3 year growth › Similar EBITDA 3 year growth › Similar Sales growth › Similar Net Income growth Energizer Holdings Inc. (NYSE: ENR) › 20% › Skin care section › Direct selling method, distributors, wholesalers › Similar FCF 3 year growth The Estee Lauder Companies Inc. (NYSE:EL) › 20% › Large Market Cap (22 B) › Similar EBITDA 3 year growth › Similar Net Income 3 year growth › Similar Sales 3 year growth › Similar EBITDA 3 year growth Avon Products Inc. (NYSE: AVP) › 5% › Similar Beta › Similar product › Similar business approach › Similar geographic focus › Different at EBITA growth, sales growth, net income growth Metrics › LTM Comps(30%) Metrics › Forward Comp (70%) DCF Analysis Revenue Model › Based on Geographic › Five areas: North Asia, Greater China, Americans, South Asia/Pacific and Europe Revenue Model -North Asia › Japan: (1% growth) o Projecting 1-3% revenue growth in 2013 o Increase in sales leader activity o New product launch o Reason: unsuccessful product launch before Revenue Model -North Asia › South Korea: (5% growth) o Projecting 10-12% revenue growth in 2013 o New product launch o Reason: Special government regulation Revenue Model -Greater China › Projecting 15-18% growth rate › Mainland China (25%) o Fastest growing direct selling market o 3rd largest direct selling market › Taiwan (5%) and Hong Kong (5%) o Mature market with stable growth rate Revenue Model -Americas( 5%) › Projecting 12-15% growth rate in 2013 › Latin America projected 60% revenue growth rate › New product launch › Reason: questioned by short sellers, investors confidences Revenue Model -South Asia/Pacific (25%) › Expansion into Vietnam in 2012 › Projecting 5-10% revenue in 2013 › Reason: Great experience with new product launching; New market entry Revenue Model -EMEA (5%) › Projecting 12-15% revenue › New project launch in 2012 › Reason: management team projected way too high last year Working Capital Model & DCF Model › Percent of revenue › Growth margin remain at 83.5% › Constant COGS › SG&A increase due to upper level sales leaders increase › Capital expenditures increase due to build facilities in Provo and China › 5% intermediate growth rate was used to smooth cash flow growth heading into perpetuity Final Valuation Final Implied Price LTM Comparable Analysis Forward Comparable Analysis DCF Analysis Current Price Implied Price Undervalued 15% $ 59.47 35% $ 55.86 50% $ 51.49 $ 44.22 $ 54.22 18.44% Portfolio History ›Currently holding 50 shares in Tall Firs portfolio oCost basis of $2883.7 oMarket value of $2211.0 oUnrealized loss of 23.33% ›Currently holding 52 shares in Svigals’ portfolio oCost basis of $2968.5 oMarket value of $2299.4 oUnrealized loss of 22.54% Recommendation › Due to Nu Skin’s strong potential of growing, I recommend a hold in all portfolios Questions Appendix A – Issues about China Market Year Event 1998 Exloration phase, acquired Pharmanex and two small companies 2002 Built Shanghai manufactruing facility and established retail stores 2003 Began selling Nu Skin products through retail stores 2005 New direct selling regulations published 2006 Obtained initial direct selling license 2007-2008 Transistion period, restructuring, new management tem 2008-2012 Continued expansion of provincial DS licenses and rapid revenue growth China › Management team average tenure about 20 years oUnderstand local regulatory framework oWorks cooperatively with local regulators oHas a track record of regulatory compliance and successful operations China › Solid Infrastructure in China: o4 Manufacturing Plants o2 R&D Labs o40 Stores o15 Provincial & Municipality Licenses Significant Market Potential For Nu Skin Company 2011 Revenue 2011 % Growth Amway $4,200.00 21.4% Perfect $1,900.00 18.0% Infinitus $1,300.00 88.9% Mary Kay $1,000.00 32.0% New Era $540.00 37.2% Tiens $500.00 14.3% Yofoto $400.00 150.0% For You $283.00 80.0% Apollo $281.00 60.0% Sunhope $228.00 45.0% Herbalife $204.00 8.3% Avon $188.00 -20.0% Nu Skin $152.00 59.0% Shaklee $70.00 233.0% Five Year Business Plan in China › Increase number of direct selling licenses › Expand number of direct sellers › Triple number of retail stores › Extend distribution channel by adding independent markets Appendix B – Sustaining Growth Method › ageLOC: a compelling product platform › Strong product pipeline › Product launch process deliver strong results › Growth in every geographic region › Investing in Channel Innovation › Strong balance sheet and cash flow › Experienced management and sales leaders Appendix C - EPS Appendix D – Stock Repurchase Activity Appendix E – Increasing dividend history Appendix E – 2007-2013 Cash from Operation Appendix F- Sales Leaders Areas Sales Leaders Americas 5800 EMEA 4500 N/ASIA 15600 Greater China 16200 South Asia/ Pacific 5900