Be the Market

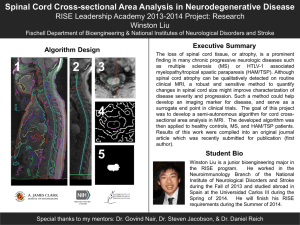

advertisement

Planning for a Sustained Lifestyle: Why Use the Thrift Savings Plan (TSP)? Edition of April 29, 2013 “Uncle Jon” Cook • Survivor Outreach Services – Financial Counselor • Financial Readiness Program • Personal Financial Management (PFM) Specialist • Accredited Financial Counselor (AFC) • Army Emergency Relief (AER) • Notary Public • Employment Readiness Program • Military Spouse Employment Program (MSEP) • (Former) Professional in Human Resources (PHR) & (Former) Certified Workforce Development Professional (CWDP) (309) 782 - 0815 1 – 877 – 882 – 0523 jon.c.cook.civ @ mail. mil www. riamwr. com / acs / Cascade of Concepts • Military Saves Campaign (of the America Saves Campaign, annually in February) • Three types of money: this class is on Money Future • Rule of 72: translate Annual Percentage Rate (APR) into Time • “It’s not the money you make; it’s the money you get to keep!” Ric Edelmann • Saving and Investing: “Loanership” and Ownership • Pyramid of Risk: arranging types of savings and investing; applying Rule of 72 and diversification • Realizing capital gains and losses (vice “paper” gains and losses) • Dollar Cost Averaging - riding the market’s ups and downs: you are a buyer, then a seller • Investing styles • Beat the Market • Be the Market: Index Investing and Diversification • Thrift Savings Plan (TSP) • Five Funds for Indexing • L Funds for diversification Please do ask questions as we go through • Traditional and Roth the session. • 5% Match This presentation is designed to give you • Your next steps quite a few “Scooby Doo” moments! Disclaimer • This presentation is for the information and education of the participants. • The information presented is neither an endorsement nor a guarantee. • Past performance is no guarantee of future performance. • Before making any financial commitment, consult with your Family Members and appropriate professional advisers. www. military saves. org • I will help myself by saving money, reducing debt, and building wealth over time. • I will help my family and my country by encouraging other Americans to “Build Wealth, Not Debt.” Mental Health Physical Health Social Spiritual Finances Exercise Personal $ Diet Intellectual Stein, M. (1998). Prosperous Retirement. Boulder, CO: EMSTCO Press. p. 19. 6 Why plan for retirement now? Retirement is way off in the future! “It’s not the money you make; it’s the money you get to keep!” Ric Edelmann Saving & Investing Saving: “loanership” interest 1099-INT Investing: “ownership” dividends 1099-DIV capital gains (or losses) 1099-B Hypothesis: There is a major up and down in the market every 5 to 7 years. Retrieved November 20, 2012 from: http://stockcharts.com/freecharts/historical/djia1900.html 14,226.20 March 4, 2013 Life’s Events Retirement Long Term Care College, major home maintenance Emergencies, insurance deductibles, big vacations, car down payments, Medical co-pays Christmas, Birthdays, Anniversaries, Weddings, back-toschool, Car Services, Trips, taxes, “stuff” Bonds and Bond funds Stocks and Stock funds + 5 to 7 years - 5 to 7 years Long term CD’s, short term Bonds and Bond funds Money Market from Mutual Funds CU & Bank short term CD’s & Money Funds Savings Accounts Return on Investment (ROI) Inflation Taxes Fees CUPS! At a minimum beat • Inflation If inflation is 2.5% … And a savings account is .5% - is it a cup or funnel? • Taxes Tax Adverse - vice - Tax Aware If a mutual fund makes 5% … • Fees and its annual fee is 1% you made 4% - before taxes Your “leftover’s” ROI Pyramid of Risk Collectibles and venture capital Stock Preferred Stock Mutual Funds Bonds and CD’s Cash, Checking, Savings Financial Plans Insurance “Real” vice “Paper” Gains and Losses “A capital gain is only ‘realized’ after you sell…” Buyers and Sellers The Market price rises to $10 a share – How much have you made? The Market price rises to $25 a share and you sell – How much have you made now? Market Price The Market price drops to $2 a share – How much have you lost? You buy your shares at $5 per share Time Dollar Cost Averaging $100 at $5/share = 20 shares (=20) $100 at $10/share = 10 shares (=90) $100 at $10/share = 10 shares (=105) Market Price $100 at $33/share = 3 shares (=108) $100 at $10/share = 10 shares (=30) $100 at $2/share = 50 shares (=80) When did you buy the least shares? Sold 108 shares @ $30/share = $3,240 $700 investment yields $3,240 $100 at $20/share = 5 shares (=95) Time When did you buy the most shares? OK, Buyers? What is your tolerance for risk in a down market? “What is the market’s next move? Buyers and Sellers ? Market Price Time Your Wealth Building Task is to Buy Shares Retirement ? Adjusting Phase Managing Growth and Income during retirement Accumulation Phase Buyer – Seller ? You’re asking me, during the accumulation phase, even when the market is falling, to keep buying shares? YES: Ignore the paper-losses; dollar cost averaging with a buy and hold strategy. Investing Styles • Beat the Market: day trading; buy and hold; momentum; cyclical; income; growth; value; contrarian … • “Be the Market”: buy a little of all of it – Index Investing • Jack Bogle, founder of Vanguard • Only 20% of the managed funds and accounts beat the market averages; which means 80% of them don’t! = You ought to be using the market averages (indexes). 1% automatically to C Fund unless you change it 1% to 3% draws and equal match Your 4% or 5% contribution draws a 3.5% or 4% match Maxing out at 5% match www. tsp. gov Sponsored by the Office of Personnel Management (OPM) The Federal Government’s 401k Plan Which one (G,F,C,S,I) should you own? In what proportion? Lifecycle L-funds: proportions based on time Slight adjustments every fiscal quarter moving towards L-Income (dollar cost average your way out of the market) TSP > Investment Funds > Fund Options > Lifecycle Funds Source: TSP Highlights for January / February 2012: Is Roth for You? Interest Vision Software (at ACS) Invest Monthly for 20 Years = 240 Months @ estimated 9% APR $300/month yields $200,366.06 You put in (principal) $72,000 Your growth (capital gains, dividends and interest) $128,366.06 Totals to $200,366.06 When did you want to pay your taxes? Traditional (IRA, 401k, 403b, SEP) • Your contributions are tax-deferred • You pay at regular income rates as you withdraw the proceeds (principal + growth) You put in (principal) $72,000 Tax Deferred Your growth (capital gains, dividends and interest) $128,366.06 Tax Deferred Totals to $200,366.06 with taxes paid as you receive your distributions after you retire ROTH (Roth IRA, Roth 401k [TSP]) • Your annual contributions (principal) are taxed • Your distributions (principal + growth) are not taxed You put in (principal) $72,000 and pay the income taxes annually Your growth (capital gains, dividends and interest) $128,366.06 Tax Free Totals to $200,366.06 with no further tax consequences Interest Vision Software (at ACS) Invest Monthly for 20 Years = 240 Months @ estimated 9% APR $300/month yields $200,366.06 When did you want to pay your taxes? You put in (principal) $72,000 Your growth (capital gains, dividends and interest) $128,366.06 Totals to $200,366.06 Traditional B1. Wages reduced by amount deferred Amount deferred “D” in Block 12 B1. Roth contributions are just part of your taxable wages Roth Nothing in Block 12: Roth contributions’ taxes paid each year; nothing is deferred Traditional – Roth – One/Both - Convert? • There is no right answer – it depends … • Age; years to retirement; what is already saved; best guess on future income tax rates …. • It’s a personal decision based on many factors …. • A financial & emotional decision based upon when you desire to pay your taxes …. Traditional + Your agency match (up to 5%) has to be deposited in traditional + High income earner trying to shelter money from current taxes + Estimate that you will be in lower tax brackets during retirement + Large amounts already in traditional (deferred) accounts and don’t want to pay additional taxes to convert + You plan on receiving distributions before age 70 ½ Roth + Amount not matched + Young worker, not earning a lot, and not paying a lot of current taxes + Estimate that you will be in higher tax brackets during retirement + Smaller amounts already in traditional (deferred) accounts and willing to pay additional taxes to convert + You may desire the money after age 70 ½ or never (passed along in your estate) - Cannot touch a Roth for 5 years www.tsp.gov Contribution Comparison Calculator (as it applies to your paycheck) Unchecked Roth Options https://www.ebis.army.mil Q: Why TSP as opposed to other planners, brokers or mutual funds? A1: Vastly reduced expenses. A2: Dollar cost averaging into index funds, and you can diversify (L funds). Index Investing, Allocation by Lifecycle, Dollar Cost Averaging, and Buy and Hold Got it!!! What could possibly go wrong? Lifecycle L-funds: proportions based on time Slight adjustments every fiscal quarter moving towards L-Income (dollar cost average your way out of the market) TSP > Investment Funds > Fund Options > Lifecycle Funds Money Magazine, September 2012, pp. 97-102 His bottom line – the last item in his article: Simple, cheap index-fund portfolio = TSP L-Fund Analysis framework for making Financial Objective Statements Purpose: Amount needed or desired: $________ Time or time frame: Tolerance for risk: Method(s): www. tsp. gov Sponsored by the Office of Personnel Management (OPM) The Federal Government’s 401k Plan Planning for a Sustained Lifestyle: Why Use the Thrift Savings Plan (TSP)? Edition of April 29, 2013 www.irs.gov Retirement Contribution Limits Backup Slide 1A Backup Slide 1B Backup Slide 2A