BBA Finance - City University of Hong Kong

advertisement

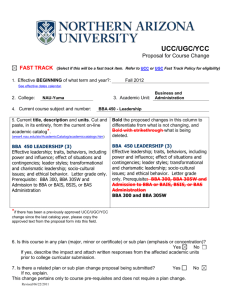

Presented by : Coordinator of Undergraduate Programs: Dr. Fred Kwan 1 EF website Three EF majors BBA (Hons) Business Economics BBA (Hons) Finance (two streams) Finance Quantitative Finance and Risk Management BBA (Hons) Banking and Financial Services Four EF minors Business Economics (BE) Finance (FIN) Personal Financial Planning (PFP) Quantitative Finance (QF) 2 Practice-oriented, Discovery–Enhanced Curriculum: Applications of theories to real-world financial decision-making using cases, etc. • Trading Room Workshop: students do real-world trading in financial markets. Internship opportunities available to students A large number of EF students on Dean’s List About 100 students every year got scholarships from EF Department for outstanding academic achievements Students have won in competitions in recent years Graduates working in banks, regulatory agencies, consulting firms, corporations, accounting firms Big 4, etc. 3 Strong professional knowledge At CityU EF: Knowledgeable professors Active learning in classrooms: Students participate, ask questions and give comments Global view of issues Students keep an inquiring mind Students and professors keep abreast of current events 4 About 40 regular teaching staff • International background: From Hong Kong, Mainland China, Taiwan, Japan, Korea, Thailand, Malaysia, India, Belgium, France, Italy, Romania, Turkey, and Uzbekistan. Dedicated to teaching, actively engaged in research Teaching Excellence Awards (TEA) • Some EF teaching staff have won CityU’s highest honors in teaching 5 Soft skills Good oral and written English skills Interpersonal skills Professional conduct: Ethics How you handle everyday life 6 7 Prepare students to be effective managers Familiarize students with the aims and functions of firms and how they operate Provide students with an understanding of the institutional details at the regional and international levels • Economic environment • Laws and regulations • International agencies 8 Principles of Macroeconomics Mathematics for Economics and Finance Intermediate Microeconomics Security Analysis and Portfolio Management Macroeconomics for Business Strategy Principles of Econometrics Economies of China (mainland) and Hong Kong Economic and Business Forecasting Corporate Accounting 12 Choose two areas • Applied Business Economics • Regional Economic Studies • International Trade and Finance • Urban & Property Market Analysis • Business and Financial Markets Elective courses 10 Traditional Economics programs CityU’s EF Business Economics Tend to be overloaded with theories Strike a balance between theories and applications Applications of economics in diverse settings Applications of economics focused on business settings Many traditional economics programs do not focus on preparing students for jobs Co-curricula activities to prepare students as a well-rounded professional 11 Columbia University National Taiwan University Commencement Possibly September 2014 (commence 3rd year of study) September 2014 (commence 2nd year of study) Enrollment Up to 10 students per year Up to 5 students per year Requirement • Completed at least 60 credit units • CGPA: 3.0 or above • IELTS: 7.0 or above • TOEFL: 100.0 or above • Completed at least one year of full-study • GPA: 3.0 or above Fees (in years at host university) Pay the regular fees to host university Pay the regular fees to home university Note: Students will spend 2 years in the host university in each program. After completion of the program, students will have two certificates from the participating universities (i.e. City University of Hong Kong and Columbia University/National Taiwan University). 12 Economic Consultant Economic Researcher Management Consultant Corporate Manager Government Regulatory Agency Investment Advisor Private Banker Real Estate Analyst Securities and Market Analyst Economic Journalist 13 BBA Finance City University of Hong Kong (Tentative quota: 80) Stream of (i) Finance (ii) Quantitative Finance and Risk Management 14 Prepare graduates for responsible management positions in the area of finance in the industrial, commercial, financial and government sectors 15 Develop student capability of financial asset valuation Enable students to make competent financial decisions Enable students to take a comprehensive and balanced view of overall business decisions and corporate strategies 16 Principles of Macroeconomics Mathematics for Economics and Finance Security Analysis and Portfolio Management Advanced Security Analysis and Portfolio Management Asia-Pacific Capital Markets and Standards of Practice Derivatives and Risk Management Regulation and Management of Financial Institutions Trading Room Workshop 17 Financial Systems, Markets and Instruments Corporate Finance Principles of Econometrics International in Finance and Banking Corporate Accounting 18 Stochastic Calculus for Finance Principles of Option Pricing Quantitative Methods in Finance Risk Management Models Automated Data Analysis in Financial Modelling Statistics for Economic and Financial Modelling 19 Solid training in both theory and practice of Finance Emphasize interactions with other business disciplines Focus on the Asia-Pacific region 20 Commercial or Investment or Private Banker Corporate Strategist Credit or Securities (Debt and Equity) Analyst Institutional Sales of Securities Management Consultant Portfolio Manager Risk Manager for financial institutions or nonfinancial corporations Treasury Department Graduates of the QFRM stream may also pursue these careers: Derivatives Structurer Quantitative Analyst Algorithm Trading and Hedge Fund 21 22 Students are trained as financial service professionals who are capable in the various aspects of financial services (including banking, economics, insurance, law, maritime trade and international and real estate finance) 23 Equip students with a good mastery of the knowledge, skills and ethics necessary in the financial services industry Equip students with a solid knowledge of the operations of banks and other financial institutions Enable students to draw from broader academic fields to understand and handle the practical issues involved in the provision of financial services 24 Personal Finance and Retail Banking Security Analysis and Portfolio Management Corporate Accounting International Finance and Banking Regulation and Management of Financial Institutions Business and Law Banking Law Life Insurance Corporate Finance Real Estate Economics and Finance Derivatives Analysis and Advanced Investment Strategies 25 Bank/ Insurance Risk Manager Commercial/ Private Banker Credit Analyst Investment Advisor Portfolio Manager Corporate Risk Manager Institutional Sales for Debt and Equity Securities Real Estate Valuer Wealth Managers 26 To provide students a moderate level of understanding of how business economics can be applied to support business decision making Micro-Economics Financial Management Macro-Economics Macroeconomics for Business Strategy Intermediate Microeconomics Several Electives Courses Provide students with knowledge of the basic analytical tools in finance and applications of finance theories to practical problems in the financial markets Develop students’ analytical ability to analyse financial problems and issues that nonfinancial corporations and financial institutions face Micro-Economics Financial Management Macro-Economics Security Analysis and Portfolio Management Derivatives Analysis and Advanced Investment Strategies Several Elective Courses To equip students with the tools to manage their own personal finance and provide the tools and fundamental knowledge for those wanting to serve as professional financial planners Micro-Economics Financial Management Macro-Economics Personal Finance and Retail Banking Security Analysis and Portfolio Management Derivatives Analysis and Advanced Investment Strategies Several Elective Courses Provide students with knowledge of the basic tools of financial engineering and their applications in the financial market settings Develop students’ understanding on the use of derivative instruments in portfolio management and corporate hedging Enable students to have a basic perspective of the roles of financial engineering in the context of overall corporate strategy Micro-Economics Financial Management Macro-Economics Mathematics for Economics and Finance Principles of Option Pricing Principles of Econometrics Statistics for Economics and Financial Modeling Several Electives Courses The Department of Economics and Finance BBA Scholarships • Max. no.: 150 • Value: HK$2,000, HK$3,000 The Department of Economics and Finance Exchange Program Awards • Max. no.: 15 • Value: HK$8,000 for each award The Department of Economics and Finance BBA Distinguished Graduate Scholarship • Max. no.: 1 for each major • Value: HK$10,000 for each award 30 Mentoring Schemes • Staff mentor, Student mentor, Professional mentor Study Tours Exchange Program Internship Career Preparation BEST (Business Elites Seminar Talk) Databases (Bloomberg, PACAP, DataStream, IMF, etc.) 31 41 42 43 44 45 46 47 39 49 50 51 52 53 54 55 Vitas LI (2009 Graduate in BBA Finance) UBS AG Tom Ai (2010 Graduate in BBA Finance) BNP Paribas, Japan Dick Wu Rita Xiao Simon Liu (2009 Graduate in BBA Finance) Consultant Stirling Finance Limited (2010 Graduate in BBA Business Economics) Analyst Barclays Capital Florence Chow (2010 Graduate in BBA Finance) Investment Banking Analyst Citigroup (1994 Graduate in BSc Finance) Portfolio Strategist BOCI Prudential Asset Management Ltd Thomas Kwan (1998 Graduate in BSc Finance) Associate Director Corporate Finance PricewaterhouseCoopers Hong Kong Karson Chan (2002 Graduate in BBA Financial Engineering) Associate JP Morgan Carles Fan (2001 Graduate in BBA Fin’l Engr) Senior Structurer Solutions and Structuring Team, Banco Santander, Asia 56 We welcome you to CityU EF! Thank you 57