Fair Credit Reporting Risk-Based Pricing Regulations - Bcac

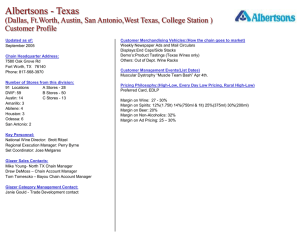

advertisement

Fair Credit Reporting Risk-Based Pricing Regulations Federal Reserve Board’s Regulation V Risk-Based Pricing When creditors offer more favorable terms to consumers with good credit histories and less favorable terms to consumers with poor credit histories. Background FACT Act of 2003 signed on 12-04-2003. Section 615(h) required risk-based pricing notice. Proposed rules were issued 05-19-2008. Final rules were issued on 12-22-2009. Final rules are effective on 01-01-2011. Purpose Risk-based pricing notice is designed to improve accuracy of consumer reports by alerting consumers to existence of negative information on their reports. Once alerted to the existence of negative information, consumers can check their reports for accuracy and correct any inaccurate information. Notice is intended to complement existing adverse action notice framework. Implementation Issues Banks are given a menu of approaches that can be used to comply with the statute’s legal requirements. Rules apply only to credit for personal, family, or household purposes. Rules do not apply to consumer leases. Rules do not apply to guarantors, cosigner, sureties, or endorsers. Overview A person must provide a risk-based pricing notice to a consumer… when the person uses a consumer report in connection with an application, and based on that consumer report, provides credit to that consumer on material terms that are materially less favorable than the most favorable terms available to a substantial proportion of consumers from or through that creditor. *Notice is also required if APR is increased after origination because of information contained in a credit report, unless the creditor provides an adverse action notice. Material Term For credit that has an APR, the material term is the APR. For credit that does not have an APR, the material term is the financial term… that the creditor varies based on the consumer report, and that has the most significant financial impact on consumers (such as an annual membership fee or deposit). Materially Less Favorable The terms granted or extended to a consumer differ from the terms granted or extended to another consumer from or though the same person such that the cost of credit to the first consumer would be significantly greater that the cost of credit to the other consumer. Options for Determining Materially Less Favorable Case-by-Case Review Credit Score Proxy Method Tiered Pricing Method Credit Card Issuer Option Case-By-Case The creditor may determine, on a case-bycase basis, whether a consumer has received material terms that are materially less favorable than terms other consumers have received from or through that creditor by comparing the material terms offered to the consumer to the material terms offered to other consumers for a specific type of credit offered Credit Score Proxy Method Creditors that use credit scores to set material terms of credit can determine a cutoff score. This cutoff can be… point at which 40% of consumers have higher credit scores and 60% have lower credit scores, or if more than 40% have received credit at most favorable terms, then the percentage point at which consumers who historically have been granted credit on material terms other than the most favorable terms. Tiered Pricing Method A creditor that sets the material terms of credit by assigning each consumer to one of a discrete number of pricing tiers, based on a consumer report, may provide a risk-based pricing notice to each consumer who is not assigned to the top pricing tier or tiers. Credit Card Issuer Option Credit card issuer can provide a risk-based pricing notice to a consumer if the consumer applies for a credit card in connection with a multiple-rate offer and, based a consumer report, is granted credit at an APR that is higher than the lowest APR available under that offer. Credit Score Disclosure Exceptions Instead of issuing a risk-based pricing notice to just those consumers offered credit on “materially less favorable” terms, the creditor can provide all consumers who apply for credit with a notice consisting of their credit score and certain additional information. Other Exceptions Applications where consumer applies for and receives specific material terms. Applications where consumer has been or will be provided a notice of adverse action under section 615(a) of FCRA in connection with the transaction. Prescreened solicitations involving firm offers of credit. Timing of Notice Closed-End Credit: At or after approval decision is communicated but before consumer becomes contractually obligated. Open-End Credit: At or after approval decision is communicated but before the 1st transaction. Account Reviews: If advance notice of APR change is required: At the time the APR increase is communicated to the consumer If no advance notice of APR is required: No later than 5 days after effective date of the change. Automobile Transactions: Special Rules Instant Credit Transactions: Special Rules Who Provides the Notice? The person to whom the loan is initially payable must provide the risk-based pricing notice (or satisfy an exception). This is the case even if… the loan is assigned to a third party, or the person to whom the loan is initially payable is not funding the loan. Note: Although legal responsibility rests with party to whom obligation is initially payable, parties may determine by contract who will send notice. Multiple Consumers Risk-based pricing notice: If a transaction involves two or more consumers… At same address, a single notice addressed to both consumers will suffice. Not at same address, each consumer must receive a notice. Credit score disclosure notice: If a transaction involves two or more consumers, each consumer must be provided an individualized notice. Free Credit Report A consumer who receives a risk-based pricing notice has a right to a separate free consumer report upon receipt of a risk-based pricing notice. The notices provided under the credit score disclosure exception are not riskbased pricing notices and do not give rise to the right to receive a free credit report. Definitions Previously Defined Definitions The following terms have the same definition in Regulation V as they do in Regulation Z: annual percentage rate closed-end credit open-end credit plan consummation The following terms are defined using FCRA’s statutory definitions: credit creditor credit card credit card issuer credit score Material Terms – Open End Credit (Except Credit Cards) The APR that is the material term should exclude… any temporary initial rate that is lower than the rate that will apply after the temporary rate expires, any penalty rate that will apply upon the occurrence of one or more specific events (such as a late payment or an extension of credit that exceeds the credit limit), and any fixed APR option for a home equity line of credit. Material Terms – Credit Card The APR that is the material term should be… For credit cards with a purchase APR, the APR that applies to purchases (“Purchase APR”). For credit cards with no purchase APR: the APR that varies based on information in a consumer report and that has the most significant financial impact on consumers. Note: Open-end rules regarding exclusion of temporary initial rate and penalty rates are also applicable to calculation of purchase APR. Material Terms – Closed-End Credit The APR that is the material term should be the APR disclosed in Regulation Z disclosures prior to consummation. Note: This definition did not address temporary initial rates or penalty rates because, for purposes of the closed-end provisions of Regulation Z, a penalty rate is not included in the calculation of the APR and a temporary initial rate is but one component of a single AOR for the transaction. Material Terms – Credit with no APR The financial term that varies based on information in a consumer report and that has the most significant financial impact on consumers, such as a deposit required in connection with credit extended by a telephone company or a utility or an annual membership fee for a charge card. Materially Less Favorable The terms provided to a consumer differ from the terms provided to another consumer from or through the same person such that the cost of credit to the first consumer would be significantly greater than the cost of credit to the other consumer. Factors relevant to determining the significance of a difference in cost include… the type of credit product, the term of the credit extension, if any, and the extent of the difference between the material terms provided to the two consumers. The Rules Who Must Receive a RiskBased Pricing Notice General Rule A person must provide a risk-based pricing notice if the person – uses a consumer report in connection with an application for, or a grant, extension, or other provision of, credit to that consumer; AND based in whole or in part on the consumer report, grants, extends, or otherwise provides credit to that consumer on material terms that are materially less favorable that the most favorable material terms available to a substantial proportion of consumers from or through that person. Case-by-Case Method Bank can directly compare the material terms offered to each consumer and the material terms offered to other consumers for a specific type of product. “Specific type of product” means one or more credit products with similar features that are designed for similar purposes. Examples include student loans, unsecured credit cards, secured credit cards, new automobile loans, used automobile loans, fixed-rate mortgage loans, and variable rate mortgage loans. Steps in a Case-by-Case Method 1. 2. Identify the appropriate subset of current or past consumers to compare to any given consumer. (This subset would need to be an adequate sample of consumers who have applied for a specific type of credit product.) Compare the material terms. (But creditor would need to disregard any underwriting criteria that do not depend upon consumer report information). Alternatives to Case-by-Case Method Credit Score Proxy Method Tiered Pricing Method Credit Card Issuer Option Note: For purposes of consistency, a person must use the same method to evaluate all consumers who are granted, extended, or otherwise provided a “specific type of product” from or though that person. Credit Score Proxy– General Rule A creditor that uses credit scores to set material terms of credit can… 1. 2. determine the score that represents the point at which approximately 40% of its consumers have higher credit scores and approximately 60% of its consumers have lower credit scores, and provide a risk-based pricing notice to each consumer with a credit score below that cutoff score. Credit Score Proxy – General Rule Example A person extended credit to 10,000 consumers. It determines that 40% of those consumers (or 4,000 consumers) had credit scores of 700 or higher. That person would use 400 as its cutoff score. If a consumer was approved for credit with a score of 699 or lower, that consumer would need to be provided a risk-based pricing notice. Credit Score Proxy – Alternative Sampling Method If a person finds that more than 40% of its customers have received credit at the most favorable terms, that person can… 1. determine the point at which some percentage of its customers have historically been given credit on material terms other than the most favorable terms, 2. determine the score that represents that point, and 3. provide a risk-based pricing notice to each consumer with a credit score below that cutoff score. Credit Score Proxy - Alternative Sampling Method Example A credit card issuer takes a representative sample of consumers to whom it provided credit* over the preceding six months. Determines that 80% received credit at the lowest available APR (most favorable term). Determines that those 80% of customers have a score at or above 750. Sets 750 at its cutoff score. Provides risk-based pricing notice to consumers with credit scores below 750. *Correct universe is consumers to whom the person has provided credit.” Credit Score Proxy – Alternative Sampling Method - Special Rules A person is permitted, but not required, to use the alternative approach when more than 60% of its customers receive credit at other than the most favorable terms. BUT A person may not use the alternative approach when fewer than 40% of its customers receive credit at the most favorable terms. Credit Score Proxy - Alternative When No History Available When a person is new to credit business, introduces new credit products, or just starts to use risk-based pricing, it can determine a credit score cutoff based on information from market research of relevant third party sources for the specific type of credit product. When a person acquires a credit portfolio as a result of a merger or acquisition, it can determine the cutoff score based on information from the party which acquired, with which it merged or from which it acquired the portfolio. Credit Score Proxy – Alternative Recalculation of Cutoff Score Sampling Method: Person using the sampling approach must recalculate its cutoff score at least every 2 years. No History Available: Person relying on third party information must recalculate its cutoff score within 1 year based on its own consumers’ information. If a person does not provide credit to new consumers during the 1-year period, it can continue to use third party information until it obtains sufficient data (but no longer than 2 years). Credit Score Proxy – Alternative Use of Multiple Credit Scores If a person uses more than one credit score to set the material terms of credit, must determine the cutoff score using the same method the person uses to evaluate multiple scores when making a credit decision. Credit Score Proxy – Alternative Multiple Credit Scores (Examples) Example #1: If a person uses the average of two scores when setting the material terms of credit, then… that person must use the average of its consumers’ scores when calculating the cutoff scores. Example #2: If a person uses the lower of two scores when setting the material terms of credit, then… that person must use the lower of its consumers’ scores when calculating the cutoff score. Credit Score Proxy – Alternative Multiple Credit Scores (Safeharbor) When a person that uses multiple credit scores does not consistently use the same method to evaluate multiple scores, the person must calculate the cutoff score using a reasonable means. This is defined as… any one of the methods the person regularly uses or (b) the average credit score of each consumer to whom it provides credit. Credit Score Proxy Credit Score Not Available A person using the credit score proxy method (pursuant to the general rule or the alternative rule) that provides credit to a consumer with no credit score must … assume the consumer receives credit on other than the most favorable material terms, and provide a risk-based pricing notice to the consumer. Alternatives to Case-by-Case Method Credit Score Proxy Method Tiered Pricing Method Credit Card Issuer Option Note: For purposes of consistency, a person must use the same method to evaluate all consumers who are granted, extended, or otherwise provided a “specific type of product” from or though that person. Tiered Pricing Method The tiered pricing method can be used by a person that sets the material terms of credit provided to a consumer by placing the consumer within one of a discrete number of pricing tiers based, in whole or in part, on information in a consumer report. Tiered Pricing Method Four or Fewer Pricing Tiers A person must provide a risk-based pricing notice to each consumer who does not qualify for the top tier (i.e., the lowest priced tier). Example: A person uses a tiered pricing structure with APRs of 8, 10, 12, and 14 percent. It would be required to provide a risk-based pricing notice to each consumer to whom it provides credit at 10, 12, and 14 percent. Tiered Pricing Method Five or More Pricing Tiers A person must provide a risk-based pricing notice to each consumer who does not qualify for… the top two tiers (i.e., the two lowest priced tiers), AND any other tier that together with the top two tiers comprise no less than the top 30% but no more than the top 40% of the total number of tiers. Tiered Pricing Method Five or More Pricing Tiers (Example) Question: A person has 9 pricing tiers. Consumers in which tiers should receive a pricing notice? Answer: The bottom six tiers. Risk-based pricing notices are never needed for the top two tiers. And, in this case, the third tier must be added to the top two tiers create a top set of tiers that captures at least 30% but no more than 40% of the total number of tiers. Alternatives to Case-by-Case Method Credit Score Proxy Method Tiered Pricing Method Credit Card Issuer Option Note: For purposes of consistency, a person must use the same method to evaluate all consumers who are granted, extended, or otherwise provided a “specific type of product” from or though that person. Credit Card Issuers Credit card issuers may… select the select the option, or select the the tiered case-by-case method, special credit card issuer credit score proxy method or pricing method. Credit Card Issuer Option A credit card issuer may provide a riskbased pricing notice when… a consumer applies for credit with more than one possible purchase APR, and that consumer receives a credit card with a purchase APR that is greater than the lowest purchase APR available in connection with the application or solicitation pursuant to which credit is extended. Credit Card Issuer Option (Example) Question: A credit card issuer sends a solicitation to a consumer that discloses several possible purchase APRs that may apply, such as 10%, 12%, or 14%, or a range of purchase APRs from 10% to 14%. The consumer applies for a credit card in response to the solicitation. The card issuer provides a credit card to the consumer with a purchase APR of 12% based on a consumer report. Must the credit card issuer provide the applicant with a riskbased pricing notice? Answer: Yes -- because the consumer received credit at a purchase APR greater than the lowest purchase APR available under that solicitation. Credit Card Issuer Option (Example) Question: Assume same facts as preceding example, except that the consumer received a credit card with a purchase APR of 10%. Also assume that that consumer or other consumers might qualify for a purchase APR of 8% under a different credit card solicitation by the same credit card issuer. Must the credit card issuer provide the applicant with a risk-based pricing notice? Answer: No. The card issuer is not required to provide a risk-based pricing notice simply because a better purchase APR may have been available under a different solicitation. Overview A person must provide a risk-based pricing notice to a consumer… when the person uses a consumer report in connection with an application, and based on that consumer report, provides credit to that consumer on material terms that are materially less favorable than the most favorable terms available to a substantial proportion of consumers from or through that creditor. *Notice is also required if APR is increased after origination because of information contained in a credit report, unless the creditor provides an adverse action notice. Account Review A person must provide a risk-based pricing notice if that person… uses a consumer report in connection with a review of credit that has been extended to the consumer, and based on information in a consumer report, increases the APR. Account Review Example Question: A credit card issuer periodically obtains consumer reports for the purpose of reviewing the terms of credit it has extended in connection with credit cards. As a result of this review, the credit card issuer increases the purchase APR applicable to a consumer’s credit card based on information in a consumer report. Must the credit card issuer provide a notice? Yes: The credit card issuer must provide a riskbased pricing notice to the consumer. Account Review Exception When an adverse action notice is provided to the consumer in connection with an account review that results in a rate increase, the regulation’s exception for adverse action notices would apply and the creditor would not be required to provide the consumer with a risk-based pricing account review notice. The Risk-Based Pricing Notice Content, Form, Delivery Methods, and Timing Content A risk-based pricing notice (except an account review notice) must contain… A statement that a consumer report (or credit report) includes information about the consumer’s credit history and the type of information included in that history; A statement that the terms offered, such as the APR, have been set based on information from a consumer report; A statement that the terms offered may be less favorable than the terms offered to consumers with better credit histories; Content (Continued) A statement that the consumer is encouraged to verify the accuracy of the information contained in the consumer report and has the right to dispute any inaccurate information in the report; The identity of each consumer reporting agency that furnished a consumer report used in the credit decision; A statement that federal law gives the consumer the right to obtain a copy of a consumer report from the consumer reporting agency or agencies identified in the notice without charge for 60 days after receipt of the notice Content (Continued) A statement informing the consumer how to obtain a consumer report from the consumer reporting agency or agencies identified in the notice and providing contact information (including a toll-free telephone number, where applicable) specified by the consumer reporting agency or agencies; and A statement directing consumers to the web sites of the Federal Reserve Board and Federal Trade Commission to obtain more information about consumer reports. Content – Account Review Notice A risk-based pricing notice provided as a result of an account review must contain… A statement that a consumer report (or credit report) includes information about the consumer’s credit history and the type of information included in that credit history; A statement that the person has conducted a review of the account using information from a consumer report; A statement that as a result of the review, the annual percentage rate on the account has been increased based on information from a consumer report; Content – Account Review Notice (Continued) A statement that the consumer is encouraged to verify the accuracy of the information contained in the consumer report and has the right to dispute any inaccurate information in the report; The identity of each consumer reporting agency that furnished a consumer report used in the account review; A statement that federal law gives the consumer the right to obtain a copy of a consumer report from the consumer reporting agency or agencies identified in the notice without charge for 60 days after receipt of the notice; Content – Account Review Notice (Continued) A statement informing the consumer how to obtain a consumer report from the consumer reporting agency or agencies identified in the notice and providing contact information (including a toll-free telephone number, where applicable) specified by the consumer reporting agency or agencies; and A statement directing consumers to the web sites of the Federal Reserve Board and Federal Trade Commission to obtain more information about consumer reports. Form of the Notice Risk-based pricing notice must be… clear and conspicuous, and provided to the consumer in oral, written, or electronic form. Model forms are not required – but do provide a safe harbor for compliance. Form – Identifying Information Risk-based pricing notice is not required to include the name of consumer, transaction identification number, or date. BUT Model notice may be modified to include name of consumer, transaction identification number, date, or other information that will assist in identifying the transaction to which the form pertains. Timing of Notice Closed-End Credit: At or after approval decision is communicated but before consumer becomes contractually obligated. Open-End Credit: At or after approval decision is communicated but before the 1st transaction. Account Reviews: If advance notice of APR change is required: At the time the APR increase is communicated to the consumer If no advance notice of APR is required: No later than 5 days after effective date of the change. Automobile Transactions: Special Rules Instant Credit Transactions: Special Rules Timing: Automobile Transactions When a person to whom a credit obligation is initially payable provides credit to a consumer for the purpose of financing the purchase of an automobile from an auto dealer or other party that is not affiliated with the person, any requirement to provide a risk-based pricing notice is satisfied if the person… arranges to have the auto dealer or other party provide the required notice to the consumer within the required time frames, AND maintains reasonable policies and procedures to verify that the auto dealer or other party provides such notice to the consumer within the applicable time periods. Notice: Automobile Transactions If the person arranges to have the auto dealer or other party provide a notice containing a credit score, the person’s obligation is satisfied if the consumer receives a notice containing a credit score obtained by the dealer or other party, even if a different credit score is obtained and used by the person on whose behalf the notice is provided. Timing: Instant Credit Transactions When credit under an open-end credit plan is provided to a consumer for the purpose of financing the contemporaneous purchase of goods or services, any risk-based pricing notice required to be provided may be provided at the earlier of: The time of the first mailing by the person to the consumer after the decision is made to approve the provision of open-end credit, such as in a mailing containing the account agreement or a credit card; or Within 30 days after the decision to approve the grant, extension, or other provision of credit. The Exceptions Credit Score Disclosure Exceptions Instead of issuing a risk-based pricing notice to just those consumers offered credit on “materially less favorable” terms, the creditor can provide all consumers who apply for credit with a notice consisting of their credit score and certain additional information. Credit Score Disclosure Exception The regulation provides 3 credit score disclosure exceptions: Loans Secured by Residential Property Other Loans (not Secured by Residential Property) Credit Score Not Available Note: These exceptions are not available in account review scenarios. Credit Score Disclosure Exception Loans Secured by Residential Property A person is not required to provide a risk-based pricing notice in connection with a loan request to be secured by one- to four-family residential property if the person provides to each consumer a notice that contains the following— The information required to be disclosed to the consumer pursuant to section 609(g) of the FCRA; A statement that a consumer report (or credit report) is a record of the consumer’s credit history and includes information about whether the consumer pays his or her obligations on time and how much the consumer owes to creditors; A statement that a credit score is a number that takes into account information in a consumer report and that a credit score can change over time to reflect changes in the consumer’s credit history; Credit Score Disclosure Exception Loans Secured by Res. Property (Cont) A statement that the consumer’s credit score can affect whether the consumer can obtain credit and what the cost of that credit will be; The distribution of credit scores presented in the form of a bar graph containing a minimum of six bars that illustrates the percentage of consumers with credit scores within the range of scores reflected in each bar or a clear and readily understandable statement informing the consumer how his or her credit score compares to the scores of other consumers. Use of a graph or statement obtained from the person providing the credit score that meets the requirements of this paragraph is deemed to comply with this requirement; Credit Score Disclosure Exception Loans Secured by Res. Property (Cont) A statement that the consumer is encouraged to verify the accuracy of the information contained in the consumer report and has the right to dispute any inaccurate information in the report; A statement that federal law gives the consumer the right to obtain copies of his or her consumer reports directly from the consumer reporting agencies, including a free report from each of the nationwide consumer reporting agencies once during any 12 month period; Contact information for the centralized source from which consumers may obtain their free annual consumer reports; A statement directing consumers to the web sites of the Federal Reserve Board and Federal Trade Commission to obtain more information about consumer reports. Credit Score Disclosure Exception Loans Secured by Res. Property (Cont) The credit score disclosure exception notice must be: Clear and conspicuous; Provided on or with the notice required by section 609(g) of the FCRA; Segregated from other information provided to the consumer, except for the notice required by section 609(g) of the FCRA; and Provided to the consumer in writing and in a form that the consumer may keep. Credit Score Disclosure Exception Loans Secured by Res. Property (Cont) Timing: The credit score disclosure exception notice must be provided to the consumer at the time the disclosure required by section 609(g) of FCRA is provided, but in any event… at or before consummation in the case of closed-end credit or before the first transaction is made under an open-end credit plan. Credit Score Disclosure Exception Loans Secured by Res. Property (Cont) Multiple Credit Scores: When a person obtains two or more credit scores and… uses one of those credit scores in setting the material terms of credit, the credit score disclosure exception notice must include that credit score. uses multiple credit scores in setting the material terms of credit, the credit score disclosure exception notice must include one of those credit scores. The notice may include more than one credit score, along with the additional information for each credit score disclosed. Credit Score Disclosure Exception Loans Secured by Res. Property (Cont) Example: A person that uses consumer reports to set the material terms of mortgage credit provided to consumers regularly requests several credit scores and uses the low score to determine the material terms it will offer the consumer. That person must disclose the low score in the credit score disclosure exception notice. Credit Score Disclosure Exception Loans Secured by Res. Property (Cont) Example: A person that uses consumer reports to set the material terms of mortgage credit provided to consumers regularly requests several credit scores, each of which it uses in an underwriting program to determine the material terms it will offer to the consumer. That person may choose one of these scores to include in the credit score disclosure exception notice. Credit Score Disclosure Exception Other Loans A person is not required to provide a riskbased pricing notice in connection with a loan request, other than a loan request to be secured by one- to four-family residential property, if the person provides to each consumer a notice that contains the following— A statement that a consumer report (or credit report) is a record of the consumer’s credit history and includes information about whether the consumer pays his or her obligations on time and how much the consumer owes to creditors; Credit Score Disclosure Exception Other Loans (Continued) A statement that a credit score is a number that takes into account information in a consumer report and that a credit score can change over time to reflect changes in the consumer’s credit history; A statement that the consumer’s credit score can affect whether the consumer can obtain credit and what the cost of that credit will be; The current credit score of the consumer or the most recent credit score of the consumer that was previously calculated by the consumer reporting agency for a purpose related to the extension of credit; The range of possible credit scores under the model used to generate the credit score; Credit Score Disclosure Exception Other Loans (Continued) The distribution of credit scores among consumers who are scored under the same scoring model that is used to generate the consumer’s credit score using the same scale as that of the credit score that is provided to the consumer, presented in the form of a bar graph containing a minimum of six bars that illustrates the percentage of consumers with credit scores within the range of scores reflected in each bar, or by other clear and readily understandable graphical means, or a clear and readily understandable statement informing the consumer how his or her credit score compares to the scores of other consumers. Use of a graph or statement obtained from the person providing the credit score that meets the requirements of this paragraph is deemed to comply with this requirement; The date on which the credit score was created; The name of the consumer reporting agency or other person that provided the credit score; Credit Score Disclosure Exception Other Loans (Continued) A statement that the consumer is encouraged to verify the accuracy of the information contained in the consumer report and has the right to dispute any inaccurate information in the report; A statement that federal law gives the consumer the right to obtain copies of his or her consumer reports directly from the consumer reporting agencies, including a free report from each of the nationwide consumer reporting agencies once during any 12month period; Contact information for the centralized source from which consumers may obtain their free annual consumer reports; and A statement directing consumers to the web sites of the FRB and FTC for more information about consumer reports. Credit Score Disclosure Exception Other Loans (Continued) The credit score disclosure exception notice must be: Clear and conspicuous; Segregated from other information provided to the consumer; and Provided to the consumer in writing and in a form that the consumer may keep. Credit Score Disclosure Exception Other Loans (Continued) Timing: The credit score disclosure exception notice must be provided to the consumer as soon as reasonably practicable after the credit score has been obtained, but in any event at or before consummation in the case of closed-end credit or before the first transaction is made under an open-end credit plan. Credit Score Disclosure Exception Other Loans (Continued) Multiple Credit Scores: Same rules apply for other loans as apply for loans secured by one- to four-family residential property (see prior slide). Credit Score Disclosure Exception Credit Score Not Available A person that regularly relies on the credit score disclosure exception notice is not required to provide a risk-based pricing notice to a consumer for whom a credit score is not available if… The person does not obtain a credit score from another consumer reporting agency in connection with or providing credit to the consumer; and The person provides to the consumer a notice that contains the following— Credit Score Disclosure Exception Credit Score Not Available A statement that a consumer report includes information about the consumer’s credit history and the type of information included in that history; A statement that a credit score is a number that takes into account information in a consumer report and that a credit score can change over time; A statement that credit scores are important because consumers with higher credit scores generally obtain more favorable credit terms; A statement that not having a credit score can affect whether the consumer can obtain credit and what the cost of that credit will be; A statement that a credit score about the consumer was not available from a consumer reporting agency, which must be identified by name, generally due to insufficient information regarding the consumer’s credit history; Credit Score Disclosure Exception Credit Score Not Available A statement that the consumer is encouraged to verify the accuracy of the information contained in the consumer report and has the right to dispute any inaccurate information in the consumer report; A statement that federal law gives the consumer the right to obtain copies of his or her consumer reports, including a free consumer report from each of the consumer reporting agencies once during any 12month period; The contact information for the centralized source from which consumers may obtain their free annual consumer reports; and A statement directing consumers to the web sites of the Federal Reserve Board and Federal Trade Commission to obtain more information about consumer reports. Credit Score Disclosure Exception Credit Score Not Available See prior slides regarding loans not secured by residential real estate for information regarding the format and timing of this additional notice. Other Exceptions Applications where consumer applies for and receives specific material terms. Applications where consumer has been or will be provided a notice of adverse action under section 615(a) of FCRA in connection with the transaction. Prescreened solicitations involving firm offers of credit. Exceptions: Specific Material Terms A person is not required to provide a risk-based pricing notice to the consumer if the consumer applies for specific material terms and is granted those terms. This exception is not applicable if the specific material terms were specified by the person using a consumer report after the consumer applied for or requested credit and after the person obtained the consumer report. For purposes of this section, “specific material terms” means a single material term, or set of material terms, such as an APR of 10 percent, and not a range of alternatives, such as an APR that may be 8, 10, or 12 percent, or between 8 and 12 percent. Exceptions: Specific Material Terms Example A consumer receives a firm offer of credit from a credit card issuer. The terms of the firm offer are based on information from a consumer report that the credit card issuer obtained under the firm offer of credit provisions. The solicitation offers the consumer a credit card with a single purchase APR of 12%. The consumer applies for and receives a credit card with an APR of 12%. Other customers with the same credit card have a purchase APR of 10%. The exception applies because the consumer applied for specific material terms and was granted those terms. Although the credit card issuer specified the APR in the firm offer of credit based on a consumer report, the credit card issuer specified that material term before, not after, the consumer applied for or requested credit. Exception: Adverse Action A person is not required to provide a riskbased pricing notice to a consumer if the person provides an adverse action notice to the consumer under section 615(a) of the FCRA. Exception: Prescreened Solicitations A person is not required to provide a risk-based pricing notice to a consumer if the person: Obtains a consumer report that is a prescreened list as described in FCRA; and Uses the consumer report for the purpose of making a firm offer of credit to the consumer. Note: This exception applies to any firm offer of credit by a person to a consumer, even if the person makes other firm offers of credit to other consumers on more favorable material terms. Exception: Prescreened Solicitations Examples A credit card issuer obtains two prescreened lists from a consumer reporting agency. One list includes consumers with high credit scores. The other list includes consumers with low credit scores. The issuer mails a firm offer of credit to the high credit score consumers with a single purchase APR of 10% and a firm offer of credit to the low credit score consumers with a single purchase APR of 14%. The credit card issuer is not required to provide a risk-based pricing notice to the low credit score consumers who receive the 14% offer because use of a consumer report to make a firm offer of credit does not trigger the risk-based pricing notice requirement. Risk-Based Pricing Notices Examination Procedures 1. Determine whether the financial institution uses consumer report information in consumer credit decisions. If yes, determine whether the institution uses such information to provide credit on terms that are “materially less favorable” than the most favorable material terms available to a substantial proportion of its consumers. Relevant factors in determining the significance of differences in the cost of credit include the type of credit product, the term of the credit extension, and the extent of the difference. If “yes,” the financial institution is subject to the riskbased pricing regulations. Risk-Based Pricing Notices Examination Procedures (Continued) 2. Determine whether the financial institution provides a risk-based pricing notice to a consumer. If it does, proceed to step #3. If the institution does not provide a risk-based pricing notice, proceed to step #5 to determine whether an exception applies. Risk-Based Pricing Notices Examination Procedures (Continued) 3. Determine the method the financial institution uses to identify consumers who must receive a risk-based pricing notice and whether the method complies with the regulation. For institutions that use the case-by-case method, determine whether the institution directly compares the material terms offered to each consumer and the material terms offer to the other consumers for a specific type of credit product. Risk-Based Pricing Notices Examination Procedures (Continued) For institutions that use the credit score proxy method: determine whether the institution calculates the cutoff score by considering the credit scores of all, or a representative sample, of consumers who have received credit for a specific type of credit product; determine whether the institution recalculates the cutoff score no less than every two years; for new entrants into the credit business, for new products subject to risk-based pricing, or for acquired credit portfolios, determine whether the institution recalculates the cutoff scores within time periods specified in the regulation; for institutions using more than one credit score to set material terms, determine whether the institution establishes a cutoff score according to the methods specified in the regulation; and if no credit score is available for a consumer, determine whether the institution provides the consumer a risk-based pricing notice. Risk-Based Pricing Notices Examination Procedures (Continued) For institutions that use the tiered pricing method: when four or fewer pricing tiers are used, determine if the institution sends risk-based pricing notices to consumers who do not qualify for the top, best-priced tier; or when five or more pricing tiers are used, determine if the institution provides risk-based pricing notices to consumers who do not qualify for the two top, bestpriced tiers and any other tier that, combined with the top two tiers, equal no less than the top 30 percent and no more than the top 40 percent of the total number of tiers. Risk-Based Pricing Notices Examination Procedures (Continued) For credit card issuers: Determine whether the issuer uses the credit score proxy or the tiered pricing method. If the issuer does not use the credit score proxy or tiered pricing method, determine whether the card issuer uses the required methods to identify consumers to whom it must provide a risk-based pricing notice. Determine whether the card issuer provides a riskbased pricing notice to each consumer that is provided a credit card with a purchase APR greater than the lowest purchase APR available under the program or solicitation. Risk-Based Pricing Notices Examination Procedures (Continued) 4. Determine whether the risk based pricing notice contains all of the required information. Proceed to step #10. Risk-Based Pricing Notices Examination Procedures (Continued) 5. If the institution does not provide a risk-based pricing notice, determine if one of the exception applies: specific terms of credit; notice of adverse action; firm offer of credit in a prescreened solicitation; credit score disclosure exception notice. Risk-Based Pricing Notices Examination Procedures (Continued) 6. For institutions that choose to provide a credit score disclosure to consumers that request a loan that is or will be secured by residential real property, determine whether the Section 222.74(d) notice generally is provided to each consumer that requests such an extension of credit and that each notice contains all of the required information. Risk-Based Pricing Notices Examination Procedures (Continued) 7. For institutions that chooses to provide a credit score disclosure to consumers that request a loan that is not or will not be secured by residential real property, determine whether the Section 222.74(e) notice generally is provided to each consumer that requests such an extension of credit and that each notice contains all of the required information. Risk-Based Pricing Notices Examination Procedures (Continued) 8. For institutions that otherwise provide credit score disclosures to consumers that request loans, determine whether the Section 222.74(f) notice is provided to the applicable consumers in situations where no credit score is available for the consumer, as required by 222.74(f). Determine whether each notice contains all of the required information. Risk-Based Pricing Notices Examination Procedures (Continued) 9. For institutions that provide credit score exception notices and that obtain multiple credit scores in setting material terms of credit, determine whether the score(s) is disclosed in a manner consistent with the regulation. Risk-Based Pricing Notices Examination Procedures (Continued) 10. Regardless of whether the institution provides risk-based pricing notices or credit score exception notices, if the institution increases the consumer’s APR as the result of a review of a consumer’s account, determine whether the financial institution provided the consumer with an account review risk-based pricing notice if an adverse action notice was not already provided. Risk-Based Pricing Notices Examination Procedures (Continued) 11. Determine whether the account review riskbased pricing notice contains all of the required information. 12. For all notices, determine whether the notices are clear and conspicuous and comply with the specific format requirements for the notices. 13. For all notices, determine whether the notices are provided within the required timeframes. Risk-Based Pricing Notices Examination Procedures (Continued) 14. For all notices, determine whether the financial institution follows the rules of construction pertaining to the number of notices provided to the consumer(s). 15. For all notices, determine whether the financial institution uses the model forms in Appendix H of the regulation. If yes, determine that it does not modify the model form so extensively as to affect the substance, clarity, comprehensibility, or meaningful sequence of the forms (Appendix H).