Cumulative Tax System

1

CUMULATIVE TAX

SYSTEM

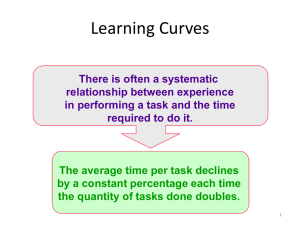

The purpose of the PAYE system is to ensure that an employee's tax liability is spread out evenly over the year.

To ensure that this is achieved, PAYE is normally calculated on a cumulative basis

2

Employer duty - Tax

• When employee commences work, employer notifies

Inspector of Taxes and applies for a TDC

• Employer duty to ensure they have either a TAX

DEDUCTION CARD P13/P14

Methods of Tax deduction

• PAYE tax deductions are calculated using one of the following methods:

1.

Emergency Basis

2.

3.

4.

Temporary Basis

Cumulative Basis

Non-Cumulative Basis (Week 1/Month 1 Basis)

3

4

Cumulative

• The tax to be deducted in a particular week or month is the cumulative tax due from 1 January to that date, reduced by the amount of tax previously deducted.

• The cumulative system operates for both tax credits and standard rate cut-off points.

• Any tax credits and/or standard rate cut-off point, which are not used in a pay period, are carried forward to the next pay period within that tax year.

• Manual Replaced with electronic

5

Electronic TDC

6

7

Electronic TDC

• Click http://www.revenue.ie/en/business/paye/e-taxdeduction-card.html

• Select the appropriate TDC link

• Complete the Employee’s details

• Upon entering the Tax Credits and Cut-Off Point from the

Tax Credit Certificate, Select the 'Calculate' button

• The TDC can be saved on your PC