TALES FROM SERENEX:

UNIVERSITY SPIN-OFF TO PFIZER

ACQUISITION

Anil K. Goyal, Ph.D., CLP

Carolina Innovations Seminar

Thursday, January 6, 2011

Story Outline

1

• Preface:

2

• Chapters: Years 2001 - 2008

3

• Epilogue: Essential Ps of Serenex

Beginning and Conclusion

© 2010 by A.Goyal All rights reserved.

2

DISCLAIMERS

1) “ALL PERSONS, INCIDENTS AND SITUATIONS

PORTRAYED IN THIS PRESENTATION ARE

FICTIONAL. ANY RESEMBLANCE TO ACTUAL

PERSONS, INCIDENTS, AND SITUATIONS IS

COINCIDENTAL AND ACCIDENTAL.”

2) “INDIVIDUAL RESULTS MAY VARY”

© 2010 by A.Goyal All rights reserved.

3

The Beginning and the Culmination

June 2001

April 2008

• Spin-Off from Univ. of Virginia

(Prof. Tim Haystead)

• Proteomics Company

(Tools/technology)

• 2 Employees (Prof. Haystead

and George Young)

• Personal loan from George

Young

• Company with 2 clinical

programs and a drug

discovery pipeline

• ~32 Employees

• ~$80M invested

• Acquired by Pfizer

• Multi-hundred Million $$

exit for investors

© 2010 by A.Goyal All rights reserved.

4

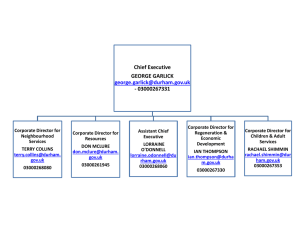

2001-2002

Co Location:

Incubator to Downtown

Durham

incubator in RTP

2003 – 2008

Downtown Durham

“Clark and Sorrell”

(Garage & Auto

Repair Shop)

Durham Historic

Landmark

© 2010 by A.Goyal All rights reserved.

5

Clark & Sorrell 1910 & 2001

1910

2001

© 2010 by A.Goyal All rights reserved.

6

Year 2000-2001: The Beginning

• Founding Management Team:

– Professor Tim Haystead, at Univ. of Virginia (UVa)

– George Young, SVP of Ops, ex-VP Sales, Dyax (living in MA/NC)

– Robert Dishman, CEO, ex-Director, Dyax (living in MA)

– Susan Dana Jones, SVP of Corp. Development (living in MA)

– Lanny Bynum, SVP Finance & Administration

• Patents:

Technology patents on ATP-Sepharose resin

• Market Areas: Proteomics (Protein separation and

identification), target discovery and toxicity profiling

• Prof. Haystead moves to Duke University

• Serenex (“Out of Serendipity”) established in Durham

• Series A: Metaphase Venture Partners, $2 million

• Pfizer and Pharmacia Evaluate Proteome Mining Technology

© 2010 by A.Goyal All rights reserved.

7

Serenex’s Proteome Mining Technology

Proteome

Extract (e.g.

Pig tissues)

Compound Conc.

Compound

Eluted

Proteins

Proprietary Resin

Specific proteome

fraction is captured

Resin with bound

Purine Binding

proteins

Competitive displacement

of proteins off resin

© 2010 by A.Goyal All rights reserved.

Protein separation, MS analysis of

peptides to identify proteins

8

2002: Series B Funding & New Leadership

• Apr

Steve Hall joins as VP of R&D

Ex- Lilly/Sphinx, Squibb; 20+ yrs. @ pharma

Business Model Shift:

Tools Drug Discovery Platform/ Services

& Internal Discovery

• Aug

Series B Financing: $15 Million

• Sept

• Oct

• Nov

Chiron Proteome Mining Deal

JnJ Proteome Mining Deal

Richard Kent, joins as President and CEO

Intersouth Partners

Lilly Ventures

Seaflower Ventures &

Metaphase Venture Partners

Ex-GSK Chief Medical Officer, 20+yrs @pharma

© 2010 by A.Goyal All rights reserved.

9

2003: Deals, Internal Discovery & Grow Mgmt Team

• May

• July

GSK discovery services deal

New Mgmt Team Members:

– Ian Howes as CFO

– Anil Goyal as VP of BD

• Initiated Internal Drug Discovery Effort:

– Developed strategy

– Designed & assembled a focused custom compd library

– Screened compound library with Proteome Mining

Technology (“Chemoproteomics” screen)

• Nov

• Nov

Roche discovery services deal

Internal screening resulted in >9

target programs

© 2010 by A.Goyal All rights reserved.

10

2004: Progress on all fronts…but

• Signed Several Discovery Services deals

– Lilly, Novartis, Aventis, BMS.... (generated minuscule $s)

• Internal Discovery Effort

– Generates hits for >6 target programs

• Raised $8 million in Series B extension (August)

– Intersouth Partners

– Takeda Research Investment (TRI) &

– Western Technology + other Series B funders

• Market Forces:

– VCs funding only clinical stage companies

(or NRDOs..”No Research Development Only” company)

– Pharma/Biotech not doing platform deals that give

significant upfront $s

© 2010 by A.Goyal All rights reserved.

11

2005: Major Shift in Business Plan

• Focused internal effort on one target

Heat Shock Protein 90 (Hsp90) Inhibitor

• Small downsizing

• In-Licensed Clinical Stage Compound: OC-1012 for Oral

mucositis (chemotherapy side effect) treatment

– Outcome of extensive search (initiated back in mid-2004) for a

Phase 1/2 oncology &/or inflammation drug

• Raised $30 million in Series C

– Richie Capital (a Hedge Fund) + all Series B funders

• Business Development: Initiated marketing for Hsp90

program

© 2010 by A.Goyal All rights reserved.

12

2006: Execute the Plan & Partnering Decision Making

• Management Team Expanded

– Sol Lucas, VP clinical development (ex-GSK),

– Lex Smith, VP technical development (Fulcrum, ex-GSK)

• SNX-1012: Initiated Phase 2 Clinical Trial

• SNX-2112/5422 (Hsp90 Program):

– Continued Aggressive Business Development Effort

– Biogen Idec acquires Conforma (May 2006)

$150M upfront + $100M Milestone

– Infinity & MedImmune alliance (Aug 2006)

$70M upfront + $430M Milestones + Royalties

– Deals benchmark value of Hsp90 area

– Received two term sheets to partner the program

• Raising Series D funding….

© 2010 by A.Goyal All rights reserved.

13

Nov/Dec 2006 Issue

CONFIDENTIAL

14

April 2007: SNX-5422 IND Filing with FDA

July 2007: Start First Clinical Trial

© 2010 by A.Goyal All rights reserved.

15

2007: Grow Hsp90 Program, Partnering & Series D

• Industrial Espionage Case. Filed Law Suit against

Yunsheng Huang (ex-contract chemist) who stole and

funneled IP to a Chinese company

• Raised $31M ($26M Series D & $5M debt facility)

+ Cornell Capital Partners, Pearl Street Ventures

+ MC Life Science Ventures, Pac-Link Bio Venture Capital,

+ All previous investors

• Phase 2 trial of SNX-1012 Moving but Slowly

• Management Team Addition

– Judy Bryson, VP clinical development (ex-GSK)

• Hsp90 Program: Data beyond oncology, in inflammation

and CNS diseases builds “Product Pipeline in a Program”

• BizDev: Negotiating >5 strategic alliance term sheets &

an acquisition offer

© 2010 by A.Goyal All rights reserved.

16

2008: Close an M&A Deal

• Due Diligences Visits: Intensive preparation and filling

of the “e-Room” with all corporate/financial documents

• Dual Track Negotiations

– Strategic Partnership for oncology with several large pharmas

– Acquisition offer(s) (with spin-off of SNX-1012)

• Mar: Acquisition deal by Pfizer signed

$Multi-hundred Million cash deal (Upfront $ & milestones)

• Apr: Spun-off SNX-1012 into Coserics, LLC

• Sept: Programs transitioned to Pfizer sites

All employees moved on with severance

package + stock sale

© 2010 by A.Goyal All rights reserved.

Deal of Year Award

GROWTH Company

Of YEAR Award

17

Business Model Evolution

Management Team Evolution

Internal

Drug

Discovery Discovery

Services

Product

In-Licensed Pipeline

Clinical

(2 Products

Product

in Clinic)

Tools/

Technology

Platform

2001 2002 2003 2004 2005 2006 2007 2008

© 2010 by A.Goyal All rights reserved.

18

Essential Ps

© 2010 by A.Goyal All rights reserved.

19

QUESTIONS?

© 2010 by A.Goyal All rights reserved.

20