Journal Entries: Periodic Inventory System Examples

advertisement

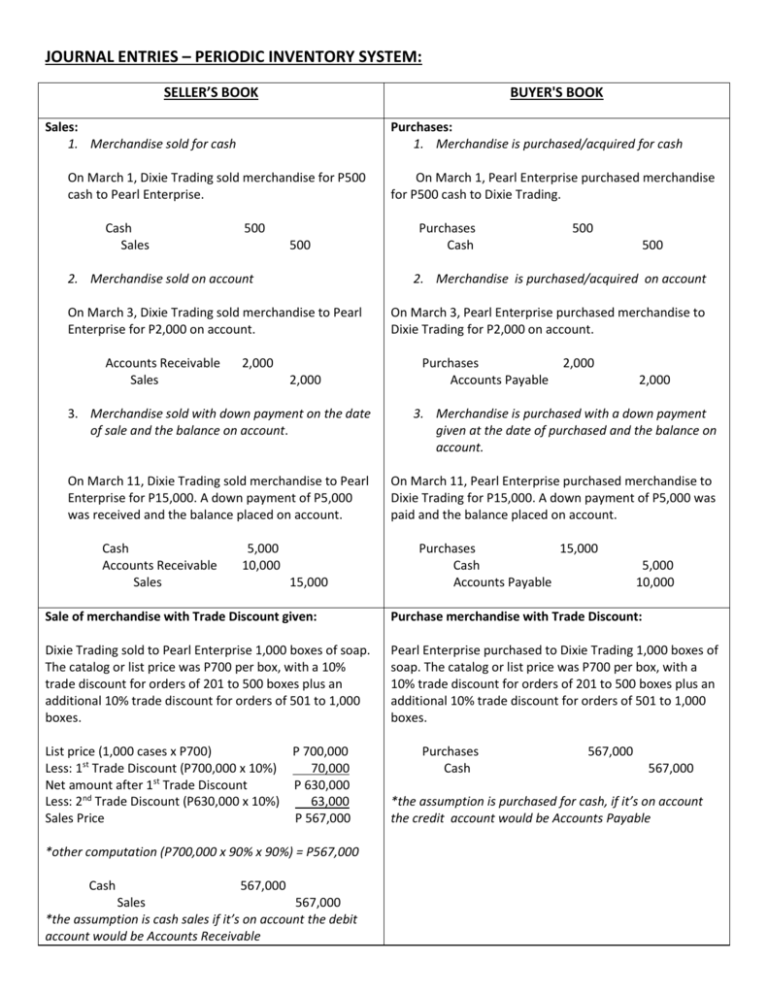

JOURNAL ENTRIES – PERIODIC INVENTORY SYSTEM: SELLER’S BOOK BUYER'S BOOK Sales: 1. Merchandise sold for cash Purchases: 1. Merchandise is purchased/acquired for cash On March 1, Dixie Trading sold merchandise for P500 cash to Pearl Enterprise. Cash Sales 500 500 2. Merchandise sold on account Purchases Cash 500 500 2. Merchandise is purchased/acquired on account On March 3, Dixie Trading sold merchandise to Pearl Enterprise for P2,000 on account. Accounts Receivable Sales On March 1, Pearl Enterprise purchased merchandise for P500 cash to Dixie Trading. 2,000 2,000 On March 3, Pearl Enterprise purchased merchandise to Dixie Trading for P2,000 on account. Purchases Accounts Payable 2,000 2,000 3. Merchandise sold with down payment on the date of sale and the balance on account. 3. Merchandise is purchased with a down payment given at the date of purchased and the balance on account. On March 11, Dixie Trading sold merchandise to Pearl Enterprise for P15,000. A down payment of P5,000 was received and the balance placed on account. On March 11, Pearl Enterprise purchased merchandise to Dixie Trading for P15,000. A down payment of P5,000 was paid and the balance placed on account. Cash Accounts Receivable Sales 5,000 10,000 15,000 Purchases 15,000 Cash Accounts Payable 5,000 10,000 Sale of merchandise with Trade Discount given: Purchase merchandise with Trade Discount: Dixie Trading sold to Pearl Enterprise 1,000 boxes of soap. The catalog or list price was P700 per box, with a 10% trade discount for orders of 201 to 500 boxes plus an additional 10% trade discount for orders of 501 to 1,000 boxes. Pearl Enterprise purchased to Dixie Trading 1,000 boxes of soap. The catalog or list price was P700 per box, with a 10% trade discount for orders of 201 to 500 boxes plus an additional 10% trade discount for orders of 501 to 1,000 boxes. List price (1,000 cases x P700) P 700,000 Less: 1st Trade Discount (P700,000 x 10%) 70,000 st Net amount after 1 Trade Discount P 630,000 Less: 2nd Trade Discount (P630,000 x 10%) 63,000 Sales Price P 567,000 *other computation (P700,000 x 90% x 90%) = P567,000 Cash 567,000 Sales 567,000 *the assumption is cash sales if it’s on account the debit account would be Accounts Receivable Purchases Cash 567,000 567,000 *the assumption is purchased for cash, if it’s on account the credit account would be Accounts Payable Sales Return and Allowances: Purchase Return and Allowances: 1. Dixie Trading accepted the returns of damaged merchandise from a customer. Issued a credit memo for P500 to the customer. 1. Pearl Enterprise returned damaged merchandised to its supplier. Received a credit memo from supplier for P500. Sales Return and Allowances Accounts Receivable 500 Accounts Payable 500 Purchase Returns and Allowances 500 2. A customer refunded P200 cash for return of damaged merchandise. Sales Return and Allowances Cash 200 2. A cash refund was received for merchandise returned to supplier, P200. Cash 200 500 200 Purchase Returns and Allowances 200 Sales Discounts: Purchase Discounts: Transactions: May 01 Sold Merchandise to Pearl Enterprise, P2,000 on terms of 2/10,n/30. May 03 Issued a credit memo for damaged merchandise returned by Pearl Enterprise,P100 May 11 Received check from Pearl Enterprise in full payment of their account. Transactions: May 01 Purchased Merchandise to Dixie Trading, P2,000 on terms of 2/10,n/30. May 03 Received a credit memo for damaged merchandise from Dixie Trading, P100 May 11 Paid check to Dixie Trading in full payment of its account. May 1 Accounts Receivable Sales May 3 Sales Return and Allowances Accounts Receivable May 11 Cash Sales Discounts Accounts Receivable 2,000 2,000 100 100 1,862 38 1,900 *please take note that Sales Discount is based on Net Sales (Sales less Sales Returns and Allowances in the above example Net Sales is P1,900). *in the above example that payment is within the discount period of 10 days. If the payment will be beyond May 11 or 10 days. No discount will be given and the entry will be debit Cash 1,900 and credit Accounts Receivable 1,900 May 1 Purchases Accounts Payable 2,000 2,000 May 3 Accounts Payable 100 Purchase Return and Allowances 100 May 11 Accounts Payable Cash Purchase Discounts 1,900 1,862 38 *please take note that Sales Discount is based on Net Sales (Sales less Sales Returns and Allowances in the above example, P1,900) *in the above example that payment is within the discount period of 10 days. If the payment will be beyond May 11 or 10 days. No discount will be given and the entry will be debit Accounts Payable 1,900 and credit Cash 1,900 Freight out or Delivery Expenses or Transportation-out Freight-in or Delivery-in or Transportation-in On January 10, Dixie Trading located in Los Banos sold merchandise worth P100,000 from Pearl Enterprise located in Batangas with terms 2/10,n/30. Freight or transportation cost amounted to P10,000 was paid on January 14 based on below assumptions. On January 20 Pearl Enterprise paid in full. On January 10, Pearl Enterprise located in Batangas purchased merchandise worth P100,000 from Dixie Trading located in Los Banos with terms 2/10,n/30. Freight or transportation cost amounted to P10,000 was paid on January 14 based on below assumptions. On January 20 Pearl Enterprise paid in full. Assume the following shipping terms: Assume the following shipping terms: a. FOB shipping point, freight collect Jan 10 Accounts Receivable Sales a. FOB shipping point, freight collect 100,000 100,000 Jan 14 No Entry 98,000 2,000 100,000 b. FOB shipping point, freight prepaid Jan 10 Accounts Receivable Sales 100,000 Jan 14 Accounts Receivable Cash 10,000 Jan 20 Cash Sales Discounts Accounts Receivable 108,000 2,000 100,000 10,000 10,000 Jan 20 Accounts Payable 100,000 Cash 98,000 Purchase Discounts 2,000 b. FOB shipping point, freight prepaid 100,000 100,000 Jan 10 Purchases Accounts Payable 10,000 10,000 Jan 14 Freight-in Accounts Payable 110,000 Jan 20 Accounts Payable Cash Purchase Discounts c. FOB Destination, freight prepaid 100,000 10,000 110,000 108,000 2,000 c. FOB Destination, freight prepaid 100,000 100,000 Jan 14 Freight-out Cash 10,000 Jan 20 Cash Sales Discounts Accounts Receivable 98,000 2,000 Jan 10 Purchases Accounts Payable 100,000 100,000 Jan 14 No entry 10,000 100,000 d. FOB Destination, freight collect Jan 10 Accounts Receivable Sales 100,000 Jan 14 Freight-in Cash Jan 20 Cash Sales Discounts Accounts Receivable Jan 10 Accounts Receivable Sales Jan 10 Purchases Accounts Payable Jan 20 Accounts Payable Cash Purchase Discounts 100,000 98,000 2,000 d. FOB Destination, freight collect 100,000 100,000 Jan 14 Freight-out Accounts Receivable 10,000 Jan 20 Cash Sales Discounts Accounts Receivable 88,000 2,000 Jan 10 Purchases Accounts Payable 100,000 100,000 Jan 14 Accounts Payable Cash 10,000 10,000 90,000 90,000 Jan 20 Accounts Payable Cash Purchase Discounts *Freight-out account is used to record shipping cost shouldered by the seller for sales of merchandise to customers. Another term is Delivery Expense or Transportation-out which is shown on the Selling Expense section of the Income Statement. 10,000 88,000 2,000 *Freight-in account is used to record freight cost incurred by the buyer in acquiring merchandise. It is shown in the Cost of Goods Sold section of the Income Statement. It’s added to purchases. It is called adjunct account.