Exam 17 January 2012 - question 2 √ 1 3

advertisement

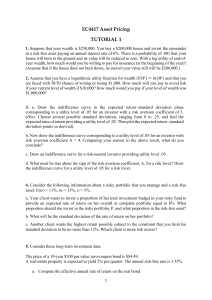

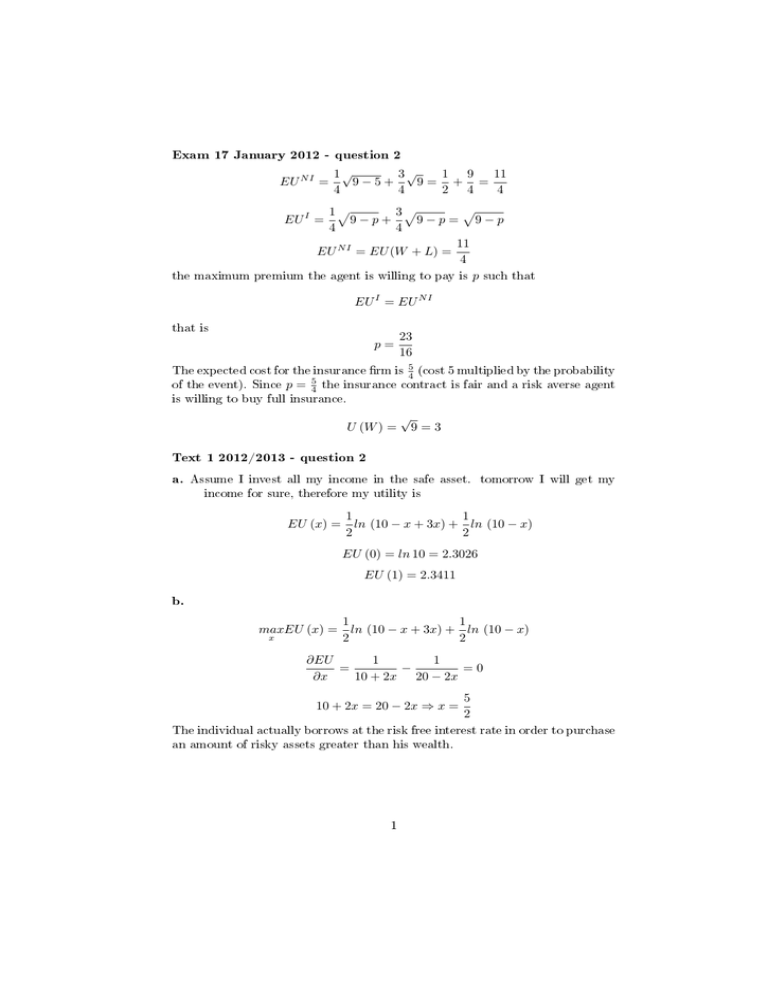

Exam 17 January 2012 - question 2 EU N I = 1√ 3√ 1 9 11 9−5+ 9= + = 4 4 2 4 4 p 1p 3p 9−p+ 9−p= 9−p 4 4 11 EU N I = EU (W + L) = 4 the maximum premium the agent is willing to pay is p such that EU I = EU I = EU N I that is p= 23 16 The expected cost for the insurance rm is 54 (cost 5 multiplied by the probability of the event). Since p = 54 the insurance contract is fair and a risk averse agent is willing to buy full insurance. U (W ) = √ 9=3 Text 1 2012/2013 - question 2 a. Assume I invest all my income in the safe asset. tomorrow I will get my income for sure, therefore my utility is EU (x) = 1 1 ln (10 − x + 3x) + ln (10 − x) 2 2 EU (0) = ln 10 = 2.3026 EU (1) = 2.3411 b. maxEU (x) = x 1 1 ln (10 − x + 3x) + ln (10 − x) 2 2 1 1 ∂EU = − =0 ∂x 10 + 2x 20 − 2x 10 + 2x = 20 − 2x ⇒ x = 5 2 The individual actually borrows at the risk free interest rate in order to purchase an amount of risky assets greater than his wealth. 1 Problem set 3B a. The carries of utility (the domain of our utility function) are departures of consumption with respect to a reference point r. b. I need to impose x < λx, which implies λ > 1. Loss Aversion: attitudes towards gains and losses are dierent because people hate losing more than they like winning. c. Diminishing Sensitivity: the further you are from the reference point the less intense the experience of departing from the reference point is d. U 1, −pB |0, 0 = υ (4) + υ −pB = 4 − 2p, U (0, 0|0, 0) = υ (0) + υ (0) = 0. e. I need to impose 4 − 2pB = 0 ⇒ pB = 2 U (0, ps |1, 0) = υ (0 − 4) + υ (ps ) = −8 + ps , U (1, 0|1, 0) = υ (0) + υ (0) = 0 −8 + p = 0 ⇒ ps = 8 f. pS > pB because of loss aversion: I suer from selling the mug... g. From point d From point e 4 − pB = 0 ⇒ pB = 4 −4 + pS = 0 ⇒ pS = 4 2