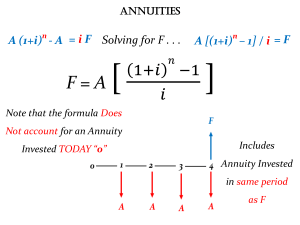

Time Value of Money MAXIMIZE THE VALUE OF THE BUSINESS (FIRM) The Investment Decision The Financial Decision The Dividend Decision Invest in assets that earn a return greater than the minimum acceptance hurdle rate Find the right kind of debt for your firm and the right mix of debt and equity to fund your operations If you cannot find investments that make your minimum acceptable rate, return the cash to owners of your business The hurdle rate Should reflect the riskiness of the investment and the mix of debt and equity used to fund it The return Should reflect the magnitude and the timing of the cash flows as well as all side effects The optimal mix of debt and equity maximizes firm value The right kind of debt matches the tenor of your assets How much cash you can return depends on current and potential investment opportunities How you choose to return cash to the owners will depend on whether they prefer dividends or buybacks • Money has time value. A rupee today is more valuable than a rupee a year hence. Why? There are several reasons: • Individual, in general, prefer current consumption to future consumption. • Capital can be employed productively to generate positive returns. These returns are risky and therefore more the risk the less is the value of cash flows. • In an inflationary period a rupee today represents a greater real purchasing power than a rupee a year hence. • Other things remaining equal, value of cash flows will decrease, if - Preference for current consumption increases - Expected inflation increases - Uncertainty increases Discounting and Compounding • Compounding converts current cash flows into future and vice versa is discounting • Discount rate is the rate at which present and future cash flows are traded off - Preference for higher consumption ( SME/shopkeeper)- Higher discount rates - Expected inflation – Higher discount rates - Uncertainty/Risk – Higher discount rates We will discuss here the following issues: • Simple cash flows • Annuities • Growing annuities • Perpetuities • Growing Perpetuities When you value assets, it’s a combination of these cash flows- Bonds are annuity (coupon) and simple cash flow at the end ( face value at maturity). Stock/company valuation is growing annuity and growing perpetuity.