2011-Book-Venture-Capital-and-Finance-of-Innovation-Metrick-Yasuda-Dec-2011

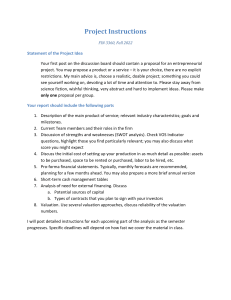

advertisement