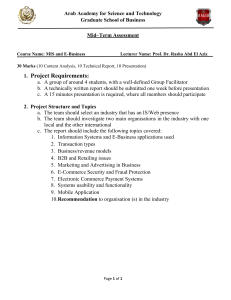

E-Business EMEA 1e Europe, Middle East, Africa First Edition Chapter 12 Online Security and E-Payment Systems Learning Objectives In this chapter, you will learn: • What security risks arise in online business and how to manage them • How to create a security policy & implement on Web client computers • How to implement security in the communication channels between computers and on web server computers • What organizations promote computer, network, and Internet security • The basic functions of online payment systems & how payment cards are used in electronic commerce • About the history and future of electronic cash • How digital wallets work • Stored-value cards and how they are used in electronic commerce • How the banking industry uses Internet technologies E-Business, Europe, Middle East, Africa First Edition 2 Online Security Issues Overview • Early Internet days – Most popular use: electronic mail • Today’s higher stakes – Electronic mail, shopping, all types of financial transactions • Common worry of Web shoppers – Stolen credit card as it transmits over the Internet – More likely to be stolen from computer where stored • Chapter topic: security in the context of electronic commerce E-Business, Europe, Middle East, Africa First Edition Origins of Security on Interconnected Computer Systems • Data security measures taken by Roman Empire – Coded information to prevent enemies from reading secret war and defense plans • Modern electronic security techniques – Defense Department wartime use • “Orange Book”: rules for mandatory access control • Business computers – Initially adopted military’s security methods • Today’s computing – Requires comprehensive computer security plans E-Business, Europe, Middle East, Africa First Edition 4 Computer Security and Risk Management • Computer security Asset protection from unauthorized access, use, alteration, and destruction • Physical security Includes tangible protection devices like alarms, guards, fireproof doors, security fences, safes or vaults, and bombproof buildings • Logical security Asset protection using nonphysical means • Threat: Any act or object posing danger to computer assets • Countermeasure: – Procedure (physical or logical) • Recognizes, reduces, and eliminates threat – Extent and expense of countermeasures • Vary depending on asset importance E-Business, Europe, Middle East, Africa First Edition Computer Security and Risk Management (cont’d.) • Risk management model – Four general organizational actions • Impact (cost) and probability of physical threat – Also applicable for protecting Internet and electronic commerce assets from physical and electronic threats • Electronic threat examples: – Impostors, eavesdroppers, thieves • Eavesdropper (person or device) – Listen in on and copy Internet transmissions E-Business, Europe, Middle East, Africa First 6 © Cengage Learning 2013 Risk management model E-Business, Europe, Middle East, Africa First Edition Computer Security and Risk Management (cont’d.) • Crackers or hackers (people) – Write programs; manipulate technologies • Obtain unauthorized access to computers and networks • White hat hacker and black hat hacker – Distinction between good hackers and bad hackers • Good security scheme implementation – Identify risks – Determine how to protect threatened assets – Calculate costs to protect assets E-Business, Europe, Middle East, Africa First Edition Elements of Computer Security • Secrecy – Protecting against unauthorized data disclosure – Ensuring data source authenticity • Integrity – Preventing unauthorized data modification – Man-in-the-middle exploit • E-mail message intercepted; contents changed before forwarded to original destination • Necessity – Preventing data delays or denials (removal) – Delaying message or completely destroying it E-Business, Europe, Middle East, Africa First Edition Establishing a Security Policy • Security policy – Assets to protect and why, protection responsibility, acceptable and unacceptable behaviors – Physical security, network security, access authorizations, virus protection, disaster recovery • Military policy: Stresses separation of multiple levels of security • Corporate information classifications – Public – Company confidential E-Business, Europe, Middle East, Africa First Edition Establishing a Security Policy (cont’d.) • Steps to create security policy – Determine assets to protect from threats – Determine access to various system parts – Identify resources to protect assets – Develop written security policy – Commit resources • Comprehensive security plan goals – Protect privacy, integrity, availability; authentication – Selected to satisfy requirements of following diagram E-Business, Europe, Middle East, Africa First Edition © Cengage Learning 2013 Requirements for secure electronic commerce E-Business, Europe, Middle East, Africa First Edition Establishing a Security Policy (cont’d.) • Security policies information sources – WindowSecurity.com site – Information Security Policy World site • Absolute security: difficult to achieve – Create barriers deterring intentional violators – Reduce impact of natural disasters and terrorist acts • Integrated security – Having all security measures work together • Prevents unauthorized disclosure, destruction, modification of assets • Security policy points – Authentication: Who is trying to access site? – Access control: Who is allowed to log on to and access site? – Secrecy: Who is permitted to view selected information? – Data integrity: Who is allowed to change data? – Audit: Who or what causes specific events to occur, and when? E-Business, Europe, Middle East, Africa First Edition Security for Client Computers • Client computers – Must be protected from threats • Threats – Originate in software and downloaded data – Malevolent server site masquerades as legitimate Web site • Chapter topics organized to follow the transaction-processing flow – Beginning with consumer – Ending with Web server at electronic commerce site E-Business, Europe, Middle East, Africa First Edition Cookies and Web Bugs • Internet connection between Web clients and servers Stateless connection • Each information transmission is independent • No continuous connection (open session) maintained between any client and server • Cookies – Small text files Web servers place on Web client – Identify returning visitors – Allow continuing open session • Time duration cookie categories – Session cookies: exist until client connection ends – Persistent cookies: remain indefinitely – Electronic commerce sites use both • Cookie sources – First-party cookies • Web server site places them on client computer – Third-party cookies • Different Web site places them on client computer E-Business, Europe, Middle East, Africa First Edition Cookies and Web Bugs (cont’d.) • Disable cookies entirely – Complete cookie protection – Problem • Useful cookies blocked (along with others) • Full site resources not available • Web browser cookie management functions – Refuse only third-party cookies – Review each cookie before accepted – Provided by most Web browsers E-Business, Europe, Middle East, Africa First Edition Mozilla Firefox dialog box for managing stored cookies E-Business, Europe, Middle East, Africa First Edition Cookies and Web Bugs (cont’d.) • Web bug – Tiny graphic that third-party Web site places on another site’s Web page – Purpose • Provide a way for a third-party site to place cookie on visitor’s computer • Internet advertising community: – Calls Web bugs “clear GIFs” or “1-by-1 GIFs” • Graphics created in GIF format • Color value of “transparent,” small as 1 pixel by 1 pixel E-Business, Europe, Middle East, Africa First Edition Active Content • Active content – Programs embedded transparently in Web pages – Cause action to occur – E-commerce example • Place items into shopping cart; compute tax and costs • Advantages – Extends HTML functionality – Moves data processing chores to client computer • Disadvantages – Can damage client computer E-Business, Europe, Middle East, Africa First Edition Active Content (cont’d.) • Cookies, Java applets, JavaScript, VBScript, ActiveX controls, graphics, Web browser plug-ins, e-mail attachments • Scripting languages: provide executable script – Examples: JavaScript and VBScript • Applet: small application program – Typically runs within Web browser • Some browsers include tools limiting applets’ actions • Active content modules – Embedded in Web pages (invisible) E-Business, Europe, Middle East, Africa First Edition Advanced JavaScript settings in Mozilla Firefox E-Business, Europe, Middle East, Africa First Edition Active Content (cont’d.) • Crackers: embed malicious active content • Trojan horse – Program hidden inside another program or Web page • Masking true purpose – May result in secrecy and integrity violations • Zombie (Trojan horse) – Secretly takes over another computer – Launches attacks on other computers • Botnet (robotic network, zombie farm) – All controlled computers act as an attacking unit E-Business, Europe, Middle East, Africa First Edition Java Applets • Java programming language – Developed by Sun Microsystems – Widespread use in Web pages: active content • Java: platform-independent programming language – Provides Web page active content – Server sends applets with client-requested pages – Most cases: operation visible to visitor – Possibility: functions not noticed by visitor Advantages – Adds functionality to business application’s functionality; relieves serverside programs • Disadvantage – Possible security violations (Trojan horse, zombie) E-Business, Europe, Middle East, Africa First Edition Java Applets (cont’d.) • Java sandbox – Confines Java applet actions to set of rules defined by security model – Rules apply to all untrusted Java applets • Not established as secure – Java applets running within sandbox constraint • Does not allow full client system access • Prevents secrecy (disclosure) and integrity (deletion or modification) violations E-Business, Europe, Middle East, Africa First Edition JavaScript • JavaScript – Scripting language developed by Netscape – Enables Web page designers to build active content – Based loosely on Sun’s Java programming language – Can be used for attacks • Cannot commence execution on its own • User must start ill-intentioned JavaScript program E-Business, Europe, Middle East, Africa First Edition ActiveX Controls • ActiveX control – Objects containing programs and properties Web designers place on Web pages • Component construction – Many different programming languages • Common: C++ and Visual Basic • Run on Windows operating systems computers • Executed on client computer like any other program E-Business, Europe, Middle East, Africa First Edition ActiveX Controls (cont’d.) • Comprehensive ActiveX controls list – ActiveX page at Download.com • Security danger – Execute like other client computer programs – Have access to full system resources • Cause secrecy, integrity, and necessity violations – Actions cannot be halted once started • Web browsers – Provide notice of Active-X download or install E-Business, Europe, Middle East, Africa First Edition ActiveX control download warning dialog box in Internet Explorer E-Business, Europe, Middle East, Africa First Edition Graphics and Plug-Ins • Graphics, browser plug-ins, and e-mail attachments can harbor executable content • Graphic: embedded code can harm client computer • Browser plug-ins (programs) – Enhance browser capabilities – Popular plug-ins: Adobe Flash Player, Apple’s QuickTime Player, Microsoft Silverlight, RealNetworks’ RealPlayer – Can pose security threats • 1999 RealPlayer plug-in • Plug-ins executing commands buried within media E-Business, Europe, Middle East, Africa First Edition Viruses, Worms, and Antivirus Software • Programs display e-mail attachments by automatically executing associated programs – Macro viruses within attached files can cause damage • Virus: software – Attaches itself to another program – Causes damage when host program activated • Worm: virus – Replicates itself on computers it infects – Spreads quickly through the Internet • Macro virus – Small program (macro) embedded in file E-Business, Europe, Middle East, Africa First Edition Viruses, Worms, and Antivirus Software (cont’d.) • ILOVEYOU virus (“love bug”) – Spread with amazing speed – Infected computers and clogged e-mail systems – Replicated itself explosively through Outlook e-mail – Caused other harm • 2001 Code Red and Nimda: virus-worm combinations – Multivector virus: entered computer system in several different ways (vectors) • 2002 and 2003: new virus-worm combinations – Example: Bugbear E-Business, Europe, Middle East, Africa First Edition Viruses, Worms, and Antivirus Software (cont’d.) • Antivirus software – Detects viruses and worms – Either deletes or isolates them on client computer • 2005 and 2006 Zotob – New breed of Trojan horse-worm combination • 2007: Storm virus • 2008 and continuing into 2009: Conflicker • 2009 and 2010: URLzone and Clampi – New viruses designed specifically to hijack users’ online banking sessions E-Business, Europe, Middle East, Africa First Edition Viruses, Worms, and Antivirus Software (cont’d.) • 2010: new Trojan horse-worm combination attack – Spread through a computer operating system – Designed to target industrial equipment • German industrial giant Siemens’ control systems • 2011: Zeus and SpyEye combined – Targeted bank account information – Not visible in Microsoft Windows Task Manager – Intercept credit card or online banking data entered in Web browser E-Business, Europe, Middle East, Africa First Edition Major viruses, worms, and Trojan horses E-Business, Europe, Middle East, Africa First Edition Major viruses, worms, and Trojan horses (continued) E-Business, Europe, Middle East, Africa First Edition 35 Major viruses, worms, and Trojan horses (continued) E-Business, Europe, Middle East, Africa First Edition Major viruses, worms, and Trojan horses (continued) E-Business, Europe, Middle East, Africa First Edition Major viruses, worms, and Trojan horses (continued) E-Business, Europe, Middle East, Africa First Edition Major viruses, worms, and Trojan horses (continued) E-Business, Europe, Middle East, Africa First Edition Viruses, Worms, and Antivirus Software (cont’d.) • Companies that track viruses, sell antivirus software, provide virus descriptions on Web sites – Symantec (Symantec Security Response) – McAfee (McAfee Virus Information) • Data files must be updated regularly – Recognize and eliminate newest viruses • Some Web e-mail systems: – Provide and update antivirus software • Used to scan attachments before downloading – Example: Yahoo! Mail E-Business, Europe, Middle East, Africa First Edition Digital Certificates • Digital certificate (digital ID) – E-mail message attachment or program embedded in Web page – Verifies sender or Web site – Contains a means to send encrypted message – Signed message or code • Provides proof of holder identified by the certificate – Used for online transactions • Electronic commerce, electronic mail, and electronic funds transfers E-Business, Europe, Middle East, Africa First Edition © Cengage Learning 2013 Delmar Cengage Learning’s digital certificate information displayed in Firefox browser E-Business, Europe, Middle East, Africa First Edition Digital Certificates (cont’d.) • Digital certificate for software: – Assurance software was created by specific company – Does not attest to quality of software • Certification authority (CA) – Issues digital certificates to organizations, individuals • Digital certificates cannot be forged easily • Six main elements: owner’s identifying information, owner’s public key, dates certificate is valid, serial number, issuer name, issuer digital signature E-Business, Europe, Middle East, Africa First Edition Digital Certificates (cont’d.) Key Number (usually long binary number) • • - Used with encryption algorithm - “Lock” message characters being protected Identification requirements vary from driver’s license, notarized form, fingerprints… Companies offering CA services – Thawte, VeriSign, Comodo, DigiCert, Entrust, GeoTrust, RapidSSL.com Secure Sockets Layer-Extended Validation (SSL-EV) digital certificate Issued after more extensive verification confirmed: • • Annual fees – €200 to more than €1500 Digital certificates expire after period of time – Provides protection (users and businesses), must submit credentials for reevaluation periodically E-Business, Europe, Middle East, Africa First Edition Internet Explorer address window display for an SSL-EV Web site E-Business, Europe, Middle East, Africa First Edition 45 Steganography • Steganography – Hiding information within another piece of information • Can be used for malicious purposes • Hiding encrypted file within another file – Casual observer cannot detect anything of importance in container file – Two-step process • Encrypting file protects it from being read • Steganography makes it invisible • Al Qaeda used steganography to hide attack orders E-Business, Europe, Middle East, Africa First Edition Physical Security for Clients • Client computers – Control important business functions – Same physical security as early systems • New physical security technologies – Fingerprint readers (less than €100) • Stronger protection than password approaches • Biometric security device – Identification using element of person’s biological makeup • Writing pads, eye scanners, palm reading scanners, reading back of hand vein pattern E-Business, Europe, Middle East, Africa First Edition Client Security for Mobile Devices • Security measures – Access password – Remote wipe: clears all personal data • Can be added as an app • Capability through corporate e-mail synchronization – Antivirus software • Rogue apps: contain malware or collect information and forward to perpetrators – Apple App Store tests apps before authorizing sales – Android Market does less extensive testing – Users should not rush to install latest app E-Business, Europe, Middle East, Africa First Edition Communication Channel Security • Internet – Not designed to be secure – Designed to provide redundancy • Remains unchanged from original insecure state – Message traveling on the Internet • Subject to secrecy, integrity, and necessity threats • Secrecy Threats – Prevention of unauthorized information disclosure – Technical issue • Requiring sophisticated physical and logical mechanisms • Privacy – Protection of individual rights to nondisclosure – Legal matter E-Business, Europe, Middle East, Africa First Edition Secrecy Threats (cont’d.) • E-mail message – Secrecy violations protected using encryption protects outgoing messages – Privacy issues address whether supervisors are permitted to read employees’ messages randomly • Electronic commerce threat – Sensitive or personal information theft – Sniffer programs record information passing through computer or router • Electronic commerce threat (cont’d.) – Backdoor: electronic holes • Left open accidentally or intentionally • Content exposed to secrecy threats • Example: Cart32 shopping cart program backdoor – Stolen corporate information (Eavesdropper example) • Web users continually reveal information – Secrecy breach – Possible solution: anonymous Web surfing E-Business, Europe, Middle East, Africa First Edition Integrity Threats • Also known as active wiretapping – Unauthorized party alters message information stream • Integrity violation example – Cybervandalism • Electronic defacing of Web site • Masquerading (spoofing) – Pretending to be someone else – Fake Web site representing itself as original E-Business, Europe, Middle East, Africa First Edition Integrity Threats (cont’d.) • Domain name servers (DNSs) – Internet computers maintaining directories • Linking domain names to IP addresses – Perpetrators use software security hole • Substitute their Web site address in place of real one • Spoofs Web site visitors • Phishing expeditions – Capture confidential customer information – Common victims • Online banking, payment system users E-Business, Europe, Middle East, Africa First Edition Necessity Threats • Also known as delay, denial, denial-of-service (DoS) attack – Disrupt or deny normal computer processing – Intolerably slow-speed computer processing • Renders service unusable or unattractive • Distributed denial-of-service (DDoS) attack – Launch simultaneous attack on a Web site via botnets • DoS attacks – Remove information altogether – Delete transmission or file information E-Business, Europe, Middle East, Africa First Edition Necessity Threats (cont’d.) • Denial attack examples: – Quicken accounting program diverted money to perpetrator’s bank account – High-profile electronic commerce company received flood of data packets • Overwhelmed sites’ servers • Choked off legitimate customers’ access E-Business, Europe, Middle East, Africa First Edition Threats to the Physical Security of Internet Communications Channels • Internet’s packet-based network design: – Precludes it from being shut down • By attack on single communications link • Individual user’s Internet service can be interrupted – Destruction of user’s Internet link • Larger companies, organizations – Use more than one link to main Internet backbone E-Business, Europe, Middle East, Africa First Edition Threats to Wireless Networks • Wireless Encryption Protocol (WEP) – Rule set for encrypting transmissions from the wireless devices to the wireless access points (WAPs) • Wardrivers – Attackers drive around in cars – Search for accessible networks • Warchalking – Place chalk mark on building • Identifies easily entered wireless network nearby – Web sites include wireless access locations maps E-Business, Europe, Middle East, Africa First Edition Threats to Wireless Networks (cont’d.) • Preventing attacks by wardrivers – Turn on WEP – Change default login and password settings • Example – Best Buy wireless point-of-sale (POS) • Failed to enable WEP • Customer launched sniffer program • Intercepted data from POS terminals E-Business, Europe, Middle East, Africa First Edition Encryption Solutions • Encryption: coding information using mathematically based program, secret key • Cryptography: science studying encryption – Science of creating messages only sender and receiver can read • Steganography – Makes text undetectable to naked eye • Cryptography converts text to other visible text – With no apparent meaning E-Business, Europe, Middle East, Africa First Edition Encryption Solutions (cont’d.) • Encryption algorithms – Encryption program • Transforms normal text (plain text) into cipher text (unintelligible characters string) – Encryption algorithm • Logic behind encryption program • Includes mathematics to do transformation – Decryption program • Encryption-reversing procedure: message is decoded or decrypted E-Business, Europe, Middle East, Africa First Edition Encryption Solutions (cont’d.) • Encryption algorithms (cont’d.) – National Security Agency controls dissemination – U.S. government banned publication of details • Illegal for U.S. companies to export – Encryption algorithm property • May know algorithm details • Unable to decipher encrypted message without knowing key encrypting the message – Key type subdivides encryption into three functions • Hash coding, asymmetric encryption, symmetric encryption E-Business, Europe, Middle East, Africa First Edition Encryption Solutions (cont’d.) • Hash coding – Process uses Hash algorithm – Calculates number (hash value) from any length message – Unique message fingerprint – Good hash algorithm design • Probability of collision is extremely small (two different messages resulting in same hash value) – Determining message alteration during transit • Mismatch between original hash value and receiver computed value E-Business, Europe, Middle East, Africa First Edition Encryption Solutions (cont’d.) • Asymmetric encryption (public-key encryption) – Encodes messages using two mathematically related numeric keys Public key: one key freely distributed to public • Encrypt messages using encryption algorithm Private key: second key belongs to key owner • Kept secret, decrypt all messages received Pretty Good Privacy (PGP) – Software tools using different encryption algorithms • Perform public key encryption – Individuals download free versions • PGP Corporation site, PGP International site • Encrypt e-mail messages – Sells business site licenses E-Business, Europe, Middle East, Africa First Edition Encryption Solutions (cont’d.) • Symmetric encryption (private-key encryption) – Encodes message with one of several available algorithms • Single numeric key to encode and decode data – Message receiver must know the key – Very fast and efficient encoding and decoding – Key must be guarded Problems: difficult to distribute new keys to authorized parties while maintaining security, control over keys & Private keys do not work well in large environments E-Business, Europe, Middle East, Africa First Edition Encryption Solutions (cont’d.) Data Encryption Standard (DES) • Encryption algorithms adopted by U.S. government • Most widely used private-key encryption system • Fast computers break messages encoded with smaller keys Data Encryption Standard (DES) • Encryption algorithms adopted by U.S. government • Most widely used private-key encryption system • Fast computers break messages encoded with smaller keys E-Business, Europe, Middle East, Africa First Edition Encryption Solutions (cont’d.) – Triple Data Encryption Standard (Triple DES, 3DES) • Stronger version of Data Encryption Standard – Advanced Encryption Standard (AES) • Alternative encryption standard • Most government agencies use today Longer bit lengths increase difficulty of cracking keys E-Business, Europe, Middle East, Africa First Edition Encryption Solutions (cont’d.) • Comparing asymmetric and symmetric encryption systems Advantages of public-key (asymmetric) systems • Small combination of keys required • No problem in key distribution • Implementation of digital signatures possible Disadvantages of public-key systems • Significantly slower than private-key systems Public-key systems: complement rather than replace private-key systems E-Business, Europe, Middle East, Africa First Edition © Cengage Learning 2013 Comparison of (a) hash coding, (b) private-key, and (c) public-key encryption E-Business, Europe, Middle East, Africa First Edition Encryption Solutions (cont’d.) Web servers accommodate encryption algorithms Must communicate with variety of Web browsers Secure Sockets Layer (SSL) Goal: secures connections between two computers Secure Hypertext Transfer Protocol (S-HTTP) Goal: send individual messages securely Secure sockets layer (SSL) protocol – Provides security “handshake” – Client and server exchange brief burst of messages – All communication encoded - eavesdropper receives unintelligible information – Secures many different communication types (HTTP, FTP, Telnet) – HTTPS: protocol implementing SSL • Precede URL with protocol name HTTPS E-Business, Europe, Middle East, Africa First Edition Encryption Solutions (cont’d.) – Encrypted transaction generates private session key • Bit lengths vary (40-bit, 56-bit, 128-bit, 168-bit) – Session key • Used by encryption algorithm • Creates cipher text from plain text during single secure session – Secrecy implemented using public-key and privatekey encryption • Private-key encryption for nearly all communications E-Business, Europe, Middle East, Africa First Edition © Cengage Learning 2013 Establishing an SSL session E-Business, Europe, Middle East, Africa First Edition Encryption Solutions (cont’d.) After secure session established: • Public-key encryption no longer used • Message transmission protected by private-key encryption • Session key (private key) discarded when session ends Each new connection between client and secure server requires entire process: Beginning with handshake Secure HTTP (S-HTTP) Extension to HTTP providing security features • Client and server authentication, spontaneous encryption, request/response nonrepudiation – Symmetric encryption for secret communications – Public-key encryption to establish client/server authentication – Session negotiation: process between client and server of proposing and accepting (or rejecting) various transmission conditions E-Business, Europe, Middle East, Africa First Edition Encryption Solutions (cont’d.) • – Establishing secure session • SSL carries out client-server handshake exchange to set up secure communication • S-HTTP sets up security details with special packet headers exchanged in S-HTTP – Headers define security technique type – Header exchanges state: • Which specific algorithms that each side supports • Whether client or server (or both) supports algorithm • Whether security technique required, optional, refused – Secure envelope (complete package) • Encapsulates message • Provides secrecy, integrity, and client/server authentication SSL has become more generally accepted standard over S-HTTP E-Business, Europe, Middle East, Africa First Edition Using a Hash Function to Create a Message Digest • Integrity violation – Message altered while in transit • Difficult and expensive to prevent • Security techniques to detect • Harm: unauthorized message changes undetected • Apply two algorithms to eliminate fraud and abuse – Hash algorithm – Message digest • Number summarizing encrypted information E-Business, Europe, Middle East, Africa First Edition Converting a Message Digest into a Digital Signature • Hash functions: potential for fraud – Solution: sender encrypts message digest using private key • Digital signature – Encrypted message digest (message hash value) • Digital signature provides: – Integrity, nonrepudiation, and authentication • Provide transaction secrecy – Encrypt entire string (digital signature, message) • Digital signatures: same legal status as traditional signatures E-Business, Europe, Middle East, Africa First Edition © Cengage Learning 2013 Sending and receiving a digitally signed message E-Business, Europe, Middle East, Africa First Edition Security for Server Computers • Server vulnerabilities – Exploited by anyone determined to cause destruction or acquire information illegally • Entry points – Web server and its software – Any back-end programs containing data • No system is completely safe • Web server administrator – Ensures security policies documented; considered in every electronic commerce operation E-Business, Europe, Middle East, Africa First Edition Web Server Threats • Compromise of secrecy – By allowing automatic directory listings – Solution: turn off folder name display feature • Sensitive file on Web server – Holds Web server username-password pairs – Solution: store authentication information in encrypted form E-Business, Europe, Middle East, Africa First Edition Web Server Threats (cont’d.) • Passwords that users select – Easily guessable • Dictionary attack programs cycle through electronic dictionary, trying every word as password – Solutions • User password requirements • Use password assignment software to check user password against dictionary • Help creating very strong passwords: – Gibson Research Corporation’s Ultra High Security Password Generator E-Business, Europe, Middle East, Africa First Edition © Cengage Learning 2013 Examples of passwords, from very weak to very strong E-Business, Europe, Middle East, Africa First Edition Database Threats • Usernames and passwords – Stored in unencrypted table – Database fails to enforce security altogether • Relies on Web server to enforce security • Unauthorized users – Masquerade as legitimate database users • Trojan horse programs hide within database system – Reveal information – Remove all access controls within database E-Business, Europe, Middle East, Africa First Edition Other Programming Threats • Java or C++ programs executed by server – Passed to Web servers by client – Reside on server – Use a buffer • Memory area set aside holding data read from file or database – Buffer overrun (buffer overflow) error • Programs filling buffers malfunction and overfill buffer • Excess data spilled outside designated buffer memory • Cause: error in program or intentional • 1998 Internet worm E-Business, Europe, Middle East, Africa First Edition Other Programming Threats (cont’d.) • Insidious version of buffer overflow attack – Writes instructions into critical memory locations – Web server resumes execution by loading internal registers with address of attacking program’s code • Reducing potential buffer overflow damage – Good programming practices – Some hardware functionality • Mail bomb attack – Hundreds (thousands) send message to particular address E-Business, Europe, Middle East, Africa First Edition Threats to the Physical Security of Web Servers • Protecting Web servers – Put computers in commerce service provider (CSP) facility • Very high-level physical security on CSP – Maintain server content’s backup copies at remote location – Rely on service providers • Offer managed services including Web server security – Hire smaller, specialized security service providers E-Business, Europe, Middle East, Africa First Edition Access Control and Authentication • Controlling who and what has access to Web server • Authentication – Identity verification of entity requesting computer access • Server user authentication – Server must successfully decrypt user’s digital signaturecontained certificate – Server checks certificate timestamp – Server uses callback system • Certificates authenticate client computers and their users E-Business, Europe, Middle East, Africa First Edition Access Control and Authentication (cont’d.) • Usernames and passwords – Provide some protection element • Maintain usernames in plain text – Encrypt passwords with one-way encryption algorithm • Problem – Site visitor may save username and password as a cookie • Might be stored in plain text • Access control list (ACL) – Restrict file access to selected users E-Business, Europe, Middle East, Africa First Edition Firewalls • Firewall – Software, hardware-software combination – Installed in a network to control packet traffic • Placed at Internet entry point of network – Defense between network and the Internet • Between network and any other network • Principles – All traffic must pass through it – Only authorized traffic allowed to pass – Immune to penetration E-Business, Europe, Middle East, Africa First Edition Firewalls (cont’d.) • Trusted: networks inside firewall • Untrusted: networks outside firewall • Filter permits selected messages though network • Separate corporate networks from one another – Coarse need-to-know filter • Firewalls segment corporate network into secure zones • Large organizations with multiple sites – Install firewall at each location • All locations follow same security policy E-Business, Europe, Middle East, Africa First Edition Firewalls (cont’d.) • Should be stripped of unnecessary software • Packet-filter firewalls – Examine all data flowing back and forth between trusted network (within firewall) and the Internet • Gateway servers – Filter traffic based on requested application – Limit access to specific applications • Telnet, FTP, HTTP • Proxy server firewalls – Communicate with the Internet on private network’s behalf E-Business, Europe, Middle East, Africa First Edition Firewalls (cont’d.) • Perimeter expansion problem – Computers outside traditional physical site boundary • Servers under almost constant attack – Install intrusion detection systems • Monitor server login attempts • Analyze for patterns indicating cracker attack • Block further attempts originating from same IP address • Cloud computing: firewall products lagging behind • Personal firewalls – Software-only firewalls on individual client computers – Gibson Research Shields Up! Web site E-Business, Europe, Middle East, Africa First Edition Organizations that Promote Computer Security • Following the Internet Worm of 1988 – Organizations formed to share information • About threats to computer systems • Principle followed – Sharing information about attacks and defenses for attacks • Helps everyone create better computer security E-Business, Europe, Middle East, Africa First Edition 90 CERT • Computer Emergency Response Team • Housed at Carnegie Mellon University – Software Engineering Institute • Maintains effective, quick communications infrastructure among security experts – Security incidents avoided, handled quickly • Provides security risk information • Posts security event alerts • Primary authoritative source for viruses, worms, and other types of attack information E-Business, Europe, Middle East, Africa First Edition Other Organizations • 1989: System Administrator, Audit, Network and Security (SANS) Institute – Education & research efforts: research reports, security alerts & white papers – SANS Internet Storm Center Web site - current information on location, intensity of computer attacks worldwide • CERIAS (Center for Education & Research in Information Assurance & Security) - Multidisciplinary information security research and education • Center for Internet Security – Not-for-profit cooperative organization – Helps electronic commerce companies • CSO Online – Articles from CSO Magazine – Computer security-related news items • Infosecurity.com – Articles about all types of online security issues E-Business, Europe, Middle East, Africa First Edition Computer Forensics and Ethical Hacking • Computer forensics experts (ethical hackers) – Computer sleuths hired to probe PCs – Locate information usable in legal proceedings – Job of breaking into client computers • Computer forensics field – Responsible for collection, preservation, and computer-related evidence analysis • Companies hire ethical hackers to test computer security safeguards E-Business, Europe, Middle East, Africa First Edition Summary of Online Security • Physical and logical computer security important in electronic commerce Security policy can identify risks and countermeasures to reduce risks • Key security provisions - Secrecy, integrity, available service • Client threats and solutions - Virus threats, active content threats, cookies • Communication channels’ threats and solutions – Encryption provides secrecy • Web Server threats and solutions – Threats from programs, backdoors • Security organizations – Share information about threats, defenses • Computer forensics – “Break into” computers searching for legal use data – Assist in identifying security weaknesses E-Business, Europe, Middle East, Africa First Edition E-Payment Systems Online Payment Basics • Online payments – Important electronic commerce site function – Several online payment options available • Vary in size and processing method • Micropayments Internet payments for items costing few cents to a euro • Micropayments barriers – Not yet implemented very well on the Web – Human psychology • People prefer to buy small value items in fixed price chunks • Example: mobile phone fixed monthly payment plans E-Business, Europe, Middle East, Africa First Edition Micropayments and Small Payments (cont’d.) • Companies which have developed micropayment systems: Millicent, DigiCash, Yaga, BitPass – ALL FAILED No company gained broad acceptance of its system No company devoted solely to offering micropayment services • Small payments – All payments of less than €10 – Being offered through mobile telephone carrier • Buyers make purchases using their mobile phones • Charges appear on monthly mobile phone bill • Bright future held back by mobile carriers’ substantial charges E-Business, Europe, Middle East, Africa First Edition Online Payment Methods • Four ways to purchase items (traditional and electronic) 1. Cash 2. Cheques 3. Credit cards 4. Debit cards • Electronic transfer: small but growing segment – Popular example: automated payments • Credit and debit cards – Worldwide: 85% of online payments – Remainder of payments primarily PayPal E-Business, Europe, Middle East, Africa First Edition Forms of payment for U.S. online transactions, estimates for 2015 Source: Adapted from forecasts by Javelin Strategy & Research and Internet Retailer. E-Business, Europe, Middle East, Africa First Edition Online Payment Methods (cont’d.) • Online payment systems – Still evolving, competition for dominance – Cheaper than mailing paper checks – Convenient for customers & save companies money • Costs per bill – Billing by mail: between €1.00 and €1.50 – Internet billing and payment costs: 50 cents • Significant environmental impact E-Business, Europe, Middle East, Africa First Edition Online Payment Methods (cont’d.) Online business payment requirements: – Safe, convenient, and widely accepted – determine which choices best for company and customers Each payment technology: • Unique properties, costs, advantages, and disadvantages • Online business payment requirements – Safe, convenient, and widely accepted • Determine which choices best for company and customers • Each payment technology: – Unique properties, costs, advantages, and disadvantages E-Business, Europe, Middle East, Africa First Edition 100 Payment Cards • Payment card – Describes all types of plastic cards used to make purchases – Categories: credit cards, debit cards, charge cards, prepaid cards, and gift cards • Credit card (Visa, MasterCard) – Spending limit based on user’s credit history – Pay off entire credit card balance • May pay minimum amount – Card issuers charge unpaid balance interest – Widely accepted – Consumer protection: 30-day dispute period E-Business, Europe, Middle East, Africa First Edition Payment Cards (cont’d.) • Credit Cards (cont.) – Card not present transactions • Cardholder not present during transaction • Extra degree of risk for merchant and bank • Debit card (electronic funds transfer at point of sale (EFTPOS) cards) – Removes sales amount from cardholder’s bank account – Transfers sales amount to seller’s bank account – Issued by cardholder’s bank • Carries major credit card issuer name E-Business, Europe, Middle East, Africa First Edition Payment Cards (cont’d.) • Charge card (e.g., American Express) – No spending limit – Entire amount due at end of billing period – No line of credit or interest charges – Examples: department store, oil company cards • Retailers may offer their own charge cards – Store charge cards or store-branded cards E-Business, Europe, Middle East, Africa First Edition Payment Cards (cont’d.) • Prepaid cards – Cards that can be redeemed by anyone for future purchase – Gift cards: prepaid cards sold to be given as gift • Single-use cards – Cards with disposable numbers • Addresses concern of giving online vendors payment card numbers, valid for one transaction only • Designed to prevent unscrupulous vendor fraud – Withdrawn from market due to lack of consumer use E-Business, Europe, Middle East, Africa First Edition Advantages and Disadvantages of Payment Cards • Greatest advantages – Worldwide acceptance & simplicity of usage • Currency conversion handled by card issuer • Entities involved in payment card processes: Merchant, merchant’s bank, customer, customer’s bank, and payment card issuer (company) – Fraud protection for merchants & build in security • Can authenticate and authorize purchases using a payment card processing network • Interchange network: set of connections between credit card issuing banks, associations owning credit cards, and merchants’ banks • Disadvantage for merchants – Per-transaction fees for merchants & monthly processing fees, viewed as cost of doing business. – Goods and services prices: slightly higher, compared to environment free of payment cards • Disadvantage for consumers – Annual fee E-Business, Europe, Middle East, Africa First Edition Payment Acceptance and Processing • Internet payment card process made easier due to standards • Online stores, mail order stores often must ship merchandise within e.g. 30 days of charging payment • Significant violation penalties • Charge account when shipped • Processing payment card transaction online – Payment acceptance • Establish card validity • Verify card’s limit not exceeded by transaction – Clearing the transaction • All steps to move funds from card holder’s bank account into merchant’s bank account E-Business, Europe, Middle East, Africa First Edition Payment Acceptance and Processing (cont’d.) • Open and closed loop systems – Closed loop systems • Card issuer pays merchant directly • Does not use intermediary • American Express, Discover Card – Open loop systems (three or more parties) • Additional payment processing intermediaries • Visa, MasterCard: not issued directly to consumers • Credit card associations: operated by association member banks • Customer issuing banks (issuing banks): banks issuing cards E-Business, Europe, Middle East, Africa First Edition © Cengage Learning 2013 Closed loop payment card system E-Business, Europe, Middle East, Africa First Edition © Cengage Learning 2013 Open loop payment card system E-Business, Europe, Middle East, Africa First Edition Payment Acceptance and Processing (cont’d.) • Merchant accounts – Acquiring bank: • Does business with Internet and non-Internet sellers • Wants to accept payment cards – Merchant account required by online merchant to process Internet transactions payment cards – Obtaining account • Merchant provides business information • Bank assesses business type risk • Bank assesses percentage of sales likely to be contested E-Business, Europe, Middle East, Africa First Edition Payment Acceptance and Processing (cont’d.) – Chargeback process • Cardholder successfully contests charge • Merchant bank must retrieve money from merchant account • Merchant may have to keep funds on deposit – Additional fees • Acquirer fees: charges for providing payment card processing service • Interchange fees: set by the card association, charged to acquiring bank, passed along to merchant E-Business, Europe, Middle East, Africa First Edition Payment Acceptance and Processing Problems facing online businesses: Fraud • Under 15 percent of all credit card transactions completed online • Responsible for 64 percent of total euro amount of credit card fraud • Online transaction fraud increased steadily through 2008 • Slight decline since 2008 Merchants’ use of antifraud measures • Scoring services providing risk ratings for individual transactions in real time • Shipping only to card billing address • Requiring card verification numbers (CVNs) for card not present transactions CVN • Three- or four-digit number printed on the credit card • Not encoded in the card’s magnetic strip E-Business, Europe, Middle East, Africa First Edition 112 Payment Acceptance and Processing Processing payment card transactions – Most online merchants have internal systems: • Handling closed loop and open loop system cards – Some accept direct deductions from customer’s checking account • Automated Clearing House (ACH): network of banks involved in direct deduction transactions – Business size considerations • Large: entire department to build/maintain systems • Mid-size: purchased software with skilled staff to manage system • Small: rely on service provider E-Business, Europe, Middle East, Africa First Edition Payment Acceptance and Processing Payment processing service providers (payment processors) • Companies offering payment card processing Front-end processor (payment gateway): • Obtains transaction authorization • Stores approval or denial record Back-end processor: takes front-end processor transactions and coordinates information flows • Handles chargebacks, other reconciliation items through the interchange network and acquiring and issuing banks, including ACH transfers E-Business, Europe, Middle East, Africa First Edition Payment Acceptance and Processing Payment processors: • IPPay, Authorize.Net, Global Payments, and FirstData Specialized payment processing services: • Digital River’s*shareit! Third party payment processor may be evident or transparent to customer • Well-recognized name provides customers with sense of security E-Business, Europe, Middle East, Africa First Edition Electronic Cash • Electronic cash (e-cash, digital cash) – Describes any value storage and exchange system created by private (nongovernmental) entity • Does not use paper documents or coins • Can serve as substitute for government-issued physical currency • Potential market – Purchases below €10 – Majority of world’s population who do not have credit cards E-Business, Europe, Middle East, Africa First Edition Privacy and Security of Electronic Cash • Electronic payment method concerns – Privacy and security, independence, portability, convenience – Privacy and security: most important to consumers • Vulnerable transactions • Electronic currency: copied, reused, forged • Important characteristics of electronic cash – Ability to spend only once – Anonymous use • Anonymous electronic cash: can’t be traced to person who spent it – Convenience E-Business, Europe, Middle East, Africa First Edition Holding Electronic Cash: Online and Offline Cash • Online cash storage – Consumer has no personal possession of electronic cash • Trusted third party (online bank) involved in all transfers, holds consumers’ cash accounts • Online system payment – Merchants contact consumer’s bank • Helps prevent fraud (confirm valid cash) • Resembles process of checking with consumer’s bank to ensure valid credit card and matching name E-Business, Europe, Middle East, Africa First Edition Holding Electronic Cash: Online and Offline Cash (cont’d.) • Offline cash storage – Virtual equivalent of money kept in wallet – Customer holds it • No third party involved in transaction – Protection against fraud concern • Hardware or software safeguards needed – Double-spending • Spending electronic cash twice • Submit same electronic currency to two different vendors • Not enough time to prevent fraudulent act E-Business, Europe, Middle East, Africa First Edition Holding Electronic Cash: Online and Offline Cash (cont’d.) • Main deterrent to double-spending – Threat of detection and prosecution • System must provide tamperproof electronic cash traceable back to origins – Two-part lock • Provides anonymous security • Signals an attempt to double-spend cash that is traceable • Electronic cash used correctly: – Preserves user’s anonymity E-Business, Europe, Middle East, Africa First Edition 120 © Cengage Learning 2013 Detecting double spending of electronic cash E-Business, Europe, Middle East, Africa First Edition Advantages and Disadvantages of Electronic Cash • Traditional brick-and-mortar billing methods – Costly and inefficient • Online stores have the same payment collection inefficiencies • Most online customers use credit cards to pay for purchases • Electronic cash system – Less popular than other payment methods – Provides unique advantages and disadvantages E-Business, Europe, Middle East, Africa First Edition Advantages and Disadvantages of Electronic Cash (cont’d.) • Advantages of electronic cash transactions – More efficient (less costly) • Efficiency fosters more business (lower prices) – Occurs on existing infrastructure (Internet) – Does not require one party to obtain authorization: • As required with credit card transactions • Disadvantages of electronic cash transactions – No audit trail – Money laundering • Technique criminals use to convert money illegally obtained into spendable cash • Purchase goods, services with ill-gotten electronic cash • Goods sold for physical cash on open market E-Business, Europe, Middle East, Africa First Edition Advantages and Disadvantages of Electronic Cash (cont’d.) • Electronic cash – More successful in Europe and Asia • Consumers prefer to use cash (does not work well for online transactions) • Electronic cash fills important need – Not successful in United States • Consumers have credit cards, debit cards, charge cards, checking accounts • KDD Communications (KCOM) – Internet subsidiary: Japan’s largest phone company – Offers electronic cash through NetCoin Center E-Business, Europe, Middle East, Africa First Edition Advantages and Disadvantages of Electronic Cash (cont’d.) • Reasons for failure of United States electronic cash systems – Electronic cash systems implementation • Requires software installed into consumers’ Web browsers – Number of competing technologies • No standards developed • Array of proprietary electronic cash alternatives that are not interoperable • Interoperable software: – Runs transparently on variety of hardware configurations and different software systems E-Business, Europe, Middle East, Africa First Edition Digital Wallets Consumer concerns when shopping online – Entering detailed shipping and payment information for each online purchase & filling out forms – Solution: allows customer to store name, address, credit card information on the site – Problem: Consumers must enter information at each site Digital wallet (electronic wallet or e-wallet) – Holds credit card numbers, electronic cash, owner identification, owner contact information – Provides information at electronic commerce site checkout counter – Benefit: consumer enters information once • More efficient shopping E-Business, Europe, Middle East, Africa First Edition Digital Wallets (cont’d.) – Digital wallet technology elements • System: infrastructure for identification • Application: software for user interaction • Device: applicable if a specific device is used • Server-side digital wallet – Stores customer’s information on remote server of merchant or wallet publisher & no download time or installation on user’s computer – Main weakness: Security breach can reveal thousands of users’ personal information to unauthorized parties • Client-side digital wallet – Stores information on consumer’s computer – Disadvantages: not portable, must download wallet software onto every computer – Advantage: sensitive information stored on user’s computer E-Business, Europe, Middle East, Africa First Edition Software-Only Digital Wallets (cont’d.) • Server-side digital wallet examples: – Microsoft Windows Live ID • Single sign-in (SSI) service • Completes order forms automatically • Personal data encrypted and password protected • Integrated services: SSI, Wallet service, Kids service, public profiles – Yahoo! Wallet • Software-based digital wallet • Automatically fills online forms • Accepted by large number of merchants E-Business, Europe, Middle East, Africa First Edition Hardware-Based Digital Wallets • Implemented using smart phones – Store owner’s identity credentials (driver’s license, medical insurance card, store loyalty cards, etc.) – Transmit portions of identify information using: • Bluetooth or wireless transmission to nearby terminal • Near field communication (NFC) technology: contactless wireless transmission of data over short distances • Status: – Popular in Japan: mobile phones with NFC chips • Oisaifu-Keitai (“mobile wallet”) – U.S. examples: • Google Wallet (uses PayPass technology) • V.me (Visa digital wallet) • PayPal digital wallet (release anticipated) E-Business, Europe, Middle East, Africa First Edition Stored-Value Cards • Microchip smart card or magnetic strip plastic card • Examples: credit cards, debit cards, charge cards, driver’s license, health insurance card, and employee or student identification card Magnetic Strip Cards • Holds rechargeable value • Passive magnetic strip cards cannot: – Send or receive information – Increment or decrement cash value stored • Processing done on device into which card inserted E-Business, Europe, Middle East, Africa First Edition Smart Cards • Smart card (stored-value card): – Plastic card with embedded microchip • Credit, debit, charge cards store limited information on magnetic strip • Information storage – About 100 times more than magnetic strip plastic card • Holds private user data – Financial facts, encryption keys, account information, credit card numbers, health insurance information, medical records E-Business, Europe, Middle East, Africa First Edition Smart Cards (cont’d.) • Safer than conventional credit cards – Information encrypted on smart card • Popular in Europe, parts of Asia – Public telephone calls, cable television programs – Hong Kong • Retail counters, restaurant cash registers have smart card readers • Octopus: public transportation smart card can be reloaded at transportation locations, 7-Eleven stores E-Business, Europe, Middle East, Africa First Edition Smart Cards (cont’d.) • Beginning to appear in United States – San Francisco TransLink integrated ticketing system for public transportation • Smart Card Alliance – Advances smart card benefits – Promotes widespread acceptance of multiple-application smart card technology – Promotes compatibility among smart cards, card reader devices, applications E-Business, Europe, Middle East, Africa First Edition Internet Technologies and the Banking Industry • Paper cheques – Largest dollar volume of payments – Processed through world’s banking system • Other major payment forms – Involve banks one way or another • Banking industry Internet technologies – Providing new tools – Creating new threats E-Business, Europe, Middle East, Africa First Edition Cheque Processing • Old method of physical cheque processing – Person wrote check; retailer deposited cheque in bank account – Retailer’s bank sent paper cheque to clearinghouse • Clearinghouse managed fund transfer (consumer’s bank to retailer’s account) – Paper cheque transported to consumer’s bank – Cancelled cheque sent to consumer • Banks now provide PDF images of processed cheque E-Business, Europe, Middle East, Africa First Edition Cheque Processing (cont’d.) • Disadvantage of paper cheques – Cost of transporting tons of paper – Float • Delay between the time person writes cheque and the time cheque clears person’s bank • Bank’s customer obtains free use of funds for few days • Bank loses use of funds for same time period • Can become significantly longer than a few days E-Business, Europe, Middle East, Africa First Edition Cheque Processing (cont’d.) • Technologies helping banks reduce float • Banks to eliminate movement of physical cheques entirely • Check 21-compliant world – Retailer scans customer's cheque – Scanned image transmitted instantly • Through clearing system – Posts almost immediately to both accounts • Eliminates transaction float E-Business, Europe, Middle East, Africa First Edition Mobile Banking • Banks exploring mobile commerce potential • 2009: banks launched sites allowing customers using smart phones to: – Obtain bank balance, view account statement, and find a nearby ATM • Future plans – Offering smart phone apps • Use to transact all types of banking business • Credit card reader attachment available for some smart phones yielding a portable payment processing terminal E-Business, Europe, Middle East, Africa First Edition 138 Criminal Activity and Payment Systems: Phishing and Identity Theft • Online payment systems – Offer criminals and criminal enterprises an attractive arena in which to operate • Average consumers: easy prey • Large amounts of money provide tempting targets – Phishing expedition • Technique for committing fraud against online businesses customers • Particular concern to financial institutions E-Business, Europe, Middle East, Africa First Edition 139 Phishing Attacks • Basic structure – Attacker sends e-mail message: • To accounts with potential for an account at targeted Web site – E-mail message tells recipient: account compromised • Recipient must log on to account to correct problem – E-mail message includes link • Appears to be Web site login page • Actually leads to perpetrator’s Web site disguised to look like the targeted Web site – Recipient enters login name, password • Perpetrator captures • Uses to access recipient’s account • Perpetrator accesses personal information, makes purchases, withdraws funds E-Business, Europe, Middle East, Africa First Edition Phishing e-mail message E-Business, Europe, Middle East, Africa First Edition Phishing e-mail message (cont’d.) E-Business, Europe, Middle East, Africa First Edition Phishing Attacks (cont’d.) • Spear phishing – Carefully designed phishing expedition targeting a particular person or organization – Requires considerable research – Increases chance of e-mail being opened – Example: 2008 government stimulus checks • Phishing e-mails appeared within one week of passage E-Business, Europe, Middle East, Africa First Edition Phishing Attacks (cont’d.) • E-mail link disguises and tricks – Example: Web server ignores all characters preceding “@”: – https://www.paypal.com@218.36.41.188/fl/login.html • Link appears different in e-mail • Phony site invisible due to JavaScript code – Pop-up windows • Look exactly like browser address bar – Including Web site graphics of financial institutions • Looks more convincing • Web sites to learn more about phishing techniques: – Conferences on Email and Anti-Spam – Anti-Phishing Working Group (APWG) E-Business, Europe, Middle East, Africa First Edition Phishing e-mail with graphics E-Business, Europe, Middle East, Africa First Edition Phishing e-mail with graphics (cont’d.) E-Business, Europe, Middle East, Africa First Edition Using Phishing Attacks for Identity Theft • Organized crime (racketeering) – Unlawful activities conducted by highly organized, disciplined association for profit – Differentiated from less-organized groups – Internet providing new criminal activity opportunities • Generates spam, phishing, identity theft • Identity theft – Criminal act: perpetrator gathers victim’s personal information – Uses information to obtain credit – Perpetrator runs up account charges and disappears E-Business, Europe, Middle East, Africa First Edition Types of personal information most useful to identity thieves E-Business, Europe, Middle East, Africa First Edition Using Phishing Attacks for Identity Theft (cont’d.) • Large criminal organizations – Efficient perpetrators of identity theft • Exploit large amounts of personal information quickly and efficiently – Sell or trade information that is not of immediate use • Other worldwide organized crime entities – Zombie farm • Large number of computers implanted with zombie programs – Pharming attack • Use of a zombie farm, often by an organized crime association, to launch a massive phishing attack E-Business, Europe, Middle East, Africa First Edition Using Phishing Attacks for Identity Theft (cont’d.) • Two elements in phishing – Collectors: collect information – Cashers: use information – Require different skills • Crime organizations facilitate transactions between collectors and cashers – Increases phishing activity efficiency and volume • Each year: – More than a million people fall victim – Financial losses exceed €500 million E-Business, Europe, Middle East, Africa First Edition Phishing Attack Countermeasures • Change protocol – Improve e-mail recipients’ ability to identify message source • Reduce phishing attack threat • Educate Web site users • Contract with consulting firms specializing in anti-phishing work • Monitor online chat rooms used by criminals E-Business, Europe, Middle East, Africa First Edition Summary of Online Payment Basics • Online stores: payment forms – Credit, debit, charge cards (payment cards) • Ubiquitous, convenient, and easy to use – Electronic cash: portable and anonymous online payment form • Useful for micropayments – Digital wallets provide convenience – Stored-value cards • Smart cards, magnetic strip cards • Banks process most monetary transactions – Use Internet technologies to process checks • Concerns: phishing expeditions, identity theft E-Business, Europe, Middle East, Africa First Edition