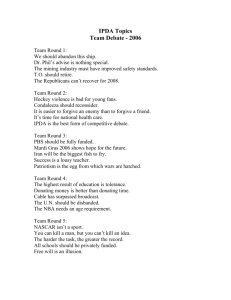

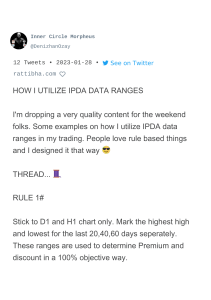

ICT IPDA – Inter Bank Price Delivery Algorithm As an ICT trader you must have heard about ICT IPDA and you must be curious to know about it. In this article we will be explaining the term ICT IPDA thoroughly. Lets begin with defining the ICT IPDA. What is ICT IPDA? The word IPDA stand for Inter Bank Price Delivery Algorithm. Algorithm means the set of rules to be followed to complete a task. So IPDA is basically the set of rules that deliver price in forex market. As you know in this age of technology anything being presented or working online is not random it has some designed rules for smooth working like YouTube and google has their own algorithm. So you can relate it with forex market, the price you see on live charts can not be random it also has some defined set of rules for the delivery which are called Inter Bank Price Delivery Algorithm. How IPDA Works? The inter bank price delivery algorithm describes the price delivery and its not random it has some objectives. To understand how the IPDA works you need to know about two main things. (I) Imbalance means the is a significant disparity between the buyers and sellers. (II) Liquidity means the availability of active market participants (willing sellers and buyers). Price basically moves for two causes either to balance any imbalance in price or to hunt the liquidity. It depends on your Daily Bias either price is going to take the liquidity or balance the imbalance. So you have to mark the previous days, weeks , month highs and lows because these are the liquidity areas mostly buy stops are placed above old highs and sell stops below old lows. So the IPDA may target these highs and lows to hunt liquidity of retail traders. Secondly if your bias supports the balance of imbalance you have to mark the SIBI and BISI and wait for price to react at these levels. In the picture above you can see price has hunt the liquidity of old lows and moved up to hunt the liquidity of old highs , side by side its balancing the imbalance. So this all is not a random movement its the IPDA that deliver such price moves. Is Price Delivery Algorithm a Myth? Lets understand it by an example. In this age of technology you might be familiar with YouTube and google and you may know about their algorithm to operate. So you can understand anything being presented online by any app or software is mainly controlled by set of rules known as the algorithm. Then how can a price delivery of each second can be random? There must be an algorithm which is controlling the delivery of price online. Which has been given commands like, if price falls the candlestick/bar should go down and if price rises it should move up. So price delivery algorithm is a fact and you must accept it. What is IPDA Data Range? IPDA data range is basically the range of previous 20, 40 or 60 days which is used by traders to identify next draw on liquidity. It helps traders in finding their weekly and daily bias also the institutional reference points to execute trades. What is IPDA Market Cycle? After every 20, 40 or 60 a shift in price delivery is created on daily chart which is termed as IPDA look back period. According to Michael Huddleston(ICT) after almost every 20 days new Liquidity Pools are created on the both side of market. Does Price Delivery Algorithm Work for Smart Money? Yes it works for the smart money. Targeting the retail and uninformed traders. Does Price Delivery Algorithm Target Retail Traders? Price delivery algorithm does not know about you and me. So it can not distinguish between a retailer or institutional trader. Retail traders lose because of their limited information about the market and its algorithm. How We can Conquer the Price Delivery Algorithm? We may not 100% conquer the algorithm. But with better understanding about the markets and its algorithm we may increase our winning ratio.