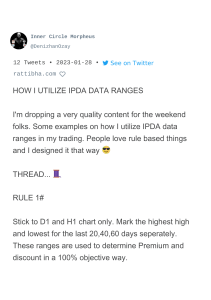

What is algorithm? -IPDA – Interbank Price Delivery algorithm -basically, it’s a computer program that it’s job it to engineer liquidity in the markets by moving price -it’s not Buying and Selling Pressure -it creates old highs and old Lows (where we place our stop losses and these are where liquidity held) -because the algorithm it’s programming logic is based on human emotions (manipulation), and it’s whole job is to manipulate price. When you know what the algorithm is going to do, you can predict the future price. Telegram @HusniFX How does IPDA Work? -The Central Banks created IPDA – They own the money (The Money is the Commodity),They can set the price of that money because they own the money and IPDA will decide what price of that money is going to be. -Retail Money is Liquidity – they are looking to seek liquidity, they will engineer the liquidity that is the Retail money that falls into the market and that is the whole purpose of what IPDA is. Note: we cannot fight with them, even if all retail traders’ money put together, so we can follow them. -IPDA its job is to deliver price efficiently to buyers and sellers in the marketplace Telegram @HusniFX There are 2 main ways IPDA Does this. 1. Rebalancing inefficient price action 2. Seek liquidity (Offset distribution/accumulation – pairing of orders 1- Rebalancing inefficient Price action Telegram @HusniFX What do we see? -Price moved too quickly to offer any buyside delivery (sellside price displacement) -this is all buyside inefficient price delivery -IPDA Will seek to re-offer buyside deliver to this buyside inefficient price delivery. Telegram @HusniFX 2. Seek liquidity (Offset distribution/accumulation – pairing of orders How does IPDA Works in its Data Ranges? 20 Days (where the high is and low is in the last 20 days) 40 days 60 Days Telegram @HusniFX Algorithmic trading Pros & Cons Thank you. Husnifx Telegram @HusniFX