Accounting Principles: Business Structures & Financial Statements

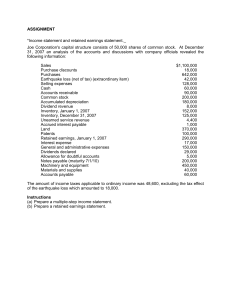

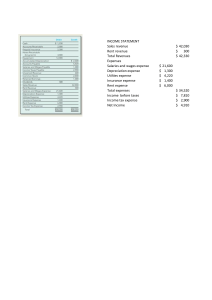

advertisement

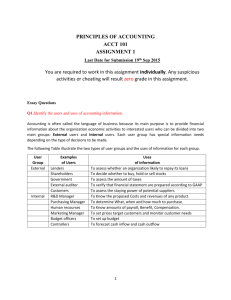

CHAPTER 1 Accounting- The information system that identifies, records, and communicates the economic events of an organization to interested Users. Identify the advantages and disadvantages of the corporate form of business organization. Corporation: A business organizes as a separate legal entity owned by stockholders. (Many owners) Advantages Easy to transfer ownership Greater capital raising potential/ Easy to raise funds Unfavorable tax treatment Stocks are easy to sell Become stockholders for investing a little bit of money No personal Liability Disadvantages Corporate stockholders usually pay higher taxes oooooo Identify internal and external users of financial information. Internal users- of accounting information are mangers who plan, organize, and run a business. These include marketing managers, production supervisors, finance directors, and company officers. Might ask questions such as: Is cash sufficient to pay dividends to Microsoft stockholders? (Finance) Can we afford to give General Motors employees pay raises this year? (Human Resources) What price for an Apple iPod will maximize the company’s net income? (Marketing) Which Pepsico product line is the most profitable? Should any product lines be eliminated? (Management) External users- users who are outside of the organization. There are several kinds. Investors use accounting to make decisions to buy, hold, or sell stock. Creditors such as suppliers and bankers use accounting information to evaluate the risks of selling or credit or lending money. Might ask questions such as: o lOMoARcPSD|46174839 Is General Electric earning satisfactory income? How does Disney compare in size to profitability to Time Warner? (Last one and this one Investors) Will United Airlines be able to pay its debts as they come due? (Creditors) Define and identify assets, liabilities, and stockholders’ equity accounts and the accounting equation. ASSESTS= LIABILITIES+ OWNERS EQUITY Assets- Resources owned by a business Liabilities- Amounts owed to creditors in the form of debts and other obligations. Owners Equity- The owners claim to assets. Identify activities as financing, investing, and operating. Example: Tootsie Roll Financing: came from personal saving’s and likely came from outside sources like banks. Investment: Invested the cash in equipment to run the business, such as mixing equipment and delivery trucks. Operating- Then he started making and selling the candy. Financing- to start or expand a business the owner or owners quite often need cash from outside sources. Two primary sources are: ● Borrowing money (debt financing) Amounts owed are liabilities Party to whom amounts are owed are creditors Notes payable and bonds payable are different types of liabilities. ● Issuing (selling) shares of stock for cash Payments to stockholders are called dividends. Investing- involve the purchase of resources (assets) needed to operate the business operation. Calculate components of the income statement, retained Operating- once a business has the asset’s it needs, it can begin it Resources owned by a business are called assets. Land (Property) Building (Plant) Equipment Cash Investments in debt or equity securities of another company. Revenues- Amounts earned from the sale of products (sales, revenue, service revenue, and interest revenue.) Inventory- Goods available for sale to customers. Accounts Receivable- Rights to receive money from a customer as the result of a sale. Credit Card is considered cash. Macy’s card would be accounts receivable. Expenses- cost of assets consumed or services used. (cost of goods sold, selling, marketing, administrative, interest, and income taxes expense). Liabilities arising from expenses include accounts payable, interest payable, wages payable, sales taxes payable, and income taxes payable. Net Income- when revenues exceed expenses Net loss- when expenses exceed revenues. If negative in (...) o earnings statement, and balance sheet and identify the interrelationships. Income Statement- Shows how successfully a business performed during a period of time. Reports the revenue and expenses for a specific time frame. owns and what it owes. *Reports revenues and expenses for a specific period of time. *Net Incomerevenues exceed expenses. *Net loss- expenses exceed revenues *Past net income provides information for predicting. Revenues- Expenses Revenues – cost of goods sold =gross profit –operating expenses =net income or net loss ooooo lOMoARcPSD|46174839 Retained Earnings Statement- Indicates how much income was distributes as dividends and how much was retained in the business. *Statements show amounts and causes of changes in retained earning during a period. *Reports assets and claims to assets at a specific point in time. *Assets have to come first and then liabilities and owners equity. *Time period is the same a that covered in the income statement. *Users can evaluate dividend payment practices. Before Balance +Net Income Net income is needed to determine ending balance in retained earnings -Dividends =Ending Retained Earnings Balance Sheet- Presents a picture at a point in time of what a business Assets (Cash, Accounts Receivable, Prepaid Insurance, Equipment, Inventory) =Liabilities (Notes Payable, Accounts Payable, Unearned service revenue, Salaries and wages payable, Interest payable) time and how much cash was used. Answers= lOMoARcPSD|46174839 +Owners Equity (Common + Preferred Stock+ Retained Earnings) Statement of Cash Flows: Shows sources of cash during a period of *Where did cash come from during the period? *How was cash used during the period.? *What was the change in cash in the cash balance during the period? Cash flow operating activities +Cash flow investing activities +Cash flow finance activities =Net cash from financing activities Net increase in cash Cash at beginning of period Cash at the end of period Identify the purpose of the auditor’s report. sheet. Earnings Per Share (EPS) = (Net Income – Preferred Dividends)/ Average Commons Shares Outstanding Define a current asset. Current Assets Long-Term Investments Property, Plant, Equipment Intangible Assets Current Assets lOMoARcPSD|46174839 Auditors opinion as to fairness of presentation of financial position and results of operations and their conformance with generally accepted accounting principles. Identify the different categories of assets found on the balance Auditor, a CPA who conducts an independent examination of the financial accounting data presented by a company. They give unqualified opinion, meaning they have no reservations concerning the material validity of the presented information, if the financial statements present the financial position, results of operations, and cash flow in accordance with accepted accounting standards. CHAPTER 2 Assets that a company expects to convert to cash or use up within one year or the operating cycle, which ever is longer. Operating Cycle is the average time it takes from the purchase of inventory to the collection of cash from customers. Common types of current assets are Calculate earnings per share. Identify the reasons companies pay dividends. o o o Cash Investments Receivables Inventories Prepaid Expenses Calculate the current ratio and understand its purpose. lOMoARcPSD|46174839 Companies also must at least maintain dividends at current levels to satisfy investors Provide certainty about the companies finical well being. They attract investors. If company does not pay it is so they can reinvest in the o company. Maybe if people feel like they are making money they will invest more money? Current Ratio= (Current Assets/ Current Liabilities) Liquidity Ratios measures the short-term ability of the company to pay it’s maturing obligations and meet unexpected needs for cash. One liquidity ratio is current ratios. o o One potential weakness of the current ratio is that it does not take into account is the composition assets. For example, a satisfactory current ratio does not disclose whether a portion of the current assets is ties up in slow moving inventory. The composition of the current assets matters because a dollar of cash is more readily available to pay the bills than dollar inventory. Interpret a high debt to assets ratio. Example, suppose a company’s cash balance declined while its merchandise inventory increased substantially. If it increased because the company is having difficulty selling its products, then the current ratio might not fully reflect the reduction on the company’s liquidity. A current ratio of 2 means that the company has twice as many current assets as current liabilities and has little risk of not meeting its current obligations. Debt to Assets Ratio= (Total liabilities/ Total assets) It measures the percentage of total financing provided by creditors rather than stockholders. Debt financing is more risky than equity financing because debt must be repaid at specific points in time, whether the company is performing well or not. Thus, the higher the percentage of debt financing, the risker the company. The adequacy of this ratio is often judged in the light of the company’s earnings. Generally, companies with relatively stable earnings, such as public utilities, can support higher debt to assets ratio than can cyclical companies with widely fluctuating earnings, such as many high tech companies. o Define free cash flow. Free cash flow= cash provided by operations- capital expendituresThis ratio means that the company has three times as much debt as equity. Cash provided by operations= how much money the business makes Capital Expenditures= plant, property, equipment Cash dividends= dividends in cash Define Generally Accepted Accounting Principles (GAAP) and the characteristic “relevant”. Generally Accepted Accounting Principles (GAAP)- A set rules and practices, having substantial authorities support, that the accounting profession recognizes as a general guide for financial reporting purposes. Relevance: Accounting information would have relevance if it would make a difference in a business decision. Information in considered relevant if it provides information that has predictive value, that is, helps provide accurate expectations about the future, and has confirmatory values, that is, confirms or corrects prior expectations. Materiality is a company specific aspect of relevance. An item is material when its size makes it likely to influence decision of an inventors. CHAPTER 3 Analyze the effect of business transactions on the accounting equation. Identify the characteristics of the double-entry system. Each transaction has a dual (double-side) effect on the equation. lOMoARcPSD|46174839 Transactions are economic events that require recording in the financial statements. Not all activities represent transactions. Assets, liabilities, or stockholders’ equity items change as a result of some economic event. Duel effect on the accounting equation oo o Record of increase and decreases in a specific asset, liability, equity, revenue, or expense item. Debit= Left Credit= Right Identify the sequence of steps in the recording process. lOMoARcPSD|46174839 Each transaction must affect two or more accounts to keep basic accounting equation in balance. Recording done by debating at least one account and crediting another. DEBITS = CREDIT If Debts are greater then credit, the accounts will have a debit balance. If Credit are greater than Debits, the accounts will have a credit balance. o o The Journal: Prepare or analyze journal entries. (Just Know How To Do It) Identify source documents. Source documents- such as a sales slip, a check, a bill, or a cash Book of original entry. Transactions recorded in chronological order. Contributions to the recording process. 1. Discloses the compete effects of a transaction. 2. Provides a chronological record of transaction. 3. Helps to prevent or locate errors because the debit and credit amounts can easily be compared. register tape, provide evidence of the transaction. Apply debit/credit rules and normal account balances. Apply the revenue recognition principle. Calculate net income using the accrual basis of accounting. Debit- Assets and Expenses go up with debit, this is it’s normal account balance. Credit- Liabilities, Owners Equity, and Revenues go up with credit, this is it’s normal account balance. Analyze account activity and calculate ending account balances. (Just Know How To Do It) Identify the purpose of a trial balance. Trial Balance lOMoARcPSD|46174839 A list of accounts and their balances at given time. Accounts are listed in the order in which they appear in the ledger. Purpose is to prove that debits equal credit. May also undercover errors in journalizing and posting. Useful in the preparation of financial statement. The trial balance my balance even when o A transaction is not journalized. A court journal entry in not posted. A journal entry is posted twice. Incorrect accounts are used in Journalizing or posting Or... offsetting errors are made in recording the amounts of a transaction. CHAPTER 4 Companies recognize revenue in the accounting period in which the performance obligation is satisfied. Basically, when you do the service, is the date you record it. Transactions recorded in the periods in which events occur. Revenues are recognized when services performed, even if cash is not received. Expenses are recognized when incurred, when cash was not paid. (Look at slide 12 as an example) Identify why adjusting entries are needed and analyze the impact of not making adjusting entries. In order for revenues to be recorded in period in which the performance obligations are satisfied, and for expenses to be recognized in the period in which they are incurred, companies make adjusting entries. Prepare adjusting journal entries. (Do examples) Define depreciation. o lOMoARcPSD|46174839 Ensure that the revenue recognition and expense recognition principles are followed. Are required every time a company prepares financial statements. Includes one income statement account and one balance sheet account. Never include cash! Adjusting entries are necessary because the trial balance the first pulling together of the transaction data- may not contain up to date and complete data. This is for several reasons 1. Some events are not recorded daily because it is not efficient to do so. Ex: are the use of supplies and the earning of wages by employees. 2. Some costs are not recorded during the accounting periods because these costs expire with the passage of time rather than as a result of recurring daily transactions. Ex: charges related to the use of buildings and equipment, rent, and insurance. 3. Some items may be unrecorded. Ex: Utility service bill that will not be received until the next accounting period. The process of allocating the cost of an asset to expense over its useful life. Buildings, equipment, and motor vehicles (long-lived assets) are recorded as assets rather than an expense, in the year acquired. Companies report a portion of the cost of a long-lived asset as an expense (depreciation) during each period of the asset’s useful life. Does not attempt to report the actual change in the value of the asset. o o o Identify the characteristics of the adjusted trial balance. Identify the purpose of closing entries. Calculate the retained earnings balance after closing entries. (Just know how to do it) o o Closing entries produce a zero balance in each temporary account. Temporary: All revenue accounts All expense accounts Dividends Permanent: lOMoARcPSD|46174839 Adjusted Trial Balance- prepared after all adjusting entries have been journalized and posted. Its purpose is to prove equality of the total debit and credit balance in the ledger after all adjustments have been made. Financial statements can be prepared directly from the adjusted trial balance. Order that it needs to be prepared in: Income statement -> Retained Earnings Statement-> Balance Sheet The purpose of the post-closing trial balance is to prove the equality of the permanent account balances the the company carries forward into the next accounting period. All temporary accounts will have a zero balance. At the end of the accounting period, companies transfer the temporary account balances to the permanent stockholders’ equity account- retained earnings. o All asset accounts All liability accounts Stockholders’ equity accounts next couple moments, up to date, real time. Ex: Bank statement on my phone. - Ending inventory Cost of good sold lOMoARcPSD|46174839 12/10/2015 Chapter 5: Analyze the flow of costs for a merchandising company. Beginning inventory + Purchase, net Available for sale How to calculate net purchase Purchases + Freight - Purchase discounts - Purchase returns and allowances Net Purchase Perpetual System-keeps up with how much inventory sold within the Facts: Maintain detailed records of the cost of each inventory purchase and sale. Records continuously, shows inventory that should be on hand for every item. Company determines cost of goods sold each time a sale occurs. Advantages of the perpetual system: Traditionally used for merchandise with high unit values Shows the quantity and cost of the inventory that should be on hand at any time. Provides better control over inventories than a periodic system. lOMoARcPSD|46174839 Periodic System- wait till end of the accounting period. NOT very detailed. Ex: You will not see that inventory is missing (possibly theft) until end of the accounting period. Facts: Does not keep a detailed record of the goods on hand. Cost of Good Sold determines by count at the end of the accounting period. Example calculations of Cost of Good Sold: Beginning inventory + Purchase, net Available for sale - Ending inventory Cost of good sold (100,000) +(800,000) (900,000) -(125,000) 775,000 Analyze purchase discounts and other costs associated with the purchase of inventory. Purchase Discounts: Credit Terms may permit buyer to claim a cash discount for prompt Examples/ Common Terms 2/10, n/30 : 2% discount if paid within 10 days, otherwise net amount due in 30 days. 1/10 EOM : 1% discount if paid within first 10 days of next month. n/10 EOM : 1% net amount due within the first 10 days of the next month. If she takes a discounts: Other Cost Associated FOB Shipping Point: EX: When I order something from Target. My responsibility when it goes to FedEx. (Inventory, cash) FOB Destination: Advantages: lOMoARcPSD|46174839 payment. Purchaser saves money. Seller shortens the operating cycle by converting the accounts receivables into cash earlier. #1 Account Payable 3,500 Inventory 70 Cash 3,430 If she does not take discounts: #3 Account Payable 3,500 Cash 3,500 Ownership of the goods passes to the buyer when the public carrier accepts the goods from the seller. Buy pays freight costs. FOB shipping point= Add as inventory in the books. Ownership of the goods remain with the seller until the goods reach the buyer. Seller pays the freight costs. Freight costs incurred by the seller are an operating expense. EX: Buy on eBay and they pay for the shipping. Their responsibility till I get it. (Freight out/ expense, cash) #1 Accounts Payable Inventory 300 300 Goods available for future sales to customers are considered inventory. lOMoARcPSD|46174839 Purchase Returns and Allowances Purchasers may be dissatisfied because goods are damaged or defective, of inferior quality, or do not meet specifications. Purchase Return: Return goods for credit if the sale was made on credit, or for cash refund if the purchase was for cash. EX: When I returned the strip dress from target this summer. Purchase Allowance: May choose to keep the merchandise if the seller will grant a reduction of the purchase price. EX: When I got a discount on my homecoming dress b/c the zipper. Define inventory: A complete list of items such as property, goods in stock, or the contents of a building. (Anything you can sell (widgets)) It is a current asset Identify when sales revenue is recorded. Companies may purchase inventory for cash or on account (credit). They normally record purchases when they receive the goods from the seller. Every purchase should be supported by business documents that provide written evidence of a transaction. Each cash purchase should be supported by a canceled check or a cash register receipt indicating the items purchases and amounts paid. Companies record cash purchases by an increase (debit) in Inventory and a decrease (credit) in Cash. Made using cash or credit (on account) Sales revenue, like service revenues, is recorded when the performance obligation is satisfied. Performance obligation is satisfied when the goods are transferred from the seller to the buyer. Sales invoice should support each credit sale. - This is what you do for the perpetual system lOMoARcPSD|46174839 Identify contra revenue accounts. Like Sales Returns and Allowances, Sales Discounts is a contra revenue account to Sale Revenue, which means it is offset against a revenue account on the income statement. The normal balance of sales returns and allowances is a debit. Companies use a contra account, instead of debiting sales revenue, to disclose in the accounts and in the income statement in the amount of sales return and allowances. Calculate net sales, cost of goods sold, gross profit, and the gross profit rate. Net Sales: Sales Revenue - Sales Return and Allowances - Sales Discounts Net sales Cost of Good Sold: #1 Cash OR Accounts Receivable xxx Sales Revenue xxx #2 Cost of goods sold xxx Inventory xxx Sales Discounts and sale returns and allowances are apart of contra revenue accounts. Beginning inventory + Purchase, net Available for sale Gross profit: Sales Revenue – Cost of Goods Sold Gross profit rate: Gross Profit / Net Sales - Ending inventory Cost of good sold lOMoARcPSD|46174839 Chapter 6: Calculate ending inventory based upon the physical count and ownership of goods. HW 6-1 shipping. - Consignment goods not included in inventory - If inventory becomes worthless, you cannot include it. - Take inconsideration of goods in transit, FOB destination or FOB - Study E6-2 from class book example EX: Illustration: Crivitz TV Company purchases three identical 50-inch TVs on different dates at costs of $700, $750, and $800. During the year Crivitz sold two sets at $1,200 each. These facts are summarized below. Calculate ending inventory under FIFO. Calculate cost of goods sold under LIFO. Kam Company has the following units and costs. Units Inventory, Jan. 1 8,000 Unit Cost $11 Units Purchase, June 19 13,000 Purchase, Nov. 8 5,000 Unit Cost 12, 13 lOMoARcPSD|46174839 If 9,000 units are on hand at December 31, what is the cost of the good sold under LIFO. (8,000 +13,OOO+5,000) – 9000 = 17,000 (5,000 * 13) = 65,000 (13,000 * 12) =144,000 144,000 + 65,000 = 209,000 Given sales, inventory transactions, expenses, and tax rate, calculate net income. EX: Calculate inventory turnover. = Cost of Goods Sold / Average Inventory * Average inventory = beginning inventory + ending inventory / 2 Define LIFO reserve. Sales Revenue - Sales Returns and Allowance - Sales Discounts lOMoARcPSD|46174839 Net Sales - Cost of Good Sold identify the accounting convention it represents. When the value of the inventory is lower than it’s cost. Gross Profit - Operating Expense Income before taxes - Income tax expense Net Income PRACTICE HW 5-6 Apply the lower of cost or market basis to inventory and Companies can “write down” the inventory to its market value in the period in which the price decline occurs. Market value = Replacement Cost Example of conservatism (allows you to anticipate future losses but not future gains.) Firms using LIFO must report the amount that inventory would increase ( occasionally decrease) if the FIFO method had been used. This reporting enables analysts to make adjustments to compare companies that use different cost flow methods oooo Creating a different net income Interpret the effect on the financial statements of an error in the physical inventory count. Inventory errors affect the computation of cost of goods sold and net income in two periods. lOMoARcPSD|46174839 Ending inventory under LIFO + LIFO reserve = Ending inventory under FIFO Lifo inventory - fifo inventory Fifo had higher cots than lifo when: cogs available for sale are the same ending inventory are different. Cogs are different Grossprofit is different An error in ending inventory of the current period will have a reverse effect on net income of the next accounting period. Over the two years, the total net income is correct because the errors offset each other. Ending inventory depends entirely on the accuracy of taking and costing the inventory. Chapter 7: Identify the three factors that contribute to fraudulent activity. Applies to publicly traded of internal control. Required to maintain a system of internal control. Corporate executives and board of directors must ensure that these controls are reliable and effective. Independent outside auditors must attest to the adequacy of the internal control system. SOX created the Public Company Accounting Oversight Board (PCAOB) lOMoARcPSD|46174839 Financial pressure – Employees sometimes commit fraud because of personal financial problems caused by too much debit. Or they might commit fraud because they want to lead a lifestyle that they cannot afford on the their current salary. Opportunity – (Most important from fraud triangle.) For an employee to commit fraud, the workplace environment must provide opportunities that an employee can exploit. Opportunities occur when the workplace lacks sufficient controls to deter and detect fraud. EX: inadequate monitoring of employee actions can create opportunities for theft and can embolden employees because they believe they will not be caught. Rationalization – In order to justify their fraud, employees rationalize their dishonest action. EX: Employees sometimes justify fraud because they believe they are underpaid while the employer is making lots of money. These employees feel justified stealing because they believe they should be paid more. Identify the requirements for internal controls enacted by the Sarbanes-Oxley Act. Methods and measures adopted to: 1. 2. 3. 4. Five primary components Given a scenario, identify the internal control principles being EX: Safeguard assets Enhance accuracy and reliability of accounting records Increase efficiency of operations. Ensure compliance and laws and regulations. control environments risk assessment control activities information and communication monitoring Bond employees who handle cash Rotate employees’ duties and require vacations Conduct background checks lOMoARcPSD|46174839 violated. 1. Human Resource Controls EX: Because of all the tools we have today, we need to make sure everything is the way it’s suppose to be. The main reason that people do not take vacations is because they are trying to hide something. This is why many companies say that vacations are mandatory. 2. Document Procedures EX: This is the reason that documents are numbered, you can tell which ones are missing. 3. Segregation of Duties EX: If someone is working in the balance books the other person should be in custody of cash on hand. So break up the duties. *The more people involved in a scandal which increase the chance of them being caught. 4. Physical Controls Companies should use prenumbered documents, and all documents should be accounted for. Employees should promptly forward source documents for accounting entries to the accounting department. Different Individuals should be responsible for related activities. The responsibilities for recordkeeping for an asset should be separate from the physical custody of that asset. 5. Independent Internal Verification separate should check their work. Just have someone who is unbiased towards each employer and put them in a situation. Make sure that the checking is random. 6. Establishment of Responsibility EX: If someone worked at a bank, each teller gets their own cashbox. Identify internal controls for cash. Cash Receipt Controls -Establishment of Responsibility: -Documentation Procedure: -Segregations of Duties cash. -Human Resource Controls lOMoARcPSD|46174839 Television monitors and garment sensors to detect theft. Safes, Vaults, and safety deposit boxes for cash and business papers. Alarms to prevent break-ins. Time clocks for recording time worked. Computer facilities with pass key access or fingerprint or eyeball scans Locked warehouses and storage cabinets for inventories and records. EX: Going back to the segregation of duties, someone else who is Records periodically verified by employee who is independent. Discrepancies reported to management. Control is most effective when only one person is responsible for a given task. Establishing responsibility often requires limiting access only to authorized personnel, and then identifying these personal. THERE ARE MANY EXAMPLES IN THE SLIDE. GO BACK AND PRACTICE Only designated personal are authorized to handle cash receipts (cashiers) Use remittance advice (mail receipts), cash register tapes or computer records, and deposit slips. Different individuals receive cash, record cash receipts and hold the Supervisors count cash receipts daily, assistant treasure compares total receipts to bank deposits daily. -Independent Internal Verification - Physical Control Cash Receipt Controls: (Over the Counter Receipts) lOMoARcPSD|46174839 Bond personal who handle cash; require employees to take vacations can conduct background checks. Store cash in safes and bank vaults: limit access to storage areas; use cash registers. Important internal control principle-segregation of record keeping from physical custody. Cash Receipt Controls: (Mail Receipts) Should be opened by two people; a list prepared, and each check endorsed “For Deposit Only” Each mail clerk signs list to establish responsibility for the data. Original copy of the list, along with the checks, is sent to the cashier’s department. Applications: Cash Disbursement Control: Voucher System Control Features: Use if a Bank The use of a bank contributes significantly to good internal control Copy of the list is sent to the accounting department for recording. Clerk also keeps a copy. lOMoARcPSD|46174839 when companies pay by check or electronic funds transfer (EFT) rather than by cash. Cash Disbursement Control Generally, internal control over cash disbursements is more effective Voucher System Controls Petty Cash Fund A network of approval by authorized individuals, acting independently, to ensure all disbursements by check are proper. A voucher is an authorized form prepared for each expenditure in a voucher system. over cash, Prepare a bank reconciliation. (This problem will not contain any errors as reconciling items.) Reconciling Items: Control Features: Use if a Bank : Bank Statements Debit Memorandum Minimizes the amount of currency on hand. Creates a double record of bank transactions. Bank Reconciliation. Credit Memorandum Bank service charge. NSF (not sufficient funds) Collect notes Receivable Interest Earned *Above all are TIME LAGS BANK Deposits in Transit Outstanding Checks Banks Memoranda Errors – prob. won’t contain Beginning Balance Per Bank + Deposit in Transit - Outstanding Checks Correct Balance BOOK Beginning Balance Per Book + Notes collected by bank - NSF (bounced) checks - Check printing or other service charge Correct Balance Prepare journal entries related to petty cash. Petty Cash Fund: used to pay small amounts. Involves: Establishing the fund March 1 Petty Cash 100 100 Cash Making payments from the fund Replenishing the funds lOMoARcPSD|46174839 REVIEW 7-14 REVIEW 7-15 result from the sale of goods and services. Jul. 5 Sales returns and allowances 100 (PRACTICE WITH JOURNAL ENTRIES) Chapter 8: Define trade receivables. - Notes and accounts receivable that result from sales transactions. Account Receivables- Amounts customers owe on account that EX: Illustration: Assume that Jordache Co. on July 1, 2014, sells merchandise on account to Polo Company for $1,000 terms 2/10, n/30. Prepare the journal entry to record this transaction on the books of Jordache Co. Jul. 1 Jordache Co. Accounts Receivable Sales Revenue 1,000 1,000 Illustration: On July 5, Polo returns merchandise worth $100 to you use your JCPenney Company credit card to purchase clothing with a sales price of $300. Illustration: On July 11, Jordache receives payment from Polo Company for the balance due. Jul. 11 Cash Sale discounts ($900 x .02) 882 18 to be received. Accounts Receivable 900 lOMoARcPSD|46174839 Accounts Receivable 100 Illustration: Some retailers issue their own credit cards. Assume that charges 1.5% per month on the balance due Accounts Receivable Sales Revenue 300 Assuming that you owe $300 at the end of the month, and JCPenney Accounts Receivable 300 Interest Receivable - Companies may grant credit in exchange for a promissory note- a written promise to pay a specified amount of money on demand or at a definite time. 300 Notes Receivables- Written promise (formal instrument) for amount Primary Notes may be used: When individuals and companies lend or borrow money When amount of transaction and credit period exceed normal limits In settlement of accounts receivable. oo o Illustration: Brent Company wrote a $1,000, two-month, 8% promissory note dated May 1, to settle an open account. Prepare entry would Wilma Company makes for the receipt of the note. accepting a five-month, 9% interest note. If Wolder presents the note to Higley Inc. on November 1, the maturity date, Wolder’s entry to record the collection is: May 1 Notes Receivable 1,000 Accounts Receivable 1,000 Illustration: Wolder Co. lends Higley Inc. $10,000 on June 1, Nov 1 Cash 10,375 Notes Receivable 10,000 300 to employees, and income tax refundable. Interest Revenue 375 ($10,000 X 9% X 5/12 =375) lOMoARcPSD|46174839 Nontrade receivables- such as interest, loans, to officers, advance Calculate net accounts receivable. Gross Accounts Receivable – Allowance for doubtful accounts = net accounts receivable AR 10,000 10% allowances doubt (1000) (How much $ you are expecting not to make) losses associated with accounts receivable should be recorded. Net 9000 Bad Debit Expense 1000 Allowance- for Doubtful accounts 1000 Net accounts receivable = the amounts you expect to make *What happens to net accounts during write off’s? Nothing Identify the accounting period bad debt expense from credit Exercise 8-5 from homework (Means you subtract) Using the allowance method, prepare the adjusting entry for bad debt expense. Exercise 8-5 from homework - Actual uncollectible are debited to Allowance for Doubtful Accounts and credited to Accounts Receivable at the time the specific account written off as uncollectible. Prepare journal entries associated with a note receivable and interest revenue. Exercise 8-7 from homework Analyze the accounts receivable turnover and average collection period. Exercise 8-10 Submission from homework Accounts Receivable Turnover: Assess the liquidity of the receivables. Average Collection period receivables. lOMoARcPSD|46174839 Measure the number of times, on average, a company collects receivables during the period. Identify methods to accelerate the receipt of cash from Use the assess effectiveness of credit and collection policies. Collection period should not exceed credit term period. A common way to accelerate receivables collection is a sale to a factor. A factor is a finance company or bank that buys receivables from businesses for a fee and then collects the payments directly from the customers. Chapter 9: Using the historical cost principle, calculate the cost of land and equipment. Cost of land: All necessary costs inquired in making land ready for its intended use increase (debit) the Land account. Cost typically include: 1. Cash purchase price 2. Closing sots such as title and attorney’s fees, 3. Real estate brokers’ commission, and 4. Accrued property taxes and other liens on the land assumed by the purchaser. Illustration: Assume that Hayes Manufacturing Company acquires real estate at a cash cost of $100,000. The property contains an old warehouse that is razed at a net cost of $6,000 ($7,500 in costs less $1,500 proceeds from salvaged materials). Additional expenditures are the attorney’s fee, $1,000, and the real estate broker’s commission, $8,000. Cash price property (100,000) Net removal cost of warehouse (6,000) Attorney’s fees (1,000) Real estate broker’s commission (8,000) Land 100,000 6,000 1,000 8,000 HW 9-3 Cost of equipment: lOMoARcPSD|46174839 Include all costs incurred in acquiring the equipment and preparing it for use. Cost Typically Include: 1. Cash purchase price 115,000 2. Sales TAX 3. Freight Changes 4. Insurance during transit paid by this purchaser 5. Expenditures required in assembling, installing, and test the unit. price of $22,000. Related expenditures are sales taxes $1,320, painting and lettering $500, motor vehicle license $80, and a three-year accident insurance policy $1,600. Prepare the journal entry to record these costs: Equipment 23,820 License expense 80 Prepaid insurance 1600 Illustration: Lenard Company purchases a delivery truck at a cash Compute the cost of the delivery truck. Cost of Delivery Truck Truck 22,000 1,320 500 23,820 Cash Price Sales Taxes Painting and lettering Identify the factors in computing depreciation. year is involved. Given a scenario, calculate the book value of a long-lived asset. Cost – Accumulated Depreciations = Book value Calculate depreciation expense after a change in salvage value. Calculate the gain or loss on the disposal of a plant asset. Calculate return on assets. Return on Assets: Net Income Average Total Assets Identify where intangible assets are found on the balance Cash 25,500 lOMoARcPSD|46174839 Calculate depreciation expense using the straight-line method. Cost – Salvage value = Deprecation = Straight line method Useful life in years - Make sure you look how many months are left in year, if more than 1 HW 9-5 HW 9-6 P9-3A P9-6A sheet. - Patents Copyrights Franchise or license Trademarks Trade names - Goodwill lOMoARcPSD|46174839 Intangible assets with a theoretically infinite life such as goodwill cannot be amortized and therefor do not appear on the balance. If the intangible assets have an identifiable value and lifespan they appear on the balance sheet as long term assets valued according to their purchase prices and their amortization prices. Accounting FINAL 12/10/2015 lOMoARcPSD|46174839 Chapter 1 & Chapter 2 Calculate components of the income statement, retained earnings statement, and balance sheet (for example, given selected financial information calculate the total current assets). Revenue - Expense Net Income Retained Earning’s Statement Retained Earnings (Beg Balance) + Net Income - Dividends Retained Earning (Ending Balance) Balance Sheet Assets Income Statement Current Assets Cash Investments Receivables Inventories Prepaid expense ooooo Long-Term Investments Investments in stock and bonds o + Liabilities Plants Property and Equipment Long useful lives Currently used in operations Land, Buildings, Equipment, Delivery Vehicles, and Furniture -Depreciationallocating the cots of assets to number of years. -Accumulated deprecation- total amount of depreciation expensed thus far in the asset’s life. Intangible Assets Assets that do not have a physical substance. Includes: o o Long term assets Long term notes receivable oooo o oo Goodwill Patents Copyright Trademarks/ tradenames Current Liabilities (Notes Payable) (Accounts Payable) (Unearned Service Revenue) (Salaries and Wages Payable) oooo lOMoARcPSD|46174839 o (Interest Payable) = Stockholders Equity Use the accounting equation to solve for an unknown. Equity Long- term liabilities Bonds payable Mortgages Payable Long Term notes payable Lease liabilities Pension liabilities ooooo (Common Stock) (Retained Earnings) Assets= Liabilities + Stockholders lOMoARcPSD|46174839 Chapter 3 Analyze the effect of business transactions on the accounting equation. HW 3-2, 3-11 Transactions are economic events that require recording in the financial statements. Not all activities represent transactions. Assets, liabilities, or stockholders’ equity items change as a result of some economic event. Duel effect on the accounting equation lOMoARcPSD|46174839 * The process of identifying the specific effects of economic events on the accounting equation. (Go over slides in Chapter 3: 10-20) Identify activities as financing, investing, and operating. Financing- borrowing money, issuing shares of stock, and paying dividends. To start or expand a business the owner or owners quite often need cash from outside sources. Investing- include the purchase or sale of long-lived assets used in operating a business, or the purchase or sale of investment securities. Operating- involve providing guide services. Example: Tootsie Roll Involve the purchase of resources (assets) needed to operate the business. Once a business has the asset’s it needs, it can began it’s operation. Chapter 4 Apply the revenue recognition principle. June Accounts Receivable Service Revenue lOMoARcPSD|46174839 Financing: came from personal saving’s and likely came from outside sources like banks. Investment: Invested the cash in equipment to run the business, such as mixing equipment and delivery trucks. Operating- Then he started making and selling the candy. Companies recognize revenue in the accounting period in which the performance obligation is satisfied. The day you complete the service, is the date you record. o EX: Assume Conrad Dry Cleaners cleans clothing on June 30, but customers do not claim and pay for their clothes until the first week of July. The journal entries for June and July would be: July Cash Account Receivable 0 0 100 100 Calculate net income from an adjusted trial balance. Trial Balance- Each account is analyzed to determine whether it is complete and up to date. You just take Revenue – Expenses from your adjusted trial balance. Prepare adjusting journal entries for prepaid rent and interest. Prepaid Expenses- Payment of cash, that is recorded as an asset because service or benefit will be received in the future. Costs that will expire either with the passage of time or through Rent Expense 100 Prepaid Rent 100 Interest Expense 100 Interest Expense 100 2/10, n/30 : 2% discount if paid within 10 days, otherwise net amount due in 30 days. 1/10 EOM : 1% discount if paid within first 10 days of next month. n/10 EOM : 1% net amount due within the first 10 days of the next month. detailed. Ex: You will not see that inventory is missing (possibly theft) until end of the accounting period. If she takes a discounts: #1 Account Payable Inventory 3,500 70 Facts: increase (debit) to expense account decrease (credit) to an asset account. Cash 3,430 If she does not take discounts: #3 Account Payable Cash 3,500 3,500 Calculate cost of goods sold under a periodic system. Periodic System- wait till end of the accounting period. NOT very Does not keep a detailed record of the goods on hand. Beginning inventory + Purchase, net Available for sale - Ending inventory Cost of good sold Chapter 6 (100,000) +(800,000) (900,000) -(125,000) 775,000 If 9,000 units are on hand at December 31, what is the Inventory, Jan. 1 Purchase, June 19 Purchase, Nov. 8 Units 8,000 13,000 5,000 Unit Cost $11 12 13 period. Example calculations of Cost of Good Sold: Kam Company has the following units and costs. cost of the ending inventory under LIFO? *100,000 lOMoARcPSD|46174839 Cost of Good Sold determines by count at the end of the accounting Calculate ending inventory using LIFO. Calculate cost of goods sold and gross profit using average cost. Cost of good sold practice: Davidson Electronics has the following: Units Unit Cost Chapter 7 Prepare a bank reconciliation. Inventory, Jan 1 5,000 $80 Purchase, April 2 15,000 10 Purchase, Aug. 28 20,000 12 If Davidson has 7,000 units on hand at December 31, the cost of ending inventory under the average-cost method is: -75,250 (net sales- cost of good sold) gross profit. Sales Revenue - Sales Return and Allowances - Sales Discounts budget. Net sales Reconciling Items: *Above all are TIME LAGS BANK Deposits in Transit Outstanding Checks Banks Memoranda Errors – prob. won’t contain Beginning Balance Per Bank + Deposit in Transit - Outstanding Checks Correct Balance lOMoARcPSD|46174839 BOOK Calculate the amount of cash to borrow based upon a cash Beginning Balance Per Book + Notes collected by bank - NSF (bounced) checks - Check printing or other service charge Correct Balance - If you do not meet the minimum this is what you do. Jul. 1 EX: Accounts Receivable Sale revenue 1,000 1,000 lOMoARcPSD|46174839 HW 7-14 Chapter 8 Calculate the cash received from an account receivable when a sales discount is taken. EX: Illustration: Assume that Jordache Co. on July 1, 2014, sells merchandise on account to Polo Company for $1,000 terms 2/10, n/30. Prepare the journal entry to record this transaction on the books of Jordache Co. to Jordache Co. 100 EX: 900 bad debt expense. Illustration: On July 5, Polo returns merchandise worth $100 Jul. 5 Jul. 11 Sales and returns and allowances 100 Accounts Receivable Illustration: On July 11, Jordache receives payment from Polo Company for the balance due. Cash 882 Sale discounts ($900 x .02) 18 Accounts Receivable Chapter 9 Prepare the adjusting entry to record the estimate of EX: EX: 8-5 HW When counting the days omit the day issues but not the due date. * Be able to solve for the time Bad Debt Expense Allowance for Doubtful accounts 1000 1000 Calculate the duration of a note receivable given the interest rate and interest expense. Identify items classified as property, plant, and equipment. Plant: All necessary costs incurred in making land ready for it’s intended use increase (debit) the Land account. Equipment: Include all costs incurred in acquiring the equipment and preparing it for use. Cash purchase price Sales Taxes Freight Charges Insurance during transit paid by the purchaser Expenditures required in assembling, installing, and testing the units. * Are critical to a companies success Property: lOMoARcPSD|46174839 Physical substance (a definite size and shape) Are used in the operations of a business Are not intended for sale to customers Are expected to provide service to the company for a number of years, except for land. Cash purchase price Closing costs such as title and attorney’s fee Real estate brokers’ commission, and Accrued property taxes and other liens on the land assumed by the purchaser. Cost – Salvage value = Deprecation How many years they want X Depreciation= accumulated depreciation Calculate depreciation expense and accumulated depreciation. (Read from the book) Chapter 10: Define current liability. Determine correct accounting for repairs and maintenance. Current liabilities: Tax Salaries and Wages Interest Notes payable Accounts payable Unearned revenue EX: lOMoARcPSD|46174839 Company expects to pay the debt from existing current assets or though the creation of other current liabilities. Company will pay the debt within one year or the operating cycle, which ever one is longer. And Accrued liabilities: 2014, if Cole Williams Co. signs a $100,000 12%, four month note maturing on January 1. When a company issues an interest-bearing note, the amount of the assets it receives generally equals the note’s face value. Prepare journal entries associated with notes payable. Practice 10-1 HW First National Bank agrees to lend $100,000 on September 1, makes an adjusting entry at December 31 to recognize interest. Sept 1 EX: Cash Notes Payable 100,000 100,000 If Cole Williams Co. prepares financial statements annually, it value of the note plus interest. It records payment as follows. Cash 104,000 Dec 31 EX: Interest expense Interest Payable 4,000 4,000 Determine proper classification (current or long-term) for a note payable on the balance sheet. Current Maturities of Long-Term Debt Portion of long-term debt that comes due in the current year. No adjusting entry required. EX: Wendy Construction issues a five-year, interest-bearing $25,000 note on January 1, 2011. This note specifies that each January 1, starting January 1, 2012, Wendy should pay $5,000 of the note. When the company prepares financial statements on December 31, 2011, What amount should be reported as a current liability? 5,000 What amount should be reported as a long-term liability? 20,000 sales of $10,000 and sales tax of $600 (sales tax rate of 6%), the journal entry is: Mar. 25 Cash 10,600 Sales Revenue 10,000 EX: lOMoARcPSD|46174839 At maturity (January 1) Cole Williams Co, must pay the face Jan 1 Notes Payable Interest Payable 100,000 4,000 Identify the correct journal entry to record sales tax. Practice 10-1 HW The March 25 cash register readings for Cooley Grocery show Cooley Grocery rings up total receipts of $10,600. Because the amount received from the sales is equal to the sales price 100%, plus 6% of sales, (sales tax rate of 6%), the journal entry is: Assume Cargo Corporation records its payroll for the week of March 7 as follows: Mar. 7 Salaries and Wages Expense FICA tax payable Federal Income tax payable State Income tax payable Salaries and Wages Payable 100,000 7,650 21,864 2,922 67,564 67,564 67,564 Ex: Understand the journal entry to record payroll. EX: Mar. 25 Cash Sales Revenue Sales tax payable 600 Record the payment of this payroll on March 7 EX: Mar. 7 Salaries and Wages Payable Cash lOMoARcPSD|46174839 Sales tax payable 600 10,600 10,000 Based on Cargo Corps’s 100,000 payroll, the company would record the employer’s expense and labiality for these payroll taxes as follows. Payroll tax expense 13,850 FICA tax payable 7,650 State unemployment taxes payable 800 Federal unemployment tax payable 5,400 DO WE NEED TO KNOW THIS? E10-6 each for its five-game home schedule. The entry for the sales of season ticket is: Sept 7 Unearned Ticket Revenue 100,000 lOMoARcPSD|46174839 Identify the journal entry for unearned revenues. EX: Aug 6 Cash 500,000 Unearned Ticket Revenue 500,000 As each game is completed. Superior records the earning of revenue. Superior University sells 10,000 season football tickets at $50 Ticket Revenue 100,000 E10-5 function of three factors: 1. Thedollaramountstobereceived 2. The length of time until the amounts are received 3. The market rate of interest The process of finding the present value is refereed to as discounting the future amounts. EX: Calculate the selling price of a bond. The current market price (present value) of a bond use a Assume that Acropolis Company on January 1, 2014, issues $100,000 of 9% bonds, due in 5 years with interest payable annually at end-year. o Based on interest rates, determine if a bond would be sold at a premium (above face value) or a discount (below face value). lOMoARcPSD|46174839 Present values of $100,000 received in 5 years = $64,993 Present value of $9000 received annually for 5 yrs= $35,007 Market Price of bonds = $100,000 $100,000, five year, 10% bonds at 98 (98% of face value) with interest Ex: Assume that on January 1, 2014, Candlestick Inc, sells payable on January 1. The entry to record the insurance is: Jan.1 Cash Discount on bonds payable Bonds payable 98,000 2,000 Sale of bonds below face value causes the total cost of borrowing to be more than the bond interest paid. The reason: Borrower is required to pay the bond discount at the maturity date. Thus, the bond discount is considered to be a increase in the cost of borrowing. sell at 102 rather then 98. Then entry record the sale is: EX: Assume that the Candlestick Inc. bonds previously described 100,000 Jan.1 Cash 102,000 Discount on bonds payable Bonds payable The carrying value of the bonds is the face value of the bonds less unamortized bond discount or plus unamortized bond premium at the redemption date. EX: lOMoARcPSD|46174839 100,000 102,000 Sale of bonds above face value causes the total cost of borrowing to be less than the bond interest paid. The reason: The borrower is not required to pay the bond premium at the maturity date of the bonds. Thus, the bond premium is considered to be a reduction in the cost of borrowing. Calculate the gain or loss on the redemption of a bond. Practice 10-1 HW Assume at the end of the fourth period, Candlestick Inc., having sold its bonds at a premium, retires the bonds at 103 after paying the annual interest. Assume that the carrying value of the bonds at the redemption date is $100,400 (principal $100,000 and premium $400). Candlestick records the redemption at the end of the fourth interest period (January 1, 2018) as: Bonds Payable 100,000 Premium on bonds payable 400 Loss on bond redemption 2,600 (DOES PREIMUM = LOSS???????????????????????????????????) Cash 103,000 100,000 * 1.03 = 103,000 Premium 400 103,000- 400= 2,600 (loss on redemption) Chapter 11: Interpret the corporate characteristic of limited liability. Limited Liability of Stockholders: Limited to their investment. common stock and calculate total shares issued. lOMoARcPSD|46174839 E10-14 EX: If the stockholder invests $500 they can only lose up to $500. - This is an advantage Understand the journal entry to record the issuance of 11-2, 11-4 (a) hw Primary Objectives: Identify the specific source of paid- in capital. Maintain the distinction between paid- in capital and retained earnings. value common stock. Prepare Hydro Slide’s journal entry if (A) 1,000 share are issued for $1 par share, and (B) 1,000 shares are issued for $5 per EX: share. 1,000 1,000 4,000 Assume that Hydro-Slide Inc issues 2,000 shares of $1 par A) Cash B) Cash Common stock(1,000 X $1) 1,000 5,000 Common stock(1,000 X $1) Paid in capital in excess of par value Stockholders equity section assuming Hydro-Slide, Inc. has retained earnings of $27,000. EX: reacquired from shareholders, but not retired. Corporations purchase their outstanding stock: Purchase of Treasury Stock: lOMoARcPSD|46174839 Define treasury stock. Treasury Stock- corporation’s own stock that it has To reissue shares to officers and employees under bonus and stock compensation plans. To increase trading of the company’s stock in the securities market. To have additional shares available for use in acquiring other companies. To increase earning per share. Generally accounted for by the cost method. Debit Treasury Stock for the price paid. Treasury stock is a contra stockholder’s equity account, not an asset. Treasury Stock decreases by the same amount when the company later sells the shares. cumulative preferred stock outstanding. Each $100 share pays a $7 dividend (.07 x $100). The annual dividend is $35,000 (5,000 x $7 per share). If dividends are two years in arrears, preferred stockholders are entitled to receive the following dividends in the current year. Calculate preferred stock dividends. EX: Scientific Leasing has 5,000 shares of 7%, $100 par value, Identify the declaration date, record date, or payment date associated with dividends. dividend. Declaration Date- board meets and authorizes dividends. Record Datethe day people learn they are eligible for dividends. Payment Date- People who own stock on the record dates get’s their money. Identify the journal entry to record the declaration of a EX: lOMoARcPSD|46174839 A debit balance in Retained Earnings is identified as a Deficit. Retained Earning Restrictions: >Capital stock In excess of par value- common stock +In excess of stated value- common stock Additional paid in capital o December 2 (Record Date) December 3 (Payment Date) Legal restrictions (gov) Contractual restrictions (lenders) Voluntary Restrictions (board of directors) Calculate total paid-in capital. Two classification of paid-in capital: >Additional paid-in capital Common Stock + Preferred Stock lOMoARcPSD|46174839 On Dec. 1, the directors of Media General declare a $0.50 per share cash dividend on 100,000 shares of $10 par value common stock. The dividend is payable on Jan. 20 to shareholders of record on Dec. 22: for use in the business. December 1 (Declaration Date) Cash Dividends 50,000 50,000 Dividends Payable No entry Net Income increase retained earnings and a net loss decreases Retained Earnings. Retained earnings is part of the stockholders’ claim on the total assets of the corporations. Recorded under stockholders equity Dividends Payable Cash 50,000 50,000 Define retained earnings. Retained Earnings- is the net income that a company retains Capital stock >Paid in capital CAPITAL STOCK + ADDITONAL PAID IN CAPITAL= TOTAL PAID IN CAPITAL Calculate total stockholders’ equity. lOMoARcPSD|46174839 11-9 Retained Earnings +Total Paid in Capital Total paid in capital and retained earnings - Treasury Stock Stockholders equity 11-9 Chapter 12: Identify the purpose of the Statement of Cash Flows and the three classifications of cash flows. Provides information to help assess: 3 Classifications of cash flows. Entity’s ability to generate future cash flow. Entity’s ability to pay dividends and obligations. Reasons for the difference between net income and net cash provided (used) by operating activates. Cash investing and financing transactions during period. Operating Activities- Income statement items. Investing Activities- Changes in investments and long term assets activities. Financing Activates- Changes in long term liabilities and stockholder equity. Distinguish among operating, investing, and financing lOMoARcPSD|46174839 Class Activity E12-6 AND 12-2 HW E12-3 Identify the relationship between net income and operating cash flows during the maturity phase. Using the indirect method, calculate net cash provided by operating activities. HW 12-4 lOMoARcPSD|46174839 Capital Expenditures- Cash Dividends Calculate net cash provided by investing activities. HW 12-3 Calculate free cash flow. 12-9 Free cash Flow= Cash Provided by Operating Activates-