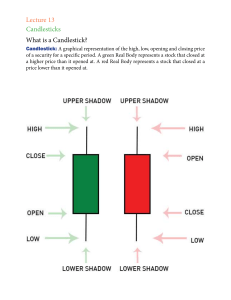

STUDY MATERIAL highest price closing price OPENING price LOWEST price highest price OPENING price OPENING price LOWEST price Disclaimer : All information of this study material gathered from internet . Please recheck all information before taking any action on investment . This study material to helps you enhance your knowledge. It's open source of information Anybody can use this for personal or commercial purpose. Bullish Candlestick Pattern Hammer Candlestick Pattern Piercing Pattern Bullish Engulfing Pattern Real Body the second candle engulfing the first candle Closing Should Be More than 50% of the previous candlestick Long Lower Shadow Morning Star Pattern Bullish Harami Candlestick Pattern Three White Soldiers Marubozu Candlestick Pattern Inverted Hammer Candlestick Pattern Bearish Candlestick Pattern Hanging man Candlestick Pattern Dark cloud cover Bearish Engulfing Pattern the close must be more than 50% Evening Star Pattern Three Black Crows Candlestick Pattern Bearish Harami Candlestick Pattern Black Marubozu Shooting Star Candlestick Pattern 1. Hammer Candlestick Pattern Bullish Candlestick Pattern Real Body Long Lower Shadow As we have discussed above, Hammer is formed after the stock prices have been falling, indicating that the prices are attempting to form a bottom. Hammers signal that the bears have lost control over the prices, indicating a potential reversal to an uptrend. One should note that this candlestick should be formed after three or more bearish candles as it gives more confirmation. Trading Example Trading TF. 15M To 1D 2. Piercing Pattern Closing Should Be More than 50% of the previous candlestick Investors must look at a few characteristics when they trade with the piercing pattern: Firstly, the trend should be downtrend, as the pattern is a bullish reversal pattern. Secondly, the length of the candlestick plays an important role in determining the force with which the reversal will take place. The gap down between the bearish and bullish candlesticks indicates how powerful the trend reversal will be. Fourthly, the bullish candlestick should close more than the midpoint of the previous bearish candlestick. Lastly, the bearish, as well as the bullish candlestick, should have larger bodies. Trading Example Trading TF 4H To 1D Piercing Pattern 3. Bullish Engulfing Pattern The bullish engulfing candle signals reversal of a downtrend and indicates a rise in buying pressure when it appears at the bottom of a downtrend. This pattern reverses the ongoing trend as more buyers enter the market and move the prices up further. The pattern involves two candles, with the second green candle that is completely engulfing the body of the previous red candle. Trading Example Trading TF 5M To 1D 3. Bullish Engulfing Pattern 4. Morning Star Pattern When the market is in a bearish trend, most traders expect that it is going to continue down further. The current market sentiment is bearish, and traders are either shorting or out of the market waiting for a bullish trend to start. When the first candle of the morning star forms, this sentiment holds one. When the second candle is formed, then the market seems to be another bearish day as the candle gaps down. As the market has gone down quite a lot, some traders may begin to think that it is going to reverse. They start assuming that reverse must be coming, as it has continued down for some time. Due to this the buying pressure increases and it makes it harder for the bears to continue pushing the prices down. The market closes around where it opened, and thus creates a Doji candlestick pattern. The third-day candle confirms that the bulls have taken control over the prices. The market gaps up and more people are expecting the trend to get reverse. Due to this sentiment, the third candle is a bullish candlestick. Trading Example Trading TF 5M To 1D Morning Star Pattern 5. Three White Soldiers The three white soldiers pattern is a bullish reversal candlestick pattern that occurs at the bottom of a downtrend. As the name suggests, this pattern consists of three candlesticks that are green in color. This candlestick pattern signals an upcoming uptrend because of the strong buying pressure. These candlesticks do not have long shadows and open within the real body of the previous candle in the pattern. Trading Example Trading TF 30M To 1D Three White Soldiers 6. Marubozu Candlestick Pattern A Marubozu is a single candlestick having a long real body and with no shadows. This real body indicates a strong movement that may be in any particular direction either upside or downside. When a bullish Marubozu is formed, it indicates that the price opened, traded higher, and finally closed in the mid of an attempt to rise further. Here the opening price is the same as the low price and the closing price is the same as the high price. Trading Example Trading TF 5M To 1D Marubozu Candlestick Pattern 7. Bullish Harami A Bullish Harami candlestick is formed when a large bearish red candle appears on Day 1 that is followed by a smaller bearish candle on the next day. One should note that the important aspect of the bullish Harami is that prices should gap up on Day 2. Trading Example Trading TF 1D Bullish Harami 8. Inverted Hammer The Inverted Hammer is a signal of bullish reversal after a downtrend. It tells the traders that the bulls are now willing to buy the stock at the fallen prices. After the downtrend, there is pressure from the buyers in the market to raise the stock prices. It tells the sellers in the market to exit as they may be a bullish reversal and tells the buyers to enter their buying position as the bullish trend is about to start. But remember to confirm this signal with other technical indicators as it may sometimes fall signals. You can also wait for the next trading day to confirm the beginning of the bullish trend. If in the next trading session the opening price is more than the closing price of the inverted hammer candlestick then you can enter the buy position Trading Example Trading TF 5M To 1D Inverted Hammer 1. Hanging man Bearish Candlestick Pattern Traders should look at a few characteristics of this pattern and take advantage of the formation of this pattern. The long lower shadow of this pattern indicates that the sellers have entered the market. Usually, pattern with longer lower shadows seems to have performed better than the Hanging Man with shorter lower shadows. This candlestick pattern can be either green or red but this does not play a significant role in the interpretation of this candlestick pattern. The signal given by this pattern is confirmed when the bearish candle is formed on the next day. The traders should also analyze if the volume has increased during the formation of this pattern. Traders can enter a short position at the closing price of this candlestick or at the opening price of the next bearish candlestick. Trading Example Trading TF 5M To 1D Hanging man 2. Dark cloud cover the close must be more than 50% The Dark Cloud Cover pattern includes a large black candle forming a “dark cloud” over the previous day’s candle. The buyers push the price higher at the open, but then the sellers take over later in the session and push the prices down. This shift from buying to selling signals that a price reversal to the downside could be forthcoming. Most traders consider the Dark Cloud Cover pattern useful only when it occurs at the end of an uptrend As the prices rise, the pattern becomes more important for the reversal to the downside. If the price action is choppy then the pattern is less significant as the price remains choppy after this pattern. Trading Example Dark cloud cover Trading TF 5M To 1D 3. Bearish Engulfing The bearish engulfing pattern is the opposite of the bullish pattern. It signals a reversal of the uptrend and indicates a fall in prices by the sellers who exert the selling pressure when it appears at the top of an uptrend This pattern triggers a reversal of the ongoing trend as more sellers enter the market and they make the prices fall. Trading Example Bearish Engulfing Trading TF 5M To 1D 4. Evening Star An Evening Star is a candlestick pattern that is used by technical analysts for analyzing when a trend is about to reverse. It consists of three candlesticks: a large bullish candlestick, a small-bodied candle, and a bearish candlestick. Evening Star patterns appear at the top of a price uptrend, signaling that the uptrend is going to end. Trading Example Evening Star Trading TF 5M To 1D 5. Three Black Crows Three Black pattern is a multiple candlestick chart pattern that is used to predict reversal to the downtrend. This candlestick pattern is formed when the bearish forces come into the action and make the prices fall for three consecutive days. Traders should take a short position after this bearish candlestick pattern is formed. Traders can also take the help of volume and technical indicators to confirm the formation of this candlestick pattern. Trading Example Three Black Crows Trading TF 5M To 1D 6. Black Marubozu Black Marubozu is a large black candle with no wicks on either end. This candle is considered to be very bearish. This pattern can lead to a continuation of current downtrend or start of a bullish reversal. Trading Example Black Marubozu Trading TF 5M To 1D 7. Bearish Harami A Bearish Harami candlestick is formed when there is a One should note that the important aspect of the bearish Trading Example Bearish Harami Trading TF 1D