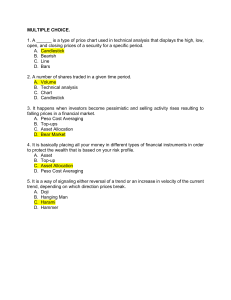

Richard’s Candlestick Cheat Sheet Brought to you by Price Action & Income Hey traders! Richard Krugel here. In this PDF, you’ll find a complete guideline to my entry conditions—plus my top 3 candlesticks and my top 3 price action patterns. Before we dive in, let’s take a look at the questions my entry conditions are designed to answer: 1. Is price at an area that fits in with my analysis? 2. Is there momentum divergence as price enters that area? 3. Are reversal candlestick patterns present in that area? 4. If conditions 1 -3 are all met, do I have sufficient capital to take a trade associated with the risk on this particular setup? My objective is to determine the main trend, and to join that trend at the end of corrections with as little risk as possible. 4 Steps for Qualifying Trade Entries Entry Condition 1: Analysis As mentioned above, my analysis is based on following and identifying corrective patterns, and pinpointing the areas where they are most likely to end. Below is just an example of what that looks like in terms of price action: Entry Condition 2: Momentum Divergence I use only one indicator in my strategy, as I am more concerned with analyzing pure price action. This indicator forms part of my entry conditions and is a great way to spot momentum drying up as price is going into an area I want to trade from. Using only the histogram of a MACD indicator in the example below, you can see it's fairly obvious that momentum started decreasing as price continued to move downwards. This is called momentum divergence: Entry Condition 3: Reversal Candlestick Patterns Most entry strategies will inevitably rely on candlestick formations for clues as to what price might do next. A careful study of major and minor turning points on any chart and on any time frame will reveal a wide range of candlestick patterns before price reversed at those areas. As you’ll see in the next part of this PDF, I only follow 3 patterns, and any combination thereof; they're also a final confirmation signal that I require to place my orders: Entry Condition 4: Risk Consideration The last condition begs the question: can I afford to take on this trade? If the answer is yes, and my account size allows it, then I immediately place my entry and stop loss orders without hesitation: My Top 3 Candlesticks 1. Reversal Candlesticks Bullish Reversal Candlestick The image above shows a bullish reversal candlestick, and you'll notice that it's a singular candle formation. Here's what a bullish candlestick is telling us: Price made a new low, but selling pressure very quickly dried up as an increase of buyers entered the market, resulting in the candle closing high off its lows, signaling buying strength. Bearish Reversal Candlestick The inverse is true with this type of formation in a bearish scenario, and the image above shows that price made the highest high before reversing and closing strongly lower off its highs. Here's what a bearish candlestick is telling us: Price made a new high, but buying pressure very quickly dried up as an increase of sellers entered the market resulting in the candle closing lower off its highs, signaling selling strength. 2. Hammer Candlesticks Bullish Hammer Candlestick These candles are easy to spot and they generally have taller wicks than their bodies, resembling a hammer's handle and head. They tend to close without (or with very little) upper wicks. Here's what a bullish hammer candlestick is telling us: Price opened near the highs of the candle and although sellers initially succeeded at pushing price lower, they lost the final battle when buyers tipped the scales in their favor again by closing price higher than the opening price. Bearish Hammer Candlestick (AKA Inverted Hammer) These bearish formations are simply upside down hammers, and are also known as inverted hammers. Here's what a bearish hammer candlestick is telling us: Price opened near the lows of the candle, and although buyers initially succeeded at pushing price higher, they lost the final battle when sellers tipped the scales in their favor again by closing price lower than the opening price. 3. Flanked Dojis These reversal patterns are formed with 3 candlesticks, the middle candle being the doji candle which is then flanked on either side by two larger candles. Doji candlesticks generally show up at areas of indecision and are defined by their very small bodies, which tend to form around the middle of the candle's length. Here's what a bullish flanked doji is telling us: Price came down strongly into an area when sellers were dominating, but there was a period of indecision at the next candle because price went up and down, not finding any real direction. This indicated a balance between buyers and sellers, and at the very next candle, buyers tipped the balance in their favor and immediately moved price back up again. Bearish Flanked Doji The opposite is true in the case of a bearish flanked doji, and in this example, the doji had a very small body where the bullish example had none. Here's what a bearish flanked doji is telling us: Price moved up strongly into an area when buyers were dominating, but there was a period of indecision at the next candle because price went up and down, not finding any real direction. This indicated a balance between buyers and sellers, and at the very next candle, sellers tipped the balance in their favor and immediately moved price lower again. My Top 3 Price Action Patterns 1. ZigZag Corrections The simplest corrective pattern I follow is a ZigZag, and it unfolds in what Elliott Wave Theory (EWT) calls waves. A ZigZag has 3 main waves, and they are labelled A-B-C. Double ZigZag (Variation) There also exists a more complex ZigZag pattern, which is named a Double ZigZag. This pattern is very common and even though it may look confusing at first glance, all that’s happening here is two single ZigZags that follow in succession. 2. Expanded Flats The second category of corrective patterns I follow is the Expanded Flat correction. There are 3 variations of flat corrections, but I only worry about following this one. (You will note that this corrective pattern also unfolds in 3 waves labelled A-B-C.) 3. Triangles Triangles are my absolute favorite patterns to follow, as they make for high probability setups with a high winning percent ratio. Above is an example of the most popular variation, the Symmetrical Triangle Pattern. The triangular nature of these corrections are easy to spot and they can form in either a symmetrical fashion or have a flat top or bottom (depending on which way the major trend is moving). Ascending/Descending Triangles I’ve also included an example of an Ascending triangle just to show you that this triangle pattern has a flat top, unlike symmetrical triangles. (A descending triangle will have a flat bottom.) One thing remains constant between all triangles: Their A-C-E waves look like stairs or steps moving higher/lower. This phenomenon can be very useful when identifying these patterns on your own charts! Take your trades to the next level: Grab my Triple Threat Trading Patterns eBook: https://bit.ly/triple-threat-free-ebook Follow me on YouTube for weekly trading tips and tutorials: https://www.youtube.com/priceactionandincome Get the complete course and guide to my Market Geometry strategy, the Exponential Profits System: https://bit.ly/eps-course Join my Trade Forecast group for signals, instant alerts, trade briefings, live training, and more: https://bit.ly/get-trade-forecasts © 2020 Price Action & Income | Contact: support@priceactionandincome.com 816 Ligonier St. Latrobe, Pennsylvania 15650 United States