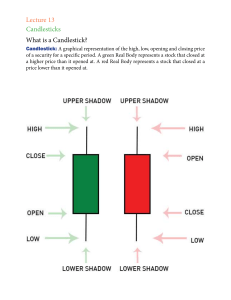

Don't attend classes 1. a. b. c. d. e. 2. a. Pleasee follow the best 5 tips Practice not to be greedy Practice not to be fearful Start with 10000 Have a notebook opening balance 10000 Have Profit and Loss column How to choose stocks Check the weekly volume on the buy side i. If the Weekly average volume is more buy than sell ,, the stock is in buy mode. If the sell is more than buy, it is in sell mode ii. Always buy stock above the Average tick price and have the stop loss of 1% of the current market price and profit target 2% of the buy price. iii. Make 2 to 3 trades per day and not more than that. Otherwise it will become an addiction and you make only loss and not profit at all. 3. Target per month a. Assuming you are investing 10K the first month , the next month, you can achieve to make the capital as 12500 , taking your both profilt and loss overall. You cannot do only profit all the time. b. Next month your capital will be 12500 , you will get additional margin money trade. Assuming you are making 4000 rupees additional next month, your capital will be 16500. By doing in the small way will get your discipline and you will learn automatically. c. You can’t do intraday like a professional trader. for that you need to gain experience and have discipline. 4. I myself lost lot of money and I have learned not to trade anymore after losing so much of money. The excitement of making profit once or twice will be trap to lose money permanently. 5. My advice is invest rather than play intraday. Rule of 16 and India vix . practice its correlation What is the 1% Risk Rule? The 1% method of trading is a very popular way to protect your investment against major losses. It is a method of trading where the trader never risks more than 1% of his investment capital. 1. Use 15 minute Candlestick Chart. 2. First 2 Candlestick after opening should be green for taking long position. 3. Take position only after 10.00 AM. 4. After formation of two red candlestick take position. 5. Check the first Candlestick. 6. Note high and low. 7. Note the difference. 8. Multiply by Fibonacci Number 2.681 9. Add with high and deduct from low. 10. Put the target at derived high and stop loss at derived low of point 9. 11. Example for today Reliance made continuous 3 green candlestick in 15 minute chart. First Candlestick high-1400 low-1390, Difference 10, Multiply by 2.681=27. Adding and subtracting with high, low derived high 1427, derived low 1363. After formation of two red candlestick take position anywhere between 10.30 to 10.45 AM for a target of 1427 and stoploss of 1363. If both not hit exit at 3 PM. Today 4/7/2017 Reliance High-1427.1, low 1389. 12. Don’t follow blindly, do paper trade for at least 3 months for every working day then try with real money. Three Points for trading 1. Know Your Strike Rate 2.