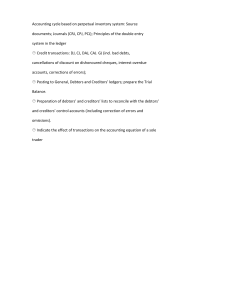

Ems • Credit: when you get smt and make an arrangement with a ship or store to pay for it later. • Before things are bought on credit a business will check if a person if creditworthy. • Creditworthy: that the person must be able to repay their debt. • Cash transactions are much easier and cheaper than credit sales as it involves less bookkeeping . • Cash transactions are less risky as the business receives the money immediately. Advantages of credit to a business • business gains more clients as most people want to buy on credit and not everyone has cash readily available. • Granting credit increases sales so more good can be manufactured which encourages job creation, ultimately boosting the economy. Disadvantages to the business of credit sales • business needs more operating capital to finance credit sales(needs money to run business until payment for good received) • Risk of bad debts or non-payment even when a business has a well planned credit policy. • Credit transactions are more time consuming than cash transactions so more staff will have to be employed leading to further costs (wages & salaries). Advantage of credit purchase for customers • can buy more expensive goods immediately instead of waiting until enough money saved. • Customer can take advantage of sales. Disadvantages of credit purchases to customer. • credit facility encourages ppl to spend money they don’t have. • Clients pay more for good as a result of credit facilities. Recording credit sales • When a sale is made the business must issue an invoice to the debtor. • Business gives original to clients and keeps duplicate for bookkeeping purposes. Debtors • debtor: person who owes money to a business. • Debtors created when good sold on credit. • A debtor is a current asset • After good sent to debtor the duplicate invoice is recorded in debtors journal. • The debtors journal is posted to the debtors ledger , daily and general ledger monthly. • A statement of the account will be mailed to a debtor at the end if each month. • Debtors cash pay their accounts in full settlement of part-payment once payed recorded in CRJ The national Credit Acf (34 of 2005) • NCA: National Credit Act • The NCA came into effect in the 1 June 2006 • The NCA aims to protect the consumers from being granted credit recklessly. • The NCA ensures that credit providers lend money responsibly and that consumers do not commit themselves to more than they can repay. • NCA applies to all credit purchases where interest if a fee is payable it does not apply to the government or business that have an asset value, annual turnover of over R1 million. • The NCA give consumers the right to be given reason for when credit is being refused or discontinued and for the consumers to receive their contract in the language of their choice. • The NCA specifies the maximum interest rate you can be charged which is based if your credit rating and credit history ( status of ur finance ps - debt u have). Debtors allowance • when business allows returns for good bought on credit • A credit note must be issued first good returns Recording transactions in DJ • DJ: debtors journal • A debtors journal is where all invoices issued for good bought in credit are recorded. • Each debtors account has a special code eg. D4 so that receipt and invoices can be allocated correctly to debtors account • Debtors allowances are posted to debtors ledger. • The debtors journal shows sales and cost of sales • Sales = cost price x (100 + markup) dived by 100 • Cost price = selling process x 100 dived by (100+markup) CRJ • debtors must settle their accounts within a certain time period. • When debtors settle their accounts business receives calc and issues a receipt and proof of payment . • The debtors control acc is an asset in Balance Sheet accounts and receipts from debtors decrease the debtors control balance. Price theory • decisions consumers make abt products is dependent in the demand for good and service. • Demand: quantity of goods and services that consumers are willing and able to purchase at different prices. Factors which effect demean of a product • price of product: quantity of a product which consumers buy depends in price as is price is low consumers are likely to buy more compared to if the price is high. • Amount of money consumers have: a consumer buy demands of their income, if their income is high they can buy more of a product but if it is low they buy less. • Weather conditions: weather can effect quantity as if it is cold warm coats will be high but if it is hit it won’t be needed to demand will be low. • Fashion: trends influence his much of a product consumers purchase. Law of demand quantity of goods demanded depends on partly the price of goods, if price is low consumers are willing to purchase more food whereas if it high consumers purchase less. The inverse relationship between price of goods and quantity is known as the Law of Demand. • The law of demand states that the higher price of good or Services the lower quantity demanded by consumers. • Demand Schedule: A table which clearly shows the quantity demanded of a good at different price levels. Demand curve • A graph that shows quantity of a good or services that consumers are willing and able to purchase at different price levels . • Demand curves usually slope down left to right. • A demand curve is created by the plotting of firsts from the demand schedule on the graph. Supply • Supply: quantity of good and services that suppliers are willing and able to purchase as different price levels. • Supply of a good is determined by factors like the cost of production ( if goof or services are cheap to produce suppliers will supply a larger quantity whereas if cost increases suppliers produce less) another factor is also the method of production ( quantity depends on method and technology, if there is technological improvement that enables greater quantity of product to be produced then supply of product increases.) Law of supply • the direct relationship between price of goods and quantity of goods producers are willing and able to supply. • The law of supply states that the higher price of goods the higher quantity supplied by producers. • Supply Schedule: A table containing values of price of a good and quantity that would be supplied at price . Supply curve • A supply schedule is a table that can be used to indicate the quantity of a good or services that producers are willing and able to provide a different prices. • A graph that show’s quantity of a good or services that producers are willing and able to provide at dif price levels. • As price of goods increase suppliers attempt to maximise profits by increasing quantity of product sold. • prices are effected by producers and consumers and supply and demand • Sellers and producers decide the price but it’s up to consumers to decide whether to buy at that price. Market Equilibrium • market equilibrium: price at which demean and supply of a good are the same , occurs where demand and supply curve intersect. • change in quantity demanded occurs due to price change. • When supply goes down , price goes down. Factors that affect demand • new technology- such as smartphones that have a new function can mean demand for new product increases. • Price can affect demand: quantity demand high when price low and when price high demand low. • Income levels: when income is higher there is more demand for good and services and when income is low there is less demand. • Changes in consumers preferences- if skinny jeans become more fashionable the demean will increase although when no one wanted them and they were out of fashion demand was low Factors that affect supply natural disaster such as flood,hurricanes as many factories can be destroyed causing supply of that product produced to decrease. Government regulations, if government policy comes into effect that imposes on import duty of product supply of product will decrease. New production of technology can increase supply as new machines add speed to working and production process making it easier. Factors that determines supply the cost of production inputs affect supply as if it is expensive porodecrs will need to reduce their supply. • One way in which traditional societies regulate supply is by being nomadic Sectors of the economy • sectors of the economy are the processes that converts materials into finished products, 3 main processes. Primary sector • The primary sector includes all industries (called primary industries) that takes raw materials from the earth. • farming, fishing and mining are primary industries. • SA gems produce mains,shear,sugar cane,fruit,wool,timber and beef. • The primary sector jobs are unskilled with some semi-skilled work in supervisor roles. • Jobs in the primary sector usually involve physical labour. • Primary sector jobs that operate world wide and are successful is large oil companies and gold mines. Secondary Sector • The secondary sector is where manufacturing and processing industries use raw materials to make other goods.p,it involves semi skilled work. • Example wheat into flour and sugar cane to sugar • The secondary sector uses machines and technology to change raw materials from the primary sector into semi finished items and finished goods. • Semi-finished: component parts for other secondary industries. • Finished goods: like sport shoes and motor vehicles for consumer market. • The secondary sector takes outputs if the primary sector and manufacturers finished goods or suitable for used by other businesses for export, sale and domestic use. • The secondary sector supports the primary and tertiary sector like sugar mills,fishing companies, paper making factories and dairy farms. • This sector requires large amounts of energy and machinery. Tertiary Sector • The tertiary sector includes all businesses that transfer the good produced by primary and secondary industries to consumers through their shops, offices and informal trade. • The service industry is apart of the term sector. • Services: things we pay businesses to do for us and include businesses like hair salon and medical centres. • The tertiary sector provides goods and services to people and families • Tertiary sector involves skilled work (highly qualified professionals), unskilled work (cleaning), semi-skilled work ( entrepreneurs ) Relationship between the 3 sectors • Primary sector supply raw materials to secondary sector to be manufactured into goods. (Some items like fruit and veg supplied directly to tertiary sector) • Secondary sector supplies primary sector with equipment to carry out operations, eg fertiliser • Tertiary sector gets everything from primary and secondary sector aswell as supplies them with good and services to carry out business operations. • No sector is independent • resource must be used sustainably during production because all the 3 sectors are linked so if one sector uses too much it will cause the other sectors to collapse. • Resource need to be soused carefully in the primary sector as if too much is used and supply runs out the secondary sectors will collapse as they being be provided with raw materials to produce goods and if no goods are made the tertiary sector won’t be able to function. Roles of sectors in economy • in poorer areas money usually comes from primary sector as ppl work close to the land where as in richer countries more money comes from tertiary sector as people are employed by businesses and provide services for others. • Developed countries = china, Korea and Japan. • Developed countries like the United kingdom makes use of tertiary sector as the standard of living is huger so people can afford services and entertainment . • As uses more primary sectors as it had diamonds, gold and platinum industries aswell as produces maize, wheat and fruit. • GDP= gross domestic profit • Things that play and important role in SA’s GDP include : agriculture, commmerrical and large scale farming, car manufacturing, tourism Journal recording notes When a CRJ acc for account accounting equation banks will be under debit and when a cpj acc bank will be credit Accountimg Equation = When a debtor pays his account bank will be debit and credit be be debtors control assets will be +/- and owners equity and liability will be 0 zero. Accounting equation = When a debtor makes a return or discount given , issues credit note to debtor then acc debit will be debtors allowance and acc credit will detors control assets will be - owners equity will be - and liability will be 0 Accounting equation = When goods are sold on credit and invoice issued record on first line debtors control (dr) and sales (cr) assets = + owners equity = + and liabilities = 0 on second line record cost of sales(dr) and trading stock (cr) , assets = - , owners equity = - and liabilities = - CRJ = Remembers when recording sales record cost of sales Underline last translation action of day many under analysis of receipt When recording loan record name of bank CRJ = only record under discount allowed when a debtor settles acc and there a dif between ipwhat he owed and what he settled the acc with. If bank or eft used don’t record under analysis of receipt. Sales price used for analysis of receipt not cost of sales. • Sales = cost price x (100 + markup) dived by 100 • Cost price = selling process x 100 dived by (100+markup) Debtors journal= sold on credit/ sold on account / issued invoice Debtors allowance journal = issued credit not (C/N) , return , discount Go over the following transactions (know how to enter it) trial balance Subsidiary journals ( CRJ, cpj, DJ, DAJ) General ledger Accounting equation