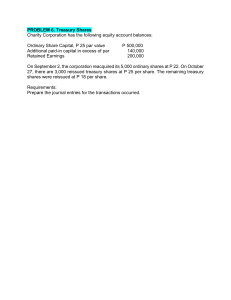

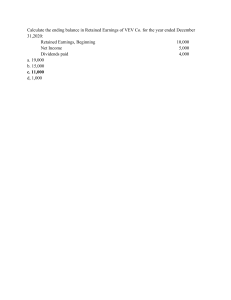

AUDITING PROBLEMS AP08 AUDIT OF SHAREHOLDER’S EQUITY Audit of Shareholders’ Equity Substantive Test of Shareholders’ Equity When auditing Shareholders' equity the principal objective for the substantive tests is to determine the following: All the equity accounts or interest on the statement of financial EXISTENCE COMPLETENESS VALUATION AND ALLOCATION Position exist. All equity interest that should have been recorded have been recorded and included in the statement of financial position. The equity accounts are stated on the statement of financial position at appropriate amounts. PRESENTATION AND Equity accounts are properly classified, described and disclosed in the DISCLOSURE financial statements, including notes, in accordance with applicable financial reporting framework. Audit of Shareholders' Equity The auditor's primary substantive procedures for Shareholders' equity will typically include the following: 1. Obtain and verify equity reconciliation schedule. 2. Obtain and review board of directors' minutes of meetings, shareholders meetings, committee meetings and articles of incorporation. 3. Review the appropriateness of accounting for share-based payment transactions. 4. Analyze retain earnings and review appropriateness of dividends. 5. Review presentation and disclosure of equity items. Page |2 MULTIPLE CHOICE QUESTIONS THEORY 1. In an examination of shareholder’s equity, an auditor is most concerned that a. Capital share transactions are properly authorized. b. Share splits are capitalized at par or stated value on the dividend declaration date. c. Dividends during the year under audit were approved by the shareholders. d. Changes in the accounts are verified by a bank serving as a registrar and share transfer agent. 2. In audit of a medium-sized manufacturing concern, which one of the following areas can be expected to require the least amount of audit time? a. Owner’s equity b. Assets c. Revenue d. Liabilities 3. When a corporate client maintains its own share records, the auditor primarily will rely upon a. Confirmation with the company secretary of shares outstanding at year-end. b. Review of the corporate minutes for data as to shares outstanding. c. Confirmation of the number of shares outstanding at year-end with the appropriate state official. d. Inspection of the share book at year-end and accounting for all certificate numbers. 4. When a client company does not maintain its own share records, the auditor should obtain written confirmation from the transfer agent and registrar concerning a. Restrictions on the payment of dividends. b. The number of shares issued and outstanding. c. Guarantees of preference share liquidation value. d. The number of shares subject to agreement to repurchase 5. The auditor is concerned with establishing that dividends are paid to client corporation shareholders owning share as of the a. Issue date c. Record date b. Declaration date d. Payment date Page |3 6. An audit program for the retained earnings account should include a step that requires verification of a. Fair value used to charge retained earnings to account for a two-for-one- share split. b. Approval of the adjustment to the beginning balance as a result of a write-down of an account receivable. c. Authorization for both cash and share dividends. d. Gain or loss resulting from disposition of treasury shares. 7. During an audit of an entity’s shareholders’ equity accounts, the auditor determines whether there are restrictions on retained earnings resulting from loans, agreements, or law. This audit procedure most likely is intended to verify management’s assertion of a. Existence b. Completeness c. Valuation d. Presentation and disclosure 8. If the auditee has a material amount of treasury share on hand at year-end, the auditor should a. Count the certificates at the same time other securities are counted. b. Count the certificates only if the company had treasury share transactions during the year. c. No count the certificates if treasury share is a deduction from shareholders’ equity. d. Count the certificates only if the company classifies treasury share with other assets. 9. In performing tests concerning the granting of share options, an auditor should a. Confirm the transaction with the Securities and Exchange Commission. b. Verify the existence of option holders in the entity’s payroll records or share ledgers. c. Determine that sufficient treasury share is available to cover any new share issued. d. Trace the authorization for the transaction to a vote of the board of directors. 10. The auditor would not expect the client to debit retained earnings for which of the following transactions? a. A 4-for 1 share split. Page |4 b. "Loss" resulting from disposition of treasury shares. c. A 1-for 10 share dividend. d. Correction of error affecting prior year's earnings. PRACTICAL QUESTIONS Problem 1 The following data were compiled prior to preparing the balance sheet of the Sumaya Corporation as of December 31, 2020: Authorized ordinary share, P100 par value P4,000,000 Unissued ordinary share 800,000 Cash dividends payable 160,000 Donated capital 800,000 Gain on sale of treasury share 80,000 Net unrealized loss on FAFVTOCI 96,000 Premium on share capital 320,000 Premium on bonds payable 240,000 Reserve for bond sinking fund 400,000 Reserve for depreciation 600,000 Revaluation increment on property 800,000 Retained earnings, unappropriated 720,000 Subscribe share capital 480,000 Subscriptions receivables 120,000 Share warrants outstanding 200,000 Treasury shares, at cost 144,000 Compute for the following: 1. Ordinary shares capital 2. Share premium 3. Appropriated retained earnings 4. Total shareholders’ equity 5. Legal capital Page |5 Problem 2 Following is the shareholders’ equity section of Skyflakes Corporation’s balance sheet at December 31, 2019: Ordinary shares, P10 par value; authorized 1,500,000 shares; issued and outstanding 900,000 shares P9,000,000 Share premium 750,000 Retained earnings 2,700,000 Total shareholders’ equity P12,450,000 Transactions during 2020 and other information relating to the shareholders’ equity accounts were as follows: • On January 26, Skyflakes reacquired 75,000 shares of its ordinary shares for P11 per share. • On April 4, Skyflakes sold 45,000 shares of its treasury share for P14 per share. • On June 1, Skyflakes declared a cash dividend of P1 per share, payable on July 15, 2020 to shareholders of record on July 1, 2020. • On August 15, each shareholder was issued one share right for each share held to purchase two additional shares of share for P12 per share. The rights expire on October 31, 2020. • On September 30, 150,000 share rights were exercised when the market value of the share was P12.50 per share. • On November 2, Skyflakes declared a two for one share split-up and charged the par value of the share from P10 to P5 per share. On November 20, shares were issued for the share split. • On December 5, 60,000 shares were issued in exchange for a secondhand equipment. It originally cost P600,000, was carried by the previous owner at a book value of P300,000, and was recently appraised at P390,000. • On December 29, the company declared a 10% share dividend, payable January 31, 2021, to shareholders on record as of January 15, 2021. The market value of the share on December 29, 2020 was P5.50 per share. • Net income for 2020 was P720,000. Based on the above and the result of your audit, determine the following as of December 31, 2020: 1. Ordinary share capital 2. Share premium 3. Unapproriated retained earnings 4. Total shareholders’ equity Page |6 Problem 3 Great Corporation began operations on January 1, 2020. The company was authorized to issue 60,000 shares of P10 par value ordinary share and 120,000 shares of 10%, P100 par value convertible preference share. In connection with your audit of the company’s financial statements, you noted the following transactions involving shareholders’ equity during 2020: Jan. 1 Issued 1,500 of ordinary share to the corporation promoters in exchange for property valued at P510,000 and services valued at P210,000. The property costs P270,000 3 years ago and was carried on the promoters’ books at P150,000. Jan. 31 Issued 30,000 shares of convertible preference share at P150 per share. Each share can be converted to five shares of ordinary share. The corporation paid P225,000 to an agent for selling the shares. Feb. 15 Sold 9,000 of ordinary share at P390 per share. The corporation paid issue costs of P75,000. May 30 Received subscriptions for 12,000 of ordinary share at P450 per share. Aug. 30 Issued 2,100 of ordinary share and 4,200 of preference share in exchanged for a building with a fair market value of P1,530,000. The building was originally purchased for P1,140,000 by the investors and has a book value of P660,000. In addition, 1,800 of ordinary share were sold for P720,000 cash. Nov. 15 Payments in full for half of the subscriptions and partial payments for the rest of the subscriptions were received. Total cash received was P4,200,000. Shares were issued for the fully paid subscriptions. Dec. Declared a cash dividend of P10 per share on preference, payable on December 31 to shareholders of record on December 15, and P20 per share cash dividend on ordinary share, payable on January 15, 2021 to shareholders of record on December 15. 1 Dec. 31 Paid the preference share dividend. Net income for the first year of operations was P1,800,000. Based on the above and the result of your audit, determine the following as of December 31, 2020: 1. Ordinary share capital 2. Share premium in excess of par value of preference share Page |7 3. Share premium in excess of par value of ordinary share 4. Retained earnings 5. Total shareholders’ equity Problem 4 The Star Corporation has requested you to audit its financial statements for the year 2020. During your audit, Star presented to you its balance sheet as of December 31, 2019 containing the following capital section: Preference share P10 par; 60,000 shares authorized and issued, of which 6,000 are treasury shares costing P90,000 and shown as an asset Ordinary share, par value P4; 600,000 shares authorized, of which 450,000 are issued and outstanding Share Premium (P5 per share on preference share issued in 2015) Allowance for doubtful accounts receivable Reserve for depreciation Reserve for fire insurance Retained earnings P600,000 1,800,000 300,000 12,000 840,000 198,000 2,250,000 P6,000,000 Additional information: 1) Of the preferred share, 3,000 shares were sold for P18 per share on August 30, 2020. Star credited the proceeds to the Preferred share account. The treasury shares as of December 31, 2019 were acquired in one purchase in 2019. 2) The preferred share carries an annual dividend of P1 per share. The dividend is cumulative. As of December 31, 2019, unpaid cumulative dividends amounted to P5 per share. The entire accumulation was liquidated in June, 2020, by issuing to the preferred shareholders 54,000 shares of common shares. 3) A cash dividend of P1 per share was declared on December 1, 2020 to preferred shareholders of record December 15, 2020. The dividend is payable on January 15, 2021. 4) At December 31, 2020, the Allowance for Doubtful Accounts Receivable and Reserve for Depreciation had balances of P25,000 and P1,050,000, respectively. Page |8 5) On March 1, 2020, the Reserve for Fire Insurance was increased by P60,000; Retained Earnings was debited. 6) On December 31, 2020, the Reserve for Fire Insurance was decreased by P30,000, which represents the carrying value of a machine destroyed by fire on that date. Estimated fire cleanup costs of P6,000 does not appear on the records. 7) The December 31, 2019 Retained Earnings consists of the following: Donated land from a shareholder (Market value on date of donation) P450,000 Gains from treasury share transactions 51,000 Earnings retained in business 1,749,000 P2,250,000 8) Net income for the year ended December 31, 2020 was P1,297,500 per company’s records. Based on the above and the result of your audit, determine the adjusted balances of the following as of December 31, 2020. (Disregard tax implications) 1. Preference Share Capital 2. Ordinanry Share Capital 3. Share Premium 4. Appropriated retained earnings 5. Unappropriated retained earnings 6. Treasury Share Capital 7. Total shareholders’ equity Page |9 Problem 5 The shareholders equity of Hirap Corporation showed the following data on December 31, 2019: 12% preference share, P30 par, 135,000 shares issued and outstanding Ordinary share, P50 par, 180,000 shares issued and outstanding Premium on preference share Premium on ordinary share Retained earnings P4,050,000 9,000,000 1,080,000 3,240,000 1,395,000 The 2020 transactions of the company affecting its shareholders’ equity are summarized chronologically as follows: 1. Issued 27,000 of preference share at P40. 2. Issued 94,500 shares of ordinary share at P70. 3. Retired 5,400 of preference share at P45. 4. Purchased 13,500 shares of its ordinary share at P80. 5. Split ordinary share two for one (par value reduce to P25). 6. Reissued 13,500 shares of treasury share – ordinary at P50. 7. Shareholders donated to the company 9,000 of ordinary share when shares had a market price of P52. One half of these shares were subsequently issued for P54. 8. Dividends were paid at the end of the calendar year on the ordinary share at P2 per share and on the preference share at the preference rate. 9. Net income for the year was P2,520,000. Based on the above and the result of your audit, determine the following as of December 31, 2020: 1. Preference share capital 2. Ordinary share capital 3. Share premium 4. Unappropriated retained earnings 5. Total shareholders’ equity P a g e | 10 Problem 6 The shareholders’ equity section of the Water Inc. showed the following data on December 31, 2019: Ordinary share, P3 par, 450,000 shares authorized, 375,000 shares issued and outstanding, P1,125,000; Share premium in excess of par, P10,575,000; Share premium from share options, P225,000; Retained earnings, P720,000. The share options were granted to key executives and provided them the right to acquire 45,000 of ordinary share at P35 per share. Each option has a fair value of P5 at the time the options were granted. The following transactions occurred during 2020: Feb. 1 Key executives exercised 6,750 options outstanding at December 31, 2019. The market price per share was P44 at this time. Apr. 1 The company issued bonds of P3,000,000 at par, giving each P1,000 bond a detachable warrant enabling the holder to purchase two shares at P40 each for a 1year period. The bonds would sell at P996 per P1,000 bond without the warrant. July 1 The company issued rights to shareholders (one right on each share, exercisable within a 30-day period) permitting holders to acquire one share at P40 with every 10 rights submitted. All but 9,000 rights were exercised on July 31, and the additional share was issued. Oct. All warrants issued in connection with the bonds on April 1 were exercised. 1 Dec. 1 The market price per share dropped to P33 and options came due. Because the market price was below the option price, no remaining options were exercised. Dec. 31 Net income for 2020 was P375,750. Based on the above and the result of your audit, determine the following as of December 31, 2020: 1. Ordinary share capital 2. Total Share premium 3. Retained earnings 4. Total shareholders’ equity P a g e | 11 Problem 7 At the beginning of year 1, Entity A grants share options to each of its 100 employees working in the sales department. The share options will vest at the end of year 3, provided that the employees remain in the entity’s employ, and provided that the volume of sales of a particular product increases by at least an average of 5 per cent per year. If the volume of sales of the product increases by an average of between 10 per cent and 15 per cent each year, each employee will receive 200 share options. If the volume of sales increases by an average of 15 per cent or more, each employee will receive 300 share options. On grant date, Entity A estimates that the share options have a fair value of P20 per option. Entity A also estimates that the volume of sales of the product will increase by an average of between 10 per cent and 15 per cent per year, and therefore expects that, for each employee who remains in service until the end of year 3, 200 share options will vest. The entity also estimates, on the basis of a weighted average probability, that 20 per cent of employees will leave before the end of year3. By the end of year 1, seven employees have left and the entity still expects that a total of 20 employees will leave by the end of year 3. Hence, the entity expects that 80 employees will remain in service for the three-year period. Product sales have increased by 12 per cent and the entity expects this rate of increase to continue over the next 2 years. By the end of year 2, a further five employees have left, bringing the total to 12 to date. The entity now expects only three more employees will leave during year 3, and therefore expects a total of 15 employees will have left during the three-year period, and hence 85 employees are expected to remain. Product sales have increased by 18 per cent, resulting in an average of 15 per cent over the two years to date. The entity now expects that sales will average 15 per cent or more over the three-year period, and hence expects each sales employee to receive 300 share options at the end of year 3. By the end of year 3, a further two employees have left. Hence, 14 employees have left during the threeyear period, and 86 employees remain. The entity’s sales have increased by an average of 16 per cent over the three years. Therefore, each of the 86 employees received 300 share options. Compute for the amounts to be recognized as compensation expense in year 1 to 3. Problem 8 An entity grants 100 cash share appreciation rights (SARs) to each of its 500 employees, on condition that the employees remain in its employ for the next three years. During year 1, 35 employees leave. The entity estimates that a further 60 will leave during years 2 and 3. During year 2, 40 employees leave and the entity estimates that a further 25 will leave during year 3. During year 3, 22 employees leave. At the end of year 3, 150 employees exercise their SARs, another 140 employees exercise their SARs at the end of year 5. The entity estimates the fair value of the SARs at the end of each year in which a liability exists as shown below. At the end of year 3, all SARs held by the remaining employees vest. The intrinsic values of the P a g e | 12 SARs at the date of exercise (which equal the cash paid out) at the end of years 3, 4 and 5 are also shown below. Year Fair value Intrinsic value 1 P14.40 2 15.50 3 18.20 P15.00 4 21.40 20.00 5 25.00 Compute for the amounts to be recognized as compensation expense and liability in year 1 to 5. Problem 9 In connection with your audit of the balance sheet of the Gumala Company on December 31, 2020, the equity section of the Balance Sheet shows following items: 6% Cumulative preference share, P100 par value (liquidation value, P115 per share); Authorized, 6,000 shares; issued, 4,000 shares; in treasury, 600 400,000 shares Ordinary share, P100 par value, authorized, 20,000 shares; issued and outstanding, 8,000 shares 800,000 Premium on preference share 150,000 Premium on ordinary share 165,000 Retained earnings 458,600 Treasury preference share, at cost 84,000 1. Compute for the total shareholders’ equity as of December 31, 2020. 2. Compute for the book value per share of each class of share as of December 31, 2020. 3. Assuming the preference share is participating, compute for the book value per share of each class of share as of December 31, 2020. Problem 10 The year-end audit of the records of Pagod disclosed a shortage in cash amounting to P600,000. The treasurer had concealed the fraud by increasing inventories by P300,000, land by P100,000 and accounts receivable by P200,000. Faced with prosecution, the treasurer offered to surrender 6,000 Pagod shares owned by him. The board of directors accepted the offer, with the agreement that the treasurer would pay any deficiency between the shortage and the book value of the shares, after adjusting for the fraud. The corporation would in turn pay the excess, if any, of the book value over the shortage. P a g e | 13 As of December 31, 2020, there were 40,000 ordinary shares issued and outstanding with a par value of P100; Retained earnings as of January 1, 2020 was P1,600,000 and net income from 2020 operations was P1,400,000. Considering the above information, answer the following: 1. What would be the book value per share for purposes of the agreement? 2. How much would the company pay the treasurer, if any? 3. Assuming further the company distributes the 6,000 shares as dividend to the remaining shareholders, what would be the balance of the Retained earnings as of December 31, 2020? Problem 11 In connection with the audit of Pavilion Company’s financial statements for the year ended December 31, 2020, your audit senior asked you to analyze the company’s shareholders’ equity section and provide him with certain figures. The shareholders’ equity sections of the company’s comparative balance sheets as of December 31, 2020 and 2019 are presented below: 12% Preference share, P100 par Ordinary share, P10* par Share premium in excess of par - preference Share premium in excess of par - ordinary Share premium from treasury share Retained earnings Total shareholders’ equity *Par value after May 31, 2020 share split. 12.31.20 P 330,000 1,642,400 53,600 257,200 7,200 1,884,800 P4,175,200 12.31.19 P 270,000 1,598,400 36,800 235,200 3,200 1,585,840 P3,729,440 Pavilion had 65,000 ordinary share outstanding as December 31, 2018. The following shareholders’ equity transactions were recorded in 2019 and 2020: 2019 May 1 July 1 July 31 - Aug. 30 - Dec. 31 - Sold 9,000 ordinary shares for P24, par value P20. Sold 700 preference shares for P124, par value P100. Issued an 8% share dividend on ordinary share. The market value of ordinary share was P30 per share. Declared cash dividends of 12% on preference share and P3 per share on ordinary share. Net income for the year amounted to P1,345,040 P a g e | 14 2020 Feb. 1 May 1 May 31 - Sep. 1 Oct. 1 - Nov. 1 - Sold 2,200 ordinary shares for P30. Sold 600 preference shares for P128. Issued a 2-for-1 split of ordinary share. The par value of the ordinary share was reduced to P10 per share. Purchased 1,000 ordinary shares for P18 to be held as treasury share. Declared cash dividends of 12% on preference share and P4 per share on ordinary share. Sold 1,000 shares of treasury share for P22. Compute for the basic earnings per share for the year 2019 and 2020. “Work hard in silence. Let success be your noise.” –Frank Ocean P a g e | 15