Financial Statement Analysis & Forecasting

advertisement

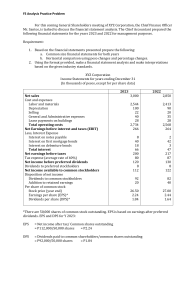

iteration process and arrive at sdgsdg the final fdforecast. ANALYSIS OF THE FORECAST Next year’s forecast as developed above is only the first part 230 1,353 1,353 Total Current Assets ₱ 2,000 ₱ 2,200 ₱ 2,200 Net plant and equipment 2,000 2,200 2,200 T lustrative Case 15-2. Projected Financial Statements with Financing Feedback For Tamarind Company, the following data have been made available: Addition to retained earning otal Assets ₱ 4,000 ₱ 4,400 ₱ 4,400 Li used to present the expected cash inflows and cash outflows CASH BREAK-EVEN CHART ● shows the relationship between the company's cash needs and cash sources ● it indicates the miniesgea mum amount of cash that should be maintained to enable the company to meet its obligation Example: XYZ Company manufactures plastic which it sells to other industrial users. The monthly production capacity of the company is 1,2rtyer 00,000 kilos. Selling price is 2.00 per abilities and Equity Accounts Payable ₱ 120 ₱ 132 ₱ 132 Notes payable bonds 1,508 1,508 + 56 1,564 Total Liabilities ₱ 2,128 ₱ 2,168 ₱ 2,280 Preference shares ₱ 80 ₱ 80 ₱ 80 Ordinary shares(50,000 shares) 260 260 + 112 372 Retained Earnings 1,532 1,668 1,656 Total Equity ₱ 1,872 ₱ 2,008 ₱ 2,108 To

![THE COMPANIES ORDINANCE, 1984 [Section 82]](http://s2.studylib.net/store/data/015174202_1-c77c36ae791dae9b4c11c6213c9c75e5-300x300.png)