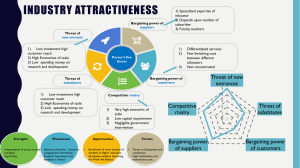

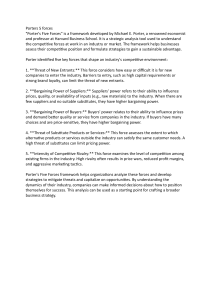

Analysis of the Airline Industry Using the Five Forces Model of Competition By Blake Hamilton Bradley The Five Forces Model, developed by Michael E. Porter, is a framework for analyzing the competitive forces within an industry. This model helps to understand the intensity of competition and the profitability potential within an industry. The five forces include: the threat of new entrants, bargaining power of suppliers, bargaining power of buyers, threat of substitute products or services, and industry rivalry. 1. Threat of New Entrants: Weak Reason: The airline industry has high barriers to entry due to substantial capital investment required for purchasing or leasing aircraft, obtaining necessary licenses, and complying with extensive regulatory requirements. Moreover, established airlines benefit from economies of scale and brand loyalty, making it difficult for new entrants to compete effectively. 2. Bargaining Power of Suppliers: Moderate to Strong Reason: The bargaining power of suppliers in the airline industry is significant, particularly for key inputs such as aircraft, fuel, and maintenance services. There are few dominant suppliers in the aircraft manufacturing industry (e.g., Boeing and Airbus), giving these suppliers substantial leverage over airlines. Similarly, fuel costs are influenced by global oil prices, which airlines have limited control over. However, the power is moderated somewhat by airlines' ability to negotiate long-term contracts and the recent trend of using more fuel-efficient aircraft. 3. Bargaining Power of Buyers: Strong Reason: Customers in the airline industry have considerable bargaining power due to the availability of extensive options for travel routes and airlines. With the rise of online travel agencies and price comparison websites, consumers can easily compare fares and services, increasing price sensitivity. Additionally, the presence of low-cost carriers has intensified price competition, giving buyers more power to demand lower prices and better services. 4. Threat of Substitutes: Moderate Reason: The threat of substitutes varies by distance and region. For short-haul flights, alternative modes of transportation such as cars, trains, and buses provide viable substitutes. High-speed rail networks, especially in Europe and Asia, present a significant substitute threat for short to medium distances. However, for long-haul international travel, there are fewer practical substitutes, which diminishes this threat. The convenience and speed of air travel remain unmatched for long distances. 5. Industry Rivalry: Strong Reason: The airline industry is characterized by intense competition among existing players. Factors contributing to this high rivalry include the high fixed costs of operations, low profit margins, and overcapacity in certain markets. Airlines frequently engage in price wars to attract customers, further eroding profitability. Additionally, the presence of both legacy carriers and low-cost carriers increases competitive pressures, as they often compete for the same customer segments. Summary and Investment Decision The analysis of the airline industry using Porter’s Five Forces Model reveals a highly competitive environment with significant challenges. The high barriers to entry protect established players, but the strong bargaining power of buyers and intense industry rivalry exert downward pressure on prices and profitability. The moderate to strong bargaining power of suppliers further complicates cost management. While the threat of substitutes is moderate and largely dependent on the travel distance, it adds another layer of competitive pressure, particularly for short-haul flights. Given these dynamics, investing in the airline industry requires a nuanced approach. Established airlines with strong brand recognition, efficient cost structures, and diversified revenue streams (such as ancillary services) may present viable investment opportunities. Additionally, airlines that have adapted to changing market conditions by implementing innovative technology, improving customer service, and maintaining operational flexibility could be better positioned for profitability. However, the overall high level of competition and external pressures such as fluctuating fuel prices and regulatory challenges suggest that the industry is not an easy investment choice. Investors must be prepared for volatility and have a long-term perspective. Given the complexity and inherent risks of the airline industry, careful consideration and thorough due diligence are essential before committing financial resources. After accounting for all these factors the answer the question of “Should I invest in the airline industry?” is a very firm “No.” In conclusion, while there are potential opportunities within the airline industry, the strong competitive forces indicate that it may not be the most attractive investment for those seeking stable and high returns. Therefore, I would approach investing in the airline industry with caution and only consider well-established airlines with a proven track record of managing competitive pressures effectively.