BYD EV Market Strategy Report: Global Expansion & Innovation

advertisement

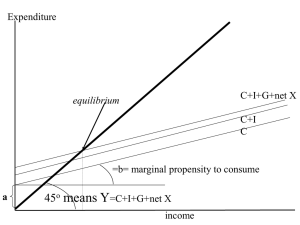

Introduction BYD (Build Your Dreams) is a Chinese Automobile manufacturer and one of the largest electric vehicles (EV) companies in the world. BYD offers a diverse portfolio of products spanning electric vehicles (EVs), energy storage systems, and renewable energy solutions As of the last quarter of 2023, BYD has beaten Tesla to emerge as the worlds’ largest EV producer. While Tesla sold 484,000 cars, BYD sold 52600 battery-only vehicles in the last quarter of 2023. Chemist Wang Chuanfu founded BYD in 1995 in the southern Chinese city of Shenzhen, China’s massive tech hub. BYD was not always an electric vehicle maker. Mr. Wang started BYD to manufacture Li-ion and NiMH batteries in 1995. BYD went onto supply its batteries to Motorola and Nokia in 2000 and 2002, respectively, two of the mobile phone industry’s juggernauts at the time. Within seven years, BYD secured its position as the second-largest producer of NiMH batteries and the third largest in Li-ion batteries.[23] After ten years, BYD had captured more than half the world's mobile-phone battery market and was the largest Chinese manufacturer (and in the top four globally) of all types of rechargeable batteries. BYD’s mission is to change the world through technological innovation that reduces greenhouse gasses and our dependency on fossil fuels. BYD aims to be a global leader in electric vehicle sales and hence has announced expansion in markets like Hungary and Mexico and Southeast Asian countries like Thailand and Indonesia in addition to India. For example, recently BYD announced that it plans to open a plant in Indonesia and has already invested in a plant in Thailand which will start operations in 2024. There are several challenges with these expansion plans and this report will primarily focus on how an automaker can successfully tread these foreign markets. We will focus on Southeast Asian markets mainly Indonesia. This report will analyze BYD’s corporate strategic objectives and propose strategies that it can adopt to maintain its leading position in the EV market in terms of global expansion and technology innovation with sustainability. Key product suites of BYD in the EV market include Plug-in Hybrid Electric Vehicles (PHEVs) and Battery Electric Vehicles (BEV). Chapter 1: Strategic Objectives BYD achieved 36.5% growth for the trailing 12 months in 2023, with operating margin of 6.4%. BYD is leading Chinese EV market with the 2nd highest market share in global EV market, with 17.1% market share in 2013, slightly behind Tesla (19.9%). (CNY,000) Revenue Growth Gross Profit Gross margin Operating profit Profit margin Net Income NI/Revenue 2023 TTM 578,647,626 36.5% 113,252,224 19.6% 2022 424,060,635 96.2% 72,244,955 17.0% 2021 216,142,395 38.0% 28,144,706 13.0% 2020 156,597,691 36,809,124 22,976,482 7,597,179 13,045,156 6.4% 28,677,877 5.0% 5.4% 16,622,448 3.9% 3.5% 3,045,188 1.4% 8.3% 4,234,267 2.7% 30,346,311 19.4% 1 Global EV Market Share, 2023 Brand Country Market Share �� US Tesla 19.90% 2 BYD �� China 17.10% 3 GAC Aion �� China 5.20% 4 SAIC-GM-Wuling �� China 5 Volkswagen 4.90% �� Germany 4.60% 6 BMW �� Germany 3.60% 7 Hyundai �� S. Korea 2.90% 8 Mercedes-Benz �� Germany 2.60% 9 MG �� China 10 KIA �� S. Korea 2.00% Rank 2.30% As for BYD's strategy in terms of product and domain strategy, they adopt a full-lineup, allencompassing approach. However, within each domain, BYD aims to penetrate markets with a low-cost route leveraging cost competitiveness. Such full-lineup, all-encompassing strategies are often pursued by industry-leading companies, and BYD, as a leader in the EV market, adheres to this strategic approach. Regarding their sales area strategy, while maintaining a dominant position in China, BYD actively pursues an overseas expansion strategy to capture the significant and rapidly growing demand for EVs worldwide. They aim to grow their business in countries like Indonesia. In April 2015, BYD officially unveiled its 7+4 Full Market EV Strategy for new energy vehicles, wherein "7" signifies seven conventional transportation sectors (including consumer vehicles, buses, taxis, coaches, logistics vehicles, construction vehicles, and sanitation vehicles), while "4" denotes four specialized sectors (warehouse, mining, airport, and port). As a frontrunner in the realm of new energy vehicles, BYD is committed to transitioning all fossil fuel-powered vehicles to electric variants within China. By 2023, it has achieved a leading position in the domestic market, capturing a 35% market share. Responding to the global shift towards transportation electrification, BYD has recognized global expansion as a new avenue for growth. Since announcing its strategy to enhance its presence in passenger car markets internationally in 2021, BYD has actively pursued expansion into overseas markets. It has successfully introduced its range of passenger cars to key markets such as Japan, Germany, Thailand, Australia, and Brazil. Presently, BYD's new energy passenger vehicles are available in over 54 countries and regions, with models like the HAN EV, TANG EV, and BYD Dolphin being exported. Particularly noteworthy is the BYD YUAN PLUS (also known as BYD ATTO 3), which has made a significant impact, emerging as the top selling NEV in Thailand, Israel, and Singapore for several consecutive months. On Feb 1 of the preceding year, BYD inaugurated its inaugural dealership in Yokohama, Kanagawa prefecture. By the year's end, there were 51 sales outlets across Japan offering BYD electric cars, including 17 dealerships. The company aims to establish 100 dealerships in Japan by 2025. BYD remains at the forefront of innovation, driving the transition towards a more sustainable future. BYD Group will adhere to its development strategy, emphasizing technological innovation to enhance the independence and controllability of its core technologies. It will continue to introduce more competitive products to contribute to the "dual-carbon" goal and promote the concept of green, low-carbon, and sustainable development through a variety of green transportation solutions. Its historical R&D/Revenue ratio stood at 3.8% in 2018, 4.4% in 2019, 4.8% in 2020, 3.7% in 2021, 4.6% in 2022, and 5.6% in the last twelve months ending in 2023. Chapter 2: 3C Analysis (Customer, Competitors, Competency) The following table summarizes the key consumer segments for EV player like BYD. Specifically this table focuses on South Asian and Southeast Asian markets like India and Thailand. Description of segment Value desired by each segment Segment size Segment growth rate Educated, environmentally conscious consumers, usually of younger age profiles low to zero emissions, fuel efficiency. seek manufacturers who prioritise eco-friendly manufacturing practices, such as using recycled materials and renewable energy sources in production facilities and minimising overall environmental impact throughout the vehicle’s lifecycle. Moderate Expected to grow as more younger generation customers join the workforce and become eligible to purchase EVs consumers who are indifferent between EVs and ICE vehicles, more concerned with performance of the car speed, power, and an exhilarating driving experience Large Projected to decrease with changes in government policies and campaigns promoting sustainability Luxury consumers/ tech savvy consumers Sleek design, premium cuttingedge features, futuristic design, comfort, well-crafted interiors. Seamless integration with handphone ecosystem. Autonomous driving. Advanced Small Moderate as though the economies are booming, many consumers Current segments driver-assistance systems (ADAS), voice-activated controls, augmented reality displays, and autonomous driving capabilities. will still be middle income. But tech savvy group is expanding. Middle-class family – price conscious and need car with basic functionality Standard features, value for money, shorter charging times, long term cost savings, fuel efficiency. Spacious SUVs with design for comfort and safety. Child friendly features Large if charging EVs is cheaper than petrol costs Projected to grow rapidly. Fleets such as taxis and fleet and leasing operators that require EVs (e.g ride-sharing app operators) Standard features with design for safety and comfort. Large High growth Urban commuters Small, compact designs to fit into narrow alleyways, with long lasting charges Large High growth Sports enthusiasts who drive off-road for outdoor adventures Rugged EVs Small Moderate growth Might desire reliable, easily available charging infrastructure with discounts and rebates or carbon credits for EV use. They might also require batteries that are efficient and might prioritise safety in such vehicles as they might be sceptical of these types of automobiles Large High growth potential as many governments have recently pledge for zero emissions Emerging segments More consumers who are willing to convert to EVs in countries with better charging points as they learn about government campaigns and policies Conclusions BYD probably needs to pick up pace of innovation and start manufacturing new models that are tailored towards driving styles in southeast asia. E.g. more durable clutches and steering wheels for impatient drivers. These markets will focus on small compact models that are easy on the pocket. Increasingly it seems like it needs to produce vehicles that can integrate with current digital ecosystems in phones and computers. BYD’s EVs must feature efficient charging to get ICE vehicle users to switch over in the long term. A more efficient battery will reduce costs in the long term and entice users to switch to EVs. Finally, autonomous driving vehicles are the future, and much must be spent on this technology to keep up with competitors. Current strategies and competencies of BYD: BYD is a low-cost producer and has achieved low costs due to economies of scale and its vertically integrated supply chain. BYD manufactures most of its parts including batteries that make up almost 40% of the entire costs of manufacturing. This gives BYD much control over its supply chain and makes it less susceptible to supply chain disruptions. For example, for BYD Dolphin only tyres and windows are delivered by suppliers and all other components are produced by the company itself. It even manufactures its own chips and was able to mitigate the effects of the pandemic. Another major reason why BYD’s cars are competitive is due to economies of scale reaped from the large output that it manufactures. Last year, BYD's vehicle production also increased significantly to 3.02 million vehicles in 2023, it was almost twice as high as in the previous year. Such a large volume of production would enable it to have have better bargaining power over its suppliers. The battery production line is a complete large-scale fully automated production line, with strong battery production capacity. Furthermore BYD invests heavily in research and development. It has high levels of engineering and technological innovations. It has mastered the core technologies of NEVs, such as batteries, motors, electronic controls and chips. E.g. blade battery (world’s most advanced battery), which uses lithium-iron-phosphate (LFP), and enhanced the energy density and total capacity of the battery by increasing the utilization rate of the battery pack space. The battery delivers maximum energy density, safety and efficiency. This specific competency is indeed rare as BYD was an early entrant to the battery market and this is highly valuable as its proprietary batteries shocked the world when they came out. It is inimitable and unique to BYD. BYD also managed to reduce the overall volume and weight of its cars by 10%, due to its so-called e-platform 3.0, a new manufacturing technology. It has also undertaken investments in autonomous driving technology. E.g. self-driving technology and in car entertainment. E.g. DiSus intelligent vehicle body control system, enabling its cars to do spinning maneuvers and crabwalk. It has invested 100 billion yuan (US$14 billion) in smart cars. The system integrates several technologies BYD has developed in both vehicle intelligence and electrification, including cloud-based artificial intelligence, 5G network connectivity, smart driving and smart-cockpit features, enabling a car to perceive changes in the internal and external environment and adjust in real time to enhance driving safety and comfort. BYD can launch high-end smart driving models equipped with lidar (light detection and ranging) sensors. Models can offer high-end intelligent driving assistance systems as an option and BYD can charge a premium for these features. Customers would appreciate such cars with highly integrated technology and can keep car enthusiasts hooked to the brand for years to come. This pace of innovation keeps them engaged and one that values sustainability. This makes BYD’s products price inelastic and therefore give it power to charge premium price for state of the art models. BYD has a diversified product portfolio that includes EVs, buses, monorails, solar panels, and rechargeable batteries. The company’s diverse product offering has enabled it to cater to different customer segments, which has helped to boost its revenue streams. E.g. BYD has started releasing cars resembling Lamborghini under a different brand, Yangwang, marking a strategy shift from relying on lower-priced runarounds to producing less conventional vehicles that come with a hefty price tag. It launches new and varied models at a rapid pace, growing its portfolio of electric vehicles to more than two dozen models, catering to almost every taste and budget (WSJ, 2023). This combination of quality and cost advantages creates wide range of positioning and pricing options that cannot be matched by competitors in primary and resale markets (Singh, 2024). In 2016, the company hired Wolfgang Egger as design chief, a role he previously played for Audi and Alfa Romeo to improve the looks of its lineups. It also lured away other international executives, including Ferrari’s head of exterior design and a top interior designer for Mercedes-Benz. The company will update its DM (Dual Mode) hybrid system, as well as its all-electric ePlatform, BYD is set to launch its fifth-generation DM system, with the DM-i branch enabling the vehicle to consume as little as 2.9 L of fuel per 100 kilometers, and drive close to 2,000 kilometers on a full tank of fuel and full charge, Competitor Analysis BYD has many competitors in China and in overseas markets. Chinese competitors include new players like Xpeng and Nio. Nio is a relatively young EV automobile company founded in 2014. The startup is known for being a maker of premium smart EVs — and its cars can be even more expensive than Teslas. Even though it's priced in the premium range Nio still managed to post a 33% increase in vehicle sales last year — but the company is still in the red after posting the equivalent of $7.4 million in revenue in 2022. Nio's full-year operational loss in 2022 was 15.6 billion yuan, or $2.3 billion, according to company financials. Guangzhou-headquartered EV car maker Xpeng Motors has been expanding aggressively in Europe, starting with Norway in December 2020. It manufactures "smart" electric vehicles targeting the mid- to high-end segment of China's automobile market. XPeng claims to differentiate itself from competitors through attractive designs, an interactive "smart" mobility experience, and relatively long vehicle driving ranges (although we don't find the driving ranges of XPeng vehicles to be significantly longer than other similar electric vehicles). The company also develops advanced driver assistance systems (ADAS) focuses its on research on technical enhancements (Investorinsightsasia, 2022) In overseas markets, the key players include Tesla. Tesla offers premium EVs that look futuristic. Tesla is traditionally known to be a luxurious brand and car maker. Tesla offers cutting edge technology like vehicle drivetrains, battery technology (including its Gigafactories), autonomous driving systems (such as Autopilot and Full Self-Driving), and energy storage solutions (Powerwall, Powerpack, Megapack) (CHATGPT, 2024). Tesla has developed a reputation for producing superb products. The Tesla Roadster seems like a dream car that most desire. Tesla’s proprietary superfast-charging stations are unparalleled too. These create efficient recharging opportunities for Tesla’s electric vehicle drivers. Tesla’s current fleet of Superchargers range in power from 72 kW for Tesla’s Urban Superchargers up to 250 kW for the newest Superchargers being installed around the world (cleantechnica, 2024). Over-the-air updates continuously improve Tesla’s all-electric vehicles and are frequent. Tesla has advantage in autonomous cars, own supercharger networks, premium cars with a luxury feel. With the Gigafactory ramping up production and more coming online in time, Tesla’s cost of battery cells continues to decline through economies of scale, innovative manufacturing, reduction of waste, and the simple optimization of locating most manufacturing processes under one roof. Tesla’s battery supply chain is a big part of Tesla’s business advantage, as its batteries are generally considered to be better than the competition’s due to the quality of battery partner Panasonic’s cells. Furthermore, Tesla focuses on continual improvement of the packs and the battery chemistry. Apart from EV players, BYD faces strong competition from fossil-fuel powered vehicle makers. These players have a distinct advantage in that they do not require charging infrastructure which is undeveloped in many countries including Indonesia where BYD plans to enter. Competition is very stiff in the EV market. However, competitors cannot seem to compete with BYD in terms of cost. Since BYD makes its own batteries, it is able to cut costs drastically. Some competitors like established ICE vehicle makers may also have stronger brand presence as compared to BYD. In order to win premium customers from overseas, BYD needs to compete based on design and advanced features like autonomous driving and smart cars instead of just relying on lower costs. In addition, though not direct competitors, there is a potential competition from other service providers like ride hailing services and public transport. However, at present these are weak competitors as public infrastructure is not well developed in countries like Indonesia. Below is a summary of the different competitors. (in Bn) Global Market cap Key Revenue Currency (Mar 17, Competitors 2023 TTM 2024) Profit margin BYD HKD 644.1 578.7 5.0% Tesla USD BMW EUR Volkswagon EUR Lucid Group USD 520.8 78.2 62.8 6.2 96.8 153.2 322.3 595.3 15.5% 9.3% 5.2% 0.0% 91.9 81.6 71.3 55.6 127.8 22.8 -38.0% 3.5% -50.0% NIO Domestic GAC Aion Xpeng HKD HKD HKD Chapter 3: Pestel analysis Political Factors: BYD stands to gain from Chinese government incentives for New Energy Vehicles (NEVs), with a significant purchase tax exemption of up to 30,000 Yuan ($4,170) per vehicle for those purchased in 2024 and 2025, tapering down to a cap of 15,000 Yuan for purchases in 2026 and 2027. The Chinese government aims to boost EV spending through incentives like trade-in programs and purchasing policy revisions, creating a favourable market for BYD. China's National Development and Reform Commission (NDRC) aims to set up over 50 vehicle-grid integration pilot programs by 2025 in mature regions, providing BYD with a platform to integrate and showcase its technology and services. China's government has dedicated significant investment in EV charging infrastructure, intending to support 20 million electric vehicles by 2025, signifying a strong tailwind for BYD's electric vehicles sales due to improved user convenience. The Chinese government's goal for 80% of new or renewed public fleets (buses, taxis, delivery vehicles) to be electrified by 2025 in pilot zones and pollution-affected regions lays a fertile ground for BYD's growth in the public sector vehicle market, with the aim of 100% electrification by 2035. Also, China plans to add over 300 coal-fired power plants, with a strategic approach to run them selectively, indicating an energy strategy that combines both renewable and non-renewable sources. European countries, like Norway and the UK, have set aggressive carbon reduction targets, fostering a conducive environment for BYD's expansion with incentives for EV purchases and investments into charging infrastructure, seeing impressive EV adoption rates. Indonesia's targets to reduce emissions in the transportation sector include reaching 1.8 million electric two-wheelers (E2Ws) by 2025 and 13 million by 2030, as well as 0.4 million electric four-wheelers by 2025 and 2 million by 2030, potentially opening up a significant market for BYD's electric models, though there is pressure for more stringent policies to align with the Paris Agreement. Other factors impacting BYD's operations include its relationship with both China and the United States. The United States has sought to impose trade restrictions on China, notably through export controls on semiconductor-related products, which have exerted a notable influence on BYD's business. In terms of these semiconductor regulations, the United States has not only urged its own nation but also countries such as Japan, South Korea, and the Netherlands to enact similar export restrictions since 2022. Over time, these regulations have been progressively reinforced. Semiconductors play a critical role in automobile manufacturing, requiring ten times more of these components compared to traditional internal combustion engine vehicles. The securement of semiconductors has become indispensable in the production of electric vehicles. During the COVID-19 pandemic, disruptions in the semiconductor supply chain led to significant challenges in procurement, resulting in doubled delivery times for companies like Toyota. Economic regulations arising from diplomatic ties with the United States, especially concerning supply chains, represent factors necessitating adaptation for BYD's operations. Geopolitical tensions with Europe are bound to affect BYD as well. In September 2023, the European Commission, the executive arm of the European Union, launched an investigation into subsidies given to electric vehicle makers in China. Economic Factors: The market size for electric vehicles in China is anticipated to more than double from USD 305.57 billion in 2024 to USD 674.27 billion in 2029, growing at a 17.15% CAGR. This strong market growth trajectory provides BYD with expansive opportunities to scale its offerings. The shift towards sustainable transportation is accelerating in China, fuelled by concerns over emissions and environmental impact. Over 30 cities aim for complete electrification of public transit, leaving ample market space for BYD's electric buses and vehicles. China's commitment to phasing out fossil fuel vehicles by 2040 aligns with BYD's product range, favouring its electric and hybrid vehicle offerings. Despite the progress seen, significant expansion potential exists in the 60% of Chinese cities without strict vehicle increment clauses. The stringent regulations in major cities like Beijing, issuing only 10,000 combustion-engine vehicle permits monthly, further prompt citizens to choose electric vehicles, benefiting BYD. BYD's international ventures, including a significant order for 1,002 electric buses in Colombia, indicate robust global market penetration and a solid international presence. Despite challenges in European markets against established brands like Tesla, BYD needs to enhance its value proposition and cost reduction to differentiate its offerings such as the ATTO 3 model in European Markets. In Indonesia, the high upfront cost of EVs poses an adoption barrier. The proposed government cost reduction incentives, including the expected IDR 7 million reduction for E2Ws, have the potential to stimulate the market, making EVs more affordable and driving further adoption. The rapid increase in E2W adoption in Indonesia demonstrates a growing consumer interest. With certain E2W models priced competitively, BYD can tap into this momentum and bolster its market share in the region. Indonesia's transition from a net oil exporter to a net oil importer since 2004 has highlighted the country's increasing reliance on imported gasoline. With approximately 52% of its total gasoline consumption supplied by imports from 2015 to 2020, there's a clear risk to the nation's energy security. The sharp rise in fossil fuel prices throughout 2022 has intensified the economic strain on the government, resulting in an expenditure on energy subsidies that was nearly three times the initial budget. This financial pressure underlines the urgency for Indonesia to prioritize energy independence. Charging infrastructure remains a technological challenge, reflected by the more than 200% growth in battery charging station installations in 2022. However, the concentration of charging stations in regions like Jakarta and Bali points to the necessity for a more evenly distributed infrastructure development. China's battery production is set to exceed demand, with a 2025 forecast predicting a capacity of 4,800 gig watt-hours, outstripping expected EV maker needs by fourfold. This surplus could lower battery costs, enhancing BYD's operational efficiency and competitive pricing edge. With 80% of the world's lithium-ion battery manufacturing in China and a cost advantage of 30% less than U.S. and European batteries, BYD is well-placed to capitalize on the cost competitiveness in global supply contracts. Raw materials' price volatility remains a risk for BYD's cost management. Strategies to mitigate this, such as flexible product pricing, will be crucial for the company's profitability. Social Factors: Environmental pollution concerns are a driving force behind a societal shift towards sustainable transportation in China. BYD's range of electric vehicles aligns well with the growing public demand for cleaner transport solutions, positioning the company to benefit from this increased environmental awareness. With projections of price parity between battery electric vehicles (BEVs) and internal combustion engine (ICE) vehicles by 2027, BYD finds itself at a pivotal juncture to capitalize on the projected surge in electric vehicle adoption. This cost equalization is a significant advantage for BYD in making its electric offerings more accessible and attractive to a broader market. The global sensitivities to electric vehicle adoption, influenced by local cultural nuances, economic variances, and policy landscape, require BYD to sculpt its strategies to match regional market demands. A nuanced understanding and approach to these distinct markets will be key to BYD's successful global expansion. In Indonesia, affordability remains a major social concern, with many EV models, particularly mid-class E4Ws, priced beyond the reach of most consumers. For BYD, addressing these affordability barriers is essential for tapping into the broader consumer base and enhancing EV adoption rates in markets like Indonesia. Technological Factors: Government initiatives in China, such as targets for improving new passenger BEV electricity consumption and creating efficient battery swapping networks by 2025, foster technological innovation and infrastructure development. These priorities offer BYD the chance to display its capabilities and maintain a technological lead in the market. BYD continues to be a forerunner in the new energy vehicle sector, constantly innovating with proprietary technologies like the pure electric real-time four-wheel drive and integrated electric control systems. The company's vehicles, like the Tang DM-p and Han DM-p, reflect innovative technology with impressive acceleration capabilities and energy-efficient features. The integration of heat pump technology highlights BYD's dedication to enhancing electric vehicle performance its pure electric mileage by 20km for every 100km and saves up to 40% energy in its airconditioning system. BYD's rollout of CTB (Cell-to-Body) technology in 2022, blending chassis and battery systems, underscores enhancements in vehicle safety, structural integrity, and overall vehicle performance. In the energy storage sector, BYD has made remarkable progress, with its products reaching a global footprint across over 70 countries and totalling 7 GWh. Innovations such as the BYD Cube, boasting a significantly higher capacity density of 89%, demonstrate BYD's technological advancements in energy storage solutions. The introduction of the Blade Battery by BYD in 2021 signifies a significant leap in lithium iron phosphate battery technology, prioritizing safety, and durability, and setting a new industry standard. Beyond the automotive space, BYD's innovations in rail transport with the mid-capacity "SkyRail" and small capacity "Sky Shuttle" extend its technological influence, offering sustainable and efficient public transportation solutions that address urban congestion. Environmental Factors: China's robust GDP growth and substantial NEV market penetration create a favourable economic climate for BYD, with NEVs comprising 50% of global ownership as of mid2023.BYD's initiatives supporting China's "3060" Dual-carbon goals reflect its alignment with global carbon emissions reduction efforts, enhancing its sustainability profile. BYD's business in China remains robust, notably establishing a dominant position in the electric vehicle industry. However, within the broader context of China's domestic economy, there's a situation where GDP growth rates have decelerated following the COVID-19 pandemic and due to the failure of zero-COVID policies and a real estate crisis. Specifically, GDP growth rates have slowed from around 7% before the pandemic to approximately 5% in Q4 of 2023, compared to the low levels of 2.9% in the preceding year, indicating a significantly reduced growth rate. In light of this situation in China, the Shanghai Composite Index, a gauge of Chinese stocks, has declined by around 16% compared to 2022 (from 3639CNY on December 31, 2021, to 3054CNY on March 16, 2024). Such a slowdown in the Chinese economy and the resultant reduction in investment pose risks for BYD, given its substantial domestic sales. BYD's actions, including energy efficiency projects which saved 8,248 tons of coal and reduced 21,444.8 tons of CO₂ emissions in 2022, display its active role in minimizing greenhouse gas emissions. The company's green development investments, community environmental actions, and RMB 5 million commitment to environmental research and education by 2024 highlight BYD's dedication to environmental protection. Indonesia responds to the global demand for more sustainable practices in battery production, the ban on nickel ore exports has spurred significant growth in the nation's capacity for refining battery-grade nickel. The operational status of two HPAL (High-Pressure Acid Leach) facilities and the planned addition of three others underscore Indonesia's alignment with the trend towards sustainable battery materials—a shift that BYD can potentially benefit from given its focus on electric vehicles factory in Indonesia. Legal Factors: Compliance with automotive industry regulations, including emissions and safety standards, is critical for BYD to ensure market participation and safeguard its reputation. Protecting intellectual property rights through patents and trademarks is key for BYD to defend its proprietary technologies and maintain its competitive edge. BYD must adhere to battery safety regulations to address EV thermal runaway risks, emphasizing the importance of rigorous safety measures in its EV design and manufacturing processes. Chapter 4: Value Chain Analysis Supply chain management: BYD operates a vertically integrated supply chain, which is somewhat unique in the auto industry. It manufactures many components in-house, including batteries, electric motors, and electronic controls. This integration allows BYD to reduce costs, improve supply chain efficiency, and ensure quality control across the production process. Figure 1: BYD components breakdown BYD also deploys and operates charging stations, then tap into a new revenue stream, diversifying their portfolio and mitigating any potential dips in car sales. Partnerships with energy companies and municipalities can further expand their reach and share investment costs, creating a win-win situation for all stakeholders. Manufacturing: Manufacturing is a core component of BYD's value chain, where the company leverages its technological innovations and efficient production processes. BYD's manufacturing capabilities are highly automated and optimized for EV production. The company's factories are equipped with state-of-the-art machinery and robotics, enabling high-volume production with consistent quality. More importantly, owning the largest electric vehicle production capacity in all of Asia endows BYD with substantial scale advantages. Even during industry-wide price reduction cycles, BYD is still able to maintain a certain level of profitability. Due to BYD's excellent vertical integration capabilities and scale benefits, its average gross margin has been increasing year by year. Remarkably, this is achieved even in the context of moderate average selling prices, with per-unit gross profit ranking second only to Tesla as seen in figure 2. Figure 2: Automobiles’ gross margins Marketing and Sales: BYD employs various marketing and sales strategies to promote its brand and products. This includes digital marketing, showrooms, and participation in international auto shows to showcase its latest EV models. BYD also focuses on building strategic partnerships and collaborations to expand its market reach and explore new business opportunities. BYD boasts a vast network of over 400 dealerships across 70 countries and regions, ensuring accessibility for its growing customer base. Figure 3: Global monthly sales data for BYD In Asia, BYD has expanded its vehicle sales to over 15 countries. Notably, in Thailand, the company's monthly sales volume has surpassed the 2,000 mark. Figure 4: Distribution of Sales Markets in Asia Figure 4: Distribution of Sales Markets in Asia Supply chain challenges: Quality management: BYD’s EV cars exported to Europe were reported to require several fixes and repairs when arrive at destination. Although BYD’s management team attributed the reason to inexperience in long-haul shipping, many consumers and distributors doubt the manufacturing quality. No matter what reasons led to overseas quality problems, negative feedback for overseas sales will hurt reputation and sustainable development. Intensifying competition: With subsidies beginning to diminish in countries such as China and Europe, BYD's cost advantage due to vertical integration may not continue domestically and internationally, and consumer preference for electric vehicles could decline. In China, government subsidies have already started to decline, and consumer enthusiasm has weakened, leading to more intensified competitive environment. Chinese new energy vehicle companies are engaging in price wars. Despite BYD's leading position, it will face the challenge of reducing prices and gross margins. Particularly, given the large investments BYD has made in its plant and equipment, lower-than-expected sales could result in significant asset impairment losses. Chapter 5: Porter’s Five Forces Analysis for the EV Market Porter’s Five Forces analytical framework developed by Michael Porter (1979) represents five individual forces that shape an overall extent of competition in the industry. BYD Porter’s Five Forces are illustrated in Figure below. Figure 5: Porter’s five forces model Threat of new entrants The threat of new entrants into the EV sector is low to moderate. Many firms are affected by the threat of entry of other firms. When the market is profitable, the chances of attracting new entrants will be high. Though the market for EVs has proven to be profitable, heavy start-up costs will have to be incurred by new entrants as R&D costs are high and much has to be spent on differentiating its products from incumbents products. Also production of EVs involves high overheads due to investments in capital equipment. To substantiate, Volkswagen plans to invest €35 billion in EV R&D by 2025, while Ford has allocated USD50 billion by 2026 for the same purposes. New entrants in the EV market might potentially face retaliation from established automakers like Tesla and BYD, including limit pricing and intensified marketing. Additionally, oil and gas companies, threatened by the shift from fossil fuels, may spread misinformation and pressure lawmakers to delay or limit EV incentives. Switching from one EV brand to another entails significant costs for consumers making it difficult for new entrants to lure away customers from incumbent firms. First of all, they need to sell their current car and invest money into buying a new model and the inconveniences associated with this. There could be other costs too such as as reluctance due to perceived risks, lack of trust in new brands, and the effort needed to adapt to new features and technology. Additionally, anxiety may arise from concerns about lower range or less reliable charging infrastructure with a new brand. Bargaining power of buyers The bargaining power of buyers in EV industry is moderate. This market is an oligopoly with 2 dominant players, Tesla and BYD owning most of the market share followed by a number of smaller players co-existing with these larger firms. Products are not homogenous and greatly differentiated. Buyers have limited bargaining power due to the advanced technologies adopted especially for the prices charged and the seller sets the price. However, buyers can voice other opinions like ESG practices and demand better service is provided. Strong loyalty programs with rewards and benefits can empower customers to negotiate better deals or demand improved service. Brands focusing on sustainability or unique driving experiences foster passionate communities whose collective voice holds the brand accountable and influences product decisions, effectively bargaining for features aligned with their values. Bargaining power of suppliers Supplier bargaining power in EV sector is moderate. Vertical integration in the EV sector affects supplier bargaining power. Traditional automakers relying on external suppliers may face higher supplier influence due to dependence. However, vertically integrated companies like BYD, involved in battery production and other key components, have more control over their supply chain. For instance, in the case of BYD Dolphin, only tires and windows are sourced externally, while all other components are produced in-house. Suppliers offering essential components or proprietary technology hold significant leverage due to limited alternatives and dependence on their expertise. For example, many standard components like semiconductors have shortages, giving suppliers more leverage. Threat of substitute products or services Threat of substitute products or services in EV sector is low to moderate. Despite environmental pressures, Internal Combustion Engine (ICE) cars maintain advantages like lower upfront costs, wider refueling infrastructure, and longer ranges for some models. Advances in hybrid technology and biofuels could delay full EV adoption. Hydrogen Fuel Cell Vehicles (FCVs) offer rapid refueling and extended range, appealing to long-distance drivers and businesses, but face challenges like limited infrastructure and higher costs. Additionally, micromobility options such as shared e-bikes, scooters, and carpooling services could provide affordable alternatives for short-distance commutes, potentially impacting EV sales in urban areas. Public transport systems and ride-sharing services can decrease the necessity for individual vehicle ownership, affecting both ICE and EV sales. The transition to remote work may reduce commuting demands, further decreasing the demand for personal vehicles, whether electric or fossil-fuel powered. Rivalry among existing firms The rivalry among existing firms in EV sector is highly intense. The EV sector is undergoing rapid growth, with global sales doubling yearly in 2023. This surge has intensified competition among established and new players. Established automakers, tech giants, and startups are all vying for market share, leading to increased rivalry across design, technology, and pricing. With many new entrants offering similar core features, competition now focuses on branding, service differentiation, and innovative partnerships. In the competitive EV sector, brand equity is a powerful tool shaping customer preferences and market dynamics. Established brands like Tesla and BYD, with loyal customer bases, enjoy a competitive advantage through repeat purchases and positive word-of-mouth promotion. Their strong reputations enable them to command premium prices, boosting profitability and facilitating investment in innovation and brand building. Chapter 6: Recommendation on Strategies 1. Strategies for expansion overseas (Set Indonesia as main targeted overseas market) 1.1 Marketing strategies In response to such threats, Chinese EV makers have been counting on Southeast Asia, the Middle East and Europe as their largest exporting markets. Enhance marketing efforts to improve brand image: BYD can focus on improving its brand image as Chinese models are often viewed as low quality substitutes. Though it is planning to launch a number of luxury models this year, Chinese brand cars are generally perceived to be of lower quality given their lower costs and the standard features. Consumers need to build trust in the model especially since BYD is aiming to expand to overseas markets. Thus a sound marketing strategy is required to entice new customers to switch to this brand. BYD has added to its offering luxury versions like the Han EV. This model has been recently upgraded to feature ambient lighting, heat pump air conditioning, upgraded Dynaudio, and steering wheel heating. The 2023 Han EV also has a range of intelligent features, including a 5G in-car connection. However, this primarily targets mid-to-large luxury sedan market and thus BYD should work on improving the perception that consumers have even for its budget models like the plug-in hybrid model the Qin Plus DM-i. This version costs just US$11,086. While this may lure consumers away from fossilfuel powered vehicles, consumers tend to have pre-conceived notions about the safety and quality of China brand. This is all the more difficult given the saturated EV market brimming with competition. Marketing efforts need to be geared to address such concerns that people have. Some consumers in Indonesia were holding back purchasing EVs due to doubts about new brands. Some potential consumers are waiting to see if something better or cheaper might appear in the market. Hence this represents a huge market potential that BYD can tap on if it reacts fast so as to gain a first mover advantage. One of the major sellers of petrol vehicles was Toyota in Indonesia. Some consumers expressed interest only in Toyota EVs. This hesitation requires quick intervention by BYD to capture a larger market share. A big reason why consumers switch brands is usually due to positive reviews either virtually or by word of mouth. Hence BYD can adopt something similar to what Tesla currently has on user experience. It publishes stories of people driving Teslas. While BYD need not copy this idea wholesale, it can aggregate reviews from users based on different performance metrics on its website to encourage prospective buyers to switch. Currently the webpage for BYD in Indonesia is overall quite dull and uninteractive. Using pop up images, videos with interactive features where customers can select different options to visualise the product can make the whole purchase experience a more interesting one. Also, BYD can improve its after sales services. The efforts that BYD has taken to improve brand image are commendable. For example, it adopts strategic partnerships or alliances with major established players to improve its brand image. BYD’s regional distributors include divisions of Sime Darby in Malaysia and Singapore, Indonesia’s Bakrie & Brothers, Ayala Corp in the Philippines, and Thailand’s Rever Automotive. It can continue to foster relationships with other stakeholders like charging infrastructure manufacturers to ensure that it does not go-it-alone and regional customers associate the products with a good brand. In Thailand, Rever Automotive, the only representative and distributor in Thailand of Chinese electric car BYD, launched an initiative to offset and claim carbon credit for end users who drive BYD cars. Upon granting permission to track mileage, users’ mileage will be converted into carbon credits, which customers can exchange for other benefits, such as using the credit to pay for charging fees at its own charging station network and those of its partners nationwide. Similar schemes can be adopted when BYD ventures to Indonesian markets. While Rever Automotive launched this service as an own initiative, BYD can partner with other charging station operators to ensure that people are enticed to switch to this brand. Given, BYD’s low costs, such services may work better than simply lowering prices. Another partnership is with driving schools where its sales consultants can promote BYD cars and provide information on various matters like financing schemes and vehicle maintenance. This allows BYD to interact with potential customers and learn more about their preferences and needs as well. 1.2 Other strategies for overseas expansion (financial and product offerings) Set sales and financial KPIs for Indonesia team aligning with their strategic plans. To be specific, their objective is to open 50 stores in Indonesia and set a factory producing 150000 cars annually in 3 years, then KPIs can be 10000 cars sold out from 2024 and subsequent annual growth rate of 20%. Towards this goal, BYD can sign more franchise dealers to give itself a larger retail presence than other car brands to tackle consumers who are still skeptical about foreign brands. BYD can sign agreements with charge point operators (CPOs) to provide preferential rates for BYD owners. BYD has introduced the BYD seal, BYD dolphin and BYD Atto 3 all of which are BEV vehicles in Indonesia. These models cost between 25000 USD to 45000 USD, while the cheapest model in China costs around USD 9700. There are several reasons for this including shipping costs and additional costs incurred to set up partnerships with foreign dealers and service networks and advertising costs. Also, BYD may not want to price too low to give the impression that its cars are of low quality. However, these BYD models costs more than the cheapest car, Datsun GO, in Indonesia, which starts at around IDR 126 million (approximately USD 8,900). Therefore, not many people would want to switch to BYD’s products given the high price coupled with concerns over range of electrically charged cars and the lack of charging infrastructure making it hard for BYD to win a larger market share. Therefore, while most of the current EV market in Indonesia comprises more affluent consumers who are more educated and with spending power, increasingly BYD may want to introduce more budget models to target the masses who have lower spending power. Introducing cheaper models is also important if BYD wants to focus on market share expansion when entering a new market instead of focusing on earning profits from the getgo as many consumers in Indonesia are still loyal to Japanese brand makers like Toyota. In the long run, BYD can offer luxury versions to improve product offerings for the affluent segments. It can also explore other products like electric 2 wheelers as the Indonesian government has been pushing to expand the domestic EV market by subsidizing purchases of both electric two- and four-wheelers (Nikkei, 2024). Finally it can consider introducing commerical vehicles like public buses for the urban market. Enhance quality management: Establish more stringent quality assurance protocols, especially for products destined for export and adopt international standards to align quality management with global expectations. BYD has avoided major quality issues affecting a large number of consumers. Still, incidents have occurred affecting both passenger and commercial vehicles. From buses in London catching fire to the number of fixes or repairs that passenger-car models exported from China require before they can be sold to consumers, BYD’s cars seem to have quality issues. Post-import touch-ups are common in the auto industry, but BYD models often require more extensive fixes than most. Analysts have attributed this to BYD’s inexperience in handling logistics. This may tarnish BYD’s hopes to build large-scale businesses in the overseas markets. Hence, BYD should aim to bring down quality manufacturing issues to below 1 % and ensure that cars can delivered as promised. Similarly BYD should ensure that its product have timely deliveries. Though it operates a vertically integrated supply chain, BYD is not fully immune to global supply chain disruptions. For example, first deliveries of the 2022 BYD Atto 3 electric SUV have been delayed in Australia, as its maker – and local importer EVDirect – were hit by ongoing production and shipping disruptions. Producing ahead in anticipation of demand is important and BYD should use advanced data capabilities to do so. Diversification for higher competitive capacity: Diversify the product range to appeal to different market segments and reduce reliance on subsidies. In the early stages of its production in Chinese EV markets, BYD chose to simultaneously launch Battery Electric Vehicles (BEV) and Plug-in Hybrid Electric Vehicles (PHEV). This strategy allowed BYD to win the market when charging infrastructure was not wellestablished, and users were not very clear about the advantages of EVs. PHEV’s characteristics like high economic efficiency and not having range anxiety played a significant role in helping BYD to win the market (CNBC, 2024). In Indonesia, the ratio of vehicles to public charge points (20.1) is above the global average (15.9). This is mainly due to the low percentage of electric vehicles penetration rate of 2%. At present, just launching BEVs may not entice many buyers as charging infrastructure is not well-established. Hence, similar to its earlier strategy in the Chinese domestic market, BYD can launch a few PHEV models in Indonesia as well. Formulate strategies for building plants in Indonesia. BYD’s international expansion is not just about selling cars, it involves manufacturing and materials too. In the long term, BYD can focus on manufacturing Battery Electric Vehicle (BEV) vehicles. With the recent electrification push by the Indonesian government, BYD can work with the Indonesian government to diversify its battery production and encourage local EV production. Noting that BYD has announced to invest $1.3bn as it aims to build an EV plant in Indonesia, it will be essential for the organization to draft a meticulous business plan focusing on the targeted models by considering factors like production volume. As an upstream market movement, BYD can initiate partnerships and joint ventures with government sponsored nickel producing companies such as PT vale to process nickel. As part of the EV vehicle plant setup, BYD can also streamline production of cell components such as cathodes and also mitigate issues related to EV charging, considering PLN is the only player to supply electricity to public and private charging stations. Given that power outages are frequent in Indonesia, especially in more remote or rural areas, BYD can work on developing batteries with faster charging times and charging infrastructure that is more efficient. BYD can also partner with PLN in installing more charging stations. 2. Strategies for domestic market 2.1 Continue heavy R&D to keep their leading position in China. The Group adheres to developing battery EVs and plugin hybrid EVs at the same time, and has successively launched disruptive technologies such as “Blade Batteries”, “DMi Super Hybrid”, “e-Platform 3.0”, “CTB Cell-to-Body Integration” and “DM-p Hybrid”. Such technological innovations should be continued as they form the basis for key differences between BYD and its competitors. In future, BYD should focus on building solid-state batteries with faster charging times and also on building safer and faster cars. BYD can improve its in car entertainment capacities too. Advanced driver-assistance systems (ADAS) have a lot of potential to be unlocked. This can make or break the driving experience and BYD must lead the industry with this technology to ensure that users continue to love the feel of the vehicle. While manufacturing is fast for BYD and it has managed to churn out new EVs pretty quickly, China’s EV boom is so recent that it remains to be seen whether there are any trade-offs between faster development and vehicle safety and quality (WSJ, 2023). BYD should continue to invest in improving quality of cars and produce durable vehicles that last long on the rough terrains of Indonesia. In the short term, it should embrace itself for overcapacity in a market with economic uncertainties and given rise of new players. China’s new production lines will outstrip demand growth between 2022 and 2025, as per forecasts. This is where BYD can continue to invest in data analytics and IoT technologies to improve its data capabilities and to react faster to changing market conditions. In addition to 4 wheel automobiles, the other 2 key markets are buses and railways in China. Another recommendation in the face of Beijing cutting back on subsidies is for BYD to tap on its economies of scale to continue to producing EVs at low cost. They must find ways to keep costs low. Research to produce spare parts at low costs by negotiating partnerships with key suppliers of raw materials is important. They should also prevent the rise of diseconomies of scale due to technical issues or organizational issues. Diseconomies of scale are commonplace in organisations like BYD and measures to enhance operational efficiency should be continuously adopted. Lastly, human capital management is essential. BYD should focus on high level training programmes for its graduate employees and boost morale of its employees by creating a conducive working cultural and by providing upskilling options. Engineers are key to ensure its research and development capacities are top-notch and this will determine if it maintains its leading position. An environment that embraces innovation must be continuously fostered even in the event of changing management. 2.2 Strategies for Electrical buses: Since Chinese government's goal is for 80% of new or renewed public fleets (buses, taxis, delivery vehicles) to be electrified by 2025 and over 30 cities aim for complete electrification of public transit, this creates ample market space for BYD's electric buses and vehicles. Since introducing battery-electric buses over a decade ago, automaker BYD has delivered over 70,000 units to customers worldwide, Buses are just a small part of BYD’s EV line-up. BYD strategy for public transport electrification: Market Segmentation and Expansion: Identify and target specific segments within the electric bus market, such as urban vs. rural areas (Small v/s large capacity), school buses, and long-distance coaches. Scale up production capacity to meet the USD 91.30 billion market size projection by 2029 and expand into new, underserved markets both within China and internationally. Financing Solutions: Create competitive financing packages for public transport authorities and private operators to alleviate the initial cost barrier of transitioning to electric buses. These could include leasing programs, pay-per-mile agreements, and battery-leasing schemes to spread costs over time. Local and Government Partnerships for Global Reach: Cultivate partnerships with local firms in international markets and Government organisations for effective market penetration, knowledge exchange, and compliance with local regulations—similar to the venture in Colombia and collaboration with Thailand. After-Sales Services and Network: Establish a reliable after-sales service network to provide maintenance, parts, and support for electric buses. Build customer confidence in product reliability and longevity. 2.3 Strategy for Sky Rail: Over 30 cities aim for complete electrification of public transit, leaving ample market space for BYD's electric public transport Market Expansion: Identify and target key cities and regions with high traffic congestion and a need for sustainable transportation solutions. Aggressively pursue opportunities in international emerging markets that are currently developing their urban transit infrastructure. Research and Development: BYD should continue to invest in the development and implementation of driverless sky rails, leveraging BYD's expertise in automation technology. Focus on creating a seamless and safe user experience through advanced sensors, increasing the transportation capacity and speed, AI algorithms, and real-time monitoring systems. Partnerships and Collaborations: Form strategic partnerships with local governments, transportation authorities, and urban planners to promote the adoption of Sky Rail technology. Collaborate with other industry leaders to leverage their expertise and resources. Service and Maintenance Contracts: BYD can focus on long-term service and maintenance contracts to ensure a steady revenue stream. This would also strengthen relationships with customers and create opportunities for future sales. 3. Supply chain strategies Transfer to green supply chain by reducing emissions during manufacturing process and adopt green logistics. As discussed earlier, BYD owns a vertically integrated supply chain. It should focus on continuing battery innovations to cut costs of production in future and to maintain its leading position as a low cost player in the market. Another issue with the supply chain is whether it is green. It has been reported that substantial carbon emissions are generated during production of EVs and in power grids used to charge their batteries. Emissions during an EV’s life cycle, from production and charging to disposal should be considered and it will take further decarbonisation throughout the EV and battery supply chains to fully realise EVs’ full green potential. EVs normally start their life with a higher “carbon debt” than internal combustion engine (ICE) vehicles, due to the additional emissions generated during the mining and refining of battery materials, such as nickel, cobalt and lithium, according to analysts. (SCMP, 2023). The charging of batteries and EVs also emit emissions. Given that China is coal heavy, a medium-sized EV produced in China currently starts life with a carbon debt almost twice that of an equivalent ICE vehicle, according to European Federation for Transport and Environment (T&E) (SCMP, 2023). Hence it is of perennial importance that EV companies focus on life cycle EV emissions. BYD has adopted green logistics and recycles retired batteries. Recently, BYD Headquarters officially launched the “Zero Carbon Industrial Campus” in Pingshan. BYD has incorporated its unique advantages in the field of new energy and provided a package of green solutions such as photovoltaics, energy storage, new energy vehicles, SkyRail, and SkyShuttle to all aspects of production and life in the campus (BYD, 2023). However, the scope of BYD's recycling operation is small, and it is limited largely to China and BYD focuses on transforming old EV batteries into power storage for renewable energy and factories across the globe. However, BYD can adopt some of the green strategies adopted by its competitors like Contemporary Amperex Technology Co (CATL). For example use low-carbon raw materials such as green aluminium and recycled materials such as nickel, cobalt and manganese in its supply chain. The shift from ICE vehicles to EVs marks a shift from a fuel-intensive to a material-intensive energy system (International Energy Agency, 2021) and material scientists suggest either cutting the use of metals in batteries that are scarce, expensive, or problematic because their mining carries harsh environmental and social costs or to improve battery recycling (Springer Nature, 2021). It is still less expensive, in most instances, to mine metals than to recycle them, BYD should try to develop processes to recover valuable metals from used batteries cheaply enough to compete with freshly mined ones. This is a key process that could reduce the impact on the environment significantly if research is devoted to improve recycling of EV batteries. Also it can ensure production plants use green electricity, intelligent energy management systems and electrify transport. The green solutions are only applied for one campus. BYD will need to think about how it can incorporate more clean energy solutions for production elsewhere especially in countries like Indonesia where the electricity grid emission factors are greater than that in China (Carbon Footprint Ltd, 2023) and where it has recently announced plans for an EV factory. CITATIONS: 1. https://sg.byd.com/company-profile/our-strategies/ 2. https://cnevpost.com/2024/01/10/automakers-nev-market-share-in-china-in2023/#:~:text=Home%20%C2%BB%20BYD-,Automakers'%20NEV%20market%20s hare%20in%20China%20in%202023%3A%20BYD%2035,Tesla%207.8%25%2C%2 0Nio%202.1%25&text=BYD%20ranks%20No.,2%2C%20and%20Nio%20No. 3. https://www.byd.com/us/news-list/BYD-New-Energy-Vehicles-Drive-Transition-toGreen-Transportation-in-Latin-America 4. https://economictimes.indiatimes.com/industry/renewables/chinese-firm-byd-plans-tocover-90-of-ev-market-in-india-this-year/articleshow/108237889.cms?from=mdr 5. https://www.byd.com/eu/newslist/BYD_Ascends_to_No_212_on_the_2023_Fortune_ Global_500.html 6. https://www.scmp.com/business/article/3232456/your-made-china-electric-vehicletruly-environmentally-friendly 7. https://cleantechnica.com/2020/07/16/teslas-5-biggest-competitive-advantages/ 8. https://www.cnbc.com/2024/01/05/how-byd-grew-from-a-phone-battery-maker-to-evgiant-taking-on-tesla.html 9. https://www.straitstimes.com/asia/se-asia/as-indonesia-pushes-ev-dream-carshoppers-stay cautious#:~:text=Indonesia%20has%20set%20a%20target,at%20the%20show%20in %202022. 10. BYD’s world-beating EVs brace for a rougher ride | Reuters 11. 2022 BYD Atto 3 deliveries delayed by up to two months - Drive