2023-3-31 BYD's Net Profit Exceeds 10 Billion Yuan in 2022

advertisement

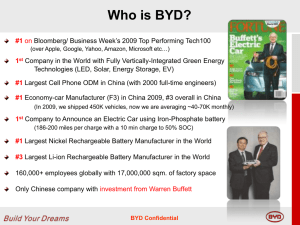

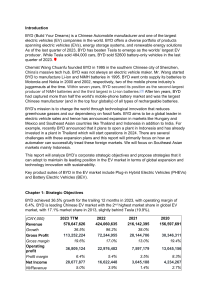

BYD's Net Profit Exceeds 10 Billion Yuan in 2022 On the evening of March 28, BYD handed over a brilliant report card. With the announcement of BYD's 2022 performance, on March 29, Wang Chuanfu, chairman of BYD, delivered a speech at BYD's performance conference. He said that BYD's goal is to become China's largest automaker by the end of 2023. 1. BYD Handed over the Best Performance Report Card On the evening of March 28, BYD disclosed its 2022 annual report. The announcement shows that BYD achieved operating income of 424.061 billion yuan in 2022, a year-on-year increase of 96.2%; net profit of 16.622 billion yuan, a year-on-year increase of 445.86%; earnings per share of 5.71 yuan; the company plans to distribute a dividend of 11.42 yuan (including tax) for every 10 shares. It is worth mentioning that this is the best performance report card BYD has handed over since its listing, and its annual net profit exceeded 10 billion yuan for the first time. According to BYD, the company will once again win the global new energy vehicle sales champion in 2022, and has also ranked first in China's new energy vehicle sales for ten consecutive years. The data shows that the company's new energy vehicle market share in 2022 will be 27%, a year-on-year increase of nearly 10 percentage points, and its leading position in the industry will become increasingly prominent. In 2022, the price of lithium carbonate, a key raw material for power batteries, soared, and the performance of many EV manufacturers has been affected: ◆ XPeng Motors has a net loss of 9.14 billion yuan, a year-on-year increase of about 88%; ◆ Li Auto has a net loss of 2.03 billion yuan. The loss increased by nearly 5.3 times year-on-year; ◆ NIO’s net loss exceeded 14.4 billion yuan, and the loss increased by 2.6 times. However, BYD is an exception. Itself is an important player in the field of electric vehicle batteries. It has effectively reduced costs through technological innovations such as self-supplied batteries, blade batteries, and CTBs, and has survived the raging tide of raw material price increases last year. How to maintain a steady increase in profitability in a fluctuating market is a test of the overall strength of EV manufacturers. In this "new energy test" in 2022, BYD has already handed in its own answer sheet. 2. Aims to Become China's Largest Automaker by the End of 2023 On March 29, at BYD's performance conference, Wang Chuanfu said that China's auto demand in January and February was weaker than last year. However, BYD still maintained a strong growth, and sales in January and February were higher than the same period last year, increased by 84.2%. He also said that BYD's electric buses have already been sold in the United States. In the passenger vehicle sector, BYD's passenger cars are currently exported to Europe, Southeast Asia and South America, and there is no plan to enter the U.S. passenger car market. Therefore, the tax credit policy of the US "Inflation Reduction Act" has no effect on BYD. In response to the recent price war in China's auto market, Wang Chuanfu said that the reason for the price war is the contradiction between supply and demand, and the supply exceeds demand. Some companies will be eliminated, and some companies will gain a larger market share. The EV market in China will also enter a knockout stage in 2023. If the supply exceeds demand, the price war will continue. Wang Chuanfu also said that the price war did have a certain psychological impact on consumers, but it is believed that the impact will be reduced by the end of April. With the launch of various auto shows in May, market confidence will gradually recover. It is believed that in May, the Chinese auto market will return to a relatively good growth level. Wang Chuanfu also revealed that the listing plan of BYD Semiconductor remains unchanged, but there are some adjustments in the process. The rapid growth of the group's business and the huge demand have made semiconductor sales account for a large proportion of the group, and its independence has also weakened. Of course, it is impossible for BYD's vehicle growth to be so fast every year. As the growth rate returns to normal, it is believed that the proportion of BYD's semiconductor business that depends on the group in the future will decrease at an appropriate time, and it will also be eligible for listing at that time. 3. Entering Overseas Markets From the perspective of overall sales, BYD has become the "number one player" in new energy vehicles. In March 2022, BYD officially stopped the production of fuel vehicles, and has since then focused on the new energy vehicle track. In 2022, BYD achieved sales of 1.8635 million new energy vehicles, surpassing Tesla, its "old enemy" who has been entangled for many years (global delivery of 1.31 million vehicles). However, in terms of sales regions, BYD still focuses on the Chinese market and is still in the early stages of development in overseas markets. In order to truly become a "global car company", BYD has also accelerated the pace of going overseas. ◆In February 2022, BYD Yuan PLUS will start pre-sales in Australia, and orders are booming. ◆In July 2022, BYD held a brand conference in Tokyo and announced its official entry into the Japanese passenger vehicle market. ◆In September 2022, BYD held a press conference on new energy passenger vehicles in Europe, and launched three models of Han EV, Tang EV, and Yuan PLUS for the European market, and made their debut at the Paris Motor Show in France in October. ◆In November 2022, BYD entered Brazil, held a press conference in Sao Paulo, Brazil, and launched two models, Song PLUS DM-i and Yuan PLUS. Throughout 2022, BYD exported 55,900 vehicles, opening up sales in Europe, Asia-Pacific, America and other regions. By 2023, BYD has greatly accelerated the pace of overseas expansion. In January, overseas EV sales reached 10,400, and in February it increased to 15,000. In the first two months of 2023, BYD achieved nearly half of its overseas sales last year, with strong export growth. The China National Finance Securities Research Report believes that BYD is fulfilling its potential to go overseas. In February, BYD exported 15,002 vehicles, a year-on-year increase of 1187%, and a month-on-month increase of 44.1%. From January to February, the cumulative year-on-year increase was 1607%, which is close to that of SAIC, a traditional overseas car company, and has achieved explosive growth. BYD's competitiveness in the domestic electric car market has been fully proven. It has established production bases and sales networks in many overseas locations, and the growth of overseas exports is highly certain.