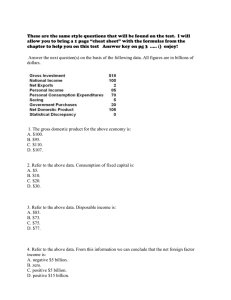

means Y 45 Expenditure C+I+G+net X

advertisement

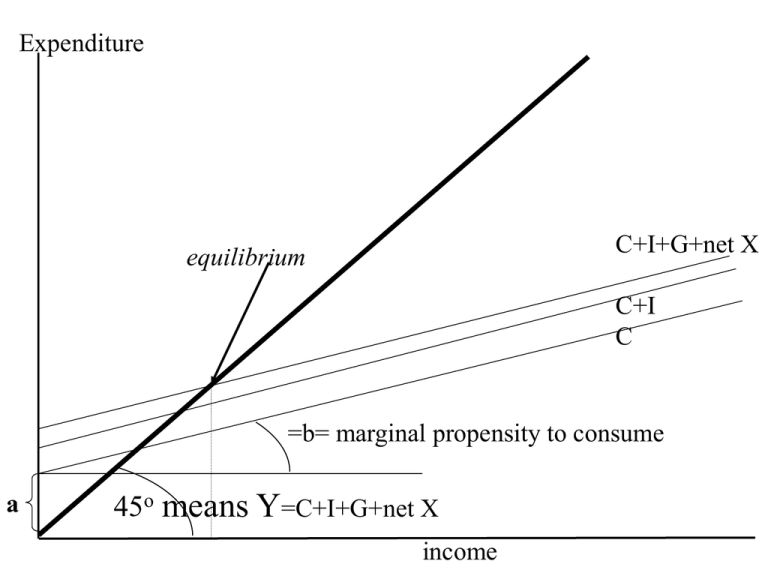

Expenditure

C+I+G+net X

equilibrium

C+I

C

=b= marginal propensity to consume

a

45o means Y=C+I+G+net X

income

Expenditure

New equilibrium

New

C+I+G+net X

$10 billion Old equilibrium

More

Govt

Expenditure

C+I+G+net X

45o

HOW MUCH DOES

INCOME RISE?

income

Expenditure

$10 b.

More

Expenditure

45o

$10 b.

Means $9 b.

More income

More income

Means $9

b. more Expend

Means $10 b.

More income

Etc.

Etc.

New

C+I+G+net X

C+I+G+net X

INCOME RISES BY

$100 BILLION.

income

New equilibrium

New

C+I+G+net X

$10 billion Old equilibrium

More

Govt

Expenditure

C+I+G+net X

45o means Y=C+I+G+net X

C+I

C

Shifts of the Consumption

Function

• In the function C = a + bYD a change in

either of the values of a or b will change

the dimensions of the function.

CONSUMPTION (C) (dollars per year)

Shifts of the Consumption

Function

C = a2 + bYD

C = a1 + bYD

a2

a1

0

DISPOSABLE INCOME(dollars per year)

CONSUMPTION (C) (dollars per year)

Shifts of the Consumption

Function

C = a2 + bYD

Increased confidence

==>increased consumption

of $100 billion

a2

a1

0

DISPOSABLE INCOME(dollars per year)

C = a1 + bYD

CONSUMPTION (C) (dollars per year)

Shifts of the Consumption

Function

Increased consumption

of $100 billion

==>Increased income

of $100 billion

a2

a1

0

DISPOSABLE INCOME(dollars per year)

C = a2 + bYD

C = a1 + bYD

CONSUMPTION (C) (dollars per year)

Shifts of the Consumption

Function

ASSUME MPC=.8

Increased income

of $100 billion

==>Increased consumption

of $80 billion

a2

a1

0

DISPOSABLE INCOME(dollars per year)

C = a2 + bYD

C = a1 + bYD

CONSUMPTION (C) (dollars per year)

Shifts of the Consumption

Function

Increased consumption

of $80 billion

==>Increased income

of $80 billion

a2

a1

0

DISPOSABLE INCOME(dollars per year)

C = a2 + bYD

C = a1 + bYD

CONSUMPTION (C) (dollars per year)

Shifts of the Consumption

Function

ASSUME MPC=.8

Increased income

of $80 billion

==>Increased consumption

of $64 billion

a2

a1

0

DISPOSABLE INCOME(dollars per year)

C = a2 + bYD

C = a1 + bYD

CONSUMPTION (C) (dollars per year)

Shifts of the Consumption

Function

Increased income

of $64 billion

==>Increased income

of $64 billion

a2

a1

0

DISPOSABLE INCOME(dollars per year)

C = a2 + bYD

C = a1 + bYD

CONSUMPTION (C) (dollars per year)

ULTIMATELY IS 5 TIMES

GREATER THAN INITIAL SHIFT

C = a2 + bYD

+51.2...

+80

100

+64

500

a2

a1

0

DISPOSABLE INCOME(dollars per year)

C = a1 + bYD

THE MULTIPLIER

___1___ =

___1___

100 * 1-MPC

100 * 1- 0.80

=500

CONSUMPTION

(billions of dollars per year)

Shifts vs. Movements

f

Cf

C = a1 + bYD

g

Cg

C = a2 + bYD

Shift

a1

h

Ch

a2

0

Y2

Y1

DISPOSABLE INCOME (billions of dollars per year)

NO FOREIGN SECTOR, NO GOVERNMENT

Structural Equations:

Z=C+I+G

Identity

Yd= C + S

Capital letters are endogenous

Y=Z

Equilibrium

C=co + c1 *Yd

Behavioral

I=Io

Exogenous

Reduced Form Equations:

Y = 1/(1-c1) * {co +Io}

S= Y-C

GOVERNMENT BUT NO FOREIGN SECTOR

Structural Equations:

Z=C+I+G

Identity

Yd= C + S

Y=Z

Equilibrium

C=co + c1 *Yd

Behavioral

=co + c1 *(Y-T)

I=Io

G=Go

Exogenous

T=To

Reduced Form Equations:

Y = 1/(1-c1) * {co - c1 *To +Io +Go}

S= Y-T-C

GOVERNMENT w/ INCOME TAX BUT NO FOREIGN SECTOR

Structural Equations:

Z=C+I+G

Identity

Yd= C + S

Y=Z

Equilibrium

C=co + c1 *Yd

Behavioral

=co + c1 *(Y-To- t*Y)

I=Io

Parameter

G=Go

Exogenous

T=To+ t*Y

Reduced Form Equations:

Y = 1/(1-c1 +t*c1) * {co +Io +Go-c1To}

S= Y-T-C

GOVERNMENT w/ INCOME TAX and FOREIGN SECTOR

Structural Equations:

Z=C+I+G+X-IM

Identity

Yd= C + S

Y=Z

Equilibrium

C=co + c1 *Yd

Behavioral

=co + c1 *(Y- t*Y)

I=Io

Parameter

G=Go

Exogenous

T=To+t*Y, IM=q*Y

Reduced Form Equations:

Y = 1/(1-c1 +t*c1+q) * {co +Io +Go+To}

S= Y-T-C

MACROECONOMIC SCHOOLS OF THOUGHT

Classical Economics:

1920s

Keynes’ General Theory: 1930s

Keynesian Cross: 1940s

IS-LM & Phillips Curve:

1950s

Monetarism: 1960s

New Classical Economics:1970s

New Keynesian Economics: 1980s

Post Keynesian Economics:

1950s-1990s

Lower Price

Lower

Output

Higher Price

Leftward

(downward)

Shift of Demand

Leftward

(upward)

Shift of

Supply

Higher

Output

Rightward

(downward)

Shift of

Supply

Rightward

(upward)

Shift of Demand

Breakdown all shifts into their output and price vectors

Lower Price (deflation) Higher Price (inflation)

Lower

Output

(slow

Growth)

RECESSION/DEPRESSION

Leftward

(downward)

Shift of Aggregate

Demand:

STAGFLATION

Leftward

(upward)

Shift of

Aggregate

Supply:

less injections,

or more leakages

Less factors or

higher factor prices

Higher

Output

(fast

Growth)

HIGH GROWTH

-LOW INFLATION

Rightward

(downward)

Shift of

Supply :

More factors or

lower factor prices

HIGH GROWTH

-HIGH INFLATION

Rightward

(upward)

Shift of Demand:

mor injections,

or less leakages

Breakdown all shifts into their output and price vectors

Lower Price

Lower

Output

Higher Price

Less productivity (technological change)

Higher price of resources

Seller expectations of future surpluses

Less number of sellers

Leftward

(downward)

Shift of Demand

less income

less tastes for good

less buyers

less complement

lower priuce for substitutes

Buyer expectations about future

shortages

Higher

Output

Rightward

(downward)

Shift of

Supply

Leftward

(upward)

Shift of

Supply

More productivity (technological change)

Lower price of resources

Seller expectations of future shortages

More number of sellers

Rightward

(upward)

Shift of Demand

Breakdown all shifts into their output and price vectors

More income

More tastes for good

More buyers

More complement

Higher priuce for substitutes

Buyer expectations about future

shortages