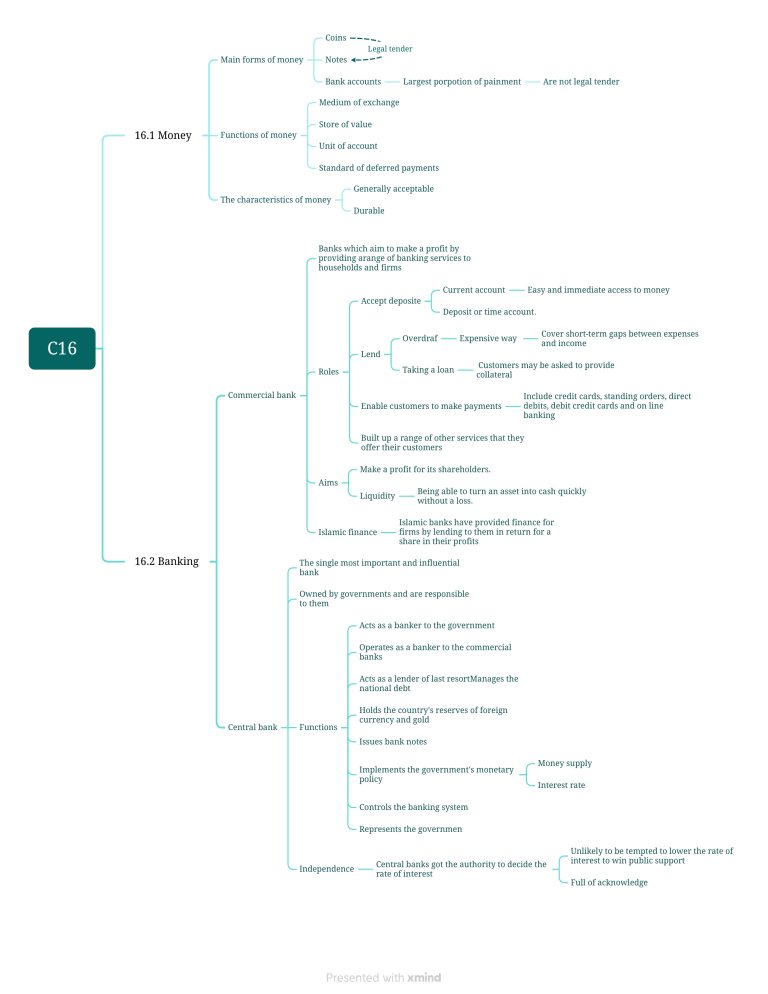

Coins Legal tender Main forms of money Notes Bank accounts Largest porpotion of painment Are not legal tender Medium of exchange 16.1 Money Store of value Functions of money Unit of account Standard of deferred payments Generally acceptable The characteristics of money Durable Banks which aim to make a profit by providing arange of banking services to households and firms Current account Easy and immediate access to money Accept deposite Deposit or time account. Overdraf C16 Cover short-term gaps between expenses and income Expensive way Lend Taking a loan Roles Customers may be asked to provide collateral Commercial bank Enable customers to make payments Include credit cards, standing orders, direct debits, debit credit cards and on line banking Built up a range of other services that they offer their customers Make a profit for its shareholders. Aims Liquidity Islamic finance 16.2 Banking Being able to turn an asset into cash quickly without a loss. Islamic banks have provided finance for firms by lending to them in return for a share in their profits The single most important and influential bank Owned by governments and are responsible to them Acts as a banker to the government Operates as a banker to the commercial banks Acts as a lender of last resortManages the national debt Central bank Functions Holds the country's reserves of foreign currency and gold Issues bank notes Implements the government's monetary policy Money supply Interest rate Controls the banking system Represents the governmen Independence Central banks got the authority to decide the rate of interest Unlikely to be tempted to lower the rate of interest to win public support Full of acknowledge