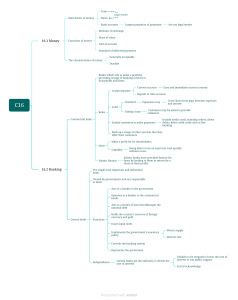

INTRODUCTION TO MONETARY POLICY THREE KEY AREA OF FINANCE 1. 2. 3. FINANCE • study of how individuals, institutions governments and businesses acquire spend and manage money and other financial assets. Why Study Finance? • FINANCIAL ENVIRONMENT • • Includes the financial system institutions, markets and individuals that make the economy operate efficiently. • FINANCIAL INSTITUTIONS • organizations or intermediaries like banks, insurance companies and investment companies. They engage in financial activities to aid the flow of funds from savers to borrowers or investors. Physical or electronic forums that facilitate the flow of funds among investors, businesses and governments. INVESTMENTS • the sale or marketing of securities, the analysis of securities and the management of investment risk. Investors include savers and lenders as well as equity investors. Investors can be corporate or personal. FINANCIAL MANAGEMENT • Involves financial planning, asset management and fundraising decisions to enhance the value of businesses. This involves decision making relating to the efficient use of financial resources in the production and sale of goods and services. To make informed economic and financial decisions. To acquire a basic knowledge of investments for business and personal reasons. To acquire basic understanding of financial management. THE FINANCIAL SYSTEMS AND THEIR FINANCIAL FUNCTIONS MONETARY SYSTEM • • FINANCIAL MARKETS • Institutions and Markets Financial Management Investments Creating Money Transferring Money FINANCIAL INSTITUTIONS • • Accumulating Savings Lending/Investing Savings FINANCIAL MARKETS • • Marketing Financial Assets Transferring Financial Assets The evolution of the financial system in the Philippines can be viewed along the major political milestones of the country 1. The Spanish Period OBRAS PIAS • • (1854) first organized Philippines institutions in the • • • • Charitable foundation during Spanish Period. Works of Piety in Spanish. Church directed a share of personal fortunes to its charities. funds are to be used for charitable, religious and educational purposes. However, some of the funds were managed by confraternities that invested capital in secular activities like underwriting cargoes for the galleon trade. 2. The American Period • Branches of International Banking Corporation and Guaranty Trust Company. 1901- American Bank (operated 4 years) 1902 – Wai hung bank and the Abrue, Newberry and Reyes Bank. (shortlived) 1906 – The S. Misaka Bank served local Japanese Community. 1906 – Postal Savings Bank, created as a division of the Bureau of Posts to promote the habit of thrift among the people and to bring banking to the rural areas. 1908 – Government-owned Agricultural Bank w/a capital of 1M pesos. It failed to render effective service to the famers due to its meager capital. Act. No. 2612 in (1916) – Philippine National Bank (PNB) Privilege note issue Organized to grant and extend long term credit to agriculture and industry. After World War 1, several foreign and domestic banks were attracted to operate in Manila. 1918 – Yokohama Specie Bank 1919 – Asia Banking Corporation 1920 – Chinese-American Bank of Commerce of Peking and China Corporation 1926 – People’s Bank and Trust Company and Mercantile Bank of China 1930 – National City Bank of New York 1935 Establishment of the Commonwealth. 1937 – Bank of Taiwan. Nederlandsche Indische Handelsbanks branch. Before the outbreak of World War 2, 17 banks (11 domestic and 6 foreign) were operating in the country with 17 offices in Manila, 22 branches in the provinces and 54 provincial agencies. • • BANCO ESPANOL-FILIPINO DE ISABELL II • • • • • First bank in the Southeast Asia. Engaged in general banking functions and financed in a limited way, the country’s foreign trade. Oldest existing business house in the Philippines/ (August 1, 1851) - Originally called ‘El banco Espanol de Filipinas de Isabel II’ in Manila 1869 - Opening of Suez Canal greatly expanded Philippines-European trade. 1873 – Chartered Bank of India, Australia and China w/headquarters in London, Agency in the Philippines. 1875 – Hongkong and Shanghai Banking Corporations (HSBC) Britished owned bank. Both banks engaged in general banking business but they were more exchange banks than commercial banks since they confined most of their activities to buying and selling of drafts and bills of exchange. • • • August 2, 1882 – The First Savings bank. ‘Monte de Piedad y Caja de Ahorros de Manila’ founded by Father Felix Huertas. Banco Peninsula Ultramarino of Madrid was also opened only within a short span (4 years). 1898 – End of Spanish Regime. Four banks still in business in Ph. • • • • • • • • 1900 – first Philippine Commission passed ACT. NO. 52 providing for the regular examination and inspection of banks by the Bureau of Treasury. February 1929 – Bureau of Banking, created assuming the power of supervision over these institutions from the Bureau of Treasury. 3. The Japanese Period • Domestic banks owned by foreign nationals and branches of foreign banks were treated as enemy property and placed under liquidation by the ruling military government. 1942 – Southern Development Bank (Nampo Kaihatsu kindo) opened in Manila and acted as fiscal agent of Japanese Government. It performed some of the functions od central bank, issue military notes, taking custody of the clearing branches of the banks and he receiving deposits from the bank. ESTABLISHMENT OF THE CENTRAL BANK OF THE PHILIPPINES FUNCTIONS OF CENTRAL BANK • 4. • • • Postwar and Independence Executive Order No. 49 (June 16 1945) – Rehabilitation of the banking system. Discharged banks from any liability for deposits made during the Japanese and made them liable only for Pre-Occupation deposit balance less voluntary withdrawals. Rehabilitation Finance Corporation (RFC) – organized primarily to provide financial aid in the rehabilitation of the country and to help in the broadening and diversification of the Philippine economic structure. RFC’s charter was amended and gave away to a much larger and expanded development banking institution, the Development Bank of the Philippines. R.A. No. 265- Central bank of the Philippines (1949). Administer both the monetary and banking systems of the country. Established principally to manage the country’s currency system. Consists in controlling the economy’s supply of money and credit, acting as he country’s sole bank of issue, and as the depository and fiscal agent of the Philippine government and its instrumentalities. The central bank relies on a number of monetary policy tools such as charges in rediscount rates, variations on legal reserve requirements, sales and purchases of the government securities, selective credit and other regulations it may deem necessary to attain its objective. ENACTMENT OF BANKING LAWS 1948 – General Banking Act (R.A. No. 337) – contained the fit major rules and regulations governing the operation, particularly of commercial and savings and mortgage banks, was passed. 1952 -Rural Bank Act was approved. 1963 – Savings and Loans Association Act, setting the stage for the development of another type of banking institution. The New Society Period a. THE 70’s: THE NEW SOCIETY PERIOD b. c. 5. The later part of 1972 highlighted the growing demands upon the banking system when the constitution of the New Society called for constructive reforms and a reorientation of the Philippine political, economic and social set-up. Statutory reforms in the financial system were strengthened with a series of Presidential Decrees and implementing of the Central Bank Presidential Decree No. 71. Under this decree, a redefinition of basic banking terms, reclassification of financial intermediaries into banks and non- banks and their expanded functions as well as guidelines on their operations was made. d. Specialized unique government banks, such as Development Bank of the Philippines and the Land Bank, are not covered by this classification but shall be subject to the supervision and regulation by the Central Bank pursuant to the provisions of Section 25 of Republic Act. No. 265. A. Expanded Commercial Bank or Universal Bank • It is considered as a one stop combank performing com-banking functions and non-related banking activities. B. Commercial Banks • it represents the largest single group of the country's banking and Financial intermediaries operating branch-banking organizational structure with all head offices located in Metropolitan Manila and the largest network branches and extension offices distributed throughout the country. • It offers the greatest variety of banking services among financial institutions such as: accepting demand, savings, time and foreign currency deposits, handling local foreign currency deposits, handling local, and foreign fund remittances, money market transactions like administering trust funds; and a host of other services that truly make them the department stores in finance. THE 80’s: THE UNIVERSAL BANKING Expanded commercial banking or universal banking is introduced. “one-stop banking” or “department store banking” – enables the clientele to avail of all banking services they need from only one bank. THE 90’s: THE NEW CENTRAL BANK June 14, 1993 – Pres Fidel V. Ramos signed into law R.A. 7653 (The New Central Bank Act), pursuant to the requirements of he 1987 Constitution for the establishment of an independent central Monetary authority. CLASSIFICATION OF THE FINANCIAL SYSTEM THE BANKING SECTOR For purpose of uniformity, simplicity, and equality of treatment, R.A. 7653 entitled "The New Central Bank Act", classified banks institutions into the following categories: An expanded commercial bank or a universal bank b, Commercial banks Regional unit banks, composed of rural banks. Thrifts banks, composed of savings and mortgage banks, stocks savings and loan associations; C. D. Rural Banks • The passage of the Rural Banks Act in 1952 saw the emergence of regional unit or rural banks which specialize in the extension of small loans for agricultural purposes as well as for retail traders. • All rural banks are privately owned, although they receive equity counterparts, loans and technical assistance from the Central Bank. Thrift Banks • Thrift banks (TBs), as defined in Republic Act (R.A.) No. 7906, which shall be composed of: (a) savings and mortgage banks, (b) stock savings and loan associations, and (c) private development banks • Saving Banks serve primarily as thrift institutions drawing funds from household and individual savers and investing such funds, together with its capital, in bonds, or in loans secured by bonds, real estate mortgages and other forms of securities. Thrift banks include: 1. Savings banks - banks organized primarily to accumulate savings deposits and invest them for specific purposes. 2. Private development banks - organized primarily to cater to the capital needs and demand for investment credit on medium to long-term loans. 3. Cooperative banks - duly registered associations of persons who undertake ventures in accordance with universally accepted cooperative principles. 4. Islamic banks - banks established to promote and accelerate socio-economic development of our Muslim brothers (esp. in ARMM) based on the Islamic concept of banking. 5. Microfinance banks - bank established to provide a broad range of financial services for micro enterprises. SPECIALIZED BANKS The three specialized government banks, composed of the Development Bank of the Philippines (DBP), the Land Bank of the Philippines (LBP), and the Philippine Amanah Bank, play special roles in the economic development of the country. 1. The DBP was established mainly to provide long term industrial and agricultural credit. 2. The Land Bank was established to serve as an instrument for carrying out part of the country's land reform program. 3. The Amanah Bank is designed to provide banking facilities at unique and reasonable terms to the Muslim provinces of Mindanao. PRIVATE NON-BACK FINANCIAL INTERMEDIARIES 1. Investment houses - constitute the largest group, in terms of resources, among the private non-bank financial intermediaries. 2. Investment companies, which are primarily engaged in investing, reinvesting or trading in securities. • • open - end companies - no fixed amount of paid-in capital; redeemable at any time; on day-today basis. close - end companies - relatively fixed amount of outstanding capital; no provisions for the issuance or redemption of shares on a day-to-day basis. 3. Finance companies are organization (partnership or corporation) that are organized to extend credit lines to consumers and to industrial, commercial, agricultural enterprises. 4. The securities dealers are companies which buy and sell securities of others or which acquire securities to resell or offer them for sale to the public. 5. Securities brokers are those engaged in the business of affecting transactions in securities and earn their income from commissions received. 6. Private insurance companies are under the direct supervision and regulation of the Office of the Insurance Commission and are authorized to conduct life of non-life insurance business. 7. Pawnshops or pawnbrokers are business establishments engaged in lending money on personal property delivered as security, pledge or collateral. 8. Non-stock savings and loans associations are associations, which primarily provide short-term loans to members and whose main sources of income are savings and time deposits. 9. Mutual and Building Loan Associations are mutually owned stock companies that specialize in extending long-term mortgage loans to members. 10. Credit unions are cooperative composed of small producers and consumers who voluntarily join together to form their business enterprises which themselves own, control and patronize. 11. Trust and pensions fund managers are institutional and personal administrators of funds created or constituted for the benefit of others. • employee welfare funds are constituted to employers wherein benefits are payable to employees upon retirement, death, cessation from work and other. • trust funds are created by trustors, or estates of absent persons, minors or by courts, thereby creating a trust relationship between the owner (trustors) of the fund or property and the manager (trustee) for the benefit of a third person called the beneficiary. 12. Lending Investors pertain to individuals or entities engaged exclusively in the business extending secured or unsecured direct loans to individual and enterprises. THE ROLE AND USES OF MONEY 2. MONEY A medium that can be exchanged for goods and services and is used as a measure of their values on the market. Money is a good that acts as a medium of exchange in transactions. It is a way for a person to trade what he/she has for what he/she wants. Money is an officially-issued legal tender typically consisting of notes and coins. Money is the circulating medium of exchange as defined by a government HISTORY OF MONEY • • • • • • • BARTER SYSTEM Before the invention of money, people traded goods and services using the barter system. The history of bartering dates back to 6000 B.C. when Mesopotamian tribes introduced the concept to the Phoenicians. Barter is an act of trading goods or services between two or more parties without the use of money —or a monetary medium Barter system refers to the system of exchange where goods and services are exchanged directly for other goods and services. It is the oldest form of commerce. The known history of bartering dates back to 6000 B.C. Reportedly introduced by Mesopotamian tribes, bartering was adopted by the Phoenicians. The Phoenicians bartered goods to those located in various other cities across oceans. 3. 4. • • • • • • • • Some of the difficulties: 1. Barter tends to slow down trade. • Goods were either perishable or too heavy to be transported from place to place Lack of double coincidence of wants. • To exchange goods for goods, a rare coincidence of wants and desires must coincide at all times. Lack of proper way to equate values of the things exchanged. Indivisibility of some goods. FIRST METAL MONEY - COINS The first metal coins date back to the 7th century BCE in Lydia (modern Turkey) and China. In China, metal coins were made of bronze and shaped like farming tools. In Lydia, coins were made of an alloy of gold and silver called electrum. Lydian staters were the first coins to be officially issued by a government body. Early iterations of coins were also used by ancient Greeks, starting in the late 7th century BC. FIRST PAPER MONEY The first paper money was created in China during the Song Dynasty in the 11th century CE. Trade played a huge part in its creation. Around 900 CE, merchants trying to get around the weight issue of carrying coins began trading transaction receipts. Early Song authorities gave a few shops a monopoly on issuing these deposit receipts. Eventually, in the 1020s, the government took over and began issuing the receipts as the first official paper money. THE GOLD STANDARD In 1816, gold became the standard of value in England. Each bank note represented a certain amount of gold, so only a limited number of bank notes could be printed. By 1900, the United States had followed suit with the Gold Standard Act. While the gold standard would slowly fade out of usage by the 1970s, the gold standard played an important role in the history of U.S. money. • • • • • FIRST BANK CREDIT CARD In 1946, John Biggins, a Brooklyn banker, came up with the idea of the Charg-It card to bring new customers into the bank. People with an account at the bank could use their card at a few select merchants. The merchant would then send the receipts to the bank, and the bank would pay for the items purchased and later bill the customer for repayment. 3. FIRST MODERN CREDIT CARD Invented in 1950, the Diners Club card is known as the first modern-day credit card. The idea came from Frank McNamara, businessman who'd forgotten his wallet while out to dinner in New York. He and his business partner, Ralph Schneider, would soon invent the Diners Club card as a way to pay without carrying cash. The Diners Club card was first used only in local restaurants before expanding to include additional retailers. The new charge card required customers to pay the balance in full at the end of every month. By 1951, the Diners Club boasted 42,000 members and had expanded to major U.S. cities. By 1953, it was accepted in Canada, Cuba, Mexico and the United Kingdom. FUNCTIONS OF MONEY MOBILE BANKING Before the introduction and enablement of mobile web services in 1999, mobile banking was completed primarily through text or SMS; it was known as SMS banking. European banks were on the frontier of mobile banking service offering, using the mobile web via WAP support. TRADITIONAL CHARACTERISTICS OF MONEY 1. 2. Utility - useful, the object must possess intrinsic value General acceptability - common usage of it would allow the object to transfer from one hand to another without question of its origin. 4. 5. 6. Portability - should be easily carried or transported from place to place. Uniformity - achieved through the use of standard and uniform metal or paper. Malleability - commodity used as money could be melted down and shaped into different form as well as imprinted with any desired sign. Durability - would have to withstand normal wear and tear. As a medium of exchange: Money allows goods and services to be traded without the need for a barter system. Barter systems rely on there being a double coincidence of wants between the two people involved in an exchange. Money is wanted not for its own sake but for what it brings in return for it. As a standard of value: Money is now used as the yardstick for values. It measures the values or utilities of the objects exchanged through the pricing system. It is the common denominator of values. As a store of value: In performing this function, money keeps value. It must be presumed that the value of money is stable to be effective as such. Money retains its value for some period of time. As a standard of deferred payment: Money functions as a basis or measurement for future debt contracts. Article 1250 of the Civil Code provides: In case an extraordinary inflation or deflation of the currency stipulated should intervene, the value of the currency at the time of the establishment of the obligation shall be the basis of payment, unless there is an agreement to the contrary. This refers to the expressing of the value of a debt i.e. if people borrow today, then they can pay back their loan in the future in a way that is acceptable to the person who made the loan As a unit of account This refers to anything that allows the value of something to be expressed in an understandable way, and in a way that allows the value of items to be compared. CLASSIFICATION OF MONEY 1. Commodity Money • • This is money that is an actual commodity that has value outside of being a medium exchange. Commodity money can be precious metals, gemstones, spices, and even coffee. 2. Fiat Money • Fiat money is entirely backed by government orders rather than a physical good. It gets its status as a medium of exchange because the government declared it an official means of payment. 3. Fiduciary Money • This is money that is based on trust rather than the intrinsic value of the money itself with no government backing. This form of payment relies on the trust or promise that it will be accepted as a form of payment. 4. Commercial Bank Money • Commercial bank money can be described as claims against financial institutions that can be used to purchase goods or services. It represents the portion of a currency that is made of debt generated by commercial banks.