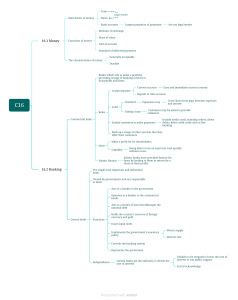

Chapter One: Introduction A bank is a financial institution that accepts deposits from the public and creates credit. Lending activities can be performed either directly or indirectly through capital markets. Due to their importance in the financial stability of a country, banks are highly regulated in most countries. Most nations have institutionalized a system known as fractional reserve banking under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, known as the Basel Accords. Economic functions of bank The economic functions of banks include: • Issue of money, in the form of banknotes and current accounts subject to cheque or payment at the customer's order. These claims on banks can act as money because they are negotiable or repayable on demand, and hence valued at par. They are effectively transferable by mere delivery, in the case of banknotes, or by drawing a cheque that the payee may bank or cash. • Netting and settlement of payments – banks act as both collection and paying agents for customers, participating in interbank clearing and settlement systems to collect, present, be presented with, and pay payment instruments. This enables banks to economize on reserves held for settlement of payments, since inward and outward payments offset each other. It also enables the offsetting of payment flows between geographical areas, reducing the cost of settlement between them. • Accept deposits − Receiving money from individuals and enterprises known as depositors. • Dispense payments − Making payments according to the convenience of the depositors. For example, honoring a check. • Collections − Bank plays as an agent to collect funds from another banks receivable to the depositor. For example, when someone pays through check drawn on an account from a different bank. • Invest funds − Contributing or spending money in securities for making more money. For example, mutual funds. • Safeguard money − A bank is regarded as a safe place to store wealth including jewelry and other assets. • Maintain savings − The money of the depositors is maintained, and the accounts are checked and on a regular basis. • Maintain custodial accounts − These accounts are maintained under the supervision of one person but are actually for the benefit of another person. • Lend money − Lending money to companies, depositors in case of some emergency . Banks in Bangladesh Present Structure The current banking framework in Bangladesh can be broadly classified into two. The first classification divides banks into three sub-categories — Bangladesh Bank, commercial banks and cooperative banks. The second divides the banks into two sub-categories — scheduled banks and non-scheduled banks. In both of these systems of categorization, the BB, is the head of the banking structure. It monitors and holds all the reserve capital of all the commercial or scheduled banks across the nation. After the independence, banking industry in Bangladesh started its journey with 6 Nationalized commercialized banks, 2 State owned Specialized banks and 3 Foreign Banks. In the 1980's banking industry achieved significant expansion with the entrance of private banks. Now, banks in Bangladesh are primarily of two types: • Scheduled banks • Non-scheduled banks Scheduled Banks: The banks which get license to operate under Bank Company Act, 1991 (Amended up to till date) are termed as Scheduled Banks. There are 61 scheduled banks in Bangladesh who operate under full control and supervision of Bangladesh Bank which is empowered to do so through Bangladesh Bank Order, 1972 and Bank Company Act, 1991. Scheduled Banks are classified into following types: State Owned Commercial Banks (SOCBs): There are 6 SOCBs which are fully or majorly owned by the Government of Bangladesh. Specialized Banks (SDBs): 2 specialized banks are now operating which were established for specific objectives like agricultural or industrial development. These banks are also fully or majorly owned by the Government of Bangladesh. Private Commercial Banks (PCBs): There are 44 private commercial banks which are majorly owned by the private entities. PCBs can be categorized into two groups: Conventional PCBs: 35 conventional PCBs are now operating in the industry. They perform the banking functions in conventional fashion i.e interest based operations. Islami Shariah based PCBs: There are 9 Islami Shariah based PCBs in Bangladesh and they execute banking activities according to Islami Shariah based principles i.e. Profit -Loss Sharing (PLS) mode. Foreign Commercial Banks (FCBs): 9 FCBs are operating in Bangladesh as the branches of the banks which are incorporated in abroad. Non-Scheduled Banks: The banks which are established for special and definite objective and operate under the acts that are enacted for meeting up those objectives, are termed as Non Scheduled Banks. These banks cannot perform all functions of scheduled banks. There are now 4 non-scheduled banks in Bangladesh which are: • Ansar VDP Unnayan Bank, • Karmashangosthan Bank, • Probashi Kollyan Bank, • Jubilee Bank Contribution of Commercial Bank in Bangladesh Ø Banks promote capital formation Ø Investment in new enterprises Ø Promotion of trade and industry Ø Development of agriculture Ø Balance development of different savings Ø Influencing the economy activity Ø Implementation of monetary policy Ø Export promotion cells Problem of the Banking Sector of Bangladesh Problem of banking sector is widespread and is not related to banking syst em only. The regulatory entity should be independent but accountable. Prudential regulation should be limited to deposit-taking institutions and should be clearly separated from non-prudential regulation. The problem of lower profitability of bank is that it might reduce the tax and thus make a trace on fiscal system where bank is the number one source of tax under large tax unit of NBR. Moreover, the revenue target may face hurdle from another side where lower growth of credit may affect investment and growth, and thus tax collection. Possibilities of the Banking Sector of Bangladesh There are huge possibilities of the banking sector in Bangladesh. These are below: Ø Banking sector of Bangladesh has a great opportunity to become a major sector of the national economy. Ø Bangladesh has huge number of population. This advantage may accelerate expansion and growth of Bangladeshi banking sector. Ø Bangladeshi banking sector is very much capable to ensure proper quality of the product services as per requirement of the global market. Ø There are nine foreign banks active in Bangladesh, but no Japanese bank yet. So there is huge prospect for Japanese bank to open their branch in Bangladesh. Bank Management: There are many definitions of bank management. In general, bank management refers to the process of managing the Bank’s statutory activity. Bank management is characterized by the specific object of management - financial relations connected with banking activities and other relations, also connected with implementation of management functions in banking. Bank management governs various concerns associated with bank in order to maximize profits. The concerns broadly include: • Liquidity management, • Asset management and Liability management and • Capital management The main objective of bank management is to build organic and optimal system of interaction between the elements of banking mechanism with a view to profit. Successful optimization of the "profitability-risk" ratio in a bank lending operations is largely determined by the use of effective methods of bank management. Ability to take reasonable risk is one of the elements of entrepreneurship culture in general and banking culture in particular. Reliability of the bank management is determined by the following characteristics: • Management expertise in strategic analysis, planning, policy development and management functions; • quality of planning; • risk management (credit, interest rate and currency risks); • liquidity management; • management of human resources; • creation of control systems: audit and internal audit, monitoring of profitability and risks liquidity; • Unified information technology system: integrated automation of workflow, accounting, current analysis and control, strategic planning. All the above conditions show themselves during implementation of bank management and its components. Differences between Conventional Banking System and Islamic Banking System: The following are the differences between the Conventional Banking System and Islamic Banking System. Conventional Banking System Islamic Banking System Money is a product and source of exchange which has a value to trade. The asset is a product and money is just a source of exchange. Interest is charged based on the time period for which loan is taken. The profit earned on trade is the main source of generating income. Loss sharing is not applied in conventional banking Losses can be shared if an entity incurs a loss. Interest is charged irrespective of business performance There is no concept of interest and losses are shared under Islamic financing. There is no agreement for exchanging goods and services during the cash disbursement for operating finance. According to Murabaha, Salam and Istisna contracts while disbursement of funds the agreement for exchanging the goods and services is mandatory. There is no presence of goods and service during the disbursement of funds. Money expansion may create inflation. There is a presence of goods and service during fund disbursement. Since money is not expanded there is no inflation which is created. The business entity increases the prices of goods and services because of the inflation. The cost of the product includes the inflation aspect in determining the price. There is high control over inflation and no extra prices are charged by business entities. Long term financing and bridge loans are not processed on the basis of capital goods. Prior to disbursement of cash Musharakah and diminishing Musharakah deals are done and it makes sure that capital is available for the project. The regulatory authorities get loans from the central bank and with money market operation and this is done without initiating the capital expenditure. Once the delivery of goods is confirmed to the National Investment fund, the government can get loans from monetary agencies. Money circulates among few hands and there is no real growth. Since real wealth goes into many hands and money circulates in different people there are multiplying effects of real wealth. If the loan is not paid then it becomes a nonperforming loan and it is written off. If the project is unsuccessful, the management decides to transfer the ownership to another entity to overcome the losses. Debt finance has interest expenses which are part of taxable income and it causes tax burden on salary individuals and because of this savings income is severely affected resulting in a reduction of gross GDP. Profits are shared in Mudarabah and Musharakah and it results in reduced burden over salary individuals and this will increase the savings and also the income of the individuals showing a growth of GDP. What is difference of Branch Banking and Agent Banking? 1. Branch Banking is a formal body of the main bank. Conversely, Agent Banking is an informal body of the banking system. 2. Branch Banking requires more resources and operating costs to perform the function, whereas anyone can do agent banking as it requires very little capital. 3. Branch Banking cannot reach the more remote location due to negative operating costs at these places, but anyone can do agent Banking and hence has more reach. 4. Branch Banking is an extended part of a parent bank. On the other hand, Agent Banking is a financial institution doing all the bank functions on its behalf. 5. In Branch Banking, it has the authority to decide by discussing it with higher bodies, while in Agent Banking, it only has to perform pre-assigned duties of the bank. Key Differences between Mobile Banking and Internet Banking The difference between mobile and internet banking can be drawn clearly on the following grounds: 1. Internet banking is nothing but a banking transaction, carried out over the internet, via, respective bank or financial institution’s website, under a personal profile, with a personal computer. Conversely, mobile banking is a service that enables the customer to perform banking transactions using a cellular device. 2. Mobile banking can be performed with the help of mobile telecommunication devices, i.e. Mobiles or Tablets. On the contrary, for conducting internet banking transaction, one needs to use devices like computers or laptops. 3. Mobile banking uses Short message service, mobile application or the web. In contrast, Internet Banking uses bank’s website 4. In mobile banking, fund transfer is possible with the help of IMPS (Immediate Payment Service), NEFT (National Electronics Funds Transfer System) or RTGS (Real Time Gross Settlement). As against, in internet banking, funds can be transferred from one bank or branch to another, with the help of NEFT (National Electronics Funds Transfer System) or RTGS (Real Time Gross Settlement). 5. While the number of functions performed by Mobile banking system is limited, internet banking offers an array of services to their customers .