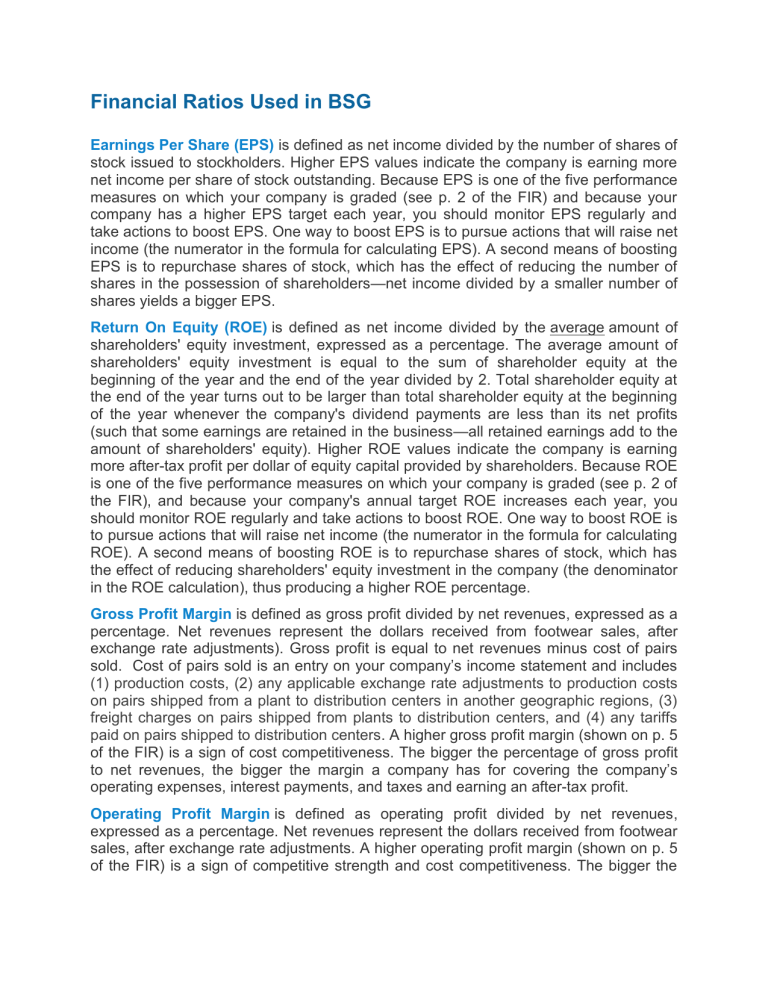

Financial Ratios Used in BSG Earnings Per Share (EPS) is defined as net income divided by the number of shares of stock issued to stockholders. Higher EPS values indicate the company is earning more net income per share of stock outstanding. Because EPS is one of the five performance measures on which your company is graded (see p. 2 of the FIR) and because your company has a higher EPS target each year, you should monitor EPS regularly and take actions to boost EPS. One way to boost EPS is to pursue actions that will raise net income (the numerator in the formula for calculating EPS). A second means of boosting EPS is to repurchase shares of stock, which has the effect of reducing the number of shares in the possession of shareholders—net income divided by a smaller number of shares yields a bigger EPS. Return On Equity (ROE) is defined as net income divided by the average amount of shareholders' equity investment, expressed as a percentage. The average amount of shareholders' equity investment is equal to the sum of shareholder equity at the beginning of the year and the end of the year divided by 2. Total shareholder equity at the end of the year turns out to be larger than total shareholder equity at the beginning of the year whenever the company's dividend payments are less than its net profits (such that some earnings are retained in the business—all retained earnings add to the amount of shareholders' equity). Higher ROE values indicate the company is earning more after-tax profit per dollar of equity capital provided by shareholders. Because ROE is one of the five performance measures on which your company is graded (see p. 2 of the FIR), and because your company's annual target ROE increases each year, you should monitor ROE regularly and take actions to boost ROE. One way to boost ROE is to pursue actions that will raise net income (the numerator in the formula for calculating ROE). A second means of boosting ROE is to repurchase shares of stock, which has the effect of reducing shareholders' equity investment in the company (the denominator in the ROE calculation), thus producing a higher ROE percentage. Gross Profit Margin is defined as gross profit divided by net revenues, expressed as a percentage. Net revenues represent the dollars received from footwear sales, after exchange rate adjustments). Gross profit is equal to net revenues minus cost of pairs sold. Cost of pairs sold is an entry on your company’s income statement and includes (1) production costs, (2) any applicable exchange rate adjustments to production costs on pairs shipped from a plant to distribution centers in another geographic regions, (3) freight charges on pairs shipped from plants to distribution centers, and (4) any tariffs paid on pairs shipped to distribution centers. A higher gross profit margin (shown on p. 5 of the FIR) is a sign of cost competitiveness. The bigger the percentage of gross profit to net revenues, the bigger the margin a company has for covering the company’s operating expenses, interest payments, and taxes and earning an after-tax profit. Operating Profit Margin is defined as operating profit divided by net revenues, expressed as a percentage. Net revenues represent the dollars received from footwear sales, after exchange rate adjustments. A higher operating profit margin (shown on p. 5 of the FIR) is a sign of competitive strength and cost competitiveness. The bigger the percentage of operating profit to net revenues, the bigger the margin for covering interest payments and taxes and earning an after-tax profit. Net Profit Margin is defined as net profit (or net income or after-tax income, all of which mean the same thing) divided by net revenues, expressed as a percentage. Net revenues represent the dollars received from footwear sales after exchange rate adjustments. A company's net profit margin represents the percentage of revenues that end up as net profit. The bigger a company's net profit margin, the better the company's profitability in the sense that a bigger percentage of the dollars it collects from footwear sales flow to the bottom-line. Credit Rating Ratios (that appear in the Comparative Financial Data on page 5 of the Footwear Industry Report) Three financial measures are used to determine your company's credit rating: 1. The debt-to-assets ratio is defined as total liabilities divided by total assets—both numbers are shown on the company's balance sheet. A debt-to-assets ratio of .20 to .35 is considered “good”. As a rule of thumb, it will take a debt-to-assets ratio close to 0.10 to achieve an A+ credit rating and a debt-asset ratio of about 0.25 to achieve an A– credit rating (unless the interest coverage ratios are in the 5 to 10 range and the default risk ratio is above 4.00). Debt-to-asset ratios above 0.50 (or 50%) are generally alarming to creditors and signal “too much” use of debt and creditor financing to operate the business, although such a debt level could still produce a B+ or A– credit rating if a company can maintain with very strong interest coverage ratios (say 8.0 or higher) and default risk ratios above 4.00. 2. The interest coverage ratio is defined as annual operating profit divided by annual interest payments. Operating profit is reported on the Income Statement and on p. 5 of the FIR; interest payments are reported on the Income Statement. Your company's interest coverage ratio is used by credit analysts to measure the “safety margin” that creditors have in assuring that company profits from operations are sufficiently high to cover annual interest payments. An interest coverage ratio of 2.0 is considered “rock-bottom minimum” by credit analysts. A coverage ratio of 5.0 to 10.0 is considered much more satisfactory for companies in the footwear industry because of earnings volatility over each year, intense competitive pressures which can produce sudden downturns in a company's profitability, and the relatively unproven management expertise at each company. It usually takes a double-digit times-interest-earned ratio to secure an A– or higher credit rating, since this credit measure is strongly weighted in the credit rating determination. 3. The default risk ratio is defined as cash flow from operations divided by the combined annual principal payments on all outstanding loans. Cash flow from operations is equal to net profit plus depreciation. This credit measure also carries a high weighting in the credit rating determination. A company with a default risk ratio below 2.0 is automatically assigned “high risk” status (because it is short of cash to meet its principal payments if its ratio is below 1.0 and is on the borderline of being short when the ratio is between 1.0 and 2.0) and cannot be given a credit rating higher than C+. Companies with a default risk ratio between 2.0 and 4.0 are designated as “medium risk”, and companies with a default ratio of 4.0 and higher are classified as “low risk” because their free cash flows are 4 or more times the size of their annual principal payments). The interest coverage ratio and the debt-to-asset ratio are the two most important measures in determining a company's credit rating. However, it is hard for a company to achieve a credit rating of A or A+ without having a default risk ratio that is at least close to or above 4.0. Other Financial Measures and Ratios (appearing in the Comparative Financial Data on page 5 of the Footwear Industry Report and also in the Selected Financial Statistics Section for the page of the Company Operating Report where your company’s Balance Sheet and Cash Flow Statement are reported) The current ratio equals current assets divided by current liabilities. It measures the company's ability to generate sufficient cash to pay its current liabilities as they become due. At the least, your company's current ratio should be greater than 2.0 to provide a healthy cushion for meeting current liabilities. Ratios in the 5.0 to 10.0 range are far better yet. Cash flow from operations equals net profit plus depreciation. Cash flow from operations is used in calculating the company’s default risk ratio. Days of inventory equals the number of branded pairs in inventory divided by the number of branded pairs sold times the number of days in the year. In formula terms, this equates to: [number of branded pairs in inventory ÷ number of branded pairs sold] x 365. Fewer days of inventory are usually better up to a point (but keeping too few pairs in inventory impairs the delivery times to footwear retailers and runs the risk of not having enough pairs in inventory to fill retailer orders should sales prove to be higher than expected). The dividend payout ratio is defined as total dividend payments divided by net profits, expressed as a percentage (or the dividend per share divided by earnings per share, expressed as a percentage—both calculations yield the same result). The dividend payout ratio thus represents the percentage of earnings after taxes paid out to shareholders in the form of dividends. Generally speaking, a company's dividend payout ratio should be less than 75% of net profits (or EPS), unless the company has paid off most of its loans outstanding and has a comfortable amount of cash on hand to fund growth and contingencies. If your company's dividend payout exceeds 100% for more than a year or two, then you should consider a dividend cut until earnings improve. Dividends in excess of earnings are unsustainable and thus are viewed with considerable skepticism by investors—as a consequence, dividend payouts in excess of 100% have a negative impact on the company's stock price.