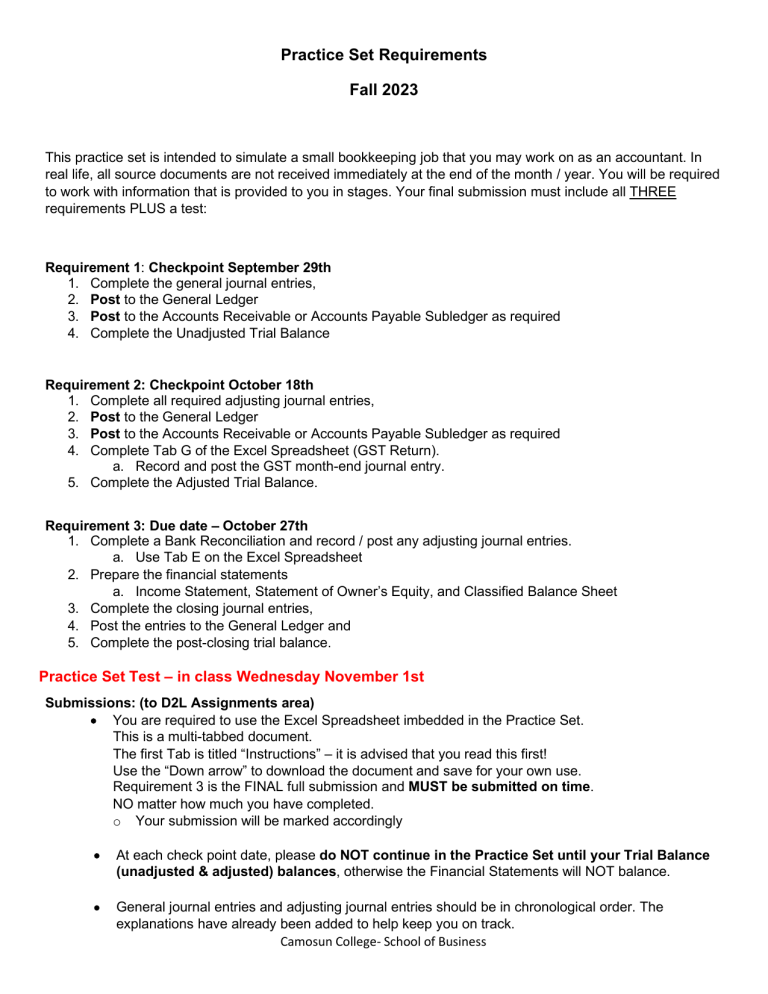

Practice Set Requirements Fall 2023 This practice set is intended to simulate a small bookkeeping job that you may work on as an accountant. In real life, all source documents are not received immediately at the end of the month / year. You will be required to work with information that is provided to you in stages. Your final submission must include all THREE requirements PLUS a test: Requirement 1: Checkpoint September 29th 1. Complete the general journal entries, 2. Post to the General Ledger 3. Post to the Accounts Receivable or Accounts Payable Subledger as required 4. Complete the Unadjusted Trial Balance Requirement 2: Checkpoint October 18th 1. Complete all required adjusting journal entries, 2. Post to the General Ledger 3. Post to the Accounts Receivable or Accounts Payable Subledger as required 4. Complete Tab G of the Excel Spreadsheet (GST Return). a. Record and post the GST month-end journal entry. 5. Complete the Adjusted Trial Balance. Requirement 3: Due date – October 27th 1. Complete a Bank Reconciliation and record / post any adjusting journal entries. a. Use Tab E on the Excel Spreadsheet 2. Prepare the financial statements a. Income Statement, Statement of Owner’s Equity, and Classified Balance Sheet 3. Complete the closing journal entries, 4. Post the entries to the General Ledger and 5. Complete the post-closing trial balance. Practice Set Test – in class Wednesday November 1st Submissions: (to D2L Assignments area) • You are required to use the Excel Spreadsheet imbedded in the Practice Set. This is a multi-tabbed document. The first Tab is titled “Instructions” – it is advised that you read this first! Use the “Down arrow” to download the document and save for your own use. Requirement 3 is the FINAL full submission and MUST be submitted on time. NO matter how much you have completed. o Your submission will be marked accordingly • At each check point date, please do NOT continue in the Practice Set until your Trial Balance (unadjusted & adjusted) balances, otherwise the Financial Statements will NOT balance. • General journal entries and adjusting journal entries should be in chronological order. The explanations have already been added to help keep you on track. Camosun College- School of Business