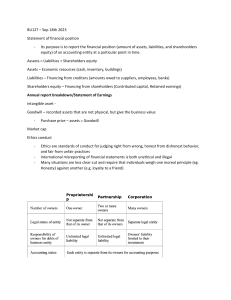

CFA 2024 Level II - SchweserNotes Book 2 (Kaplan Schweser) (Z-Library)

advertisement