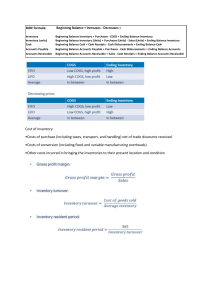

I. Periodic inventories TH Company uses the periodic inventory method and has the following inventory information available for the month of November Date Transaction Units Unit cost 11/1 Beginning inventory 250 $8 11/5 Purchase No.1 300 $12 11/12 Sale No.1 (150) 11/18 Purchase No. 2 250 $16 11/25 Sale No. 2 (300) Answer the following independent questions and show computation supporting your answers 1. Assume that the company uses the average cost method. What is the dollar value of the ending inventory on Nov 30? What is the dollar value of the COGS during November? 2. Assume that the company uses the FIFO inventory method. What is the dollar value of the ending inventory on Nov 30? What is the dollar value of the COGS during November? Date 11/1 11/5 11/18 Explanation Beginning Inventory Purchase Purchase Total COGS available for sale Units 250 300 250 800 Units Cost $8 $12 $16 Total Cost $2,000 $3,600 $4,000 $9,600 Ans: 1. Average cost method - Beginning Inventory = 250 x $8 = $2,000 Purchase = (300 x $12) + (250 x $16) = $7,600 - COGS available for sale = Beginning Inventory + Purchase ( total 800 units) = $2,000 + $7,600 = $9,600 $9,600 - Cost per Unit = - Units sold = 150 + 300 = 450 Units in ending inventory = 350 Ending Inventory = 350 x $12 = $4,200 COGS = $9,600 - $4,200 = 5,400 - 800 = $12 2. FIFO method - Units in ending inventory = 350 Date 11/18 11/5 Total Units 250 100 350 Ending Inventory Units Cost $16 $12 Total Cost $4,000 $1,200 $5,200 Ending Inventory = $5,200 COGS = $9,600 - $5,200 = $4,400 II. Notes receivable Instructions: Prepare the Journal entries to record the following events: Jul. 1: TL Company accepted a 8%, 3-month, $10,000 note dated July 1 from TH Company for the balance due on TL’s account Jul. 31: TL accrued interest on the above note for the month of July Oct. 1: Collected TH Company note in full. Assume interest was correctly accrued on August 31 and September 30 Oct. 1: Assume instead that the note is dishonored and that no interest has been accrued. TH Company is expected to eventually pay the amount owed. Date Account Title Debit Credit Jul.1 Note Receivable $10,000 Account Receivable $10,000 Jul.31 Interest Receivable 67 Interest Revenue 67 10,000 x 8% x 1/12 Oct.1 Cash 10,133 Interest Revenue 133 Note Receivable 10,000 Oct.1 Account Receivable 10,200 Note Receivable 10,000 Interest Revenue 200 III. Plant asset disposal entries Prepare the necessary journal entries to record the following transactions in 2018 for BCTH Co. March 1 Discarded old store equipment that originally cost $20,000 and had a book value of $4,000 on the date of disposal. Assume depreciation on the equipment has already been recorded for the current year July 31 Sold a delivery truck for $8,000. The delivery truck originally cost $30,000 and had accumulated depreciation of $24,000 on the date of sale. Assume the depreciation on the truck has already been recorded for the current year Sept 30 Equipment with a 4-year useful life was purchased on January 1, 2012, for $16,000 and was sold for $5,000. The equipment had been depreciated using the straight-line method with an estimated salvage value of $4,000. Depreciation expenses was last recorded on December 31, 2017. Date Mar.1 Jul.31 Sep.30 IV. Account Title Acc Depreciation – E Loss on Disposal of Asset Equipment Cash Acc Depreciation – Truck Gain on Disposal of Asset Equipment Cash Depreciation Expense Loss on Disposal of Asset Acc Depreciation - E Equipment Debit Credit $16,000 $4,000 20,000 8,000 24,000 2,000 30,000 5,000 3,000 11,000 3,000 16,000 Journal Entries Date Oct.5 Oct.8 Oct.10 Account Title Account Payable Cash Inventory Account Payable Inventory Cash Debit Credit $15,000 $15,000 12,000 12,000 200 200 Oct.15 Oct.20 Oct.25 V. Account Payable Inventory - Discount Cash Account Receivable Sale Revenue COGS Inventory Sale Returns and Allowances Account Receivable Inventory COGS 12,000 240 11,760 16,000 16,000 9,500 9,500 1,000 1,000 600 600 Multiple-step Income statement TL Department Store Income Statement For the Year Ended December 31, 2018 Sales Sales Revenue Less: Sale discounts Net Sales $400,000 $20,000 380,000 Cost of Goods Sold 260,000 Gross Profit 120,000 Operating Expenses Selling expense Admin expense Total operating expense Income from operations 36,000 17,000 53,000 67,000 Other Revenues and Gains Interest Revenue 900 Other Expense and Losses Interest Expense 2,500 Net income $ 63,600