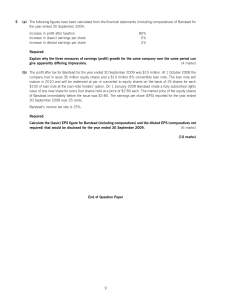

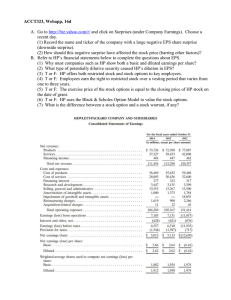

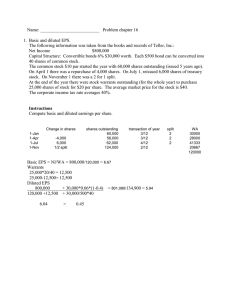

Calculating Basic Earnings per Share Justin Chircop © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Objectives • To introduce the concept of earnings per share and to understand why so much emphasis is placed on this number • To distinguish between the ‘basic earnings per share’ and ‘diluted earnings per share’ metrics • To review some of the key issues and techniques associated with computing basic earnings per share © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Session overview • What is earnings per share and why is it such an important figure? • Relevant accounting standards for basic (and diluted) earnings per share • Computational practicalities involving the numerator (earnings) – The definition of earnings • Computational practicalities involving the denominator (number of shares) – Weighted average number of shares – Adjustments for share issues involving no corresponding inflow of capital – Hybrid share issues such as discounted rights issue © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Earnings per share • Given the equity approach to financial reporting, a natural demand exists for an equity-based measure of periodic performance – Earnings per share (EPS) is designed to meet this demand • The concept of EPS is that earnings are apportioned to owners’ equity Profit after tax, minority interest, preference dividends Number of ordinary shares – Provides indication of amount of earnings available to ordinary shareholders – Enables earnings associated with an equity stake in one company to be compared with those from an equity stake in another company • EPS is one of the most widely quoted statistics in financial analysis – Important input to earnings-based valuation models © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Earnings per share (continued) • How important is EPS for valuation? “At 8.15am each weekday morning the security salesmen and analysts at my firm meet to consider the ideas that will be put to our 300 or so institutional customers during the day. Analysts give their recommendations for specific shares: buy, hold or sell. It is these recommendations, together with similar conclusions reached at 20 or so other security houses, that collectively drive the share prices in the market. The single most important figure affecting the analysts’ and hence the markets’ view is forecasted EPS.” (Ian Hay Davidson, Financial Analyst at CLSA) © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Number of Estimate s Announce date of the Actual, from the Detail Actuals File IBES Ticker Symbol Official Ticker Symbol Measur e Periodicity @TSC TSCO EPS ANN 34 32.52 32.73 1.74 36.86 29.6 20110228 35.72 20110419 @TSC TSCO EPS ANN 30 34 34 1.67 37 31 20120229 37.41 20120418 @TSC TSCO EPS ANN 26 31.47 31.63 1.83 35 28.6 20130228 35.97 20130417 Median Estimate Mean Estimate Standard High Deviation Estimate Low Estimat e Actual Value, from Forecast the Period End Detail Date (SAS Actual Format) s File © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Earnings per share – frequently used in performance contracts • How important is EPS for performance measurement? EXECUTIVE COMPENSATION ARRANGEMENTS AT TESCO PLC ALL EXECUTIVE DIRECTORS: PERFORMANCE-RELATED INCENTIVE PAY (TESCO 2012 AR) PERIOD Shortterm (70% of bonus) Longterm MEASURES INCENTIVISES MAX INCLUDING POTENTIAL % OF BASE SALARY Earnings per Year on year 200-250% share earnings growth (underlying profit) EPS growth Longer-term 225-275% earnings growth PERFORMANCE PERIOD DELIVERED VIA One Year Annual cash and annual deferred share bonuses (3-year deferral) Executive shares or discretionary share options* Three years Note: Vesting of the options is dependent on the achievement of earnings per share performance conditions, with the first 100% subject to the achievement of EPS growth of at least RPI plus 9% over three years and the balance vesting for achieving EPS growth of at least RPI plus 15%. (2012 AR, p. 67) © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Calculating earnings per share – IAS 33 (Revised) • IAS 33 was first introduced for accounting periods beginning on or after 1 Jan 1998, and revised for periods beginning on or after 1 Jan 2005. Only minor differences to SFAS 128 in USA (now ASC 260). • IAS 33 (Revised) requires calculation of both basic and diluted EPS – Basic EPS aims to provide a measure of the interests of each ordinary share of a parent entity in the performance of the entity over the reporting period – The aim of diluted EPS is consistent with basic EPS while also taking into account all dilutive potential ordinary shares outstanding during the period • The underlying logic of IAS 33 is that EPS (including diluted EPS) should be a historical (i.e., backward-looking) performance measure – Diluted EPS relates to currently ‘overhanging’ securities and not potential future securities © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS – IAS 33 -top • Basic EPS calculated as follows: NB: IAS 33 also requires firms to report EPS from continuing operations where profit (loss) on continuing operations is presented as a separate line item in the P&L statement Profit (loss) attributable to ordinary shareholders Number of ordinary shares outstanding and ranking for dividend in the period © Department of Accounting & Finance, Lancaster University Compass Plc 2010 Income Statement: Two EPS figures reported under IAS 33 COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS – IAS 33 -top • Basic EPS calculated as follows: NB: IAS 33 also requires firms to report EPS from continuing operations where profit (loss) on continuing operations is presented as a separate line item in the P&L statement Profit (loss) attributable to ordinary shareholders Number of ordinary shares outstanding and ranking for dividend in the period • Issues concerning the numerator (earnings) – Includes all income after deducting – expense items – non-controlling interests – Tax and any preference share dividends – Ordinary dividends are NOT deducted from the profit figure © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS – bottom (continued) • Issues concerning the denominator (number of shares) – Focus is on outstanding ordinary shares (as formally defined in IAS 33) – All outstanding ordinary shares included in basic EPS with the exception of: • Partly paid ordinary shares included as a fraction of a share based on their dividend participation relative to fully paid shares • Repurchased treasury shares not considered as outstanding for EPS purposes • Shares that are contingently returnable (e.g., put warrants) → excluded from the basic eps calculation until they cease to be subject to recall • Ordinary shares issued subject to conditions (e.g., convertible preference shares) only included from the date when all conditions satisfied – Non-equity shares (such as non-voting preference shares) are explicitly excluded from denominator – If more than one class of ordinary shares, EPS calculated for each class © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS: A simple example Capital structure: 45,000,000 ordinary shares of €1 each 10,000,000 5% preference shares of €1 each Profit on ordinary activities before tax Tax on profit on ordinary activities Profit on ordinary activities after tax Minority interests Profit for financial year attributable to members of the holding company Preference dividends Ordinary dividends Retained profit for year Basic EPS = €5,031,000 / 45,000,000 €’000 6,519 916 5,603 72 5,531 (500) (2,301) 2,730 = €0.11 © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS: Time weighting using weighted average • Further issues concerning the denominator: Changes during period – Under IAS 33 all outstanding ordinary shares are brought into the basic EPS calculation, time-weighted for changes occurring during the period – Rationale for time-weighting based on an assumed positive correlation between capital (or more precisely, income-generating assets) and earnings • More capital implies higher expected earnings and vice versa • Calculation of basic EPS as a performance measure therefore requires number of shares to be adjusted to reflect changes in capital available to generate earnings © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Weighted average calculation: Timeline representation Details: Financial Year Begins: Financial Year Ends: Issued Shares at beg of year: No. of Shares in Treasury: Outstanding shares at beg of year: Share Issues: Share Repurchases: 1 January 2012 31 December 2012 2,000 shares 300 shares 1,700 800 new shares issued on 31 May 2012 250 shares repurchased on 1 December 2012 © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Weighted average calculation: Timeline representation 1 Jan 2012 Start of financial year 31 Dec 2012 End of financial year © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Weighted average calculation: Timeline representation 1 Jan 2012 Start of financial year 31 May 2012 31 Dec 2012 End of financial year © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Weighted average calculation: Timeline representation No. shares: 1,700 No. months: 5 (1,700 5/12) 1 Jan 2012 Start of financial year 31 May 2012 31 Dec 2012 End of financial year © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Weighted average calculation: Timeline representation (1,700 5/12) 1 Jan 2012 31 May 2012 31 Dec 2012 800 new shares issued Start of financial year End of financial year © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Weighted average calculation: Timeline representation (1,700 5/12) 1 Jan 2012 31 May 2012 1 Dec 2012 31 Dec 2012 800 new shares issued Start of financial year End of financial year © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Weighted average calculation: Timeline representation No. shares: 2,500 No. months: 6 (1,700 5/12) 1 Jan 2012 + (2,500 6/12) 31 May 2012 1 Dec 2012 31 Dec 2012 800 new shares issued Start of financial year End of financial year © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Weighted average calculation: Timeline representation (1,700 5/12) 1 Jan 2012 + (2,500 6/12) 31 May 2012 800 new shares issued Start of financial year 1 Dec 2012 31 Dec 2012 250 existing shares repurchased End of financial year © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Weighted average calculation: Timeline representation No. shares: 2,250 No. months: 1 (1,700 5/12) 1 Jan 2012 + (2,500 6/12) 31 May 2012 800 new shares issued Start of financial year + (2,250 1/12) 1 Dec 2012 31 Dec 2012 250 existing shares repurchased End of financial year © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Total weighted average calculation: Timeline representation No. shares: 1,700 No. shares: 2,500 No. shares: 2,250 No. months: 5 No. months: 6 No. months: 1 (1,700 5/12) 1 Jan 2012 + (2,500 6/12) 31 May 2012 800 new shares issued Start of financial year + (2,250 1/12) 1 Dec 2012 31 Dec 2012 250 existing shares repurchased End of financial year © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Incremental weighted average : Timeline representation (1,700 12/12) + (800 7/12) - (250 1/12) 1 Jan 2012 31 May 2012 800 new shares issued Start of financial year 1 Dec 2012 31 Dec 2012 250 existing shares repurchased End of financial year © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS: Time weighting using weighted average • Further issues concerning the denominator: Changes during period – Under IAS 33 all outstanding ordinary shares are brought into the basic EPS calculation, time-weighted for changes occurring during the period – Rationale for time-weighting based on an assumed positive correlation between capital (or more precisely, income-generating assets) and earnings • More capital implies higher expected earnings and vice versa • Calculation of basic EPS as a performance measure requires no. of shares to be adjusted to reflect changes in capital available to generate earnings – Calculation of weighted average: 1 31 1 31 Jan 2012 May 2012 Dec 2012 Dec 2012 Weighted average total Bal. @ beginning of year Issue of new shares Repurchase of treasury shares Bal. @ year end Issued 2,000 800 2,800 Treasury Outstanding (300) 1,700 2,500 (250) 2,250 (550) 2,250 = (1,700 5/12) + (2,500 6/12) + (2,250 1/12) = 2,146 shares Weighted average incremental = (1,700 x 12/12)+(800 x 7/12) – (250x1/12) = 2,146 shares COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS – More complex changes during the year • The weighted average technique is used in the following circumstances involving a change in the number of ordinary shares during the period: – Shares issued for cash (either at full market price or at a discount) – Rights issue (either at full market price or at discount) – Shares repurchased for cash – Share options exercised during the year – Convertible securities converted during the year – Issue of shares to acquire another business • Such shares included in basic EPS calculation under assumption that shares were issued on the acquisition date (even if the actual date of issue is later) • Use acquisition date because this is the date from which the results of the newly acquired business are recognised in the income statement © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS – Bonus issue as if at start of year • While many changes in outstanding share capital involve corresponding inflow (outflow) of resources, some do not: 1. Capitalisation, bonus or scrip issue – Increases the number of shares without inflow of resources, as ordinary shares issued to existing shareholders for no consideration – Consequently, no additional earnings will be expected to accrue as a result of the issue → Treat additional shares as having been in issue for the whole period • Also include additional shares in EPS calculation of all prior period comparative data so as to ensure comparability over time Example: 3 million ordinary shares @ 1 Jan 2012: 1 for 3 bonus issue of shares @ 1 Dec 2012 No. shares used in basic EPS calculation: 3,000,000 + [1/3 3,000,000] = 4,000,000 Assume extra shares issued at beginning of year (i.e., 12/12) © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS – Rights issue as if part bonus and part full price 2. A bonus element in any other issue (e.g., as part of a rights issue at discount) – A rights issue is a popular mechanism through which entities are able to access the capital markets for further funds – existing shareholders given the opportunity to acquire further shares on a pro-rata basis to their existing shareholdings – ‘rights’ will usually be offered at a discount – the transaction is equivalent to a bonus issue combined with an issue of shares at full market price → Denominator adjustment consists of two components • Bonus element as if bonus shares have been in issue for the whole period (exactly the same as bonus issue example) • Full market price element included under weighted average method from date of rights issue © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS: Rights issue at discount – bonus fraction • A rights issue at discount is equivalent to: – A bonus issue of shares reflecting the discounted element of the issue (i.e., shares or part thereof issued for ‘free’), plus – An issue of shares at full market price • Need to compute the bonus element of the issue – Bonus element is known as the ‘bonus fraction’, and is computed using: Actual cum-rights price on last day of quotation cum-rights Theoretical ex-rights price Actual price at which the shares are quoted inclusive of opportunity to take up future shares under the rights issue Theoretical price at which the shares would be quoted (all else equal) after the new shares have been issued © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS: Rights issue at discount example Example Capital structure @ 1 January 2012: 48 million ordinary shares of €0.50 each Profit on ordinary activities after taxation @ 31 December 2012: €2.4m Actual prior to rights issue share price (‘cum-rights’) on last day of quotation cum-rights was €1 (‘cum’ = ‘with’, ‘ex’ = ‘without’) Rights issue occurs on 31 August 2012 on a 1 for 4 basis @ €0.80 • The EPS calculation is a 4 stage process: – Stage 1: Calculate theoretical ex-rights price Initial holding of Rights taken up New holding 48m shares 48x1/4 shares 60m shares Theoretical ex-rights price = €57.60m / 60m = €0.96 Market value Cost 80p Theoretical value €m → Denominator in ‘bonus fraction’ 48.00 9.60 57.60 Assumptions: 1. All rights are taken up 2. The value of the company rises exactly by the rights cash received © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS: Rights issue at discount (continued) ALTERNATIVE CALCULATION OF EX-RIGHTS PRICE • The EPS calculation is a 4 stage process: – Stage 1: Calculate theoretical ex-rights price (alternative method) 60,000,000 €x = (48,000,000 €1) + (12,000,000 €0.80) 60,000,000 €x = €48,000,000 + €9,600,000 x = €0.96 No. shares after rights issue: 48m + (48m 1/4) No. shares before rights issue No. shares in rights issue: 48m 1/4 © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS: Rights issue at discount – bonus fraction applied – Stage 2: Compute the bonus element implicit in the issue Actual cum-rights price Theoretical ex-rights price = 100 = 25 96 24 Bonus fraction (i.e., 1.04167) → Actual issue can therefore be split into components: • Bonus issue of 0.04167 for 1 (0.04167 x 48 = 2m), reducing the theoretical share price to €0.96 • Issue of the 10m residual number of shares (=12m – 2m) at the new (theoretical) market price of €0.96 Note: No bonus element exists if bonus fraction < 1. Rights issue treated as an issue for cash at the full market price © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS: Rights issue – computing weighted average – Stage 3: Compute weighted average share capital for the period No. of shares in issue @ 1 Jan: As if bonus element: = 48m 0.04167 Adjusted no. of shares in issue @ as if 1 Jan: As if full price new share element at 31 August = 48m = 2m = 50m = 12m – 2m No. of shares in issue after rights issue: 48m + (48m 1/4) = 10m = 60m Weighted average number of shares in issue during year: 50 8/12 60 4/12 = 33,333,334 = 20,000,000 53,333,334 – Stage 4: Final EPS calculation Basic EPS = £2.4 million / 53.3 million £0.045 © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Total weighted average : Timeline representation (60m 4/12) (50m 8/12) 1 Jan 2012 31 Aug 2012 31 Dec 2012 Rights issue 50m x 8/12 + 60 x 4/12 = 53.333m Start of financial year End of financial year © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Incremental weighted average : Timeline representation (48m 12/12) (2m 12/12) + + 1 Jan 2012 Bonus element = 48m x 1.00 = 50m x 0.96 (10m 4/12) 31 Aug 2012 Full price element = 12m x 0.80 = 10m x 0.96 31 Dec 2012 Rights issue 48m x 12/12 + 2m x 12/12 + 10m x 4/12 = 53.333m Start of financial year End of financial year © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Basic EPS: Rights issue at discount – intuitive demonstration Example Capital structure @ 1 January 2012: 48 million ordinary shares of €0.50 each Profit on ordinary activities after taxation @ 31 December 2012: €2.4m Rights issue occurs on 31 August 2012 on a 1 for 4 basis @ €0.80 Actual cum-rights price on last day of quotation cum-rights was €1 • Ex-rights as a total calculation Share holding Pre-rights issue Rights taken up Post-rights issue Number Market price 48m £1.00 12m (= 48m x 1 / 4) £0.80 60m £0.96 (=£57.60 / 60m) Market capitalisation £48.00m £ 9.60m £57.60m Bonus fraction = 1.00/0.96 = 1.04167 for 1 bonus issue Therefore the rights issue of 12m shares is partitioned into: a) 0.4176 x 48m = 2m ‘free’ / bonus shares, and b) The remaining 10m x £0.96 full price shares (=12m – 2m) © Department of Accounting & Finance, Lancaster University COMPUTING EARNINGS PER SHARE: BASIC EPS Summary and review • Earnings per share is one of the most widely quoted and used financial statement statistics – Provides a basis for performance measurement (widely used in executive compensation contracts – Provides a basis for valuation (via the PE ratio) • Changes in the number of shares outstanding during the accounting period represent the major computational complication – Computing the weighted average number of shares – Adjusting for share issues that do not involve a corresponding inflow of capital (e.g., bonus issues, share splits, etc.) – Accounting for the impact of a discounted rights issue (which involves both bonus issue and issue at full market price elements) © Department of Accounting & Finance, Lancaster University