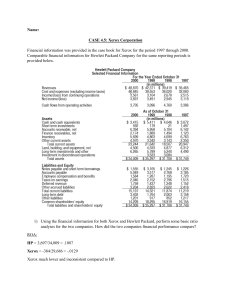

Name: Jazmin Herrera CASE 4.5: Xerox Corporation Financial information was provided in the case book for Xerox for the period 1997 through 2000. Comparable financial information for Hewlett Packard Company for the same reporting periods is provided below. 1) Using the financial information for both Xerox and Hewlett Packard, perform some basic ratio analyses for the two companies. How did the two companies financial performance compare? ROA: HP = 3,697/34,009 = .1087 Xerox = -384/29,686 = -.0129 Xerox much lower and inconsistent compared to HP. Profit margin ([Rev-Cost]/Revenue): When comparing net profit margin between both companies, HP’s was stable throughout the years shown, but Xerox was all over the place. Debt to Equity Ratio (Debt/Shareholders Equity): HP = 3,402/14,209 = .2394 Xerox = 15,404/3,630 = 4.24 Xerox’s debt to equity ratio is significantly higher compared to HP.